Political violence coverage (strikes, riots and civil commotion, or SRCC, plus terrorism and war) is currently sitting in a shifting market. Losses due to SRCC have increased by 3,000% (!) as per Swiss Re, largely due to increasing geopolitical instability and the arrival of social media. Riots in France in June 2023 are estimated to have cost the insurance market close to $780 million, and the 2024 July/August riots in the U.K. (which started and quickly spread due to misinformation and disinformation on social media) have estimated insurance losses of $320 million (which are assumed to have been limited due to the 2016 U.K. Riot Compensation Act). Terrorism coverage follows the same path, as recent losses have led to hardening markets, resulting in challenged capacity and increased premiums.

War coverage is somewhat different, with policies often containing flexibility for coverage to be withdrawn within a specific time if a threat escalates in certain industries. Even so, the 2022 Russia-Ukraine war was preceded by warnings of an imminent invasion from the Americans, while some European intelligence agencies failed to predict the onset of the war (which could have affected how many policies remained in place or were altered in time in favor of the insurer). The Ukraine war will affect insurance policies and premiums, and in October 2022 the Organization for Economic Co-operation and Development (OECD) estimated overall insurance industry losses would reach $20.6 billion.

What coverage is actually needed?

Looking specifically at the terrorism threat, do you need to buy coverage for the full value of your asset, including business interruption? This obviously depends on what kind of asset you are considering, its location, its defense lines and your risk appetite (which might include lenders' requirements). As an example, would a large-scale wind farm with a total insured value of $1 billion need to buy full value terrorism coverage? The analysis starts by quantifying the risk. There are plenty of ways to determine the risk of a specific scenario occurring, and a couple of commercially available solutions for the insurance industry exist, although they currently come with geographical limitations to their capabilities. You could argue that your estimated maximum loss (EML) for a terrorism scenario is a total loss of the asset, in a scenario that might not be fully realistic or with an extremely low probability (e.g., an aircraft impact, a 20,000-pound bomb or something similar).

The rationale for instead using a probable maximum loss (PML) approach as the trigger is that rather than purchasing terrorism coverage for the full value of assets and associated business interruption costs, alternative worst-case scenarios that do not result in the total loss of the asset are considered. This can potentially enable coverage to be tailored to the more probable events. Before that can be done, a detailed threat assessment should be completed to determine which specific scenarios should be evaluated in the PML study.

Threat Assessments

The threat assessment needs to include a full analysis of the current political situation, including historical data, which can be found from both open source and credible commercial providers. For a terrorism event, hostile actors and potential resources can be identified and used as input to the PML study for the asset. The assets actual defense lines will also help to identify the most probable scenario and how that scenario would play out in the unlikely event of an attack. There are plenty of both national and international standards in place that provide guidelines for a choice of scenario (e.g., FEMA 452), as well as theoretical bomb size. This is typically expressed in TNT equivalent, i.e., the amount of energy released in an explosion.

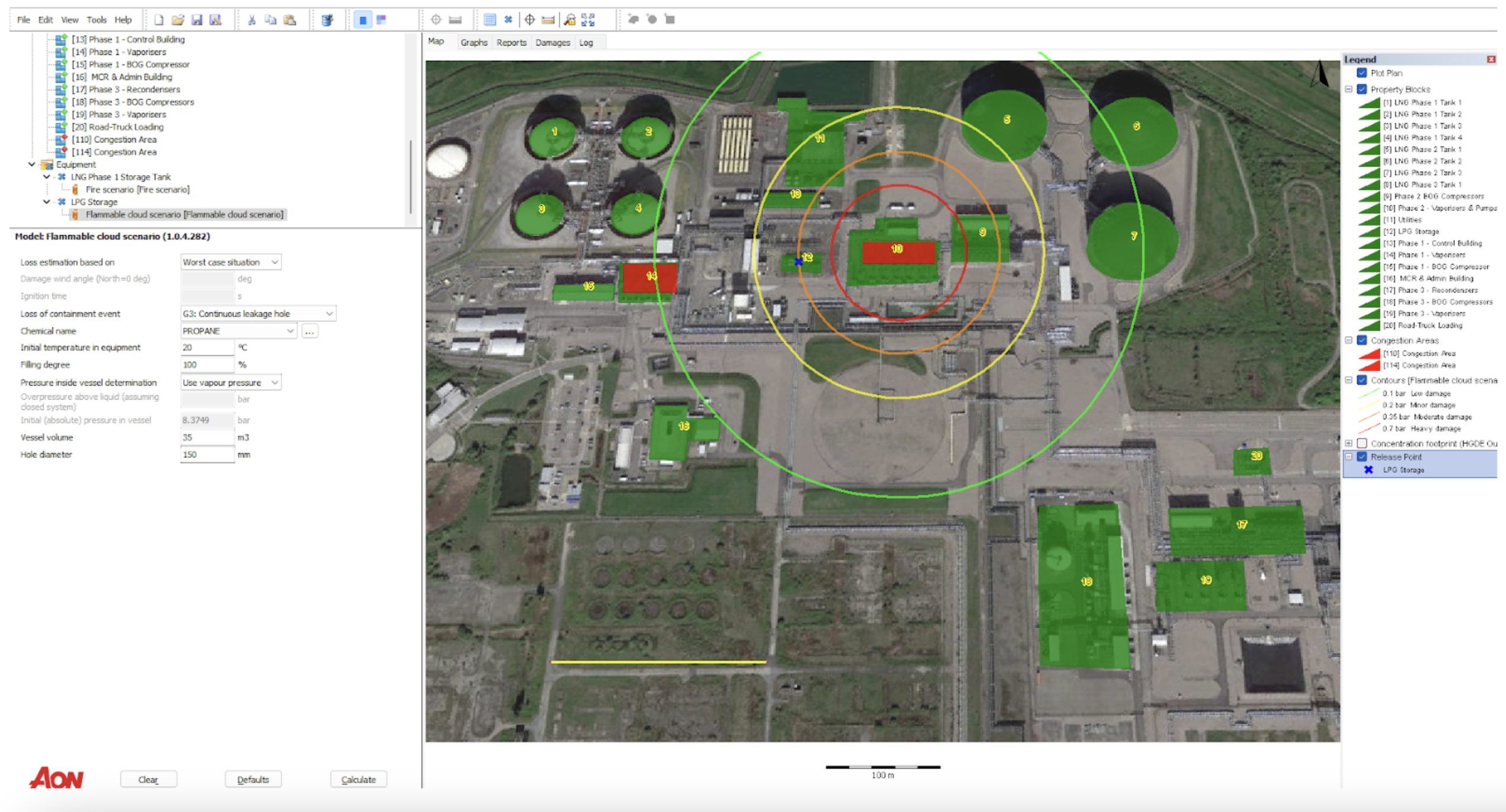

Blast Damage Modeling

Once the scenario has been chosen, a blast damage model can be used to determine the effects of a specific event, depending on the location of the bomb. This is a key aspect often overlooked and related to the assets defense lines. By analyzing the resulting incident overpressure, one can determine the structural damage to property. An example of an analysis done on an energy facility using the tool ALERT can be seen below.

As another example, a hotel with bollards in place outside the hotel entrance might reduce the effects of a terrorist attack significantly, as the attacker will be hindered from detonating the bomb inside the hotel. That could not just save lives but also prevent a full collapse of the building. Bollards have the benefit of always being functional, which can't be said about other protective systems, like drone defense systems, which have shown weaknesses in recent attacks on energy facilities in the Middle East. These are just two examples of security details that will affect potential scenarios and subsequent choice of insurance coverage.

To summarize:

- Risk environments are highly volatile and territorial. The insured should look at each political violence peril in detail to determine how much coverage is required to balance capital versus risk appetite.

- Political violence coverage can be advisable based on a targeted scenario approach.

- A tailored PML approach offers the possibility to analyze how various safety and security measures could reduce the exposure.

- Detailed blast damage is a critical part of the assessment process.

References:

S. Collins, "Swiss Re warns of rising riot losses," Commercial Risk, 16 October 2024.

L. S. Howard, "Insured Losses From UK Riots Will Be Manageable, With Claims Below £250M: Report," Insurance Journal, 13 August 2024.

F. Churchill, "Political violence market hardening amid rising losses: AGCS," Insurance Day, 23 February 2023.

F. Churchill, "Defining 'unprecedented' in the world of political violence," Insurance Day, 19 August 2024.

OECD, "Impact of the Russian invasion of Ukraine on insurance markets," Business and Finance Policy Papers, Paris, 2022.

S. Kalin et S. Westall, "Costly Saudi defences prove no match for drones, cruise missiles," Reuters, 2019.