The more things change, the more they stay the same. What remains constant are the fundamentals of what makes insurance a well-capitalized, reliable cornerstone of the U.S. economy. The basic model of assessing risk, collecting insurance premiums, investing and paying claims still works. What's been completely upended is how carriers evaluate and acquire the best risks - and how much more important effective risk evaluation is today.

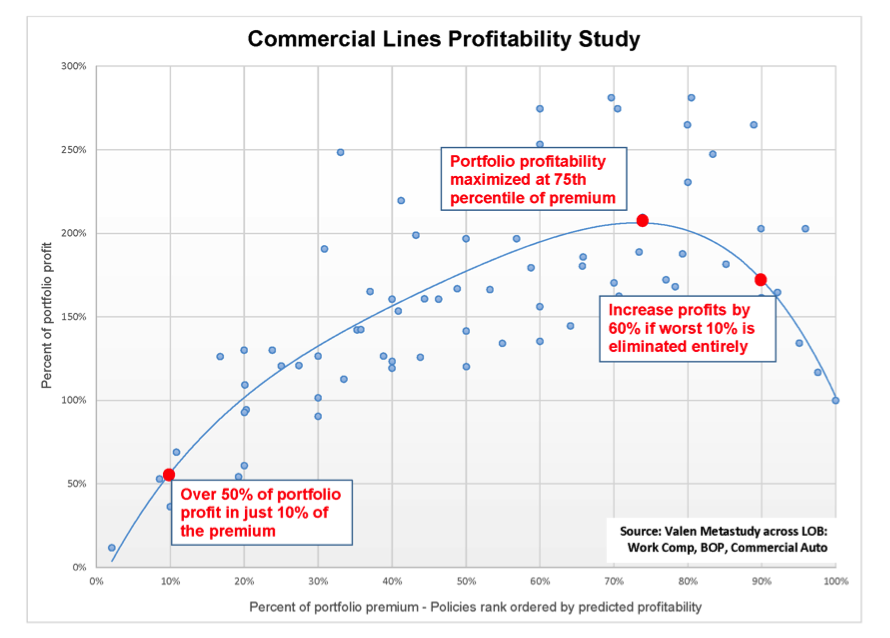

Advanced data and predictive analytics have changed the customer acquisition and retention game. When an insurer can pinpoint which policies are going to be the most profitable 10% and also know that same small segment is delivering 50% of total profit, you know the rules have changed.

The chart below represents a study of the portfolios from a diverse set of commercial insurers and lines of business. The study shows that that this surprising statistic holds true across companies. It helps demonstrate the real advantage -- and potential threat -- of data analytics. The insurer that can accurately identify the best 10% of the market is going to be able to compete on, and win, this business.

What does being data-driven mean in practice?

Information is a business enabler; you don't need to embark on "big data" or predictive analytics initiatives just for the sake of them. You shouldn't feel pressured to lead the rallying cry to become a data-driven organization because everyone is talking about it. You consume data to gain insights that will solve problems that matter and achieve specific objectives.

Data-driven decision making is a commitment and a passion to go beyond the limits of heuristics, because you know it's necessary to reach a new level of understanding of where your business is today and where it's headed in the near term. Data-driven cultures have a disciplined curiosity and rigor to find credible patterns in the data before finalizing their conclusions - which is why everyone emphasizes how important it is to create a test-and-learn culture. Armed with a solid business case, transparency and good processes, data-driven organizations use analytics in combination with human expertise to make better decisions.

Why is this so urgent?

A recent Bloomberg article reported that the workers' compensation industry posted its first underwriting profit since 2006, which is welcome news. At the same time, the article noted that this is directly related to how insurers have reacted to the current investment environment. In the absence of meaningful investment returns, insurers are keenly focused on bridging the gap by improving underwriting profits and enhancing operational efficiencies: "The reality is, in today's interest-rate environment, we need to be driving combined ratios under 100," said Steve Klingel, CEO of the National Council on Compensation Insurance (NCCI).

This isn't limited to one line of business. As Robert Hartwig, president of the Insurance Information Institute, noted in a recent interview, "You're not going to see vast swings you did 10 or 15 years ago, where one year it's up 30% and two years later it's down 20%". The reason he gave: "Pricing is basically stable... The industry has gotten just more educated about the risk that they're pricing."

Now what?

No one said implementing data analytics in an underwriting environment is a small task or a quick fix. Many companies focus primarily on selecting the right predictive model. In reality, the model itself is just one part of a larger process that touches many parts of the organization.

Data analytics can only be successful if developed and deployed in the right environment. You may find that you have to retool your people so that underwriters don't feel that data analytics are a threat to their expertise, or actuaries to their tried-and-true pricing models. Never underestimate the importance of the human element in moving to a data-driven culture.

Given the choice between leading a large-scale change management initiative and getting a root canal, you may be picking up the phone to call the dentist right now. It doesn't have to be that way: Following a thoughtful, straightforward process that involves all the stakeholders early and often goes a long way.