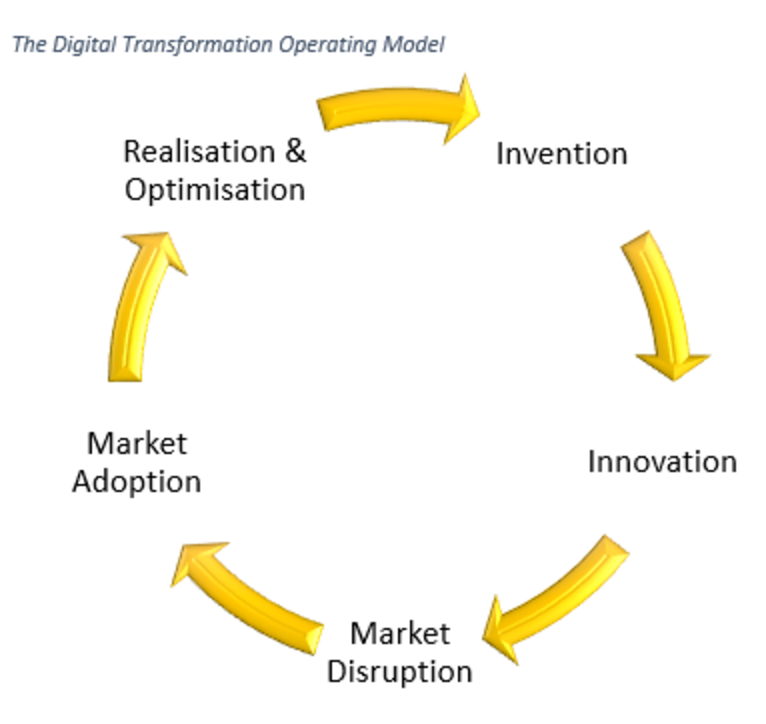

Senior management have to stop thinking of digital transformation as a passing fad, and embrace the fact that the world has changed. As in the 18th and 19th centuries, change will drive change, and as the management in those times developed process management models (see, PDCA is NOT Best Practice) to drive the development of automated production, so, too, managers now have to develop transformation models to take account that disruption and innovation will drive further disruption and innovation.

Transformation as a Lifestyle Choice

The fact that you have transformed your operation today is only a temporary reprieve. You need to redefine your business model to be an agile platform continually identifying and innovating to improve end-customer quality of life: That’s your customer’s customer.

Women as the Mothers of Innovation

The current beat-up of getting more women involved in STEM (science, technology, engineering, math) misses the understanding that innovation has at its root, a deep empathy for the quality of life of others. Developing and elevating women’s inherent intuition as to the plight of others will do more to foster innovation than a plethora of inventions. Hundreds of inventions never see the light of day, yet a handful of innovations have changed the world. Again, please re-read my previous article on Misunderstanding Innovation.

If Malcolm Turnbull truly wants Australia to develop an innovative culture, we should be promoting more people into psychology, sociology, anthropology and statistics. These are the strategic vocations of innovation, while STEM and invention are the tactical solutions. Yes, stats is math, but it allows us to understand bias as well as predictive analytics, which identifies and prioritizes targets for innovation.

See also: Why You Need a Digital Leader

Where to From Here?

Accepting the need to transform your business model is in itself an inherent risk. Just as a window cleaner straps on a safety harness before scaling a building, so having an active risk and compliance system operational is a mandatory prerequisite before embarking on any transformation. You will need systems that alert you to emerging issues and to give you continual insight, throughout the transformation process, without the need to go and look for it. The business graveyard is as full of those who lost their footing on the way as those who did nothing. This is not a shameless plug for what I do but rather the reason I do it.

Senior management have to stop thinking of digital transformation as a passing fad, and embrace the fact that the world has changed. As in the 18th and 19th centuries, change will drive change, and as the management in those times developed process management models (see, PDCA is NOT Best Practice) to drive the development of automated production, so, too, managers now have to develop transformation models to take account that disruption and innovation will drive further disruption and innovation.

Transformation as a Lifestyle Choice

The fact that you have transformed your operation today is only a temporary reprieve. You need to redefine your business model to be an agile platform continually identifying and innovating to improve end-customer quality of life: That’s your customer’s customer.

Women as the Mothers of Innovation

The current beat-up of getting more women involved in STEM (science, technology, engineering, math) misses the understanding that innovation has at its root, a deep empathy for the quality of life of others. Developing and elevating women’s inherent intuition as to the plight of others will do more to foster innovation than a plethora of inventions. Hundreds of inventions never see the light of day, yet a handful of innovations have changed the world. Again, please re-read my previous article on Misunderstanding Innovation.

If Malcolm Turnbull truly wants Australia to develop an innovative culture, we should be promoting more people into psychology, sociology, anthropology and statistics. These are the strategic vocations of innovation, while STEM and invention are the tactical solutions. Yes, stats is math, but it allows us to understand bias as well as predictive analytics, which identifies and prioritizes targets for innovation.

See also: Why You Need a Digital Leader

Where to From Here?

Accepting the need to transform your business model is in itself an inherent risk. Just as a window cleaner straps on a safety harness before scaling a building, so having an active risk and compliance system operational is a mandatory prerequisite before embarking on any transformation. You will need systems that alert you to emerging issues and to give you continual insight, throughout the transformation process, without the need to go and look for it. The business graveyard is as full of those who lost their footing on the way as those who did nothing. This is not a shameless plug for what I do but rather the reason I do it.Future of Digital Transformation

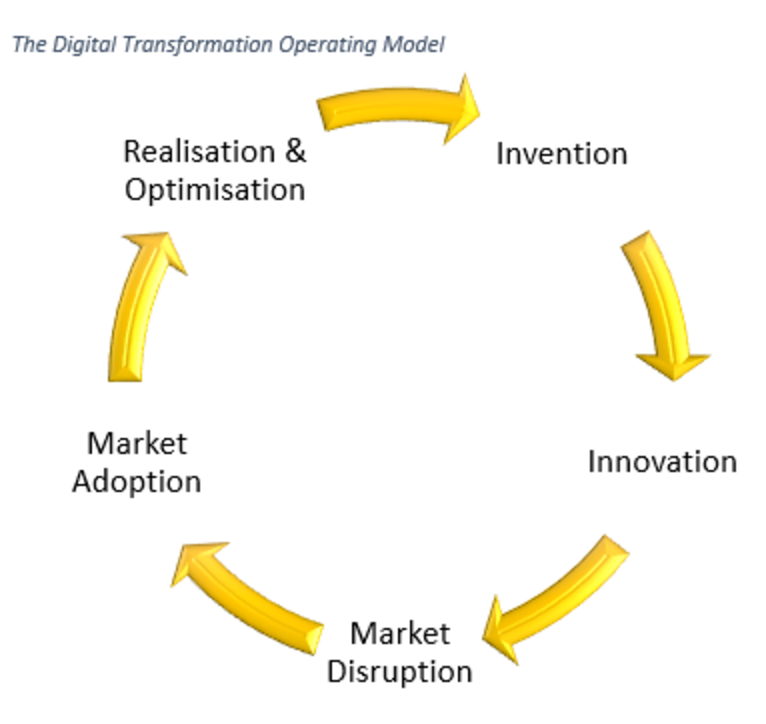

Management must accept that digital transformation is not an event but rather the operating environment of 21st century business.

Senior management have to stop thinking of digital transformation as a passing fad, and embrace the fact that the world has changed. As in the 18th and 19th centuries, change will drive change, and as the management in those times developed process management models (see, PDCA is NOT Best Practice) to drive the development of automated production, so, too, managers now have to develop transformation models to take account that disruption and innovation will drive further disruption and innovation.

Transformation as a Lifestyle Choice

The fact that you have transformed your operation today is only a temporary reprieve. You need to redefine your business model to be an agile platform continually identifying and innovating to improve end-customer quality of life: That’s your customer’s customer.

Women as the Mothers of Innovation

The current beat-up of getting more women involved in STEM (science, technology, engineering, math) misses the understanding that innovation has at its root, a deep empathy for the quality of life of others. Developing and elevating women’s inherent intuition as to the plight of others will do more to foster innovation than a plethora of inventions. Hundreds of inventions never see the light of day, yet a handful of innovations have changed the world. Again, please re-read my previous article on Misunderstanding Innovation.

If Malcolm Turnbull truly wants Australia to develop an innovative culture, we should be promoting more people into psychology, sociology, anthropology and statistics. These are the strategic vocations of innovation, while STEM and invention are the tactical solutions. Yes, stats is math, but it allows us to understand bias as well as predictive analytics, which identifies and prioritizes targets for innovation.

See also: Why You Need a Digital Leader

Where to From Here?

Accepting the need to transform your business model is in itself an inherent risk. Just as a window cleaner straps on a safety harness before scaling a building, so having an active risk and compliance system operational is a mandatory prerequisite before embarking on any transformation. You will need systems that alert you to emerging issues and to give you continual insight, throughout the transformation process, without the need to go and look for it. The business graveyard is as full of those who lost their footing on the way as those who did nothing. This is not a shameless plug for what I do but rather the reason I do it.

Senior management have to stop thinking of digital transformation as a passing fad, and embrace the fact that the world has changed. As in the 18th and 19th centuries, change will drive change, and as the management in those times developed process management models (see, PDCA is NOT Best Practice) to drive the development of automated production, so, too, managers now have to develop transformation models to take account that disruption and innovation will drive further disruption and innovation.

Transformation as a Lifestyle Choice

The fact that you have transformed your operation today is only a temporary reprieve. You need to redefine your business model to be an agile platform continually identifying and innovating to improve end-customer quality of life: That’s your customer’s customer.

Women as the Mothers of Innovation

The current beat-up of getting more women involved in STEM (science, technology, engineering, math) misses the understanding that innovation has at its root, a deep empathy for the quality of life of others. Developing and elevating women’s inherent intuition as to the plight of others will do more to foster innovation than a plethora of inventions. Hundreds of inventions never see the light of day, yet a handful of innovations have changed the world. Again, please re-read my previous article on Misunderstanding Innovation.

If Malcolm Turnbull truly wants Australia to develop an innovative culture, we should be promoting more people into psychology, sociology, anthropology and statistics. These are the strategic vocations of innovation, while STEM and invention are the tactical solutions. Yes, stats is math, but it allows us to understand bias as well as predictive analytics, which identifies and prioritizes targets for innovation.

See also: Why You Need a Digital Leader

Where to From Here?

Accepting the need to transform your business model is in itself an inherent risk. Just as a window cleaner straps on a safety harness before scaling a building, so having an active risk and compliance system operational is a mandatory prerequisite before embarking on any transformation. You will need systems that alert you to emerging issues and to give you continual insight, throughout the transformation process, without the need to go and look for it. The business graveyard is as full of those who lost their footing on the way as those who did nothing. This is not a shameless plug for what I do but rather the reason I do it.