A growing number of policymakers, advocates and experts predict that extreme weather may lead to higher costs for home and flood insurance.

Some analysts are even predicting that the effects of climate change may make home insurance and flood insurance unaffordable for many Americans.

Home insurance companies charge higher premiums to cover property associated with higher risks. Added insurance costs could lead to lower home prices.

"As insurance rates rise commensurate with increasing risk related to weather hazards, and property taxes rise to cover the costs of climate mitigation and adaptation, real estate values for properties in vulnerable areas will fall," predicts Donna Childs, author of the book "Prepare for the Worst, Plan for the Best: Disaster Preparedness and Recovery for Small Businesses.”

"The insurance premiums and property taxes for these properties become higher,” Childs said.

Daren Blomquist, senior vice president at ATTOM Data Solutions, observes that natural disaster risks have affected home prices. Blomquist notes that home price appreciation in cities with the highest flood risk was half that for the U.S. housing market overall during the past decade. It’s been one-third that for cities with the highest hurricane surge risk.

"The broader market has also outperformed appreciation in cities with the highest wildfire risk during the last decade, although the gap is much narrower,” Blomquist said.

Climate change top insurer issue

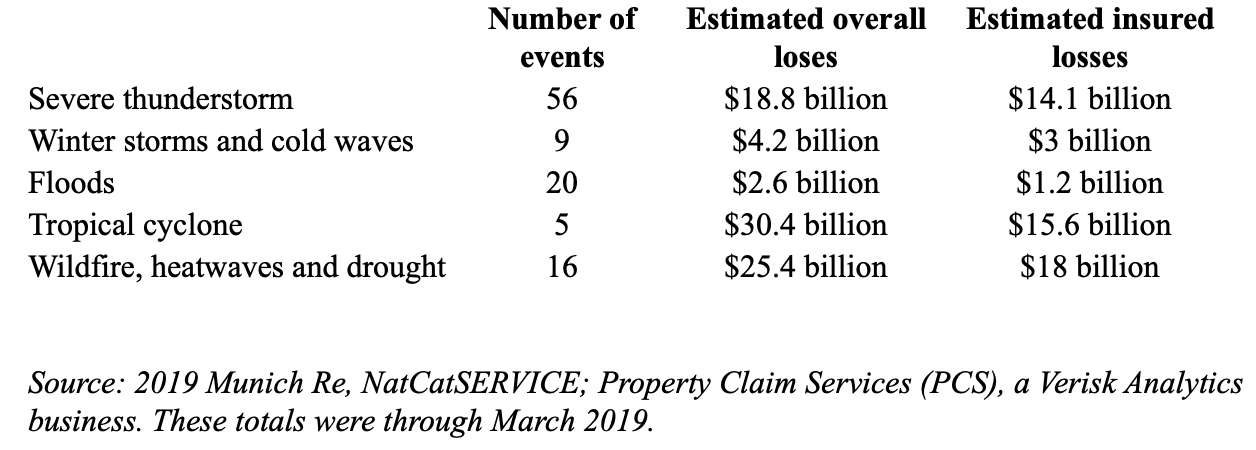

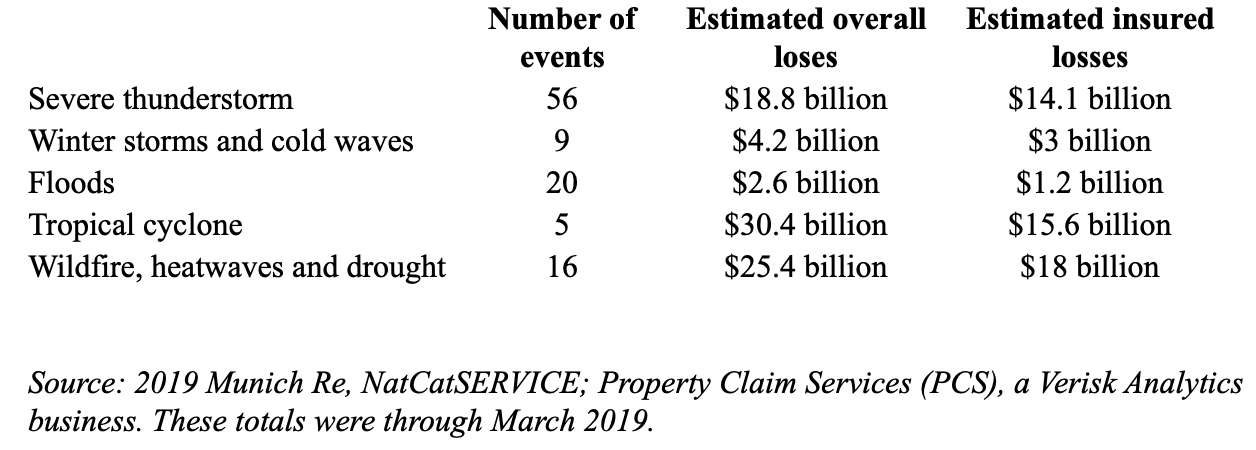

Many insurance experts consider climate change as one of the most pressing issues. That concern may lead to higher insurance costs for homeowners.

The riskier the property, the more an insurer charges. The result — more climate change-related claims means:

Climate change top insurer issue

Many insurance experts consider climate change as one of the most pressing issues. That concern may lead to higher insurance costs for homeowners.

The riskier the property, the more an insurer charges. The result — more climate change-related claims means:

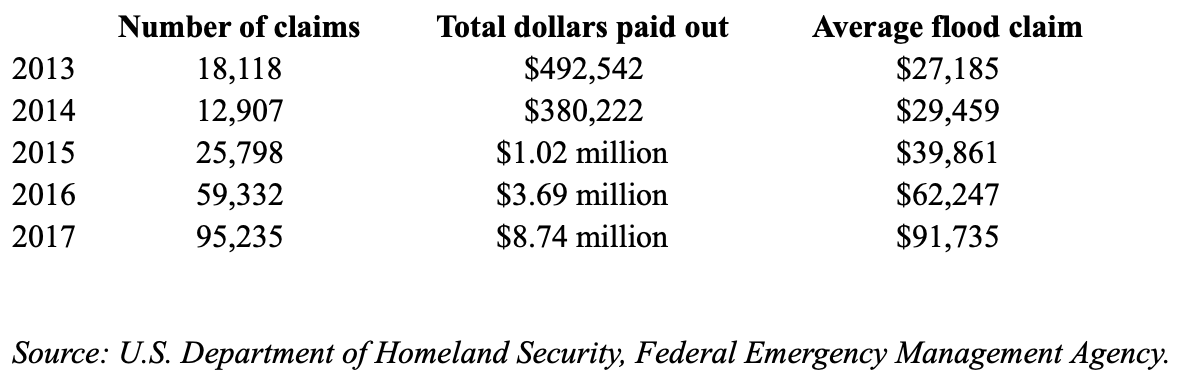

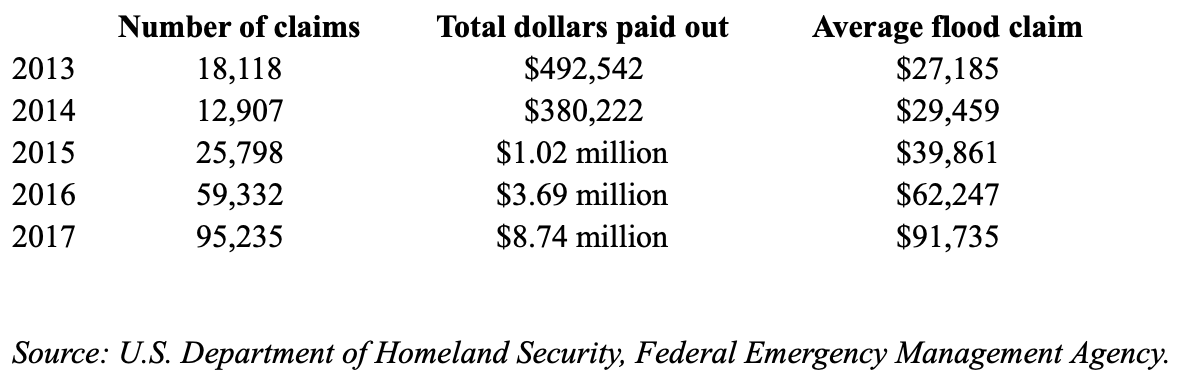

Despite the increase in claims and average flood claim amounts, flood insurance policies are purchased less frequently today than they were a decade ago. In 2009, insurance companies sold 5.7 million flood insurance policies. In 2017, the number dipped to slightly more than 5 million.

Tornadoes, hurricanes and climate change

The Center for Climate and Energy Solutions says some areas, such as the North Atlantic, have seen more hurricanes over the past three decades. Scientists predict Category 4 and 5 hurricanes will increase in the coming years, though the overall number of hurricanes may decrease.

“Although scientists are uncertain whether climate change will lead to an increase in the number of hurricanes, warmer ocean temperatures and higher sea levels are expected to intensify their impacts,” according to the Center for Climate and Energy Solutions.

States prone to hurricanes feature hurricane deductibles. If your home gets damaged in a hurricane, you’ll have to pay a hurricane deductible after filing a claim. These deductibles are different from regular home insurance deductibles.

Depending on an area’s risk, hurricane deductibles are based on a percentage of a home’s insured value. It’s usually between 2% and 5%, but Florida allows insurers to charge up to 10%.

Whether your home policy covers you for hurricane damage depends on the fine print. You may need to get a windstorm rider to cover hurricane damage, such as lost siding, shingles or shattered windows.

Combating climate change and rate hikes

Childs said taking preventive actions can lower risks. "For example, when I purchased my home, the land on the western side slopes downward at a 30-degree angle, and the basement windows are flush with the ground, with the result that water would come downhill, creating the risk of water intrusion into the basement,” Childs said.

See also: Parametric Solution for Wildfire Risk

Childs trenched this area and inserted a serrated pipe that connects to the sewer system. She also made a significant energy retrofit that reduced her utility bills by 40% and protects against the risk of extreme heat.

Childs said home buyers should factor in climate risks when purchasing a home, including figuring out whether to buy flood insurance, even if you’re not in a high-risk area.

When buying a home:

Despite the increase in claims and average flood claim amounts, flood insurance policies are purchased less frequently today than they were a decade ago. In 2009, insurance companies sold 5.7 million flood insurance policies. In 2017, the number dipped to slightly more than 5 million.

Tornadoes, hurricanes and climate change

The Center for Climate and Energy Solutions says some areas, such as the North Atlantic, have seen more hurricanes over the past three decades. Scientists predict Category 4 and 5 hurricanes will increase in the coming years, though the overall number of hurricanes may decrease.

“Although scientists are uncertain whether climate change will lead to an increase in the number of hurricanes, warmer ocean temperatures and higher sea levels are expected to intensify their impacts,” according to the Center for Climate and Energy Solutions.

States prone to hurricanes feature hurricane deductibles. If your home gets damaged in a hurricane, you’ll have to pay a hurricane deductible after filing a claim. These deductibles are different from regular home insurance deductibles.

Depending on an area’s risk, hurricane deductibles are based on a percentage of a home’s insured value. It’s usually between 2% and 5%, but Florida allows insurers to charge up to 10%.

Whether your home policy covers you for hurricane damage depends on the fine print. You may need to get a windstorm rider to cover hurricane damage, such as lost siding, shingles or shattered windows.

Combating climate change and rate hikes

Childs said taking preventive actions can lower risks. "For example, when I purchased my home, the land on the western side slopes downward at a 30-degree angle, and the basement windows are flush with the ground, with the result that water would come downhill, creating the risk of water intrusion into the basement,” Childs said.

See also: Parametric Solution for Wildfire Risk

Childs trenched this area and inserted a serrated pipe that connects to the sewer system. She also made a significant energy retrofit that reduced her utility bills by 40% and protects against the risk of extreme heat.

Childs said home buyers should factor in climate risks when purchasing a home, including figuring out whether to buy flood insurance, even if you’re not in a high-risk area.

When buying a home:

Climate change top insurer issue

Many insurance experts consider climate change as one of the most pressing issues. That concern may lead to higher insurance costs for homeowners.

The riskier the property, the more an insurer charges. The result — more climate change-related claims means:

Climate change top insurer issue

Many insurance experts consider climate change as one of the most pressing issues. That concern may lead to higher insurance costs for homeowners.

The riskier the property, the more an insurer charges. The result — more climate change-related claims means:

- Higher insurance costs

- Insurers becoming stricter about who even gets coverage

Despite the increase in claims and average flood claim amounts, flood insurance policies are purchased less frequently today than they were a decade ago. In 2009, insurance companies sold 5.7 million flood insurance policies. In 2017, the number dipped to slightly more than 5 million.

Tornadoes, hurricanes and climate change

The Center for Climate and Energy Solutions says some areas, such as the North Atlantic, have seen more hurricanes over the past three decades. Scientists predict Category 4 and 5 hurricanes will increase in the coming years, though the overall number of hurricanes may decrease.

“Although scientists are uncertain whether climate change will lead to an increase in the number of hurricanes, warmer ocean temperatures and higher sea levels are expected to intensify their impacts,” according to the Center for Climate and Energy Solutions.

States prone to hurricanes feature hurricane deductibles. If your home gets damaged in a hurricane, you’ll have to pay a hurricane deductible after filing a claim. These deductibles are different from regular home insurance deductibles.

Depending on an area’s risk, hurricane deductibles are based on a percentage of a home’s insured value. It’s usually between 2% and 5%, but Florida allows insurers to charge up to 10%.

Whether your home policy covers you for hurricane damage depends on the fine print. You may need to get a windstorm rider to cover hurricane damage, such as lost siding, shingles or shattered windows.

Combating climate change and rate hikes

Childs said taking preventive actions can lower risks. "For example, when I purchased my home, the land on the western side slopes downward at a 30-degree angle, and the basement windows are flush with the ground, with the result that water would come downhill, creating the risk of water intrusion into the basement,” Childs said.

See also: Parametric Solution for Wildfire Risk

Childs trenched this area and inserted a serrated pipe that connects to the sewer system. She also made a significant energy retrofit that reduced her utility bills by 40% and protects against the risk of extreme heat.

Childs said home buyers should factor in climate risks when purchasing a home, including figuring out whether to buy flood insurance, even if you’re not in a high-risk area.

When buying a home:

Despite the increase in claims and average flood claim amounts, flood insurance policies are purchased less frequently today than they were a decade ago. In 2009, insurance companies sold 5.7 million flood insurance policies. In 2017, the number dipped to slightly more than 5 million.

Tornadoes, hurricanes and climate change

The Center for Climate and Energy Solutions says some areas, such as the North Atlantic, have seen more hurricanes over the past three decades. Scientists predict Category 4 and 5 hurricanes will increase in the coming years, though the overall number of hurricanes may decrease.

“Although scientists are uncertain whether climate change will lead to an increase in the number of hurricanes, warmer ocean temperatures and higher sea levels are expected to intensify their impacts,” according to the Center for Climate and Energy Solutions.

States prone to hurricanes feature hurricane deductibles. If your home gets damaged in a hurricane, you’ll have to pay a hurricane deductible after filing a claim. These deductibles are different from regular home insurance deductibles.

Depending on an area’s risk, hurricane deductibles are based on a percentage of a home’s insured value. It’s usually between 2% and 5%, but Florida allows insurers to charge up to 10%.

Whether your home policy covers you for hurricane damage depends on the fine print. You may need to get a windstorm rider to cover hurricane damage, such as lost siding, shingles or shattered windows.

Combating climate change and rate hikes

Childs said taking preventive actions can lower risks. "For example, when I purchased my home, the land on the western side slopes downward at a 30-degree angle, and the basement windows are flush with the ground, with the result that water would come downhill, creating the risk of water intrusion into the basement,” Childs said.

See also: Parametric Solution for Wildfire Risk

Childs trenched this area and inserted a serrated pipe that connects to the sewer system. She also made a significant energy retrofit that reduced her utility bills by 40% and protects against the risk of extreme heat.

Childs said home buyers should factor in climate risks when purchasing a home, including figuring out whether to buy flood insurance, even if you’re not in a high-risk area.

When buying a home:

- Shop around for insurance and know what you’re buying. If you need additional coverage, ask the insurer about riders and other coverage.

- Take precautions to protect your home. If you’re building a new home, talk to the builder about the materials being used. If you live along the coast, check on storm shutters. Explore fire-suppression systems. All of these additions could lead to lower rates and even home insurance discounts.