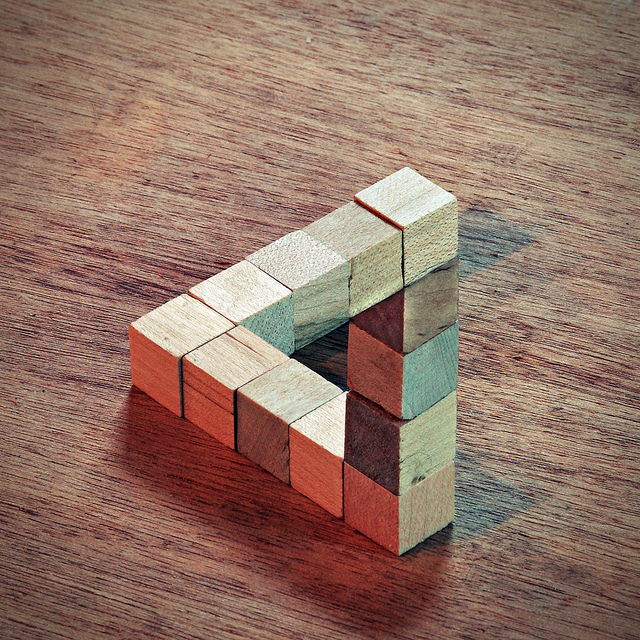

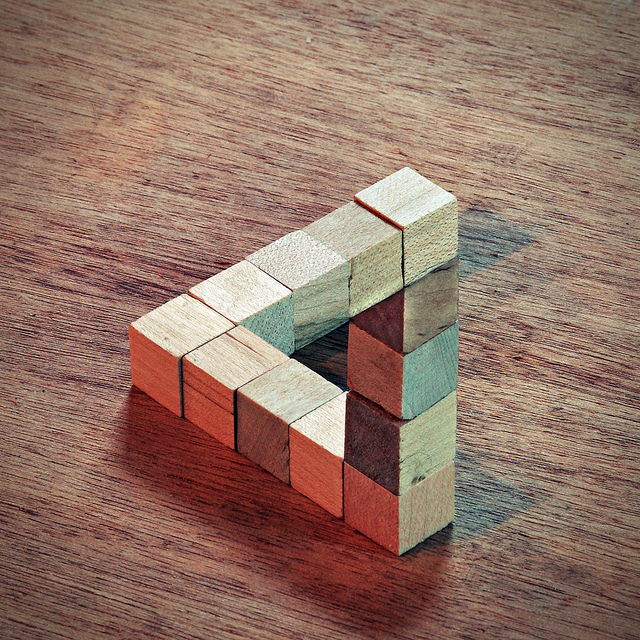

Building Blocks for Risk Leaders (Part 2)

Risk leaders increasingly need broader experience and capabilities and should hone their skills outside their organizations.

Risk leaders increasingly need broader experience and capabilities and should hone their skills outside their organizations.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Christopher E. Mandel is senior vice president of strategic solutions for Sedgwick and director of the Sedgwick Institute. He pioneered the development of integrated risk management at USAA.