Insurers looking ahead into 2022 are likely to be concerned about an economic and investment environment that offers a lot of uncertainty. There are new highs in stocks, cycle lows in bond yields and spreads, recurring waves of virus variants, central banks in apparent disarray and political turmoil everywhere. Despite all these danger signs, we are guardedly optimistic that the current recovery will continue well into the new year.

2021 has been a transition year. Reflation, i.e., the building back from the 2020 depression, was good in Q1. Inflation, the big fear in Q2 and Q3, threatens to be bad. Across the globe, we see a transition from a goods recovery to a services recovery, with the U.S. and China leading the way.

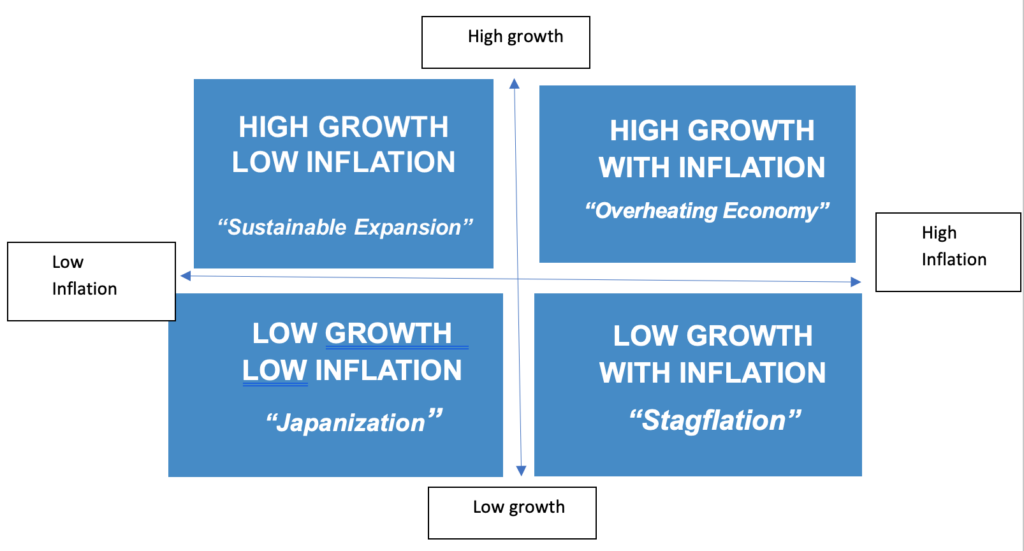

What’s next? Do we maintain growth or face stagnation? Either way, is it with or without the scourge of high inflation? [See the “Growth-Inflation Matrix” below.]

Many are reading the “up” cards (i.e., the current facts) that show some economic growth indicators slowing while inflation is rising. The Delta variant has prompted mask mandates to re-emerge in some areas, and returning to school is challenged too; it’s logical that the mood of the consumer has been dampened. Further, stress in the Chinese property sector highlighted by default concerns regarding Evergrande threatens global stability. However, we should look at a few of the “down” cards (i.e., unresolved areas of concern.)

We believe the rollover from recovery to expansion in the U.S. is well established, built on strong pre-pandemic fundamentals, fueled by substantial central bank support and lavish government spending. Roughly 70% of economic activity in the U.S. is consumer spending. While the U.S. consumer pulled back some over the summer, most recent data show that Delta is nearing its peak. Employment data continues to improve, and supply chains appear to us to be on the mend. We expect the slower third quarter growth will prove to be temporary.

Fiscal Spending: Beyond the Necessary?

After long-standing requests from central bankers for fiscal help, the Biden administration is definitely complying, rolling out several significant spending bills running in the trillions of dollars. This is being called “stimulus,” but the “down” cards here may be the unintended consequences. And we expect there will be many, given that the final bill appears likely to be between 5,000 and 10,000 pages of mandates, taxes and regulations.

A number of market observers have expressed concerns with all this spending, but Conning’s main concern isn’t inflation - it’s the crushing of incentives and stifling of production. In the end, that may kill the recovery, as on the margin it discourages very productive people from producing more and less productive people from improving.

Yet the spending continues, with calls for more.

Paying for It All at the Cost of Growth

What could break the cycle? Perhaps figuring out how to pay for it. The flip side of spending in terms of fiscal policy is taxation. Some observers say the current proposals amount to the biggest tax increase in more than 50 years; regardless, they don’t appear to us to be pro-growth.

Some policymakers who subscribe to Modern Monetary Theory (MMT) believe the central bank should be able to support all the spending we need through monetary policy. But the world’s central bankers appear confused, oscillating between easing and tightening as they try to decide which is faster: growth in virus variants or economic activity. The U.S. Federal Reserve itself is not immune from the opinion split: About half a dozen of FOMC voting members see no rate increases through 2023, another half dozen expect to raise rates up to four times by then, and the remainder expect one or two increases.

Two old sayings combine to form a powerful deflationary force in the economy: “Necessity is the mother of invention” and “practice makes perfect.” We think production will do what production always does when demand spikes (absent government interference): expand, build back and repair itself to meet demand. The need for new and better processes can spur innovation and creativity, such as the advances that led to the recent U.S. energy independence. The incentives and competition of the free market make us better and better at those advances, lowering their costs and improving their efficiencies.

See also: Biggest Risks to an Economic Recovery

Regulatory Role May Decide Recovery’s Strength

That “government interference” part, however, is a significant qualifier given this administration’s regulatory proclivities. Conning believes the likelihood of many policy changes is reduced by the current divided government along with President Biden’s falling approval numbers in national polls, so the momentum we’ve built will likely carry us through with good growth into 2022. But the threat of slowing the expansion still looms, as regulatory burdens are not transitory.

Does that mean “stagflation”?

Stagflation is stagnant growth with high concurrent consumer price inflation. We think we will continue to have good growth, so stagnation is not the base case. But stagflation has an evil twin, what some have called “Japanization,” given the two lost decades of Japan’s economy – long-term economic stagnation without inflation despite expansionary monetary and fiscal policies.

In the U.S., we now see increasing regulation, especially in energy, banking and climate-targeted mandates, proposals for higher taxes and “free money” via MMT. If, thanks to these policy developments, we don’t sustain the recovery, we think the near-term risk feels more like Japanization than stagflation.

We have, and we expect to continue to have, a robust recovery from the economic doldrums of 2020, but, needless to say, rerouting trillions from the private sector to the government can easily derail it. Should some version of the massive spending, tax and regulatory bill make it through the House, only two Democratic senators, each from the largely Republican states of Arizona and West Virginia, would stand in its way. It bears watching but, for now, we think there’s a good chance to continue our sustainable expansion that will support current market valuations.

Growth-Inflation Matrix

Forward-looking statement disclosure: These materials contain forward-looking statements. Readers should not place undue reliance on forward-looking statements. Actual results could differ materially from those referenced in forward-looking statements for many reasons. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying any forward-looking statements will not materialize or will vary significantly from actual results. Variations of assumptions and results may be material. Without limiting the generality of the foregoing, the inclusion of forward-looking statements herein should not be regarded as a representation by the investment manager or any of their respective affiliates or any other person of the results that will actually be achieved as presented. None of the foregoing persons has any obligation to update or otherwise revise any forward-looking statements, including any revision to reflect changes in any circumstances arising after the date hereof relating to any assumptions or otherwise.