KEY TAKEAWAYS:

--The typical auto insurance model, which has been around for a century, notes the base price of a new vehicle and assumes roughly 20% depreciation each year. But the pandemic has uncoupled that model from reality.

--In recent years, scarcity of vehicles and other issues have resulted in a surge in used car values – sometimes going above their price new, often holding value instead of plunging and generally not depreciating as in “normal” times.

--Every pricing system, every actuarial triangle and any predictive model using the last 20 years or more of historical data is ignorant of this kind of volatility and unprepared to say what should happen next. It's time for insurers to change the way they look at vehicle values.

----------

If you were to rent a car, you would expect that a more expensive vehicle would cost you more. You would also expect that, if you damaged that more expensive vehicle, it might cost more to repair. So, you would not be surprised to see a higher-cost insurance option associated with more expensive (and perhaps more powerful or luxurious) versions.

Well, your regular insurance program for your vehicle is not working quite like that – at least not yet.

While the base price of any vehicle can move your insurance rate north, as you add on optional equipment, most current insurance pricing systems don’t take those new features into account. Existing pricing models ignore anything beyond the base price new from an MSRP on the window sticker. Maybe more surprising, that is the last time they think about the value of your car.

Why? Let’s take a step back in time.

The very first auto insurance policy is attributed to Travelers in 1897 for a risk in Ohio. Other auto insurance companies, such as State Farm and USAA, recently celebrated 100-year anniversaries for insuring consumer vehicles. While it’s exciting to see brands across the industry celebrate such a marker, we also just weeks ago saw the very first loss in an annual report in 100 years for one insurance company – something we think can largely be attributed to missing the changing conditions on the value of a used vehicle.

Over the last century of auto insurance, paper policies managed in mailboxes and inbox bins have been increasingly replaced by digital policies on smartphone apps in the cloud, but many legacy processes have not kept up with the times. Two iconic pieces of auto insurance history come to mind – the use of base price new MSRP to set a value in a “set it and forget it” fashion and the use of a one-size-fits-all factor curve for setting a relativity-based insurance value for a vehicle over time (across the nation or within a state).

Why should these processes be left in the past?

See also: Deteriorating State of Car Insurance

We will save the window sticker story of base price versus total price and the gap between the two for another day. Today, we want to spend a moment exploring active valuation methods versus static and embedded methods for vehicles.

Model risk management disciplinarians may not have gotten around to vehicle valuation for pricing yet – the use of base price new and no further detailed tracking of the asset is deep in tradition and only noticeable in filings and rating algorithms, so hidden in plain sight. The current displacement in valuation trends, however, has completely uncoupled the traditional approach from today’s reality.

Let's explore.

Model Risk Matters - Active vs. Static Methods

One of the more longstanding traditional presumptions since the time before computers were introduced, back when data was manipulated with slide rules and look up tables, is that vehicles always get cheaper with age. That is not a shocking thought, but in recent volatile car valuation times, this embedded thinking has turned into a systemic risk (model risk). Let’s look at a specific case and then the general case.

The Toyota 2017 Rav4 model year value trend: A specific example in these pandemic era times

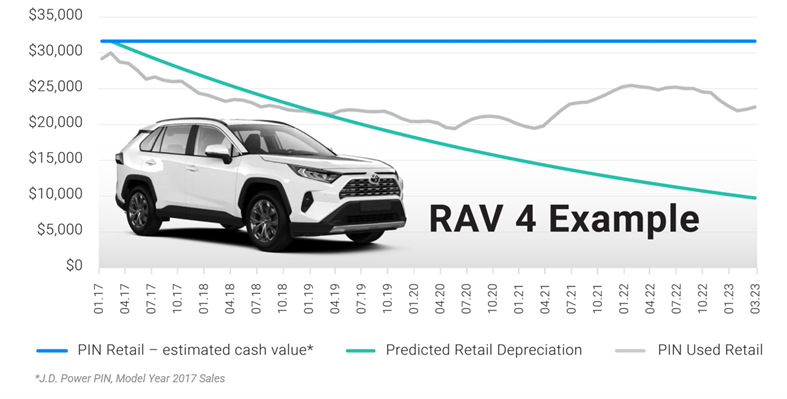

Prior to April 2020, the market for a used 2017 Rav4 followed a traditional rule of thumb: straight-line depreciation of about 20% a year. That meant that, in five years, it would have lost 2/3 of its original price. $30k-ish moves to $10k-ish across 60 months. (See the green line in the Rav4 exhibit.)

While other things that consumers insure, like houses, rings, art, etc., all seem to cost more over time – sometimes intrinsically and sometimes due to inflation – the cost for cars normally is presumed to trend downward as they wear out their mechanical function with usage. Nowadays, however, are not normal.

In recent years, scarcity of vehicles and other issues have resulted in a surge in used car values – sometimes going above their price new, often holding value instead of plunging and generally not depreciating as in “normal” times. (See the gray line in the Rav4 exhibit.) Values can also vary from type of vehicle to brand of vehicle and perhaps to the trim level and optional equipment for popular configurations – not a one-size-fits-all situation.

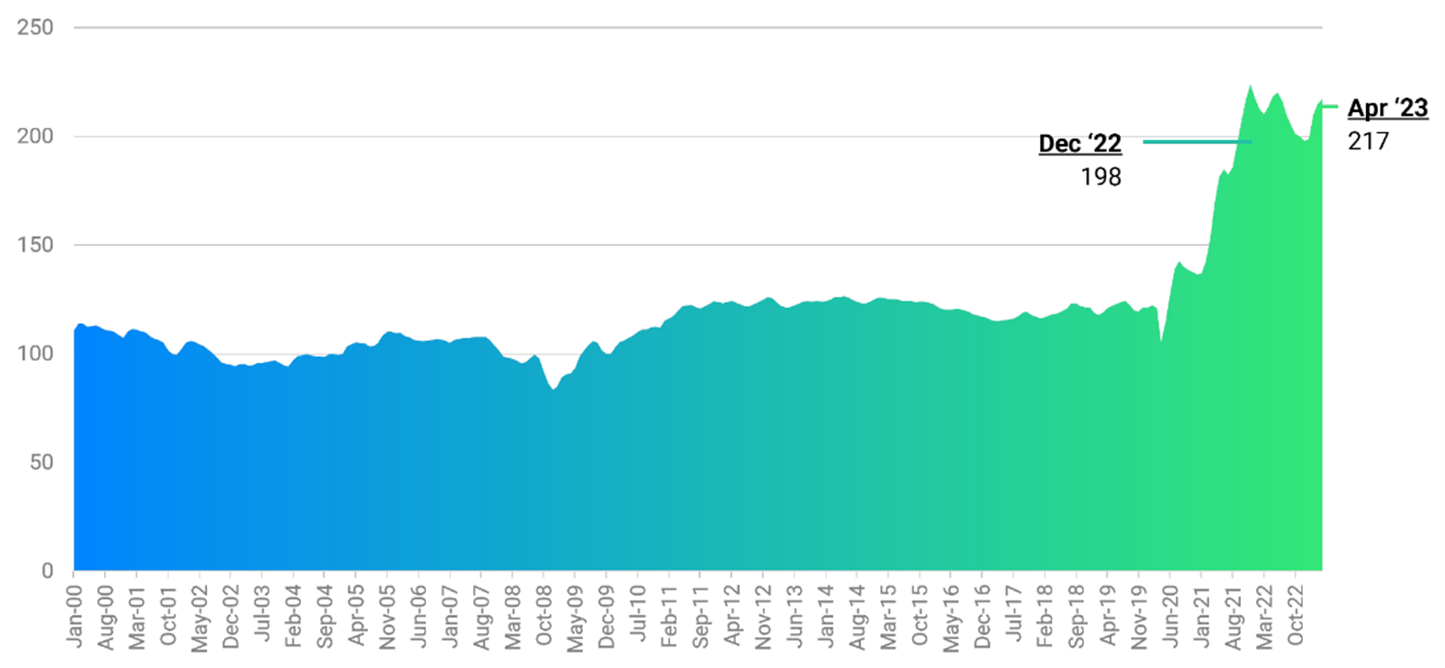

The J.D. Power Used Vehicle Price Index (UVPI), constructed to measure relative market valuation for vehicles less than eight years old (a classic plan for targeting under 100,000 miles on the odometer), indicates that, since the turn of the millennium in the year 2000 until the beginning of the pandemic in 2020, there were relatively “calm seas” in the used car price space.

J.D. Power Used Vehicle Price Index: Trend from January 2000 - April 2023

We observe a notable downturn during the global financial meltdown in late 2008 (and follow-on recession), with a new plateau in pricing slightly higher for post-recession than pre-recession. There were many insurance pricing increases put into effect to adjust to that new plateau of value of vehicles about a decade ago, but otherwise we see a relatively uneventful 20 years of valuation on an indexed basis.

That is until the pandemic.

What we see today indicates that a sea change like never before has hit the shore of used vehicle values. Every pricing system, every actuarial triangle and any predictive model using the last 20 years or more of historical data is ignorant of this kind of volatility and unprepared to say what should happen next.

See also: Buckle Up for Telematics 2.0

It's time for insurers to change the way they look at vehicle values.

Today, it seems every auto insurance company is raising rates across the board on a more frequent basis and in higher amounts than at any time in our lives. Even with the current rising tide, however, we have not seen enough increase to match the change in the most valuable parts of the car fleet, which are up almost double (from the 1-teens to the 2-teens) in the most recent months of the used vehicle price index (UVPI).

While it is impossible to know what will happen next, it seems the insurance industry can comfortably assume it needs to really pay attention to the value of insured vehicles in a different way than they have so far, to be around for the next 100 years.

This article originally appeared on the J.D. Power site here.