Urine Drug Testing Must Get Smarter

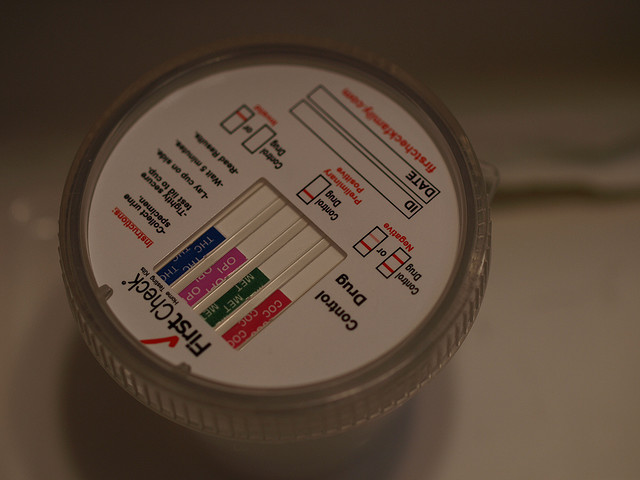

The current approach to urine drug testing yields too many false negatives and positives, doing no favors to either workers or employers.

The current approach to urine drug testing yields too many false negatives and positives, doing no favors to either workers or employers.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

The basis of competitive advantage has changed for predictive analytics. Having them used to be an edge, but now you have to do more.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Credit data have been deteriorating for six months. It's not yet a red alert but is definitely cause for concern for the U.S. economy.

|

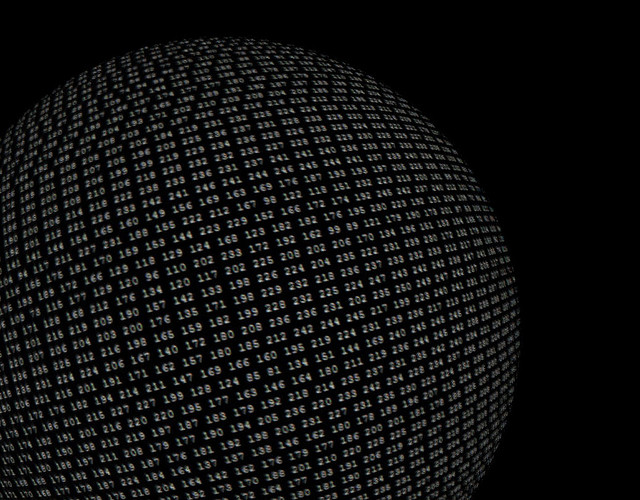

In the economic cycle of 2003-2007, one question we asked again and again was, “Is the U.S. running on a business cycle or a credit cycle?” How much of the growth was sustainable, and how much depended on an expansion of credit?

That question was prompted by a series on credit data we have tracked for decades, data that tells a very important story about the character of the U.S. economy. That credit data series is the relationship of total U.S. credit market debt relative to U.S. GDP.

Let’s try to put this in English, because the credit data is sending a warning signal about the U.S. economy.

What is total U.S. credit market debt? It is an approximation for total debt in the U.S. economy at any point in time. It’s the sum total of U.S. government debt, corporate debt, household debt, state and local municipal debt, financial sector and non-corporate business debt outstanding. It very much captures the dollar amount of leverage in the economy. GDP is a very straightforward number: the sum total of the goods and services we produce as a nation. So what we are looking at is how much financial leverage in the economy relative to the growth of the actual economy itself has changed over time. What is clearly most important is long-term trend.

From the official inception of this series in the early 1950s until the early 1980s, growth in this representation of systemic leverage in the U.S. grew at a moderate pace. Liftoff occurred in the early 1980s as the Baby Boom generation came of age. We believe two important demographic issues help explain this change.

First, there is an old saying on Wall Street: People do not repeat the mistakes of their parents, they repeat the mistakes of their grandparents. From the early 1950s through the early 1980s, the generation that lived through the Great Depression was largely alive and well and able to tell their stories. A generation was taught during the Depression that excessive personal debt can ruin household financial outcomes, so debt relative to GDP in the U.S. flatlined from 1964 through 1980. As our GDP grew, our leverage grew in commensurate fashion. Dare we say we lived within our means? To a point, there is truth to this comment.

Alternatively, from the early 1980s onward, we witnessed an intergenerational change in attitudes toward leverage. Grandparents who lived through the Depression were

no longer around to recite personal stories. The Baby Boom generation moved to the suburbs, bought larger houses, sent the kids to private schools, financed college educations with home equity lines of credit and carried personal credit balances that would have been considered nightmarish to their grandparents. The multi-decade accelerant to this trend of ever-increasing systemic leverage relative to GDP? Continuously lower interest rates for 35 years to a level no one ever believed imaginable, grandparents or otherwise. That is where we find ourselves today.

Why have we led you on this narrative? Increasing leverage has been a key underpinning to total U.S. economic growth for decades. Debt has grown much faster than GDP since 1980. For 3 1/2 decades now, in very large part, expanding system-wide credit has driven the economy.

Although U.S. total debt relative to GDP has fallen since the peak of 2008, in absolute dollar terms, U.S. total credit market debt has actually increased from $50 trillion to $60 trillion over this time. Moreover, U.S. federal debt has grown from $8 trillion to close to $18.5 trillion since Jan. 1, 2009, very much offsetting the deflationary pressures of private sector debt defaults. To suggest that credit expansion has been a key support to the real U.S. economy is an understatement.

|

|

By no means are these comments on leverage in the U.S. economy new news, so why bring the issue up now?

We believe it is very important to remember just how meaningful credit flows are to the U.S. economy now because a key indicator of U.S. credit conditions we monitor on a continuing basis has been deteriorating for the last six months. That indicator is the current level of the National Association of Credit Managers Index.

As per the National Association of Credit Management (NACM), the Credit Managers Index is a monthly survey of responses from U.S. credit and collections professionals rating factors such as sales, credit availability, new credit applications, accounts placed on collection, etc. The NACM tells us that numeric response levels above 50 represent an economy in expansionary mode, which means readings below 50 connote economic contraction. For now, the index rests in territory connoting economic expansion, but the index is also sitting quite near a six-year low.

In our April monthly discussion, we spoke of the slowing in the U.S. economy in the first quarter of 2015. We highlighted the Atlanta Fed GDPNow model, which turned out to be very correct in its assessment of Q1 U.S. GDP. While the Atlanta Fed was predicting a 0.1% Q1 GDP growth rate number, the Blue Chip Economists were expecting 1.4% growth. When the 0.2% number was reported, it turns out the Atlanta Fed GDPNow model was virtually right on the mark. As of now, the Atlanta Fed GDPNow model is predicting a 0.8% GDP number for Q2 in the U.S. (the Blue Chip Economists are expecting a 3.2% number).

Now is the time to keep a close eye on credit expansion in the U.S. We’ve been here before in the current cycle as the economy has moved in fits and starts in terms of the character of growth. Still, a slowing in the macro U.S. economy along with a slowing in credit expansion intimated by the NACM Credit Managers Index is a yellow light for overall U.S. growth. A drop below current levels in the NACM numbers would heighten our sense of caution regarding the U.S. economy.

Although no two economic cycles are ever identical in character, fingerprint similarities exist. At least for the last two to three decades, the rhythm of credit availability and credit use has been one of those key similarities. Although we know past is never a guaranteed indicator of the future, the NACM Credit Managers Index was an extremely helpful indicator in the last cycle. This index dropped into contractionary territory (below 50) in December 2007. In the clarity of hindsight, that very month marked the onset of the Great Recession of late 2007 through early 2009.

Again, for now we are looking at a yellow light for both credit expansion and the US economy. A further drop through the lows of the last six years in the Credit Managers Index would not be a good sign, but we are not there yet. As always, we believe achieving successful investment outcomes over time is not about having all of the right answers, but rather asking the correct questions and focusing on key indicators. September 2015 will mark the seven-year point of the U.S. Fed sponsoring 0% short-term interest rates in the U.S. If this unprecedented Fed experiment was not at least in part aimed at sparking U.S. credit expansion, then what was it all about?

The 0% interest rate experiment is likely to end soon. The important issue now becomes just what will this mean to U.S. credit expansion ahead? We believe the NACM Credit Managers Index in forward months will reveal the answer.

|

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Chip-and-PIN credit cards are supposed to cut way down on exposure to hacking, but early results from the rollout show potential problems.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Mobile is now widely use to interact with customers on personal lines and to help with loss and risk management in commercial lines.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

"Lean" techniques are historically associated with manufacturers but can do a lot to improve the business of brokers and risk managers.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Until insurers (and agents and brokers) can operate entirely using apps on smart devices, they can't claim to have mobility solutions.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Barry Rabkin is a technology-focused insurance industry analyst. His research focuses on areas where current and emerging technology affects insurance commerce, markets, customers and channels. He has been involved with the insurance industry for more than 35 years.

Warning labels are required on food and credit card contracts. It's time to make companies list data breaches and how they were handled.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Although dealing with provider networks is wildly complex, there are concrete steps that employers can take to cut their medical costs.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

John Youngs is the chairman and CEO of OneSource StopLoss Insurance Services. He entered the insurance industry in 1983, working as a broker, and moved to the insurer side in 1989, with a focus on large group self-funded, group life and long-term disability and development of community health plans, the precursor of affordable care organizations.

Metrics are great, but only if they're the right numbers, based on the right goals, and aren't distorted by the time they reach the daily staff.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|