Lawsuit Sheds Light on PBM Fees

And nobody looks good. Not Express Scripts (the PBM), Kaleo (the drug maker) and certainly not the plans that pay the hefty drug prices.

And nobody looks good. Not Express Scripts (the PBM), Kaleo (the drug maker) and certainly not the plans that pay the hefty drug prices.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

David Contorno is president of Lake Norman Benefits. Contorno is a native New Yorker and entered this field at the young age of 14, doing marketing for a major life insurance company.

Disaster mitigation and restoration services are critical, but how you manage these services may affect the outcome of your claim.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Jeff Esper is director of marketing and business development for RWH Myers, where he has developed a dynamic educational marketing program designed to share expert insights with the risk management community via web meeting, live presentation and blog (rwhMyersInsights.com).

Saying no is hard, but even harder is living the life you don't want to lead because you couldn't say no. Saying no just takes practice.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Andy Molinsky is a professor at Brandeis University’s International Business School, with a joint appointment in the Department of Psychology.

He received his Ph.D. in organizational behavior and M.A. in psychology from Harvard University.

Don't view change as black and white. For instance, a digital mix including agent channels outperforms a strictly D2C approach.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Eric Gewirtzman, CEO and co-founder of Bolt Solutions, is a leading force for innovation in the insurance industry, blending more than 20 years of expertise with extensive experience in creating and delivering game-changing insurance-related products and services.

Premium financing options that help clients afford the best policies on the market are a great way to generate customer loyalty.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Sean Jagroop is director of premium financing for Fortegra Financial Corporation (a Tiptree Inc. company).

Distribution channels are exploding, but the industry still has a fundamental problem: We can't even agree on who the customer is.

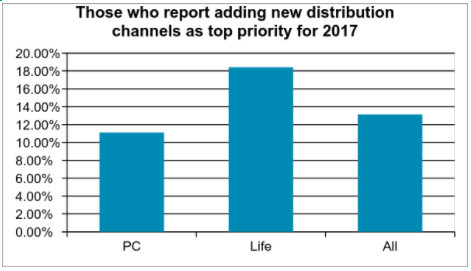

Source: Celent[/caption]

The kinds of strategies carriers take are heavily influenced by their view of the agent. In no other industry that I know of do we have a disagreement about who the customer is. Yet in the insurance industry, this is a matter of religion for many people. Some insurers say that the policyholder is the customer. After all, they’re the ones who write the check and use the service. But others are adamant that the agent is the customer. They influence or make the placement decision — deciding which insurer will write the account.

This question of who is the agent appears to have an impact on the investments insurers are making when it comes to managing the channels. Those who see the agent as their primary customer also are more likely to see distribution channel management as a top corporate priority.

In addition to the traditional channels, a number of new channels are emerging. The biggest news here is the explosion of insurtech startups that have high hopes of disrupting the acquisition process. They provide a unique experience online and hope to garner a large portion of the online marketplace because of their ease of doing business. Some focus on unique slivers of the marketplace. We are aware of more than 145 startups in the US and over 300 worldwide.

While a few insurers are very worried about the impact of InsureTech startups, most are watching closely and a little worried. This is more true for PC insurers where more than 40% say they’re a little worried – likely because of the greater activity in PC. Life insurers generally are watching, but not too worried, or see them as potential partners (31%).

Direct-to-consumer isn’t limited to insurtech startups. There are also a large number of insurers that are actively engaged in building out direct-to-consumer capabilities. Many insurers offer some sort of direct sales capabilities for personal auto. Increasingly, they are extending to this direct sales capability to more complex lines including homeowners, workers compensation, and small business. To be successful here, an insurer has to have a streamlined process, a slick user interface, minimal data input, tailored advice, and real-time decisions.

However, going direct to the consumer can create channel conflict. A variety of techniques are utilized to include and preserve the existing channel. Some will use a different brand such as biBerk, Say Insurance, TypTap, Haven Life, or eSurance. Some will assign an agent using algorithms that take into account location, status, or current production levels. Some will prompt the consumers to choose an agent.

Going direct isn’t the only new distribution strategy carriers are experimenting with. Digital agents, aggregators, partnerships with other carriers and partnerships with non-traditional distributors are all gaining traction. As consumers increasingly expect instant action, insurers are looking for ways to be available at the point of need rather than after the need has been generated.

Many insurers have defined themselves by their channel, saying “We’re a direct writer” or “We’re an independent agency company.” You don’t have to abandon those channels. But as a CEO of an insurtech startup said in a recent conversation, “Choosing your channel as the driving identity of your company is like me wearing a high school letterman jacket when I go out to dinner. It may be part of my identity, but I’m a 42 year old man. It doesn’t work anymore.” For most insurers, shedding the letterman jacket means integrating multiple distribution channels into whatever their historic context is.

See also: How to Find Distribution Payday

This doesn’t come cheap. Expanding channels requires expanded technology capabilities. As consumers become more digital, the channel that is changing the most is the agent channel. Consumers are already voting with their wallet and moving online in droves, and insurtech firms are taking advantage of that. But it’s not easy for insurers to just go direct. Most insurers don’t have the skills necessary to sell a policy. They may have programs to help the agents, but don’t have their own capabilities. Decisions need to be made about how to proceed. Will they create an in-house call center? Will they commit marketing dollars to organically generate traffic to the website?

As these operational decisions are being made, technology capabilities also must be expanded. Those who are going direct require a slick UI on the website as well as business rules, prefill, and workflow on the policy admin side to support straight-through processing. Ongoing servicing requires the ability to expose policies, bills, and claims functionality. Those who are partnering with aggregators or digital agencies need to build out connectivity solutions to pass data back and forth. Those who are partnering with other carriers may need an agency management system to track the leads and the commissions associated with them. And of course, the demand for data to manage these new channels is voracious. Distribution strategies are increasingly driving IT investments.

While multiple channels are effective at targeting specific markets, the increasing complexity of managing these channels is placing pressure on IT organizations. Additionally, the explosion of insurtech startups carries with it the potential for channel disruption. Carriers can work with these startups, invest in the startups, or imitate the startups, but those who ignore them do so at their own peril.

Source: Celent[/caption]

The kinds of strategies carriers take are heavily influenced by their view of the agent. In no other industry that I know of do we have a disagreement about who the customer is. Yet in the insurance industry, this is a matter of religion for many people. Some insurers say that the policyholder is the customer. After all, they’re the ones who write the check and use the service. But others are adamant that the agent is the customer. They influence or make the placement decision — deciding which insurer will write the account.

This question of who is the agent appears to have an impact on the investments insurers are making when it comes to managing the channels. Those who see the agent as their primary customer also are more likely to see distribution channel management as a top corporate priority.

In addition to the traditional channels, a number of new channels are emerging. The biggest news here is the explosion of insurtech startups that have high hopes of disrupting the acquisition process. They provide a unique experience online and hope to garner a large portion of the online marketplace because of their ease of doing business. Some focus on unique slivers of the marketplace. We are aware of more than 145 startups in the US and over 300 worldwide.

While a few insurers are very worried about the impact of InsureTech startups, most are watching closely and a little worried. This is more true for PC insurers where more than 40% say they’re a little worried – likely because of the greater activity in PC. Life insurers generally are watching, but not too worried, or see them as potential partners (31%).

Direct-to-consumer isn’t limited to insurtech startups. There are also a large number of insurers that are actively engaged in building out direct-to-consumer capabilities. Many insurers offer some sort of direct sales capabilities for personal auto. Increasingly, they are extending to this direct sales capability to more complex lines including homeowners, workers compensation, and small business. To be successful here, an insurer has to have a streamlined process, a slick user interface, minimal data input, tailored advice, and real-time decisions.

However, going direct to the consumer can create channel conflict. A variety of techniques are utilized to include and preserve the existing channel. Some will use a different brand such as biBerk, Say Insurance, TypTap, Haven Life, or eSurance. Some will assign an agent using algorithms that take into account location, status, or current production levels. Some will prompt the consumers to choose an agent.

Going direct isn’t the only new distribution strategy carriers are experimenting with. Digital agents, aggregators, partnerships with other carriers and partnerships with non-traditional distributors are all gaining traction. As consumers increasingly expect instant action, insurers are looking for ways to be available at the point of need rather than after the need has been generated.

Many insurers have defined themselves by their channel, saying “We’re a direct writer” or “We’re an independent agency company.” You don’t have to abandon those channels. But as a CEO of an insurtech startup said in a recent conversation, “Choosing your channel as the driving identity of your company is like me wearing a high school letterman jacket when I go out to dinner. It may be part of my identity, but I’m a 42 year old man. It doesn’t work anymore.” For most insurers, shedding the letterman jacket means integrating multiple distribution channels into whatever their historic context is.

See also: How to Find Distribution Payday

This doesn’t come cheap. Expanding channels requires expanded technology capabilities. As consumers become more digital, the channel that is changing the most is the agent channel. Consumers are already voting with their wallet and moving online in droves, and insurtech firms are taking advantage of that. But it’s not easy for insurers to just go direct. Most insurers don’t have the skills necessary to sell a policy. They may have programs to help the agents, but don’t have their own capabilities. Decisions need to be made about how to proceed. Will they create an in-house call center? Will they commit marketing dollars to organically generate traffic to the website?

As these operational decisions are being made, technology capabilities also must be expanded. Those who are going direct require a slick UI on the website as well as business rules, prefill, and workflow on the policy admin side to support straight-through processing. Ongoing servicing requires the ability to expose policies, bills, and claims functionality. Those who are partnering with aggregators or digital agencies need to build out connectivity solutions to pass data back and forth. Those who are partnering with other carriers may need an agency management system to track the leads and the commissions associated with them. And of course, the demand for data to manage these new channels is voracious. Distribution strategies are increasingly driving IT investments.

While multiple channels are effective at targeting specific markets, the increasing complexity of managing these channels is placing pressure on IT organizations. Additionally, the explosion of insurtech startups carries with it the potential for channel disruption. Carriers can work with these startups, invest in the startups, or imitate the startups, but those who ignore them do so at their own peril.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Karlyn Carnahan is the head of the Americas Property Casualty practice for Celent. She focuses on issues related to digital transformation. Carnahan is the lead analyst for questions related to distribution management, underwriting and claims, core systems and operational excellence.

With new OSHA electronic incident-reporting rules ready to go into effect, it's time to focus on workplace safety data collection.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Paul Marushka is Sphera’s founding president and CEO, responsible for providing overall strategic leadership for the company in developing, directing and implementing go-to-market, service, product and operational plans.

As Hurricane Harvey devastates Houston and other parts of Texas and Louisiana, while Typhoon Hato whales on Macau and Hong Kong, we don't have to even look past the banner headlines to see the crucial role that insurance plays in protecting society—and to see the huge opportunities in front of us if we can do even better.

In that spirit, I offer this month's Six Innovators to Watch. Only one, HazardHub, directly addresses the sorts of catastrophes in the news this week, but all show great promise. I hope you find them intriguing.

AppBus

AppBus integrates all the enterprise applications an insurer might use in a single environment, making it easier for employees to securely access the information tools they need while avoiding duplicate data entry. AppBus can combine standard business applications like CRM software with tools being created by insurtech innovators. AppBus augments those services with a library of key content and information to make users more productive. Users can create role-based interfaces to provide the specific tools that individuals need, especially when in the field. Learn more about AppBus at: https://www.itlinnovatorsedge.com/companies/appbus

Aquaai

Aquaai has developed an autonomous marine robot that looks and swims like a fish and can be used to gather marine data in an eco-friendly and efficient manner. The drone is equipped with interchangeable sensors that can be used to gather an array of data, such as water health, temperature and oxygen levels. While the first market application is aquaculture industry, the platform is applicable to multiple uses, from pollution cleanup to disaster recovery, port security and marine monitoring. Learn more about Aquaai at: https://www.itlinnovatorsedge.com/companies/aquaai

Carpe Data

Carpe Data provides predictive scoring and data products to insurers, drawing on both traditional and alternative sources of data to give insurers new insights to customers and risk. Carpe Data serves both the property/casualty and life insurance market by leveraging the social web, online content, wearables, connected devices and other forms of next-generation data. The company places a particular emphasis on consumer privacy while serving the information needs of insurers. Learn more about Carpe Data at https://www.itlinnovatorsedge.com/companies/carpe-data

HazardHub

HazardHub offers a robust array of property-level hazard databases for both natural and man-made hazards, creating a powerful tool for both educating consumers about their own property exposures and delivering better data to underwriters. The company’s goal is to make it more cost-effective for insurers to use hazard data in their decision-making processes, from underwriting to claims analysis to predictive modeling. Learn more about HazardHub at https://www.itlinnovatorsedge.com/companies/hazardhub-inc

MyHealthConnection

MyHealthConnection.tv provides a white-labeled, fast, secure and affordable virtual healthcare platform for mobile or desktop computers. Users can quickly initiate live video consultations with physicians, specialists, healthcare experts and various resources from their homes or while on the go, enabling patient interactions beyond a clinic’s walls that can drive down costs and improve efficiency and patient satisfaction. The platform also can deliver medical training and education resources and enable peer-to-peer consultations and remote patient visits in a highly secure, HIPAA-compliant system. Learn more about MyHealthConnection.tv at https://www.itlinnovatorsedge.com/companies/my-health-connection

Rejjee

Rejjee is designed to serve customers who have product losses that fall at or below their insurance deductibles, while also capturing data on these “hidden” losses that are occurring but not resulting in claims—often due to a policyholder’s fear that a claim would drive up premiums, with little financial recovery. Rejjee provides users with discount replacement offers on their lost valuables, connecting them with a network of retailers that offer discounts on replacement, resulting in a faster recovery and helping users find a more affordable replacement when insurance isn’t tapped for a loss. Rejjee is working with several insurers that are testing its solution as a new way to serve and engage with their customers, win loyalty and avoid the potential churn that could accompany unmet financial needs. Learn more about Rejjee at: https://www.itlinnovatorsedge.com/companies/rejjee

The Innovators to Watch honorees are drawn from among the thousands of insurtech companies that are featured in Innovator’s Edge, a technology platform created by ITL to drive strategic connections between insurance providers and insurtech innovators. From this growing pool, only those companies that have completed their Market Maturity Review—a series of modules designed to help insurers conduct baseline due diligence on the innovator and make a more informed connection—are eligible to be considered for Innovators to Watch, helping them to stand out in this crowded diverse field.

For information on previous honorees, click here: July, June, May, April and March.

Cheers,

Paul Carroll,

Editor-in-Chief

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Paul Carroll is the editor-in-chief of Insurance Thought Leadership.

He is also co-author of A Brief History of a Perfect Future: Inventing the Future We Can Proudly Leave Our Kids by 2050 and Billion Dollar Lessons: What You Can Learn From the Most Inexcusable Business Failures of the Last 25 Years and the author of a best-seller on IBM, published in 1993.

Carroll spent 17 years at the Wall Street Journal as an editor and reporter; he was nominated twice for the Pulitzer Prize. He later was a finalist for a National Magazine Award.

In terms of public policy, I am not confident that pricing insurance like magazines is in the public’s or even the industry's best interest.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Chris Burand is president and owner of Burand & Associates, a management consulting firm specializing in the property-casualty insurance industry.

These 10 insurtechs win in two ways: They increase customer satisfaction while also producing operational efficiencies.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Roger Peverelli is an author, speaker and consultant in digital customer engagement strategies and innovation, and how to work with fintechs and insurtechs for that purpose. He is a partner at consultancy firm VODW.