In the 1993 movie Groundhog Day, Bill Murray plays a Pittsburgh broadcaster stuck in a loop, replaying the same day, Feb. 2, over and over. The screenplay, written by Danny Rubin and Harold Ramis, was ingenious in its ability to make us consider what we would change in a day if we had an unlimited number of do-overs. Would we repeat the same mistakes? Would we suffer through irritation at replaying the same scenes again and again? Or would we choose to get better at what we do, adapt to fix the issues around us and maybe even try to improve the lives of others.

Though every day in a distributor’s world is different — different people, different coverages, different issues to solve — current distribution tools and methodologies may look the same way they have looked for years, even when both insurers and distributors know that there is a better way.

Distributors and insurers wake up each day to accomplish their goals within the context of the insurer’s present level of distribution maturity. Every day, both sides see the positives and negatives of processes that could be better. Are they following a path that will take them to real distribution maturity?

It’s an important question because insurers and distributors rely so heavily on one another. What insurers need, in many cases, is an understanding of what will happen tomorrow if they are willing to make some changes today. Can insurers envision the opportunities clearly enough that they are motivated to switch gears and change something right now, and tomorrow, and the next day? What will their efforts mean to courting and keeping the best distributors?

Majesco and PwC recently released a report that examines this very issue; Distribution Management: A Path to Maturity. The report outlines in detail five distinct levels of distribution maturity. What are the inherent characteristics of Level 1? What improves at each level? How does the learning from one level transfer into the business wisdom at the next? Is there a perfect ending?

The end goal is for distribution management transformation to deliver value across three key dimensions:

- Improve productivity and next-gen distributor experience.

- Increase operational efficiency and effectiveness.

- Improve insurer ability to adapt to change.

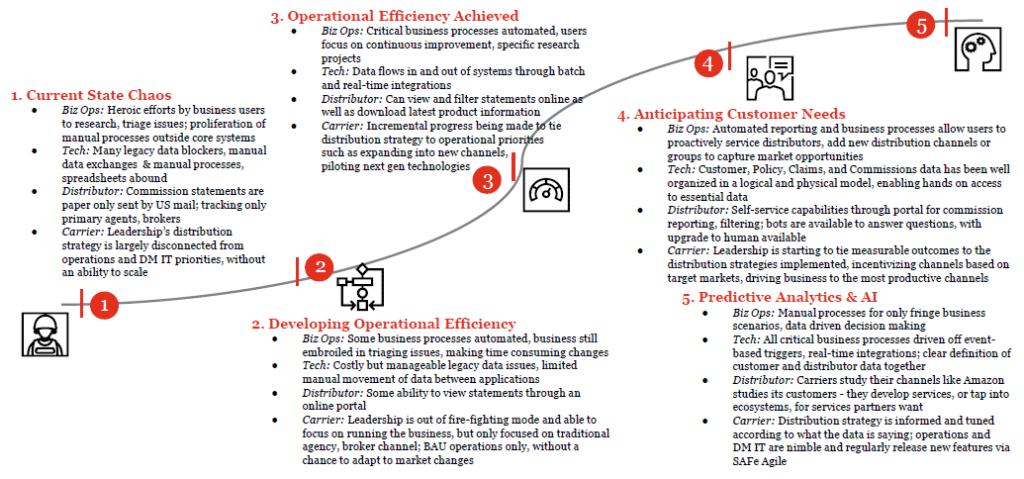

Climbing the Maturity Curve (The 5 Stages of DM Maturity)

Stage 1. Current State Chaos

Stage 2: Developing Operational Efficiency

Stage 3: Operational Efficiency Achieved

Stage 4: Anticipating Customer Needs

Stage 5: Predictive Analytics & AI

A Day in the Life — Challenges, Hurdles and Efficiencies

For each of the stages, we’ve envisioned what it is like to live each day from the insurer and distributor perspectives. Is technology hurting or helping? What hurdles need to be dealt with before moving to the next step? As you read the list below, consider where your organization might be placed along the curve, then keep reading for a glimpse at the capabilities and efficiencies you might gain at the next step.

1. Current State Chaos

The earliest stage of the maturity curve is characterized by an enormous amount of manual effort just to stay a step behind. Fundamental tasks like research or triaging of issues are extensive and time-consuming for business users.

On the technology side, users must have a keen awareness of where different data lies across a multitude of offline documents or tables due to the abundance of siloed spreadsheets. As a result, carriers see centralization of knowledge in a few highly experienced resources. They experience long replacement cycles, inconsistent service quality and data management challenges. There is an inherent risk of this tacit knowledge being held by a small group of employees, many of whom may be quickly approaching retirement age. What happens when they leave and take this knowledge with them? All of this means that the organization must focus on survival rather than thriving.

From a distributor perspective, “ease of doing business” is nonexistent. Changes are time-consuming. Call volume skyrockets due to a lack of transparency and access to information. Lots of time is spent troubleshooting or researching what happened, when and why. Issues can’t be addressed quickly and result in a lot of incorrect transactions. Growth, let alone retention of top distributors, is a challenge, at best. It is hard to get the benefits from any technical investments without integrations to other core systems or the availability of digital information.

2. Developing Operational Efficiency

At the second stage of the maturity curve, carriers start to develop simple, yet fractured automations that break up the monotony of manual heroics. While this is a relatively improved stage, there will still be a high degree of manual effort.

Many carriers reach this phase and get discouraged with the results. Historically, this is an awkward period that should be viewed as a “practice phase” based on early results, rather than the endpoint of a transformation for the organization. Triaging issues remains a complicated and time-consuming process for business users.

On the technical side, legacy data issues are common, and, while they remain costly, the majority of data is starting to be passed from application to application via automated jobs. There will still be some lingering instances of legacy operational data living offline for accepted, fringe business cases only.

Operational efficiencies are still being created at this stage, but a day in the user’s life still starts and ends with operational inefficiencies. Business users will still spend considerable time triaging issues, a process that requires navigating multiple applications to find the most useful data. Distributors might be able to view select statements through a basic online portal at this stage, but little else is available online, and they are often still dealing with the inefficiencies of paper mail. To move from the first to the second stage, it is important carriers start optimizing various processes via automations, as well as implement a basic portal with at least foundational capabilities. Carriers will still need to add automations to adapt in real time.

3. Operational Efficiency Achieved

Once a carrier reaches the third stage of the maturity curve, enough automation has been implemented that the carrier can notice the operational efficiency that has been achieved. At this stage, critical business processes are automated, freeing up the bandwidth of business users. Without having to invest as much time and energy into firefighting, users can prioritize research that drives continuous improvement. Technology efficiencies are driven by batch and real-time integrations, allowing data to flow across applications without manual manipulation.

The introduction of siloed but now digitally enabled self-service tasks is the hallmark of the Stage 3 producer experience, laying a foundation for “ease of doing business” going forward. Many core platforms have made investments to allow for easier deployment of digital experiences. Producer portals allow distributors to view and filter all statements online and download the latest available product information.

One holistic benefit of achieving these operational efficiencies is that carriers will be able to increasingly tie their distribution strategy to operational priorities. Newfound abilities such as expansion into new channels or the piloting of next-gen technologies will offer tangible proof that progress is being made toward a true distribution management transformation.

4. Anticipating Customer Needs

At the fourth stage of the maturity curve, all users at a carrier are increasingly able to select how and where they want to make improvements to the business. Here, automated reporting and business processes allow users to proactively service distributors; all core operations require very little effort from users. Business users can more readily identify new distribution channels or groups, and they are able to capitalize when market opportunities present themselves. Users are further aided by the fact that customer, policy, claims and commissions data has been well-organized in a logical and physical model; it is both efficient and intuitive to get access to essential information.

The producer portal moves beyond siloed transactions to a holistic experience from onboarding, to servicing, commission statements, lead generation and more, redefining “ease of doing business.”

Business users invest little to no effort to access the information they need, and portal capabilities are fully self-servicing with human interaction being almost a luxury upgrade. Leadership at the enterprise level will be able to start tying measurable outcomes to the distribution strategies implemented during the transformation. At the channel level, incentives will be based on target markets, and business will be driven to those channels that are most productive.

5. Predictive Analytics & AI

Very few carriers, if any, have made it to Step 5. It’s the right vision to aim for, though, because it encapsulates what is currently possible.

Once carriers reach this stage, data-driven predictive alerts for business users will enhance the timing, speed and quality of decisions related to managing their distribution channels. Core processes will be conducted via automated data-driven decision making, rather than highly manual intervention by business users. Technology will inform these automations given the presence of event-based triggers and real-time integrations.

Manual effort is limited to fringe exceptions. Distribution capabilities should be mature enough that carriers can have a comprehensive understanding of their customers. They will only develop services or strategies that tap into ecosystems when it clearly makes sense for what their partners want. Distribution strategy will be fully informed and tuned to what their data is saying. Carrier technologies will be nimble enough to consistently and effectively meet the needs of customers.

You Can Get There From Here!

Carriers and distributors can escape that groundhog feeling with incremental improvements and a vision of a transformed experience for everyone. In fact, the vision is a great place to begin. What will a successful transformation look like? What are key metrics to track throughout the journey? Is this something we can do alone, or should we seek a partner?

Every organization is different, but all insurers should be working within a growth strategy that includes next-gen customer and distributor experiences. The capabilities needed will be found in next-gen distribution management technologies.

For an expanded look at transforming distribution management, be sure to download the Majesco/PwC report, Distribution Management: A Path to Maturity. For a closer look at how to achieve the right mix of technology and flexibility in your operating model, tune in the latest Majesco/PwC podcast on Adapting and Growing.