Editor’s Note: This is the fourth in a series of posts in which CJ Lotter, a 15-year industry veteran, shares lessons learned in the form of guidance to MGAs on the steps required to build a successful program. The earlier articles are available here.

By now, you’ve become familiar with our series of posts on program business. We’ve covered the processes for identifying a market to target and for validating the opportunity through research. Now comes one of the most important steps, analyzing competition. Much like the other steps, analyzing the competition can be boiled down to three things:

- Gathering all available public data

- Looking at the market on a macro level and determining which competitors own the space

- Looking at individual players and their attributes and figuring out potential market entry points

Gathering Available Data

After all your research, you should have a program plan narrowed down to a specific class code with a need gap. Now it’s time to do some research on the players already in the space. Insurance is one of the only industries in which your competitors must file their business plan, and anyone can pull the filings of anyone else. That’s exactly what we are going to do in this section.

You have already selected an industry segment to target. Now, pull the filings of each competitor in that space, and all the product offerings. This will provide the raw information for your analysis in the next two sections. If, by chance, your competition is offering a non-admitted product, you will need to go elsewhere.

Work with an industry focus group to ask about the type of insurance offerings available and gather information that way, or do market research on the product offerings available. Ideally, you will use the data you gather to answer several key questions. The most important ones will depend on your organizational goals, and we will cover those in the section on qualitative research.

See also: 10 Steps to Successful Insurance Program

Analyzing the Competition

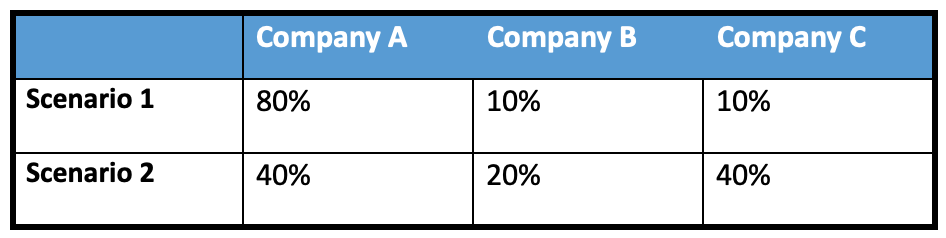

After gathering all the available competitive data, it’s time to develop the insights that will help us decide who our real competition will be. Figure out how much market share each major competitor possesses in your targeted industry. Consider these potential market share scenarios:

Each scenario will require a different set of strategies. Which of these is more appealing? If you were to pursue “Scenario 1,” you would be attacking a single dominant player. In “Scenario 2,” you would enter a market with a variety of players offering a variety of solutions.

What you decide depends on the attributes you are competing on. Traditionally, with programs, it is easier to enter a market with one established player. Ideally, this player is clunky, does business slowly and can’t react quickly enough. In this world, you can easily compete with better technology, better costs or better service, preferably all three.

A word of advice if you choose to compete on cost: Unless the cost saving is 15% or more, it will be hard to get customers to switch from an incumbent.

Profiling the Competitors

With the market data pulled and analyzed, you can now move on to a qualitative analysis of the individual competitors and ultimately decide how and where to deploy your new program. Combining the data you’ve gathered, the “word on the street” from insureds in your target market and additional market research, you’ll build profiles of the major competitors. These are the attributes you should start with:

- AM Best rating of the company

- Size of the company in premium

- Whether the company operates nationally or regionally

- Types of products (from the filings, for admitted products)

- The company’s market share in your targeted industry

- Pricing for the product (from filings, focus groups or competitive research)

- Distribution: Is the offering sold online or through agents?

The goal is to apply this data to understand which companies you will realistically compete with. Using the example we introduced in our prior post, the top provider of tow truck insurance may only serve the Midwest and Pacific Northwest, leaving open an opportunity in a Northeast market like New York. Or, perhaps there is a cost saving you can offer with a new product package.

A four-quadrant (i.e. 2x2) matrix can be a good tool here, too. Pick two important variables, one for each axis, and place all the competitors onto the graph. For example, one axis could be company size, while the other represents geographic reach (from regional to national operators).

Going as far as to do a full SWOT (strengths, weaknesses, opportunities and threats) analysis on each competitor may also be a good practice and will help illuminate the competitors you stack up against most favorably. A good resource for SWOT templates can be found here.

See also: How to Improve the Customer Journey

Final Thoughts

Through diligent research, and a good measure of analysis, you should uncover a path for potential new business. Making the right decision on where to deploy, at what price point, with which distribution model and other vital issues can make or break a program launch. Some of these will be the topics of future blog posts.

When planning a program, it is vitally important to have the conviction that you are bringing a product to the market that solves a problem better than the competition. Better pricing, better distribution or better product design are great examples of value that will improve your chance of success.

Excerpted with permission from Instec. A complete collection of Instec’s insurance industry insights can be found here.