Healthcare Firms on Hit List for Fines

As more records are kept online and more breaches occur, federal authorities are stepping up enforcement for violations of privacy rules.

As more records are kept online and more breaches occur, federal authorities are stepping up enforcement for violations of privacy rules.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Byron Acohido is a business journalist who has been writing about cybersecurity and privacy since 2004, and currently blogs at LastWatchdog.com.

WannaCry signifies two developments of profound consequence to company decision-makers monitoring the cybersecurity threat landscape.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Byron Acohido is a business journalist who has been writing about cybersecurity and privacy since 2004, and currently blogs at LastWatchdog.com.

We are exiting the pre-digital age and entering a post-digital environment where survival will be measured by rapid adaptability.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Denise Garth is senior vice president, strategic marketing, responsible for leading marketing, industry relations and innovation in support of Majesco's client-centric strategy.

A blockchain-based, industry-wide platform will be the catalyst for entirely new paradigms for selling and administering insurance.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Mark Wales is a co-founder of Galileo Platforms, an insurtech company focused on Asia. He has more than 30 years’ experience in information technology in the financial services industry, substantially in life insurance, wealth management, funds management and investment banking.

Virtually nothing has been done regarding the way insurance information is shared via forms; workers' comp may be the leading problem.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Chet Gladkowski is an adviser for GoKnown.com which delivers next-generation distributed ledger technology with E2EE and flash-trading speeds to all internet-enabled devices, including smartphones, vehicles and IoT.

With 3 trillion reasons ($$) to protect the status quo, it should be no surprise that employing frontal assault on healthcare would be laughably ineffective.

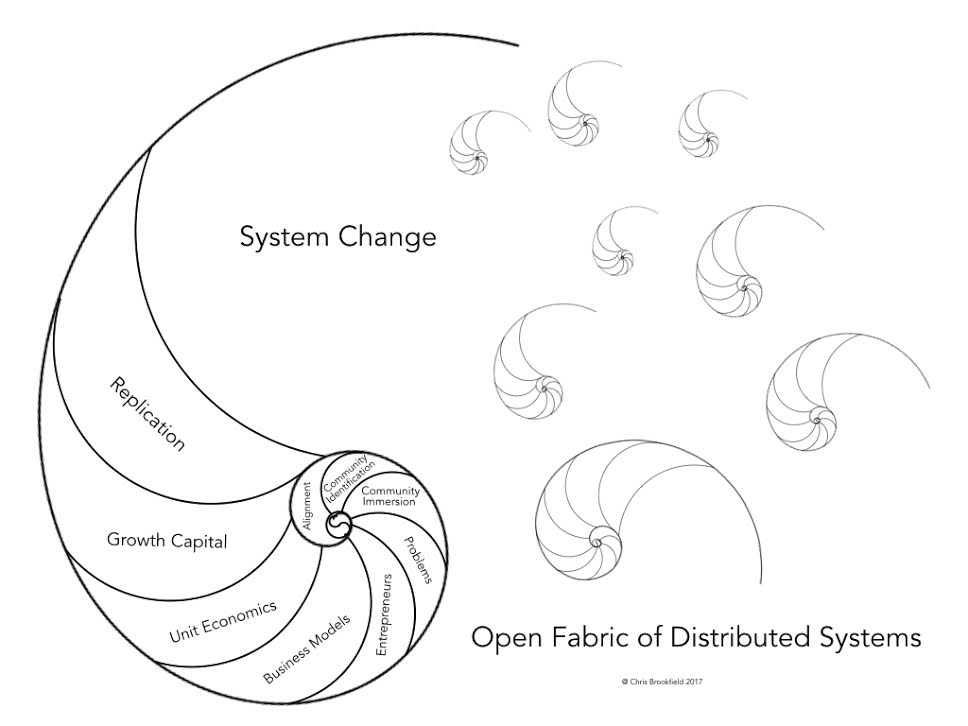

Graphic courtesy of Chris Brookfield[/caption]

The HRG believes sustainable investing requires focus on a particular region/sector with an eye towards social and economic benefits that reflect aligned values. It has a long-term focus that taps motivated local entrepreneurs to create businesses that enhances economic resilience which creates sustainable economic development (“Economic Development 3.0”). These emerging organizations are strengthened through local business and ultimately can create value for investors that ensures long-term resilience of local interests. We believe the path to optimizing health is a move away from centralized massive assets whether that is massive food production producing low-value food or massive medical centers that produce high volumes of low-value procedures (e.g., where 90% of spinal procedures were of no help). A strategy that is more aligned with community interests will deliver resilience, variability and locality that is part and parcel of Health 3.0.

See also: Healthcare Buyers Need Clearer Choices

I wrapped up by TEDx talk with the following that seems appropriate here:

Graphic courtesy of Chris Brookfield[/caption]

The HRG believes sustainable investing requires focus on a particular region/sector with an eye towards social and economic benefits that reflect aligned values. It has a long-term focus that taps motivated local entrepreneurs to create businesses that enhances economic resilience which creates sustainable economic development (“Economic Development 3.0”). These emerging organizations are strengthened through local business and ultimately can create value for investors that ensures long-term resilience of local interests. We believe the path to optimizing health is a move away from centralized massive assets whether that is massive food production producing low-value food or massive medical centers that produce high volumes of low-value procedures (e.g., where 90% of spinal procedures were of no help). A strategy that is more aligned with community interests will deliver resilience, variability and locality that is part and parcel of Health 3.0.

See also: Healthcare Buyers Need Clearer Choices

I wrapped up by TEDx talk with the following that seems appropriate here:

For too long, we’ve let healthcare crush the American Dream. We can’t stand for 20 more years of an economic depression for the middle class. No country has smarter or more compassionate nurses and doctors and no country has more innovators that have reinvented our country time and again. In every corner of healthcare, people went into healthcare for all the right reasons but perverse incentives and outdated approaches have shackled them. Whether we knew it or not, we all contributed to this mess. Now, it’s on us to fix it. When change happens community by community, it’s impossible to stop. Yes, healthcare stole the American Dream. But it’s absolutely possible to take it back. Join us to make it happen in your community.We are working on catalytic events to accelerate the change. The institute is helping raise awareness of the rising risk to corporations and boards that will compel them to act. In parallel, we continue work on The Big Heist film (think The Big Short for healthcare) that will wake up America to the greatest heist in American history. Please share Ted talk: Healthcare stole the American Dream. Here is how we take it back. Sign up for The Future Health Ecosystem Today newsletter to be in the know about healthcare's future.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Dave has a unique blend of HealthIT and consumer Internet leadership experience that is well suited to the bridging the gap between Health IT systems and individuals receiving care. Besides his role as CEO of Avado, he is a regular contributor to Reuters, TechCrunch, Forbes, Huffington Post, Washington Post, KevinMD and others.

Finding the balance between efficiency and the human touch in the claim process will separate tomorrow’s leading brands from their competitors.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Stephen Applebaum, managing partner, Insurance Solutions Group, is a subject matter expert and thought leader providing consulting, advisory, research and strategic M&A services to participants across the entire North American property/casualty insurance ecosystem.

The idea of a unified, all-risks coverage for an individual has long been theorized. Is technology finally making these bundles possible?

The concept of microinsurance has been around for a long time, and the activity in that area is now increasing rapidly, especially due to the InsurTech movement. Pervasive mobile and digital capabilities along with cloud computing have made it much easier to insure a wide range of individual events, activities, or things for a short period. On the other end of the spectrum, the idea of a unified, all-risks coverage for an individual has long been theorized, but underwriting a person for auto, home, liability, life, disability, and other risks in one bundle has not yet been practical.

I’m going to call this one-policy-covers-all-risk approach macro-insurance. Now that technology is advancing so rapidly, and customer expectations for innovative solutions are high, could macro-insurance become a reality? Will we face a time in the future when customers must choose between the micro or macro approaches for insurance coverage?

See also: Big New Role for Microinsurance

This might seem like an academic question, but there is at least one new entity that plans to offer a type of macro-insurance. An InsurTech called Sherpa promises to provide customers coverage across all insurance sectors using a single underwriting process and capitalizing on a direct business model (no agents or commissions). The company claims to have a process that uses new data sources, artificial intelligence, and deep analytics. This could be dismissed as another hare-brained idea from people that do not really understand insurance. However, Sherpa is collaborating with Gen RE and Guy Carpenter, which adds instant credibility to the venture.

Whether Sherpa will be successful remains to be seen, but it might be worthwhile to explore the opportunities and challenges related macro-insurance to get a glimpse into how these developments might affect the insurance industry from different perspectives.

Customer: From a customer perspective, the idea of an all-risks policy with no agent commission seems quite appealing. Who wouldn’t want to go through an underwriting process once and have coverage for all the typical risks a person (or business) is likely to face? However, some people might have an issue with “putting all of one’s eggs in the same basket.” That could be a deterrent to the macro approach for some customers.

Agent: At least in the Sherpa example, there are no agents. So this is a non-starter for distribution partners. However, other models may arise that offer macro-coverage and rely on the advice and council from either a fee-based or commissioned agent.

Actuary: Yikes, where to start! The macro approach is an actuary’s nightmare. There are two possible approaches. First, it may be that a team of actuaries works together to contribute in their areas of expertise to design new products. The second possibility is that actuarial is completely revolutionized, with AI and advanced analytics playing a key role, using a blend of traditional and new data elements. In either case, pricing precision will likely take some time to evolve.

Underwriter: Underwriting the person is a different approach and will require some blend of human expertise in different fields with new data and advanced technologies. Any way you look at it, underwriting becomes a completely new game in the macro-insurance world.

We could continue to explore other roles and other implications of these approaches, especially the complex regulation angle. But these initial discussions provide a preview into the kinds of issues that the industry needs to tackle. At this stage, micro-insurance is off and running, with companies like Trov, Slice, and LenderBot making strides. Macro-insurance is in its infancy and may take a long time to develop, but the concept is intriguing, and it appears that the industry is willing to begin to explore the potential.

See also: 5 Innovations in Microinsurance

So, what’s gonna happen? The most likely scenario is that traditional insurance lines of business will remain for a long time, supplemented by rapid growth in micro-insurance that often extends into new coverage areas, while macro-insurance begins a period of discovery and slow evolution.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Mark Breading is a partner at Strategy Meets Action, a Resource Pro company that helps insurers develop and validate their IT strategies and plans, better understand how their investments measure up in today's highly competitive environment and gain clarity on solution options and vendor selection.

Tensions between P&C executives and broker partners have been a hot topic on earnings calls recently; here is how to do better.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Keith Boyer is a managing partner of KMRD Partners, Inc., a Bucks County Property & Casualty agency focused on reducing the cost of risk for organizations with complex risk management requirements. KMRD Partners supports a unique mix of higher hazard clients, both public and private, that have national and international exposure. They include manufacturers, distribution companies, contractors, health care and not-for-profit organizations, financial services firms and professional service firms.

Technology can let us recapture some of the simplicity of the fabled picnics on a pleasant spring day in the bluebell-filled woodlands.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Denise Garth is senior vice president, strategic marketing, responsible for leading marketing, industry relations and innovation in support of Majesco's client-centric strategy.