Your Cybersecurity To-Do List

Cyberecurity is a company-wide issue, and quantifiable metrics not only unify language but also test and demonstrate success.

Cyberecurity is a company-wide issue, and quantifiable metrics not only unify language but also test and demonstrate success.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Many insurers are focused on how to innovate, but most do not have a stable, cost-efficient core to support and fund their innovation efforts.

Part of the issue is that the industry tends to clump two distinct opportunities together. First, there are the core competencies that insurers must master: the user experience, personalized offers, timely and transparent claims service. Get these pieces right, and you may not win—but do them poorly, and you will inevitably lose. Separate from this are the new technologies that capture headlines; if scaled successfully, these cool innovations can pave the way to an insurer’s future revenue streams.

See also: Core Transformation Is Not Negotiable

Brilliant Basics and Cutting New Ground

At Accenture, we call these two opportunities the Brilliant Basics and Cutting New Ground. By getting the Brilliant Basics right, insurers foster a stable core—the strong foundation that’s necessary to enable innovation, in the form of Cutting New Ground.

By injecting new digital technologies to transform the core, it becomes cheaper and more efficient to do the Brilliant Basics. This approach is aligned with what’s recommended by the Accenture Disruptability Index, which identified insurance as being vulnerable to disruption and recommended optimizing to improve structural productivity.

Successful core transformation can create efficiencies, reduce the cost to serve and improve growth—all of which frees up investment capital to fund Cutting New Ground initiatives. These innovation initiatives should be viewed like a portfolio of digital investments. Low-risk, low-reward projects may be more likely to succeed and deliver incremental growth. High-risk, high-reward projects may be less likely to succeed—but if they do, they can enable an insurer to establish a definitive competitive advantage. Given insurance’s risk aversion, it’s definitely a cultural shift to embark on a project knowing it may not succeed, so viewing Cutting New Ground as a portfolio of investments can be one way to mitigate cultural concerns.

Part of the issue is that the industry tends to clump two distinct opportunities together. First, there are the core competencies that insurers must master: the user experience, personalized offers, timely and transparent claims service. Get these pieces right, and you may not win—but do them poorly, and you will inevitably lose. Separate from this are the new technologies that capture headlines; if scaled successfully, these cool innovations can pave the way to an insurer’s future revenue streams.

See also: Core Transformation Is Not Negotiable

Brilliant Basics and Cutting New Ground

At Accenture, we call these two opportunities the Brilliant Basics and Cutting New Ground. By getting the Brilliant Basics right, insurers foster a stable core—the strong foundation that’s necessary to enable innovation, in the form of Cutting New Ground.

By injecting new digital technologies to transform the core, it becomes cheaper and more efficient to do the Brilliant Basics. This approach is aligned with what’s recommended by the Accenture Disruptability Index, which identified insurance as being vulnerable to disruption and recommended optimizing to improve structural productivity.

Successful core transformation can create efficiencies, reduce the cost to serve and improve growth—all of which frees up investment capital to fund Cutting New Ground initiatives. These innovation initiatives should be viewed like a portfolio of digital investments. Low-risk, low-reward projects may be more likely to succeed and deliver incremental growth. High-risk, high-reward projects may be less likely to succeed—but if they do, they can enable an insurer to establish a definitive competitive advantage. Given insurance’s risk aversion, it’s definitely a cultural shift to embark on a project knowing it may not succeed, so viewing Cutting New Ground as a portfolio of investments can be one way to mitigate cultural concerns.

Consequently, insurers need both pieces. Brilliant Basics can enable a stable core and generate investment capital that make it possible for insurers to focus on Cutting New Ground. Brilliant Basics is the elite athlete’s pre-game routine; Cutting New Ground is the game-winning performance, and maybe a record-breaking one at that.

To get started, insurers should consider the following questions:

Consequently, insurers need both pieces. Brilliant Basics can enable a stable core and generate investment capital that make it possible for insurers to focus on Cutting New Ground. Brilliant Basics is the elite athlete’s pre-game routine; Cutting New Ground is the game-winning performance, and maybe a record-breaking one at that.

To get started, insurers should consider the following questions:

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Michael Costonis is Accenture’s global insurance lead. He manages the insurance practice across P&C and life, helping clients chart a course through digital disruption and capitalize on the opportunities of a rapidly changing marketplace.

Property/casualty personal lines are under pressure unlike at any other time in history; the industry is responding with a dozen initiatives.

Property/casualty personal lines are under pressure unlike at any other time in history. The risk landscape is evolving as some circumstances result in increased losses (distracted driving, increased catastrophes), while others hold the promise to dramatically reduce risk (autonomous vehicles, the IoT). Customer expectations and demands continue to change. Emerging technologies offer new opportunities to manage risk and improve operations. New competitors and partners are surfacing every day via insurtech startups and greenfield insurance ventures.

But the industry is not standing still. Personal lines insurers are pursuing a dozen strategic initiatives that are propelling them to a stronger competitive position.

The strategic initiatives include both traditional initiatives, such as business intelligence and core modernization, and new world initiatives like investments in insurtech and a digital strategy. Creating a unified strategy with the right blend of traditional and new world initiatives is the challenging task of senior leadership today.

See also: Insurtech in P&C: It’s Not About the TechThree of the traditional initiatives are further along in the implementation and deployment lifecycle: core systems modernization, business intelligence and advanced data/analytics. In a sense, these are the most foundational capabilities needed by insurers for success in the digital age.

Two of the traditional initiatives are primarily in the strategy and planning stages: innovative products and services, and the restructuring of the workforce. Personal lines have not historically been known for product innovation, relying on tweaks to coverages and services for the same basic products for many years. Now, a new generation of opportunities is upon us with the advent of on-demand insurance, parametric insurance, episodic insurance and coverages for emerging risks such as cyber. From a workforce perspective, the industry is on the front edge of massive retirements of insurance professionals, leading to the need to introduce more technology to support the workforce (collaboration tech, AI), increase recruiting efforts and rethink business models.

While the traditional initiatives are vitally important and foundational, it is the new world initiatives that hold the promise for more competitive differentiation. Improving the customer experience and becoming more digital are the two initiatives that have been underway for several years at many insurers, and they continue to pick up steam. Newer initiatives such as investing in insurtech and emerging tech are earlier in the strategy and planning stages, but important activity is underway there nonetheless. Almost half of personal lines insurers are developing strategies to deploy new business models, an indicator of how much rethinking and transforming are actually underway.

This is a significant time of change and transformation for the personal lines sector. The next five to 10 years are likely to produce more than a few surprises, with new products, new competitors, new distribution options and the impact of insurtech and emerging tech reverberating across the industry.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Mark Breading is a partner at Strategy Meets Action, a Resource Pro company that helps insurers develop and validate their IT strategies and plans, better understand how their investments measure up in today's highly competitive environment and gain clarity on solution options and vendor selection.

The insurance industry is built on trust. So why is there so little trust between consumers and the insurance industry?

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Kay Fairchild Godfredsen became first deputy commissioner for the Iowa Insurance Division in August 2017. Most recently, she held the role of assistant general counsel at Nationwide.

For security and compliance professionals, new regulatory standards can be a stark reminder that the to-do list is long and the day is short.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Sam Abadir is vice president of industry solutions at Lockpath. He has more than 20 years of experience helping companies improve processes, identify performance metrics and understand risk.

Acquisitions are happening in the name of controlling rising costs and taking better care of patients. The question is, will they? Nope.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Pramod John is the founder and CEO at Vivo Health. Pramod John is team leader of VIVIO Health, a startup that’s solving out of control specialty drug costs; a vexing problem faced by self-insured employers. To do this, VIVIO Health is reinventing the supply side of the specialty drug industry.

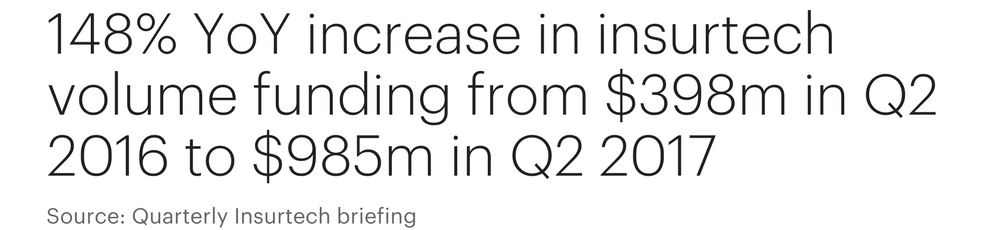

Insurtech is enjoying record growth. While 2016 saw $1.7 billion in insurtech investments, things are only picking up in 2017.

There is a growing recognition among insurers that insurtech represents more of an opportunity than a threat and that insurers should seek to collaborate closely with this latest breed of technology-fueled startups.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

John Cusano is Accenture’s senior managing director of global insurance. He is responsible for setting the industry group's overall vision, strategy, investment priorities and client relationships. Cusano joined Accenture in 1988 and has held a number of leadership roles in Accenture’s insurance industry practice.

Executive teams must urgently stop thinking about cyber risk as an IT issue and lead a shift to managing its impact across the entire organization.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Jason J. Hogg serves as chief executive officer of Aon Cyber Solutions. He is based in the firm’s New York office and was first appointed in May 2017. Hogg is responsible for the firm’s global operations and growth strategies, bringing to the role a wealth of experience in technology, finance and business leadership. Most recently, Hogg served as a senior advisor and CEO partner for Tritium Partners, a private equity firm focused on buyouts of growth companies.

For some time now, you've seen me mention our Innovator's Edge platform, where we have built the best data base, bar none, on insurtechs. We're now taking the next step, adding a framework that lets you make connections that will help you on your innovation journey.

Insurance Thought Leadership is launching the Innovator’s Edge Network, a free professional network for insurance innovation executives who are leading the transformation of insurance. The network is one of several tools available within our Innovator’s Edge platform that insurance executives can access to achieve growth through innovation.

You can join the network today at www.InnovatorsEdge.io and build a professional profile that will connect you with people, discussion groups and events that support your needs.

The free membership is designed for executives within the insurance industry who seek to expand their professional network and meet fellow innovators—both from traditional insurance companies and insurtech entrepreneurs. The IE Network also helps members follow innovation trends and developments focused on their areas of interest and gain insights to the potential impact of innovation on the industry, quickly, deeply and efficiently.

We have made it super simple for you to join the IE Network: Just go to www.InnovatorsEdge.io, register to join and provide a little information about yourself and the areas of insurance innovation that are of most interest to you.

Within each area of interest, you will be able to find potential connections, participate in online discussion forums—to share ideas, ask and answer questions and collaborate in a professional and respectful environment—and access curated analysis and perspectives from some of the most significant thought leaders in the industry.

The events feature allows you to browse future insurance and innovation events, identify those of interest and signal others within the IE Network that you are attending, speaking or sponsoring. The tool also allows users to manage face-to-face meetings at events with other network members, and manage your schedule.

Your free IE Network membership also will get you a peek behind the curtain of the premium features of Innovator’s Edge, which is our strategic growth platform that connects the insurance industry with the top innovators and entrepreneurs delivering insurtech solutions and exponential technologies that are creating growth opportunities for insurance.

Last, and most importantly, we want you to invite your friends and colleagues from the insurance innovation community to the IE Network, join you in categories and groups, join you in positions of leadership and join you in becoming an insurance innovation executive.

Have a great week.

Paul Carroll

Editor in Chief

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Paul Carroll is the editor-in-chief of Insurance Thought Leadership.

He is also co-author of A Brief History of a Perfect Future: Inventing the Future We Can Proudly Leave Our Kids by 2050 and Billion Dollar Lessons: What You Can Learn From the Most Inexcusable Business Failures of the Last 25 Years and the author of a best-seller on IBM, published in 1993.

Carroll spent 17 years at the Wall Street Journal as an editor and reporter; he was nominated twice for the Pulitzer Prize. He later was a finalist for a National Magazine Award.

...everything in the world around it has. Insurers cannot afford to be complacent when disruption has upended other industries.

Insurers cannot afford to be complacent when disruption has upended other industries. The industry can, and must, embrace change and the future-fearlessly.

Insurance hasn’t changed much in 200 years. It’s still about capital placed against risk. It’s still about creating tailored products for customers. It’s still about using information to sell through channels, to generate returns for a company. Except that capital now includes venture capital and peer-to-peer funding. Risk now includes cyber, pandemic, micro. Tailored products? Think episodic, pay-as-you-go, parametric. Information? Humanity produces 2.5 quintillion bytes of data every day (a quintillion has 18 zeroes). Customers span millennials and high-net-worth boomers, each of whom expects personalized service. Insurance hasn’t changed much in 200 years, but everything around it has. At its highest level, the insurance industry appears stable. Profits are solid, with average pre-tax RoE levels from 2010 to 2016 between 10% and 12% globally. Company rankings are stable, and share price performance is solid across the globe. That sentiment is confirmed by the Accenture Disruptability Index, a global, cross-industry study of how incumbent industries will likely fare in the face of disruption. On a scale of zero to one, with zero being minimally disrupted and one being highly disrupted, insurance scored 0.37. See also: Time to Formalize Insurance Career Path The study also identified four distinct periods of disruption, each with its particular implications and corrective actions. Insurance is in the “vulnerable” period of disruption, characterized by structural inefficiencies and low innovation that lead to low productivity. These pressures compress profitability but create a high barrier to entry that can hold off disruption—for now. Insurers cannot afford to be complacent. The industry’s future disruptability scored 0.68—above the median of 0.57 and among the highest scores in the study. An estimated 30% to 40% of EBITDA is projected to be at risk by 2020, and the industry has already experienced significant disruption. Moreover, executives know that innovation is essential not just to remaining competitive but to surviving.

To fend off disruption, insurers need to take targeted action. They must optimize to address structural productivity and inject new digital technologies to upgrade core offerings at lower cost. This last point is worth repeating: Core transformation is critical to fending off disruption. I’ll keep coming back to this throughout this blog series, as we discuss ways to transform the core, and how doing so can fuel innovation.

Feel the fear—and make change

Insurance is at the edge. It’s vulnerable to disruption and under threat of being made redundant if it continues to bask in the status quo. But insurance is not the only industry caught unprepared. Accenture research found that 93% of chief strategy officers agreed that they will be disrupted within five years—but only 20% feel highly prepared to deal with it.

What’s more, longevity comes with perks. Insurers have data, distribution channels and innovation practices that many startups would envy. Insurers are more than capable of turning disruption into an opportunity.

Over the course of this blog series, I’ll explain how insurers can meet disruption head-on. How they can create efficiencies in their core business and innovate to create revenue streams for the future. How to not just meet customer expectations, but exceed them. Why legacy systems don’t have to be an obstacle to change. And how to make the wise pivot to become an organization that is equipped for success in a digital economy.

See also: Unfair Perception of Insurance

Insurance hasn’t changed much in 200 years, but everything around it has. The insurance industry can, and must, embrace the future—fearlessly.

Insurers cannot afford to be complacent. The industry’s future disruptability scored 0.68—above the median of 0.57 and among the highest scores in the study. An estimated 30% to 40% of EBITDA is projected to be at risk by 2020, and the industry has already experienced significant disruption. Moreover, executives know that innovation is essential not just to remaining competitive but to surviving.

To fend off disruption, insurers need to take targeted action. They must optimize to address structural productivity and inject new digital technologies to upgrade core offerings at lower cost. This last point is worth repeating: Core transformation is critical to fending off disruption. I’ll keep coming back to this throughout this blog series, as we discuss ways to transform the core, and how doing so can fuel innovation.

Feel the fear—and make change

Insurance is at the edge. It’s vulnerable to disruption and under threat of being made redundant if it continues to bask in the status quo. But insurance is not the only industry caught unprepared. Accenture research found that 93% of chief strategy officers agreed that they will be disrupted within five years—but only 20% feel highly prepared to deal with it.

What’s more, longevity comes with perks. Insurers have data, distribution channels and innovation practices that many startups would envy. Insurers are more than capable of turning disruption into an opportunity.

Over the course of this blog series, I’ll explain how insurers can meet disruption head-on. How they can create efficiencies in their core business and innovate to create revenue streams for the future. How to not just meet customer expectations, but exceed them. Why legacy systems don’t have to be an obstacle to change. And how to make the wise pivot to become an organization that is equipped for success in a digital economy.

See also: Unfair Perception of Insurance

Insurance hasn’t changed much in 200 years, but everything around it has. The insurance industry can, and must, embrace the future—fearlessly.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Michael Costonis is Accenture’s global insurance lead. He manages the insurance practice across P&C and life, helping clients chart a course through digital disruption and capitalize on the opportunities of a rapidly changing marketplace.