I have been valuing insurance agencies for a long time. I have been valuing them using both the Intrinsic Value and Market Value methods most of the time. For anyone interested in reading a brilliant description of these two methods, I suggest reading the article, "Musings on Markets" (September 7, 2011), by Professor Aswath Damodaran of the NYU Stern School of Business.

Intrinsic value is usually determined using one of several versions of the discounted cash flows method (the exact definition of cash flow varies, but all are intrinsic). This method states a firm's value is determined by the firm's future expected cash flow, discounted for time and risk.

In theory, market value also emphasizes cash flow. However, my experience is that most practitioners, especially when applied by agency owners but also some consultants, so inadequately account for cash flow and the risk that something will go wrong so that for all practical purposes, cash flows are disregarded. This makes market value agency appraisals purely speculative. Sometimes the result is an under valuation. More often the result is a value exceeding reasonability. Sometimes market value and intrinsic value are materially the same. After all, a broken clock is correct twice a day and 730 times a year. Most people would say being right 730 times a year is an awesome record.

A good example is the real estate boom and bust. The intrinsic value of the real estate never supported the market value. Many analysts and promoters became quite innovative in their development of "intrinsic" metrics that supported the market values, but the basic cash flow never supported the market value. The real estate investment only made sense if one could flip the investment at an adequately higher price before the market crashed.

The same force occurred in the market for insurance agencies. Very few agencies have an intrinsic value exceeding two times today or five years ago or ten years ago. If a business appraiser or a business broker sees someone who wants to believe an agency is worth more, the list of rationalizations, justifications, fictitious economies of scale, insightful product diversification strategies, and capital plays (interesting since capital is arguably free in some forms today) are infinite. If someone shoots holes in all these arguments, then ultimately the business broker will play their ultimate card: "We're so much smarter that we can make this work."

The fact is the intrinsic value did not justify the price paid by many agency buyers five years ago. The strategies that caused the buyers to believe the values were justified were mirages of wishful thinking. The market was overheated and for whatever reasons, if buyers wanted to be in it, they had to pay a high price. There is and was nothing else to it.

The fascinating difference between intrinsic and market value for insurance agencies is that the intrinsic value should remain in a rather narrow band because:

1. Profitability in a well-managed agency is stable. By well-managed, I am excluding firms that are 100% or more dependent upon contingencies for their profits. In these agencies, profitability will vary wildly depending on their contingencies. Otherwise, expenses do not vary much year-to-year in well-managed agencies and therefore, profitability is stable.

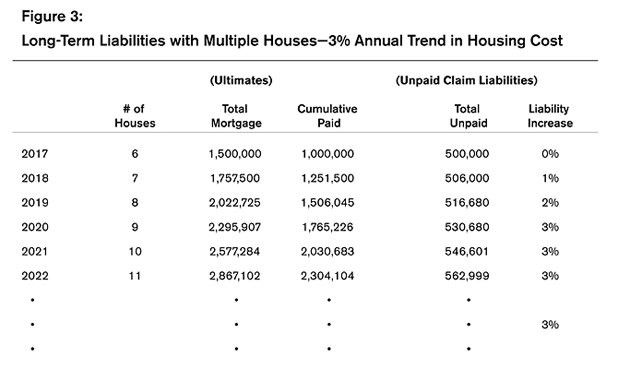

2. Sustainable growth is humble. When you read about an agency growing 10% to 25% annually, ask, "How many annuals?" In other words, how long have they truly achieved such significant growth? Also, what risks are they taking? The Property & Casualty industry grows at approximately the same rate as the U.S. economy because the Property & Casualty industry insures America's economy. That rate is approximately 3% annually.

The Property & Casualty industry is not a growth industry and it has not been one for decades. To pretend otherwise is like an older model choosing the right makeup, the right lighting, and the optimum angle to look ten years younger. In fact, the evidence is strong that firms who grow multiple times faster than average have a higher than normal probability of cheating. Often the cheating is not malevolent, but it is still cheating.

3. Risk is comparatively moderate. The insurance agency business is one of the least risky businesses. It may feel risky, but compared to most other businesses, it is quite safe.

These three factors combine to create periodic value fluctuations, but within a rather narrow band on an intrinsic basis. This is why owning an agency is a great business in tough times while maybe less appealing in great times. So why is the fluctuation so much more on a market value basis? Speculators. The speculators may be banks, brokers, private equity, other agencies, but they are speculating. This creates some issues because speculators use market value plus twenty percent or so for their values. They have a tendency to build price without adequate regard for supporting cash flow or risk. This is why a boom takes years to build and the resulting bust can take just a few weeks.

The fact that speculators pay too little attention to cash flow and risk has two significant consequences. The first is that speculators value good agencies and bad agencies too similarly. The result is they pay too much for bad agencies and sometimes fail to purchase the best agencies because they're not willing to pay an adequate premium for quality. Now, some really smart speculators have learned that certain kinds of supposedly bad agencies do not actually have post acquisition bad results. One should not confuse these two situations.

The second consequence is when inadequate attention is paid to cash flow and risk upon acquisition, speculators eventually cannot or do not pay enough attention to building the people and systems necessary for organic growth. This is readily apparent in some brokers' results today.

Whether you should or should not emphasize market value over intrinsic value depends on your position and the market cycle. As a seller in good times, the market value will usually be your best deal because this industry has blessed sellers with an infinite supply of irrational buyers. Their numbers grow and constrict with the seasons, but rarely are they in short supply for long. The only exception to this is the really good agency. A market value may rarely adequately capture the true value of these agencies' cash flows and risk. Internal perpetuation is almost always the best course for maximizing their value.

If you are a buyer, a brutally honest intrinsic valuation is the best way to manage your risk. Market value should be entirely secondary. Always remember that no acquisition is better than a bad acquisition and since roughly every study ever done shows that 75% of acquisitions are failures when truly tested, this rule is worth cementing in your brain. The exception is that if the buyer has such a bad situation that a bad acquisition can hide their current dilemma, then maybe make the bad acquisition.