- The business strategy sets the direction and targets of the company, but the operating environment changes constantly.

- To succeed, insurers must have an operational model with adequate flexibility and agility to follow market fluctuations.

- A new target operating model based on a set of design principles necessitated by the pandemic must be designed for the insurer

- It’s time to outsource all non-core activities.

Crafting the strategy for a successful future for the insurer is one thing, creating an operating model that is capable of delivering the strategy is another. Even the greatest strategy will just remain as a document if it not put into action – and this can only be done by the organization through a dedicated and reinvented target operating model.

Executing on a strategy requires an organization, systems and processes designed with the strategic purpose in mind, a target operating model. This article discusses how to translate the strategy set by the insurer into an actionable target operating model that enables the strategy to be implemented in the best possible way.

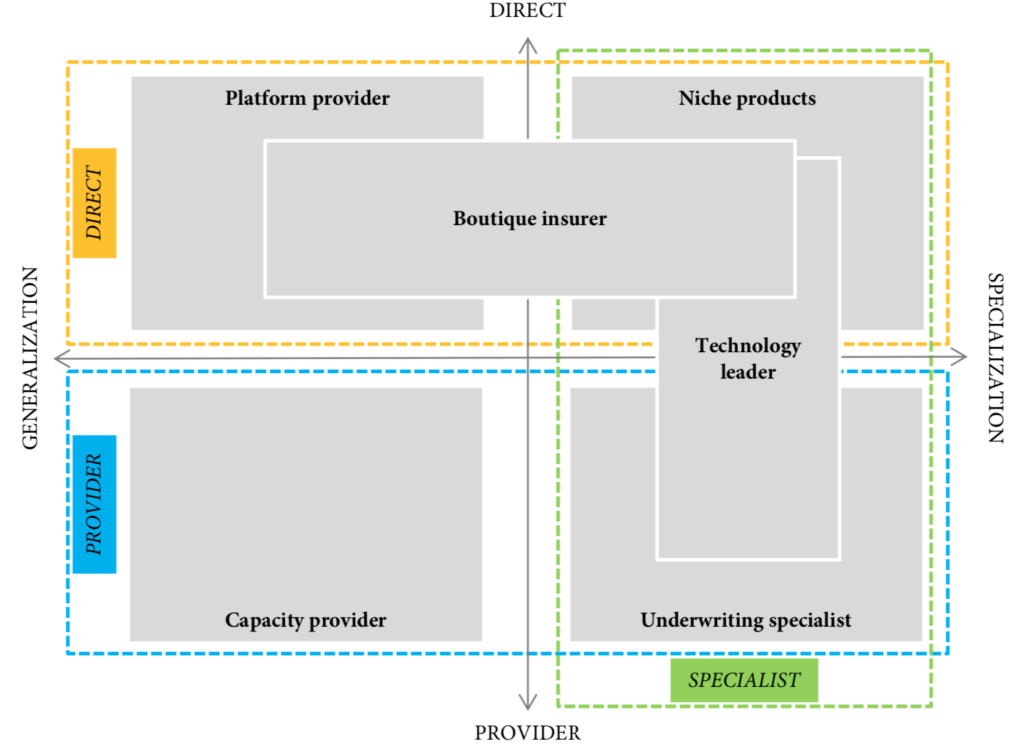

For a discussion on what strategy the insurer should target, please refer to the white paper Future of Insurance, that discusses different strategies that insurers can pursue to remain relevant and profitable in the future, aiming for one of the strategic positions shown in Figure 1 on the next page.

Figure 1: Six future strategy options for insurers to keeping relevant and profitable

It is important to understand that while the strategy sets the future direction of the insurer, the strategy itself must be broken down into actionable elements so the organization is capable of implementing the strategy.

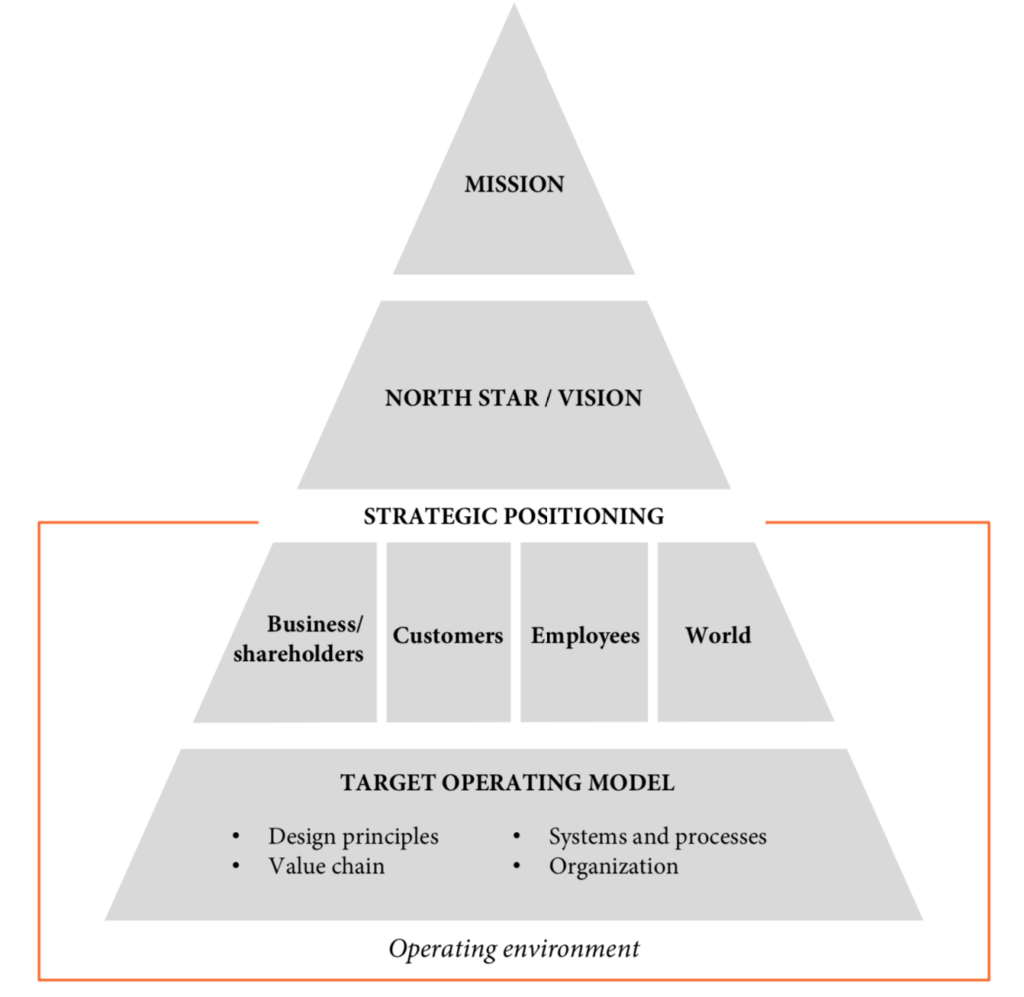

The final strategy should be a derivative of the insurer's overarching mission and vision and ensure that successful implementation delivers on these values. The mission is the insurer's reason to be and should not change over the lifetime of the company, where the vision is the three- to five-year targets that the insurer is pursuing.

Having a solid mission, a guiding North Star, is particularly important during turbulent times as the mission statement helps the company keep focus on the longer-term targets and hence keeps the direction in a volatile and fluctuating environment.

The strategy for the year – or years – is formed based on the vision and seeks to position the insurer:

- In the market; which one of the six possible strategies is the right one for the insurer, given the mission, vision and shareholders’ expectations and requirements?

- With the customers; which customer segments are we focusing on, and what special value will our strategy bring to our customers; how can we use this to differentiate ourselves in the market?

- For the employees; what differentiates us from other employers, and how do we intend to develop our talent to keep them skilled, motivated and engaged?

- ...and in the world; how do we set out to affect the world and environment around us?

Strategic choices for the business, customers, employees and impact on the world should ultimately decide the target operating model for the insurer. A target operating model describes the principles of how the organization will operate given these choices, taking the operating environment into consideration.

Figure 2: Successful strategy implementation relies on a well-defined and well-functioning operating model

The operating environment is a holistic view on where the insurer operates and covers the current situation as well as the expected development of the political environment, shareholders, competitors, customers, employees and partners.

A successful operating model is built on a deep understanding of the fluctuations and developments in the operating environment – the insurer needs an operating model that is flexible and agile enough to respond to changes in the environment, and the more volatile the environment is, the more flexible and agile the operating models needs to be.

There will often be many unknown elements of the operating environment, so identifying let alone predicting the future development of them can be difficult, but it nevertheless has to be done if the insurer is to create a viable strategy.

For further reading on this topic, a method to understanding and predicting the development of the operating environment can be found in this white paper.

Broadly, four main topics can cover what is required to build a future operating model, enabling the insurer to be responding to market changes when needed:

- Design principles — overarching principles that permeate all elements in the target operating model and act as design foundation for the target operating model

- The value chain — description of the end-to-end value chain and analysis of what non-core elements can be considered outsourced/offshored to increase the insurer's agility and flexibility.

- Systems and processes — (re)design of systems and processes throughout the organization to meet the strategic requirements

- Organization — construction of the organizational roles, targets and responsibilities so the organization is enabled to deliver what’s needed to reach the strategic targets

More than ever, the future of business and countries in the world is uncertain, so insurers need an operating model capable of following fluctuations in customer demands and market developments. This is the only way they can to stay relevant in the New Normal and beyond, and therefore an important starting point when analyzing the elements in the target operating model.

The days of slow evolution and predictable market developments are gone, and insurers must design their target operating model to cope with this.

Design principles

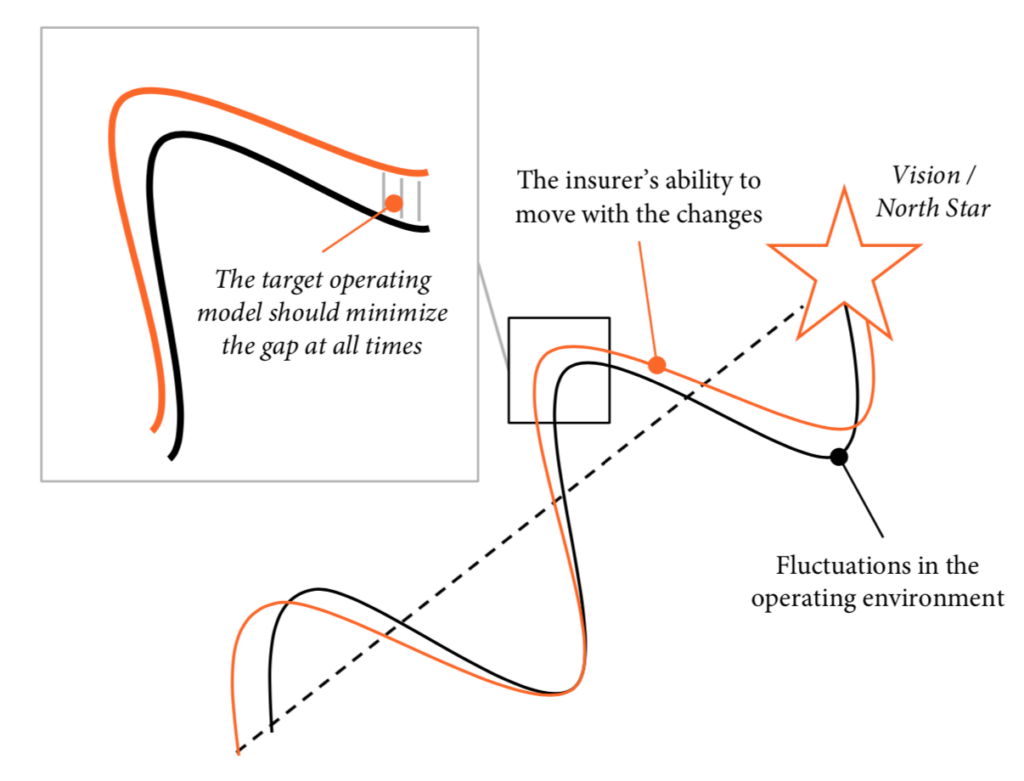

The overarching design principle for the target operating model is to enable the insurer to follow the fluctuations in the operational environment in the optimal way, i.e. being able to respond to relevant market changes (theoretically) as fast as they happen.

Execution of the strategies toward the vision should in other words be open and adjustable enough to facilitate deviation from the straight line (see figure 3), as it would be unwise assuming the market developments will be straightforward and follow a path that is easy to predict.

Figure 3: The target operating model should enable the insurer to close the gap between the market development and the insurer’s ability to follow

Designing the target operating model should therefore be done with the "closing of the market development and insurer response gap" as highest priority.

Maximum virtuality and digital workflows

A key design element of the target operating model is to maximize the virtuality of everything, from processes over partner collaboration to teamwork across the organization – the COVID-19 pandemic forced the world to be virtually and digitally competent in a very short time span, and it is important that the target operating model supports and expands on this.

The more virtual and digital competent the insurer is, the more flexibly the employees will be able to work with partners, customers and each other – and the easier it will be to adapt to future catastrophes and serious market changes.

Digitizing the workflows is another design principle that must be followed to increase the agility and flexibility of the insurer – this is not just making internal processes faster and simpler, but also supports the insurers’ ability to function with the workforce (and partners) working remotely, as there will literally be no need for physical exchange of documents or face-to-face meetings, parts of the claims processes excluded (on-site loss adjustments, repairs, hospitalization, etc.).

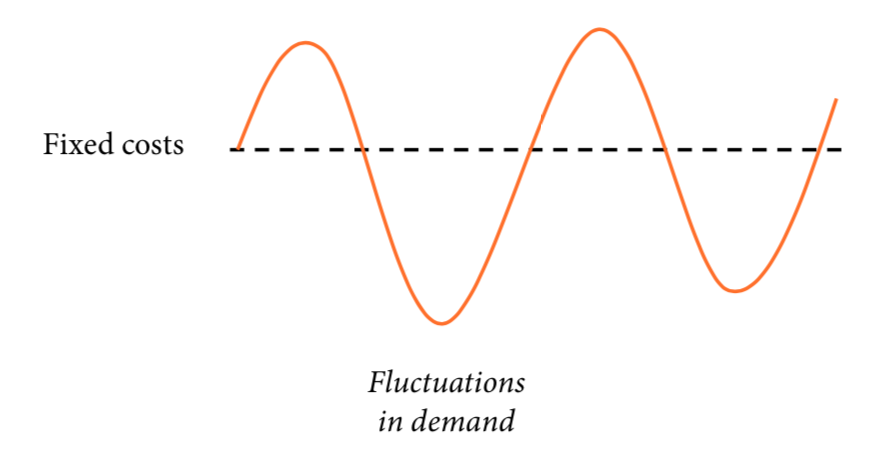

Extreme cost flexibility/minimal fixed costs

Most companies and insurers were caught off- guard by the pandemic, leaving them with a significant drop in demand but with the same, high fixed-cost base. It goes without saying this has hit the financial performance as the fixed costs, being fixed – or long-term commitments – by nature could not (can not) be easily and adjusted to follow the market movements.

See also: Planning for the Unknown Unknowns

If an insurer is to stay profitable in turbulent markets and times, it is necessary to convert the fixed cost base into a significantly more flexible cost base that can move up and down with the market movements. This will allow the costs to fluctuate with premiums and increase the profits or reduce the losses.

Figure 4: Fixed costs cannot follow the fluctuations in market demand and risks eroding the insurers’ profit

A more flexible cost base can be created by outsourcing or offshoring non-core activities and making the payments depending on "units produced"; i.e. claims handled, data operations performed, reports generated, invoices sent, etc.

Apart from offshoring/outsourcing non-core activities, it can be worthwhile looking at office rent and overhead costs. COVID-19 has enabled literally everyone to work from home, and insurance companies have proven themselves to be capable of operating almost fully remotely. Only certain loss adjustments must be done physically; everything else can be managed remotely and virtually/digitally.

By arranging a rotational remote work system, insurers will be able to reduce their rent – a major fixed cost – significantly. Just imagine the impact of reducing workspace requirements by 30%! This number can go even higher if the insurer is following a serious outsourcing strategy, as the direct and indirect cost of employees would be moved from the insurer to the outsourcing partner.

The value chain

A practical starting point for creating the target operating model, especially with focus on reducing fixed costs and increasing the flexibility and agility of the insurer, is the value chain.

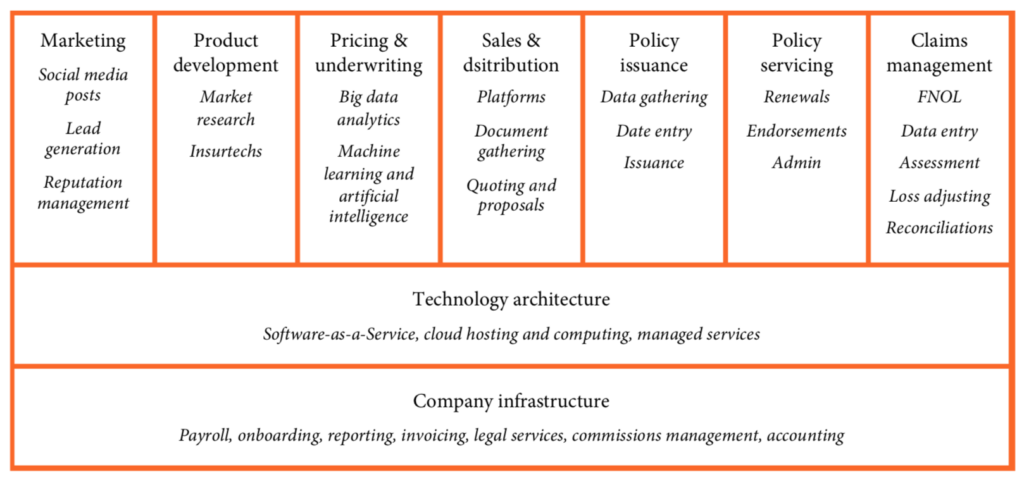

The value chain allows for a detailed walk-through of the operations, so it is possible to define (decide?) what areas of the business are core and non-core. Figure 5 illustrates the typical elements of an insurance value chain with examples of activities that can be considered for outsourcing or offshoring.

Figure 5: Examples of outsourcing potential non-core activities in the insurance value chain

For marketing activities, the insurer can consider outsourcing the planned social media posts and other branding or lead-generation activities like data collection for quoting, initial e-mail marketing and social media activities (competitions, lucky draws, etc.). Outbound calling to potential leads is also a typical marketing activity that can be managed offshore.

Reputation management can also be managed by a third-party partner – reputation management is constant monitoring of news and social media to listen for positive and negative mentions of the insurer, and react to these mentions, whether to prevent reputational damage, to answer questions or to thank for positive mentions.

Proper product development relies on market research, and that, too, can easily be outsourced to a third-party. Another, more radical, approach to product development can be partnering with insurtechs to leverage on their products and services, that are typically innovative – the white paper, Insurtechs, a part of insurers’ digital transformation?, discusses how insurers can fast-track parts of their product offerings by partnering with insurtechs.

Setting the right premium for individuals is most often heavily relying on data analysis, and the abundance of data enables very detailed pricing and underwriting. However, few insurers have the in-house experience and capabilities to leverage the vast amount of data available

It’s possible to work with partners to get big data analytics done, and the same partners could refine the results further by applying machine learning and artificial intelligence to the underwriting and provide a very individualized pricing and underwriting model for the insurer.

Platforms are already being widely used as sales and distribution channels today, as are, of course, the agents and brokers. Gathering of documents on behalf of the customer – digitally or physically – can be a time-consuming task that can be outsourced to a partner, which in turn could also use the data gathered to generate quotes and proposals, based on the models created by the big data analytics and machine learning activities.

Along the same lines, policy issuance can be handled by external partners, mainly when it comes to data gathering and data entries (where it’s not yet automated), and the actual issuance of the policy can also be done externally, on behalf of the insurer.

During the active policy period, policy servicing is another area that is typically not a core function of the insurer and could be managed by an outsourced partner. This could be managing renewals, handling endorsements and other administrative functions like basic changes to customer data (phone number, home address, etc.).

Claims management, a large and critical element of any insurer’s value chain, has several areas where outsourcing of services can be very relevant, ranging from first notice of loss, claims data entries, damage assessments, loss adjustments to general claim inquiries, reconciliations and workman’s compensation data entries.

A growing trend is for insurers to use fully outsourced claims management services, the third-party administrators. TPAs are responsible for the complete claims process and are typically providing these services to multiple insurers, allowing economies of scale to reduce the cost per claim as well as the actual claims cost, too.

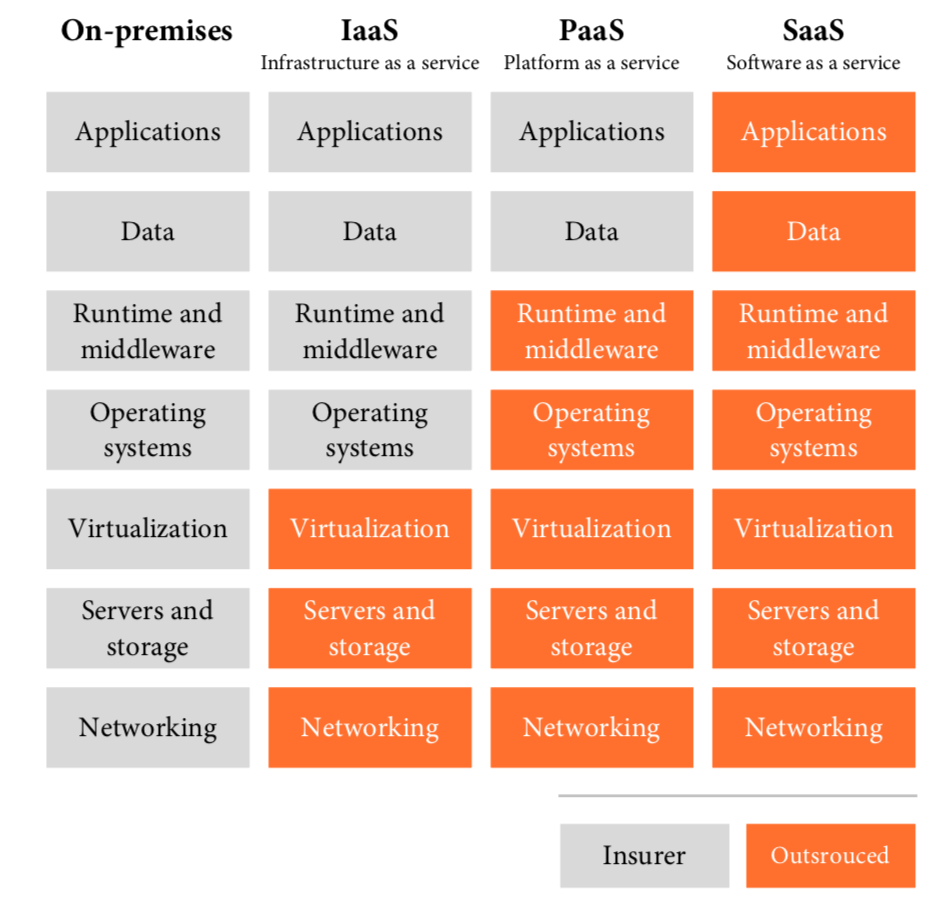

Behind it all sits the technology architecture and IT infrastructure that also have significant opportunities for outsourcing, ranging from hosting services in the cloud over managed services to actively using new(er) solutions like software-as-a-service and platforms-as-a-service.

When analyzing the tech architecture, it is important to look at not only how and where the digital environment is handled, but also who is managing the company’s application development – there may significant opportunities in offshoring large parts of the application development, too, leaving key developers and software architects with the insurer to overlook and manage the remote development.

Figure 6: The differences between various technological architecture hosting models (source: bmc)

When analyzing the tech architecture, it is important to look at not only how and where the digital environment is handled, but also who is managing the company’s application development – there may be significant opportunities in offshoring large parts of the application development too, leaving key developers and software architects with the insurer to overlook and manage the remote development.

There are several elements of the company infrastructure that can be managed by partners, as well, ranging from payroll management, employee onboarding processes, invoicing and accounting to legal services and commissions management.

Many of the reports being generated today are still to a large extent done manually, so that is an obvious area for outsourcing, at least until the report generation has been automated. The same goes for the resource demanding commissions calculations and payments and a wide range of the practical aspects of onboarding new employees.

Important considerations while evaluating outsourcing opportunities

Outsourcing or offshoring non-core activities is more complex than it may seem from the above discussion. There are many aspects and considerations that have to be taken into account when planning, to delink the activities from the insurer.

- Customer experience — for customer-facing functions, it’s imperative that the customers are receiving the same or even better service than before, and that they experience a seamless interaction with the insurer. Customers should not feel – or maybe even be aware of – that they are dealing with a third party at all.

- Compliance — any outsourcing partner must comply fully with regulatory instructions.

- Quality — the quality of the services, from data entry to claims management and repairs, should be of the same standard, or higher, than the insurer has been providing.

- Costs — it goes without saying that there should be a cost-efficiency in outsourcing. However, it is worth noting that the sheer flexibility gained by outsourcing can be enough, so the insurer may be willing to pay the same price, just with the added flexibility on cost.

- Management — how will partners be managed, and how will an escalation matrix look, to ensure that customers and partners are receiving the same quality of service and interaction?

Service level agreements (SLAs) are used to manage the above considerations. The SLAs are made with detailed service levels (customer satisfaction, average repair cost, handling times, etc.) that are closely monitored and acted upon if they fall outside the agreed scope

Core versus non-core activities

During the discussions, primarily non-core activities should be in focus when looking at outsourcing/offshoring opportunities, so a distinction between core and non-core activities would be relevant.

The notion of core and non-core activities goes all the way back to the introduction of the term core competencies, which Prahalad and Hamel defined as “a harmonized combination of multiple resources and skills that distinguish a firm in the marketplace.” This idea can act as a guide to understand what the insurer does or offers that really sets the products and services apart from the other insurers in the market.

This could be special agreements with car repair workshops that enable the insurer to offer customers a strong value proposition for car insurance. It can be distribution agreements with key partners (banks, digital platforms, brokers, etc.) or a strong brand that is trusted by the customers – or anything else.

Non-core activities are therefore activities that do not – as standalone activities – play an important role in enabling the insurer to offer differentiated products to the customer. Please note that the combination of activities can be a differentiator in itself, and that outsourcing can actually build such a distinct advantage.

Imagine outsourcing a series of processes that, combined, provide a significant improvement in customer service or claims management, allowing the insurer to leverage this to create differentiated market offerings.

Faced with outsourcing, unit leaders and management would be expected to push back and claim that most of their unit’s activities are core activities – it is up to executive management to question this, as it is rarely the case. Typically, a company only has four to five activities that are truly setting the company apart from the competition.

It is therefore necessary to scrutinize processes and activities to ensure that no stone is left unturned – a claim would be that up to 80% of the insurer’s activities are non-core and could potentially be outsourced!

Systems and processes

Following the decisions on what activities to outsource are the systems and processes around the activities. The systems and processes are what tie the activities together and enable the insurer to operate – and in many insurers’ case, the systems and processes are still based on decades-old operating principles. “It has been working so far, so why change?”

However, there should be little doubt that now is the time to change, so it is necessary to relook at how the systems and processes in the organization work, and how they have to be changed to adjust to the expected development of the markets.

Revisiting the current systems and processes should be done in a pragmatic and very structured manner, starting by mapping all processes as they are today, the as-is processes. Based on this mapping, the teams will discuss a future, to-be process and during the discussion identify what needs to change to implement the new processes.

While mapping the current as-is processes, it is expected that the team will identify several non-core activities that can be automated or outsourced, but, before planning to do so, it is necessary to analyze whether the non-core activity is required at all as the new, to-be process may eliminate the need for that specific activity.

There are two principles that are especially useful when mapping the to-be processes: user stories created by design thinking and the concept of straight-through processing.

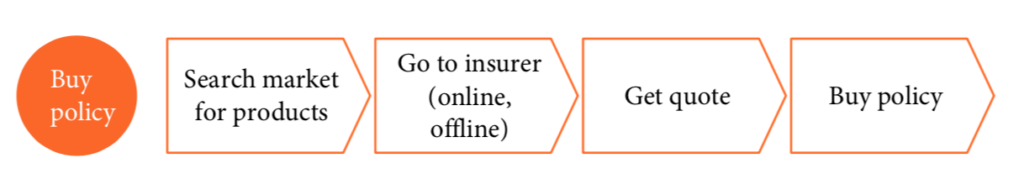

The user stories are a way of describing the customers’ perspective of dealing with the insurer and take a starting point with the customer, and not the insurer. User stories provide a simple way of mapping the stages the customer has to go through to solve a problem (buy a policy, file a claim, answer a question) irrespective of the units and departments involved at the insurer.

Figure 7: Simplified user story for buying an insurance policy

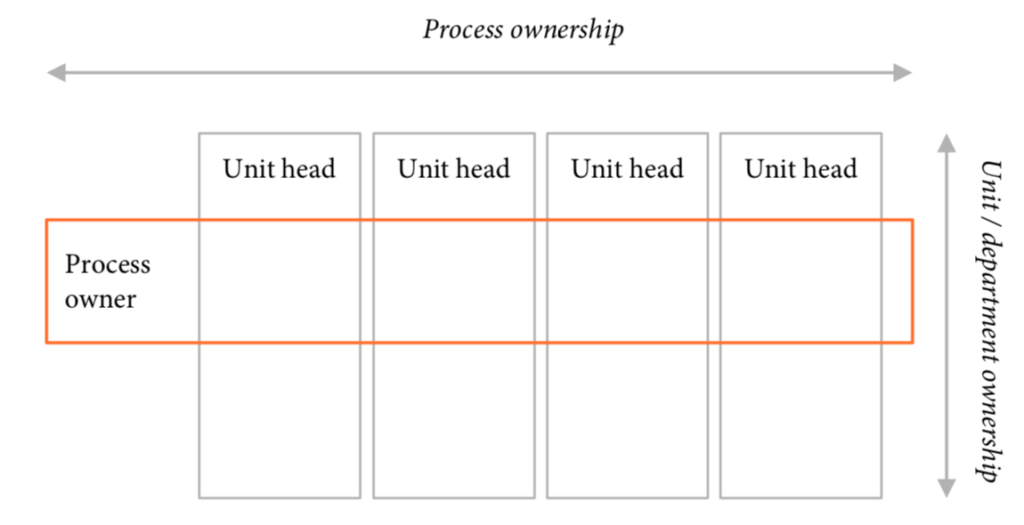

The user story is used as the foundation for the redesign of the process, which typically will reach across various units and departments. This may require changes to the organizational structure as successful change of the processes requires process ownership in the organization as opposed to business unit ownership – in other words, a responsible person for the processes is introduced into the organization and has the authority to change processes within the various business units.

Think about the many processes and units involved in the simplified user story depicted in Figure 7, from marketing over call center and branches to underwriting, administration and finance – all these units must be aligned across one to-be process, following the user story, the customer’s journey toward buying a policy.

Straight-through processing that is used to speed the transaction by streamlining the information through multiple points – this could be an invoicing process where the information is made readily available to all stakeholders in the process, thereby speeding up the evaluation and approval processes.

This is the underlying functionality of all redesigned processes, as straight-through processing is required to automate and simplify all processes, from underwriting to claims and invoicing and administration. For the new processes to be effective, relevant data for decision making should be made available throughout the process.

See also: Insurtechs’ Role in Transformation

Organization

Any successful operating model needs an organization to execute on the processes and systems designed for the operating model – and designing a target operating model also means designing a new organizational model to cope with the operating model.

The topics discussed in this article have identified at least two major areas that must be incorporated into a new organizational structure: the ability to handle a massive outsourcing of non-core activities and the introduction of process ownership to manage the redesigned processes across units and departments.

Outsourcing, or offshoring, significant elements of the insurer’s value chain adds a new set of requirements to the organization and the employees who handle the outsourced activities – managing an outsourced team is different than working directly with colleagues in the same company, so employees have to be aware of this and know how to ensure that the outsourced partnership is a success.

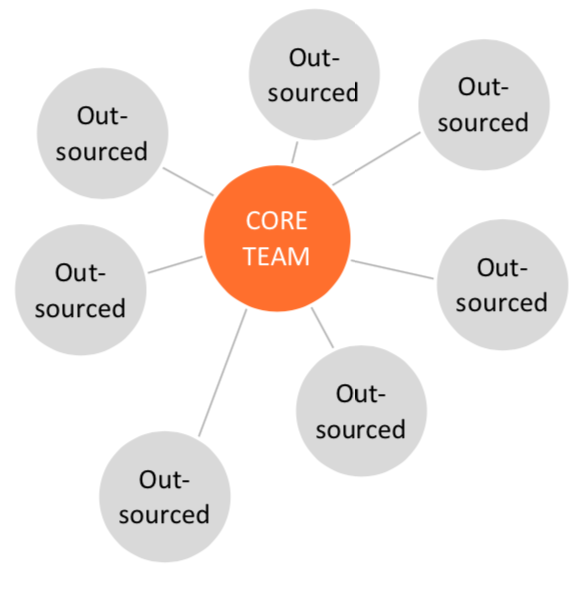

In essence, the core team will be insurance, process and systems experts from the insurer, responsible for managing the daily partnerships with the external partners. The core team will manage the core activities, ensuring seamless connection and collaboration with the external managed non-core activities.

The core teams will be guardians of the insurer’s intellectual property and are responsible for the constant development of these core competences, ensuring that the insurer is on the right strategic path and constantly developing the core activities to keep and evolve the differentiation in the market.

Figure 8: The core team holds the insurer’s intellectual property (core competences) and coordinates closely with the outsourced teams

Along the same lines, the core team is directly responsible for constantly monitoring and following up on the service level agreements set between the parties and act immediately if deviations happen.

A great starting point for the outsourcing process is to relocate existing employees to outsourcing partners and by doing so secure knowledge transfer and continuity in the operations – this also eases the difficult decision of letting a large number of employees go.

Changing from unit/department ownership to process ownership is necessary to make several of the newly established, cross-functional processes operate optimally. This can be difficult to implement as it will most likely mean significant changes in decision making authority, as unit/department owners now have to coordinate with the process owner to ensure that the processes are as smooth and effective as possible.

Figure 9: Changing processes to focus across units and departments will also change the internal organizational decision- making authority

A key element here is to ensure that the process owner and the unit/department head is measured by the same targets and performance indicators. Shared targets will enable closer cooperation and ease the change from the vertical accountability to the shared accountability across functions.

Final thoughts

Changing an insurer’s operating model is no easy task – it requires coordination and involvement from all stakeholders in the organization, and most often also participation from the board, simply because of the magnitude of changes involved.

Adding outsourcing of non-core activities to this just increases the number of tasks at hand – nevertheless, it is a job that has to be done if the insurer is to maintain a competitive position in a future world expected to be even more volatile and complex than seen so far.

It is for sure a challenging project that lies ahead – as always, it begins with a small, first step.

I hope yours was reading this article. Good luck.