Blockchains have a problem: They cannot exist in digital isolation; their value must be derived from the value of something else -- something real.

There will always come a time when something real must be represented by data on a blockchain, or when data on a blockchain must represent something real. The tools that we use today for the storage, exchange and representation of value are money and title to property. This is the most over-looked peril in blockchain technology.

Are crypto-currencies actually money?

There are many prominent articles by many smart people discussing this topic. However, at the time of this writing, according to U.S. Uniform Commercial Code, article 9, a very explicit definition for money is provided as follows:

"Money" means a medium of exchange currently authorized or adopted by a domestic or foreign government.

Therefore, the answer is clear. No, digital tokens are not money.

See also: Why Insurers Caught the Blockchain Bug

While the destruction of digital tokens may represent an economic loss, that loss would need to be somehow quantified as something real. And we’re back to where we started; at some point, token must represent something real. The courts and law enforcement cannot be invoked to protect your bitcoin, and they struggle immensely to protect the value that the bitcoin is supposed to represent, except, notably, in money laundering.

While we may be able to identify the peril and even calculate the probability of loss, we cannot predetermine the consequence of the loss and therefore we cannot price the risk correctly. End of story.

Are crypto-currencies considered property?

There is some ambiguity here, as well. When we think of property, we think of discrete units that are largely inseparable. The title to an asset travels with the whole asset as it changes hands. A lien on the property would be needed to assert dominion on the asset. But bitcoins are quite easily divisible, almost fluid, lubricating a blockchain as a secondary artifact or its maintenance program. If I loaned you a car but kept the wheels as collateral, the utility of he car would be encumbered. Or it would be like holding a lien against the money to purchase the car, and not the car. This doesn’t make sense.

The answer for all practical purposes is that crypto-currencies cannot really be treated as property at least within the boundaries of law and are therefore uninsurable.

Are we stuck?

So, if bitcoins are not money and bitcoins are not property, what are they? How does one prove ownership? How does the owner assert dominion? How would liability be assigned for economic losses of another person in a transaction where all agreements are in the form of non-revocable contracts executed by software? Where do rights and responsibilities attach?

This is a deeply troublesome discussion if you are in the business of assuring or insuring blockchain-based enterprises.

More troubling is that these precise characteristics are what make crypto-currencies attractive for illegal activity, thereby increasing variance of expectations rather than reducing variance – the exact counter-effect of insurance. If assets can be converted to crypto-currency, they become difficult to seize or repossess. The extra-legal sector is categorically uninsurable by mainstream carriers.

Fortunately, some

clever legal scholars at Harvard’s Berkman Center have suggested that perhaps ownership may be established with a claim against the cryptographic keys that open and close the contracts that contain the value articulated on blockchain. This is a very interesting idea. We have already established that these nodes and these keys are insurable. Logic may be built into key distribution to assign liability or limit liability and, thus, price risk correctly.

A Hybrid Approach

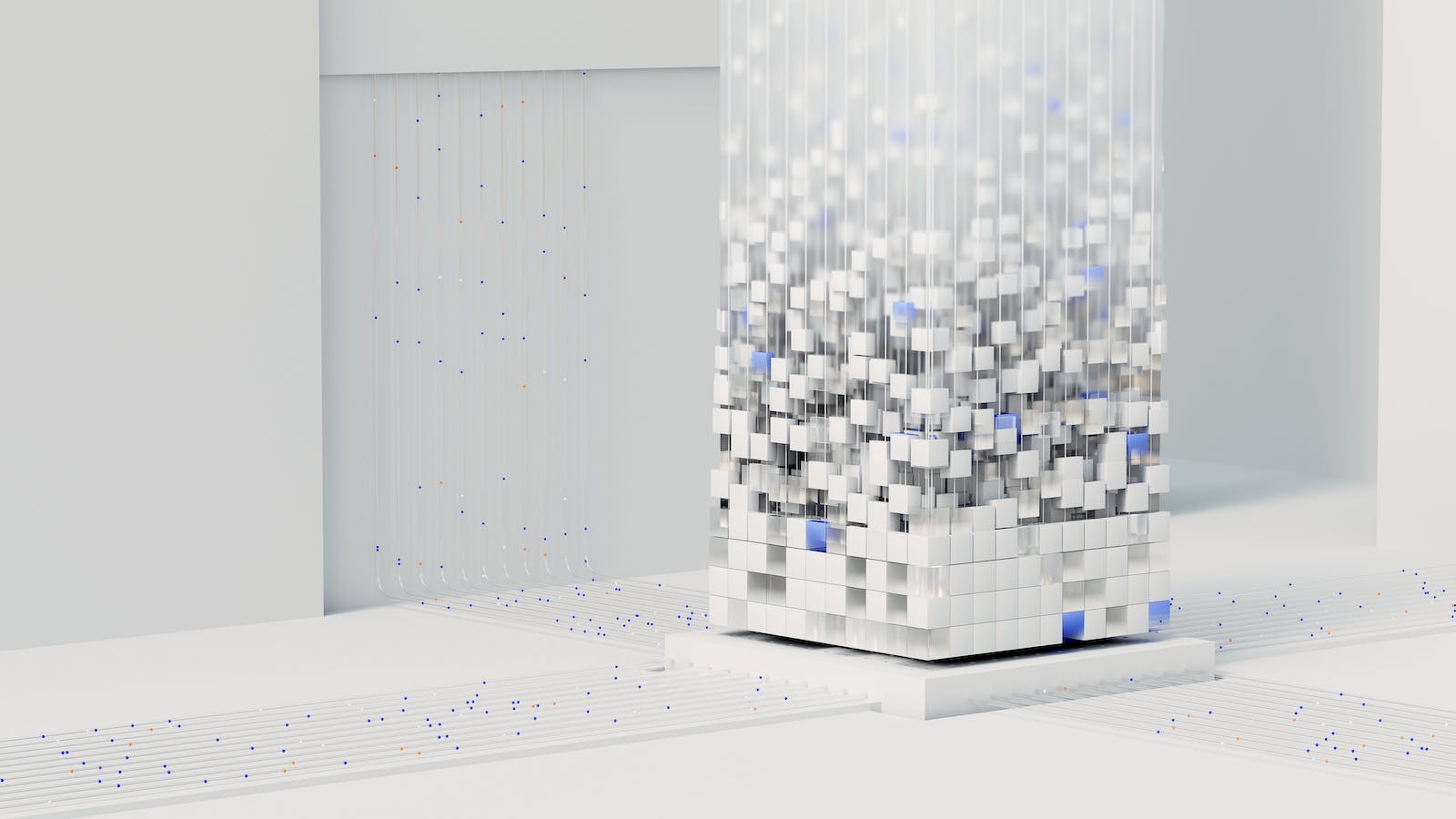

In earlier articles, we identified the problems that blockchain solves. We also identified the problems that blockchains cannot solve. Using a hybrid approach of decentralized computers and decentralized human interaction, we may be able to build a bridge that can cross the insurability gap between the virtual and the real world upon which everyone from banks, entrepreneurs and modern decentralized organizations may cross.

See also: What Is and What Isn’t a Blockchain?

Some conceptualization of the hybrid approach may consider the following: a system of physical proofs that are interchangeable with the digital proofs in a blockchain -- as needed or where appropriate.

For example:

- Instead of a computer modeling a fake network of Byzantine generals, a network of real “generals” can be set up to model a computer network.

- Instead of a solution to a trivial puzzle as a means of generating a digital token, the solution to a real life puzzle can also be used to generate a digital token.

- Instead of a hashing program that generates a cryptographic key, a person’s résumé could be used as the algorithm to hash cryptographic keys that are authorized to open and close packets on the blockchain (see Curiosumé)

- Etc…

As long as each component of the blockchain ecosystem is insurable, the entire system would remain insurable. There would otherwise be no limit to the number of blockchains that can exist nor the number or combination of analog and digital components that can be mixed as long as the tokens, in the end, can clear accounts.

(Adapted from: Insurance: The Highest and Best Use of Blockchain Technology, July 2016 National Center for Insurance Policy and Research/National Association of Insurance Commissioners Newsletter: http://www.naic.org/cipr_newsletter_archive/vol19_blockchain.pdf)