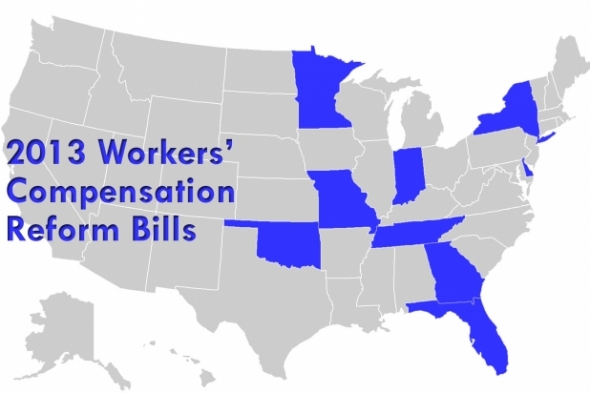

The cost of providing workers' compensation insurance is one of the top issues for companies of all sizes and across industries. Because it is regulated at the state level, companies need to stay abreast of issues in any state in which they do business. To date in 2013, nine states have seen significant workers' compensation reform bills signed into law. Highlights from the legislation in each of the nine states follows.

Oklahoma

Oklahoma's workers' compensation reform laws have received the most attention lately because of the inclusion of an opt-out provision, known as the Oklahoma Option. This legislation takes effect on February 14, 2014, and applies only to injuries occurring on or after January 01, 2014.

The ability to opt out has been a significant component of the Texas workers' compensation system for a number of years. Wyoming also has a limited opt-out provision. Approximately one-third of employers in Texas participate in the opt-out, including many large national retailers. The significant cost savings employers saw in Texas was one of the driving forces behind the Oklahoma Option.

The Oklahoma Option's application form is significantly different from that in Texas. Employers that opt out in Texas cannot simply endorse their excess liability policy to cover Oklahoma. Rather, employers in Oklahoma that choose the option are required to provide a written benefit plan that serves as a replacement for the workers' compensation coverage. This benefit plan must provide for full replacement of all indemnity benefits offered in the workers' compensation system. The plan can be self-insured, or coverage can be purchased from a licensed carrier. At this time, carriers are developing policies to provide both first-dollar and excess self-insurance coverage for the benefit plans under the Oklahoma Option.

The key component of the Oklahoma Option for employers is that it gives them full control of the medical treatment through their benefits plan. More than 60% of workers' compensation costs are medical treatment. With full medical control, employers will be able to ensure that injured workers receive the appropriate medical care from medical providers who follow widely accepted occupational medicine treatment protocols. This will eliminate doctor shopping, which is a significant cost driver in many states. The hope is that full employer medical control will eliminate unnecessary treatment, produce shorter periods of disability, and ultimately improve medical outcomes for the injured workers.

Unlike the Texas opt-out, the Oklahoma Option does not permit employees to pursue a negligence action through the civil courts. Workers' compensation is usually the exclusive remedy for an injured worker for any work-related injuries. In other words, the employee cannot usually pursue a separate tort action in civil court. In Texas, injured workers for employers who opted-out are free to pursue remedy in the civil courts. With the Oklahoma Option, any litigation must proceed through the normal workers' compensation administrative processes. This exclusive remedy has a narrow exception for injuries that were intentionally caused by the employer. Attorneys will have to overcome this very high burden of proof in order to pursue a civil complaint for a work injury.

Another difference between the Oklahoma and Texas opt-out scenarios is that the Oklahoma system is backed by a guarantee fund, which provides benefit payments in the event that a carrier or self-insured employer becomes insolvent and is unable to continue paying claims. The Oklahoma Option coverage offers guarantee funds for both self-insured employers and carriers. These are separate from the workers' compensation guarantee funds.

The Oklahoma reforms also include the switch from a court-based system to an administrative system. Oklahoma was one of the few remaining states where all workers' compensation disputes were adjudicated in the civil courts. Civil litigation is both very expensive and time-consuming. This change to an administrative system should reduce employer costs associated with litigation and produce more timely decisions, which are key elements of controlling claims costs.

Overall, the changes made in Oklahoma are positively viewed by employers and should improve Oklahoma's ranking as a top ten state for loss costs.

Delaware

The recently passed reform bill in Delaware was designed to control medical costs and encourage return-to-work efforts.

Medical cost savings will be achieved by:

- Suspending for two-years the annual inflation increase on medical fees.

- Lowering the inflation index on hospital fees.

- Creating new cost-control provisions on pharmaceuticals.

- Establishing a statute of limitations for appealing utilization review decisions.

- Expanding the fee schedule to capture items that were previously exempted.

Other changes included more emphasis on return-to-work efforts, which will be considered in calculating the workplace credit safety program.

These changes are expected to lower employer workers' compensation costs in Delaware.

Florida

The use of physician-dispensed medication has been a significant issue in Florida workers' compensation. Physicians were charging several times what the same medication would cost from a retail pharmacy, and the costs were not regulated by a fee schedule. SB 662, which was recently signed into law, creates a maximum reimbursement rate for physician-dispensed medication of 112.5% of the average wholesale price, plus an $8 dispensing fee. Although the bill is expected to produce cost savings for employers in Florida, the fee schedule amount for physician-dispensed medications is still significantly higher than that for the same medications at retail pharmacies. There are savings; however, this will continue to be a cost driver in the state.

Another issue impacting workers' compensation costs in Florida is that the First District Court of Appeals, in two separate rulings, has found sections of the workers' compensation statutes unconstitutional. Under the Westphal decision (Bradley Westphal v. City of St. Petersburg, No. 1D12-3563, February 2013), the court decided that the 104-week cap on temporary total disability (TTD) benefits was "unfair" and violated the state's constitutional right to access the court and "receive justice without denial or delay." Injured workers are currently limited to 260 weeks of TTD benefits, which was the cap under the prior law. There is concern that the arguments used in Westphal could also be used to invalidate the 260-week limit. The Court has agreed to review this decision en banc, so the ruling is not final.

In the Jacobson case (Jacobson v. Southeast Personnel Leasing, Case 1D12-1103, June 5, 2013), the court found unconstitutional a section of the Act that prevented injured workers from hiring an attorney for motions for costs on disputed claims, as this violated their right to due process.

The Jacobson case is very narrow in scope and has limited impact, but the Westphal decision has potential to significantly increase employer costs. With these cases, there is growing concern in Florida that attacks on the constitutionality of the workers' compensation statutes will continue, further eroding prior reforms that produced significant employer savings.

Despite savings produced via the fee schedule for physician-dispensed medications, if the court upholds the decision in Westphal, the associated costs will outweigh any savings from the recent legislation.

Georgia

Legislation passed in Georgia should have a positive impact on workers' compensation costs for employers. Effective July 1, 2013, medical benefits for non-catastrophic cases are capped at 400 weeks from the date of accident, whereas previously, injured workers were entitled to lifetime medical benefits for all claims. This change significantly shortens the claims tail for non-catastrophic cases. By eliminating exposure for lifetime medical coverage on all claims, it also reduces the potential exposure on any Medicare Set-Aside, as Medicare's rights on a workers' compensation claims are confined to the parameters of the state law.

In order to receive this concession from labor on the medical costs, employers agreed to increase the indemnity rates for temporary partial disability (TPD) and TTD. The indemnity rate increases are as follows:

- TPD: $334 to $350 for a period not exceeding 350 weeks from the date of injury.

TTD: $500 to $525 per week for a period not exceeding 400 weeks from the date of accident.

Indemnity rates in Georgia had not increased since 2007.

Another change involves a requirement that an injured worker make a legitimate effort to return to work when a modified-duty position is offered. The employee must complete a full work shift or eight hours, whichever is longer. If the injured worker feels that he or she is unable to work beyond that, benefits must be reinstated and the burden is on the employer to show the work offered was suitable. If the employee does not complete that full shift, then the burden of proof does not shift back to the employer and the employer can suspend benefits.

The cost savings from capping the medical benefits is expected to slightly outweigh the cost increases associated with the indemnity maximum rate increase. Thus, the net impact to employers should be a slight reduction in workers' compensation costs.

Indiana

Research indicates that workers' compensation medical fee schedules lower medical costs. In Indiana, legislation was passed that establishes a hospital fee schedule at 200% of Medicare rates. This is consistent with other states that base their fee schedules on Medicare rates. The bill also capped the price for repackaged drugs and surgical implants. Since repackaged drugs and surgical implants were previously outside the fee schedule, these caps will help to reduce employer costs. The fee schedule takes effect on July 1, 2014.

The legislation also included changes to indemnity benefits:

- Gradual average weekly wage (AWW) increase of 20% over three years, beginning with a 6% increase on July 1, 2014, and up to 20% over current AWW by July 1, 2016.

- An increase of 25% in permanent partial impairment or disability (PPI or PPD), from $1,400 per degree from 1 to 10 degrees to $1,750, gradually over three years. Higher PPI ratings, above 10 degrees, increased from 16% to 22% incrementally over the same period.

Indiana had not increased its maximum indemnity benefit for many years, so the general consensus is that the increase was overdue.

Given that medical costs typically account for 60% of the total workers' compensation expenditure, the decrease in medical costs from these reforms should offset the increase in indemnity benefits. The expectation is that this legislation will produce a small degree of savings for employers.

Minnesota

Minnesota joined most other states in amending its statutes to allow for mental-mental injuries (a psychiatric disorder without a physical injury). The law provides that the employee must be diagnosed with post-traumatic stress disorder (PTSD) by a licensed psychiatrist or psychologist in order to qualify for benefits. However, PTSD is not recognized as a work injury if it results from good faith disciplinary action, layoff, promotion/demotion, transfer, termination, or retirement.

Other changes include a cap on job development benefits and a restructuring of how attorney fees are paid. There is also an increased cost-of-living adjustment (COLA) for permanently disabled workers and an increase on the maximum indemnity rate. Lastly, rulemaking authority is now in place to include narcotic contracts as a factor in determining if long-term opioid or other scheduled medication use is compensated.

The job development benefits and narcotic use in Minnesota are significant cost drivers, so these are positive limitations for employers. However, the increase in indemnity rates, COLA, and coverage of mental-mental claims all add to employer costs. Thus, a slight overall increase in claim costs is expected as the result of the legislation passed in 2013.

Missouri

Missouri's reforms were focused on addressing the insolvent second injury fund and returning occupational disease claims to the workers' compensation system.

The Missouri Second Injury Fund has been plagued by problems for several years. It was heavily utilized by injured workers to supplement permanent partial disability awards. The fund became insolvent when prior reforms capped assessments that were supporting it while not reducing the claims that were covered by it. Under these new reforms, which are effective January 01, 2014, PPD claims are excluded from the second injury fund. Access to the fund will be limited to permanent total disability (PTD) claims where the total disability was caused by a combination of a work injury and a pre-existing disability. In addition, employer assessments to cover the funds' liabilities are increased by no more than 3% of net premiums. These increased assessments expire December 2021.

The new law also indicates that occupational diseases are exclusively covered under the workers' compensation statutes with some exceptions, which are noted below. The Act also establishes psychological stress of police officers as an occupational disease under workers' compensation.

Bringing occupational disease claims back under workers' compensation came at a cost. Trial lawyers in Missouri had significant influence in crafting this legislation. The act defines "occupational diseases due to toxic exposure" and creates an expanded benefit for occupational diseases due to toxic exposure other than mesothelioma — equal to 200% of the state's average weekly wage for 100 weeks to be paid by the employer. For mesothelioma cases, an additional 300% of the state's average weekly wage for 212 weeks shall be paid by employers and employer pools that insure mesothelioma liability. These expanded benefits are in addition to any other traditional workers' compensation benefits that are paid. Also, these enhanced benefits are a guaranteed payout to the injured worker or his or her estate. It is very unusual to see guaranteed payout of benefits in workers' compensation, so there is potential that this will lead to an increase in toxic exposure claims being filed under workers' compensation.

In addition, employers will no longer have subrogation rights on toxic exposure cases. This is a potentially significant issue. Often, attorneys do not bother filing for workers' compensation on such cases, as their focus is on larger awards available on the tort side. Attorneys know any workers' compensation benefits have to be repaid under subrogation. There is concern from some employers and defense attorneys that eliminating subrogation rights will actually encourage filing more toxic exposure claims under workers' compensation.

The establishment of a "Meso Fund" is also creating confusion. Employers must opt into this fund, and it is supported by additional assessments against the employers in an amount needed to cover the liabilities. If an employer does not opt into the Meso Fund, their liability for a mesothelioma claim is not subject to the workers' compensation exclusive remedy and action may be pursued in the civil courts. Most employers do not have exposure to mesothelioma claims, so it is expected that the only employers who will join the Meso Fund are those who frequently see such claims and are looking to spread their risk to others.

Between the increased assessments, expanded benefits for toxic exposure, and the loss of subrogation on toxic exposure cases, it is expected that this legislation will increase costs for employers in Missouri.

New York

Governor Cuomo has indicated that the workers' compensation reform legislation he recently signed into law will reduce employer costs by about $800 million annually. These savings are derived primarily by streamlining the assessment collection process and eliminating the 25-a fund and its associated assessments. New York's workers' compensation assessments are the highest in the nation, so employers welcome any relief in this area.

Many employers are questioning whether this legislation provides any real savings. Because the streamlining process is not known, whether or not assessments will be significantly lowered is still unclear.

The 25-a fund covered claims that were reopened for future medical treatment. Eliminating this fund does not save employers money. As occurred when the 15-8 fund (second injury fund) was eliminated under the last reforms, the claims previously paid by these funds will now be paid by employers directly, so there is no net savings realized. In addition, running off the 15-8 and 25-a funds will take several years, so the assessments — in particular those for the 15-8 — will continue. Because of the continued assessments, shutting down these funds will actually increase employer costs in the short-term. The long- term impact should be cost neutral, with the employers paying the claim costs directly, instead of through assessments.

Finally, the minimum weekly indemnity benefit was increased from $100 to $150. This will have a negative impact on employers who hire part-time workers earning near the minimum wage.

Until the impact of the streamlined assessments is known, it is impossible to quantify the overall impact this bill will have on employers. However, after the legislation passed, the New York Insurance Rating Board recommended a double-digit rate increase for the second consecutive year, indicating that they are skeptical the law will produce significant savings.

Tennessee

Tennessee also moved its workers' compensation dispute resolution process from a court-based system to an administrative system, leaving Alabama as the only state that still uses the trial courts for all such litigation. As mentioned in regard to Oklahoma, this should reduce employer costs associated with litigation and provide more timely resolution of disputes.

Tennessee also amended its law to provide for strict statutory construction of the Workers' Compensation Act. The law previously required that close disputes be adjudicated in favor of the injured worker. The switch means that the administrative courts no longer can favor either party and must strictly follow the statutes. In theory, this should lead to a much narrower interpretation of the statutes and reduce the courts' expansion of what is covered under workers' compensation. However, strict construction can work against the employer if the language in the statutes is vague. For example, several years ago Missouri switched to strict construction, which resulted in some unintended consequences. The courts in Missouri issued many decisions that were unfavorable to employers because the statutes in Missouri did not strictly indicate that occupational disease was subject to the exclusive remedy of workers' compensation or that permanent total disability benefits stopped at the death of the injured workers.

Calculation of permanent partial disability (PPD) has also been changed in the new Tennessee law. The multipliers for not returning an injured worker to employment have been eliminated in favor of a system based primarily on the impairment rating. Overall, PPD is expected to decrease under the new system. Until cases are adjudicated under the new system, however, this remains to be seen.

Tennessee also now requires a higher burden of proof on causation. Employees must prove that the workplace is the primary cause of any injury, meaning that the employment contributed more than 50% percent in causing the injury. This is expected to significantly reduce claims where an employee's pre-existing conditions are the main cause of the work injury.

Finally, a medical advisory committee was created to develop treatment guidelines for common workers' compensation injuries. In other states, these treatment guidelines have helped to lower medical costs. Until these guidelines are actually in place, the exact impact is unknown.

The workers' compensation legislation in Tennessee was designed to make the state more attractive for businesses. Employers should see lower costs as the result of the reforms.

Pending Legislation

At the time of this article, some state legislatures were still in session with pending workers' compensation bills. It is important for companies to stay informed on state-level changes to workers' compensation laws as they can have significant impact on costs and approaches to managing this key risk area.

Author's Note: I would like to thank members of the National Workers' Compensation Defense Network (NWCDN) for their assistance with this article. They are a tremendous resource in my efforts to monitor workers' compensation developments nationwide.