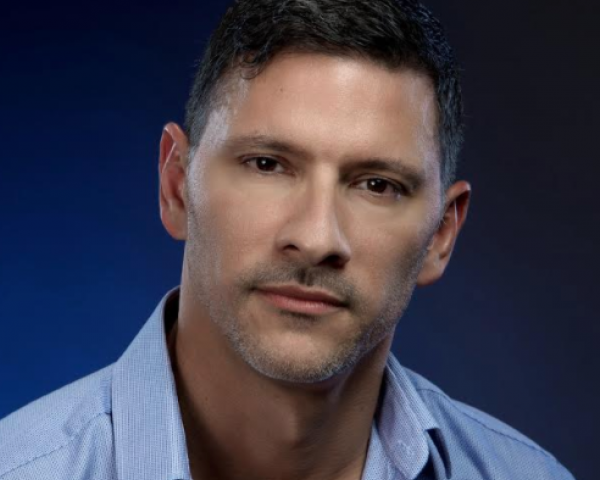

I started my career in

insurance at the same place where most of our millennials are starting theirs, in the call center. In my case, it was a Farm Bureau claims call center in the beautiful suburban campus in West Des Moines, Iowa. I didn’t know it at the time, but I got really lucky. That call center was very well run by enlightened leaders who realized they were training the future leaders of the company.

As early as the interview, managers told me that this call center was different. They understood that most of the new talent coming into the company would start in this department, and they had been instructed to engage and train those young professionals, so they would grow into productive employees not only during but after their time in the call center.

They said they wanted me to spend two to three years in the call center, while learning as much as possible about the company and the

insurance industry in general. After that, I’d be expected to start applying for positions beyond the phones. The department also required each individual to obtain the Associate in General

Insurance (AINS) and the Associate in Claims (AIC) within the first two years. Failure to comply with the educational requirement could lead to termination.

The way the call center functioned on a day-by-day basis was also quite engaging. Reps were trained well and supported in their efforts to grow their career (even when it meant time away from the phones for a class). The call center answered all first notice of loss calls for both personal and commercial lines claims, so it was not overly specialized; there was lots of variety on the day-to-day work. You’d get to keep the simple claims and work them to completion, acting as real claims adjusters. This resulted in great customer service, as roughly 40% of all calls would be answered by the person ultimately handling the

claim. The approach also resulted in lots of employee growth.

Even the way that managers measured performance was not bad at all for a call center. While they did measure the amount of time you spent on “After Call Work” and “Unavailable,” it wasn’t the main thing they cared about. To the best of my knowledge, they didn’t measure the dreaded “Time on Call” that most call centers use as their main measure of productivity. The main thing that counted in this particular call center was the number of new claims you took and the percentage of those that you kept.

At the end of every week, management would send out a list of the top 10 reps who answered the most calls and kept the highest of those calls. I was almost always in the top two for both categories, and enjoyed the friendly competition. Because the list only included the top 10, not the bottom ones, people weren’t offended by it; it was a very positive thing. Management also included in the weekly newsletter a congratulatory mention of everyone who had passed an

insurance designation test.

While at times the call center could get hectic, the overall environment was very supportive of employee growth, and nobody seemed to hate the job. Eight years later, most of the people I worked with in that call center are still in

insurance, and none of them are still call center workers. Many stayed in claims. Many are still in the same company. That’s a successful

insurance call center in our book! It was such a great place that I was sad to leave when I got an offer for a better claims position at Nationwide, which ended my call center days.

Sadly, I would find out as I met many other young

insurance professionals that great

insurance call centers that focus on developing their people are rare. Most are simply awful places to work, and, while nobody seems to be keeping statistics publicly, we have found 20 horror stories for every positive one.

There are many conferences about

insurance, and none seem to be talking about our call centers. The CPCU Society Annual Meeting and Leadership Summit has not had a single session about call centers in at least the six years I have been involved. It’s almost as if those call centers didn’t exist! Or, more likely, the leadership just doesn’t view them as

really being

insurance.

It’s like the call centers are the black sheep of the

insurance family that nobody wants to talk about!

A huge portion of young

insurance professionals in the 2010s started their

insurance careers in a call center type environment. Most of them already had college degrees (and the associated student loans). Like previous generations, they fell into

insurance by accident, but, unlike previous generations, they won’t stay out of loyalty or out of having found great careers. If we do our job right and engage them in the industry, they’ll grow. If we don’t, they’ll leave the industry, and we’ll continue having a huge talent gap.

We’re not saying that we should close all the call centers and go back to doing business exclusively in the old-fashioned way. We understand that our expense ratio will not allow us to do that in the age of price transparency and incredible competition for every

insurance customer. What we are saying is that we need to realize that, in many cases, the call center is our only touch-point with the customer, and we should be making them love their time with us. Maybe even more importantly, the call centers are our new entry level point for new talent, and given the talent crisis, our bad reputation with younger generations, and the high expense of replacing any employee, we need that talent to grow with us.

See also: How to Reinvent Call Centers

Based on the horror stories we’ve collected from conversations with fellow young

insurance pros who survived some time in the call center and lived to tell the tale, here’s what many (but not all) of the

insurance call centers are like to work in:

You have to be logged in to the phones every minute you are in the office and are not allowed to even be in the office outside of your work hours. There are rows after rows of grey cubicles, packed with unhappy 25-year-olds with their college degrees hanging precariously from the cubicle wall and the headset making a semi-permanent mark in their ear.

Engagement is so low that it could better be measured in level of desperation. Turnover is high, with the great majority leaving not only the company but the industry and swearing they’ll never work in

insurance again. The reps who haven’t quite given up on the industry yet are applying desperately to any open entry-level position that’s not a call center. It doesn’t matter if it's claims, underwriting, processing or

subrogation. Anything will do just to get off the phones! There’s so many applying for the same jobs with essentially the same resume, college degree and one to two years of

insurance call center experience, that’s it’s very hard to differentiate among them, so hiring managers mostly just reject them without an interview. Some have been told directly that “we don’t hire from the call center."

They are measured on 50-plus different characteristics, so many that it’s impossible to actually focus on improving. Who can control that many different minor factors during each phone call? The most important measures tend to be Time-on-Call and Availability. The first one measures the length of the average call, with the goal of keeping it as low as possible, and the second one measures the percentage of the time they’re available to take calls. In some extreme cases, even mandatory team meetings count against you the same as time spent in the restroom counts against you.

Performance evaluations are focused 100% on metrics and very little on your own growth or what you need to do to get out of the call center. Most of the supervisors are former call center reps themselves who only know the call center life. They often don’t know anything else about the company or the industry and can’t serve as good mentors even if they wanted to.

Professional development is encouraged by the company, but development time allowed by the department is very limited or completely non-existent, leaving it to the employee to do all growth activities outside work hours. A case could be made that a motivated employee can grow by investing his own free time into activities like

insurance designations, Toastmasters and networking, but most have no previous

insurance experience and no advice on what they should be spending their time doing to grow with the company. The only thing they know is that they don’t want to be on the phones, and they don’t want to become call center supervisors either.

We have even heard stories of call center employees being denied support in getting their basic

insurance designations because they’re not required for the call center job the employees are doing. Some are denied even the ability to participate in activities such as Toastmasters or a young professional group because those meetings are in the office, and Human Resources doesn’t want employees to be in the office outside of work hours.

There are better ways to run a call center. Not only should others learn from the example of the Farm Bureau Financial Service center where I worked, but there’s even more that we can learn from the best-run call centers outside the industry.

Look at Zappos, which was founded on the crazy idea of selling shoes online. Think about that one: Shoes are the kind of thing that absolutely has to be tried in person, and, when you go shoe shopping, chances are you try multiple shoes before you find a pair that fits just right. Zappos succeeded selling shoes online by doing two things differently: The company will ship you as many shoes as you want, and then you can try them and keep the ones you want, returning the rest. Zappos will cover the shipping both ways.

The second thing Zappos does is provide amazing customer service. To provide that service, Zappos runs large call centers staffed by very happy employees. How does it keep call center employees happy? By doing things diametrically differently from most other call centers (including

insurance call centers).

The hiring process consists of several interviews, mostly looking for personality fit. The HR rep conducting the first interview tries to simply figure out if this is a person he would want to work next to for 40 hours a week. Skills are much less important -- skills can be taught. During the hiring process, Zappos makes it very clear that the great majority of positions are at the call center, and, if you take the job, you’ll be answering the phones for a long time.

Every new employee, regardless of position, must go through the call center training. You can be hired for a vice president role and on day one you get to go to your new office to set your stuff down, and then you come back down to train for the call center with everybody else. After finishing training, everyone gets to work the call center for a couple of weeks before going on to the job they were hired for. This guarantees that all the leadership knows what the call center is like. Currently, in

insurance, there are very few, if any, senior executives who came from the call center, partially because those call centers didn’t exist or were much smaller when those executives were starting their careers.

After their first couple of weeks on the phone full time, all new Zappos employees get called into a huddle room with their manager. The conversation includes giving the employee real feedback about her performance in the call center. Then the manager reminds the employee that most jobs at Zappos are at the call center level and that it’s hard to move to a different area. Finally, the manager says something like “Charlie, I’ve got a check in your name for $2,000. I want to pay you to quit. If you don’t love the job, take the money, and we can part ways, no hard feelings.” Zappos does such a good job in hiring, orientation and training that only 2% of people take the offer.

The way Zappos measures performance is very different from others, too. It doesn't measure Time-on-Call at all. All Zappos cares about is making the customer happy. That may mean ordering a pizza for a customer who is traveling and doesn’t know where to get a pizza or chatting for seven hours with a customer about which shoes to buy for her prom.

Zappos understands that happy employees lead to happy customers, and that, in a world where your only interaction with the customer is when she visits your website or calls your call center, a call is a huge opportunity to connect with the customer. Zappos understands that a call center is NOT a cost center; it’s a key touch-point with our customer. What could be more important than that?

The

insurance industry has a lot to learn from Zappos. As millennials become a bigger and bigger part of our customer base, and they are not fans of visiting an

agent’s office, the call center becomes our touch-point with the 95% of our customers who didn’t have a

claim in any given year. Also, if the majority of your new employees are starting at the call center level, it’s our only chance to get them to fall in love with the industry and to convince them to make a career here.

See also: Insurers’ Call Centers: a Cyber Weakness?

For more about the Zappos way, I highly recommend the book

Delivering Happiness by Tony Hsieh, the CEO of Zappos. This amazing book will give you a great intro to how Zappos runs its business, especially its call centers. The company also provides guided tours of its offices in Las Vegas. The company provides training and consulting for other companies through its consulting arm Zappos Insights. You can learn more

here.

We are strong believers that the first large

carrier to figure out how to turn its call centers into talent mines will have a major competitive advantage in the talent wars. Combine that with student loan aid and maybe with opportunities to take sabbaticals every few years, and you’ll create an unmatched employee experience that millennials will not want to leave.

This article originally published at InsNerds.com.