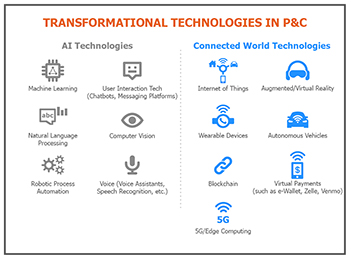

Technologies like machine learning, the Internet of Things (IoT), robotic process automation (RPA) and natural language processing (NLP) were already hot topics in P&C insurance before the world was turned upside down in 2020 due to the pandemic. These and many other “transformational” technologies have great potential for insurers in the rethinking and optimization of distribution, underwriting, claims and many other parts of the business. So, it is important to ask the question – how have the initiatives that leverage these technologies changed due to the pandemic?

Are personal and commercial lines carriers still moving forward with projects in 2021? Do executives still have the same expectations about the potential of these technologies to transform their business?

We answer these questions in detail for 13 specific technologies in two new SMA research reports, one covering personal lines and the other covering commercial lines.

However, I won’t leave you hanging in this blog, wondering about the answers to those questions. The short answer is yes – P&C insurers generally plan to move forward in 2021 with projects that leverage various technologies that have the power to deliver significant results and competitive advantage. The technologies we follow closely and have profiled in our reports have been organized into three strategic planning horizons: short-term, near-term and long-term.

For both personal and commercial lines, technologies in the AI family play heavily in the short-term category. Machine learning, NLP, RPA, computer vision and new user interaction technologies all rank high in terms of their potential to transform and in the level of activity underway or planned by insurers. Technologies that fall into the near-term or long-term horizons include wearables, blockchain, voice, AR/VR (augmented reality/virtual reality), 5G and autonomous vehicles. All have potential in insurance and will likely be incorporated into projects by innovators over the next couple of years but will not make it into broad, mainstream application until midway to late in the decade.

Our research on transformational technologies, when viewed in concert with our SMA Market Pulse surveys, shows that in some cases proofs of concept (POCs) and new projects have been put on hold in 2020, but all indications point to full steam ahead in 2021. Major projects already underway are continuing, and insurers state that they do not want to lose momentum for foundational projects like core systems. Projects that include transformational technologies needed to address digital gaps that were exposed during the pandemic have been raised in priority.

See also: AI in a Post-Pandemic Future

In many ways, the pandemic is accelerating digital transformation across all industries, including insurance. Transformational technologies will play an outsized role in that transformation and look to be important components of insurers’ plans for 2021 and beyond.