In

Part I of our profile for Europe, we reviewed our statistics for the region, which we gathered in the course of our Global Trend Map (download the full thing

here), and outlined a number of qualitative themes, exploring the first two of these:

- Growth opportunities in a relatively saturated market

- The European consumer and Europe’s early adopter status

- How European insurers can deliver on their customer promise with new tech

- Dynamic, real-time insurance and IoT

- Progress on developing connected insurance models across the continent

Here we explore themes three to five in discussion with two in-region influencers:

- Switzerland-based venture capitalist Spiros Margaris, VC (InsureScan.net, moneymeets and kapilendo)

- Charlotte Halkett, former general manager of communications at U.K.-based telematics provider Insure The Box (now MD of Buzzvault at Buzzmove)

Delivering on the Customer Promise

In Part I, we posited that Europe holds a slight innovation lead over our other major regions, finding this borne out in the more disrupted distribution landscape (with affiliate, aggregator and direct-to-customer channels all relatively well established).

However, embracing innovative distribution methods is only part of the story for European insurers seeking to engage digitally savvy and ever-more-demanding consumers; another key aspect is to incorporate a greater level of personalization into products.

"The consumer is used to a really personal experience now, and that is exactly the same as when they’re buying a pair of shoes online," comments Charlotte Halkett, formerly of Insure the Box (and now at Buzzmove). "

They’re used to being able to get something if they want it, where they want it and at the cost they want, including complete information like the exact half hour it’s going to turn up in their house and what color it is.

"That’s the same for the £1,000 insurance they’re going to buy, they want to have that real personalized experience to get the cover they want, how they want it, and to be able to influence the price that they’re going to pay. The big, overwhelming message is that the insurance industry is going to need to be flexible and innovative, because consumers are becoming ever-more-demanding, and the base level of their expectations is rising all the time."

Personalization in insurance extends from offering positive customer service across channels to customizing policy prices on an individual basis (UBI). Halkett believes that the U.K. market in particular has been a leader in this sense:

"The complexity of pricing has always been at the cutting edge in the U.K.," she says. "

From developing general linearized modeling through to telematics, the initial development has occurred within the U.K. And it’s partly to do with this being a worldwide center of insurance, that’s true, but it’s also to do with the consumer. It’s very consumer-led: consumers are very willing to adopt, consumers are very willing to try new things."

Halkett believes that the U.K. has served as a guinea pig for in-car telematics and that the models developed here can benefit a wide range of insurance markets. This impression fits in with our product-development stats for Europe overall: Auto was indeed one of the lines respondents identified as driving the most product innovation in the region, the other being health (see our earlier post on

product development). We explore UBI models, especially as they relate to the auto line, as our next theme.

"It is important to listen to your customers and speak their language in order to influence your top and bottom line. If you want to satisfy your customers, you have to know what they want and need, what they're saying about you, and how they feel about your products, services and brand." — Monika Schulze, global head of marketing at Zurich Insurance

All these customer initiatives, if they are to be more than just good intentions, require far-reaching back-office transformation; investment is required in new technologies and solid digital capabilities (such as analytics), and these in turn need to be grounded in well-conceived strategies if they are to truly take root and flourish at an organizational level. Let’s look now at what European insurers are doing practically to deliver on their customer promises.

Encouragingly, a large majority of European respondents acknowledged having formal digital, mobile and cross-platform strategies, so digitization appears to be well underway among European (re)insurers, consistent with our other regions (see

our earlier post on digital innovation). We also found a strong increase in analytics focus/investment among our European respondents, as well as a reasonable level of coordination of analytics across their organizations (see our

earlier post on analytics and AI).

Analytical and machine-learning models have plenty to get their teeth into with what customer data has been captured directly by insurers, but they can additionally be supplied with external data from third parties. We found this practice to be widespread in Europe, as indeed were formal data-governance strategies.

"The one who is doing similar business to you should be considered as a chance and not as a risk - being connected via Open APIs based on your open insurance ecosystem. You will win because your processes and technologies are faster, cheaper and more customer-oriented than others, because you are open." — Oliver Lauer, formerly head of architecture/head of IT innovation at Zurich

One major hurdle for the implementation of more data-driven, customer-centric systems is the presence of legacy, and this is just as present in Europe as anywhere else. Legacy systems came in second place among the

internal challenges for Europe (in line with the global trend), and was additionally identified by our European contributors Halkett and Margaris as a serious challenge for the region. Margaris highlights a couple of particular pain points as far as legacy systems go:

"If you have legacy systems, it’s difficult to put cutting-edge technology on top of them," he says. "

Legacy systems make it so much harder for incumbents to innovate and to comply with regulations."

Taking Insurance into the Real World, Real-Time

In

Part I of our profile on Europe, we tentatively identified Europe as an early adopter, and we saw this tendency manifested in the prevalence of new-age distribution channels and personalized, customer-centric products.

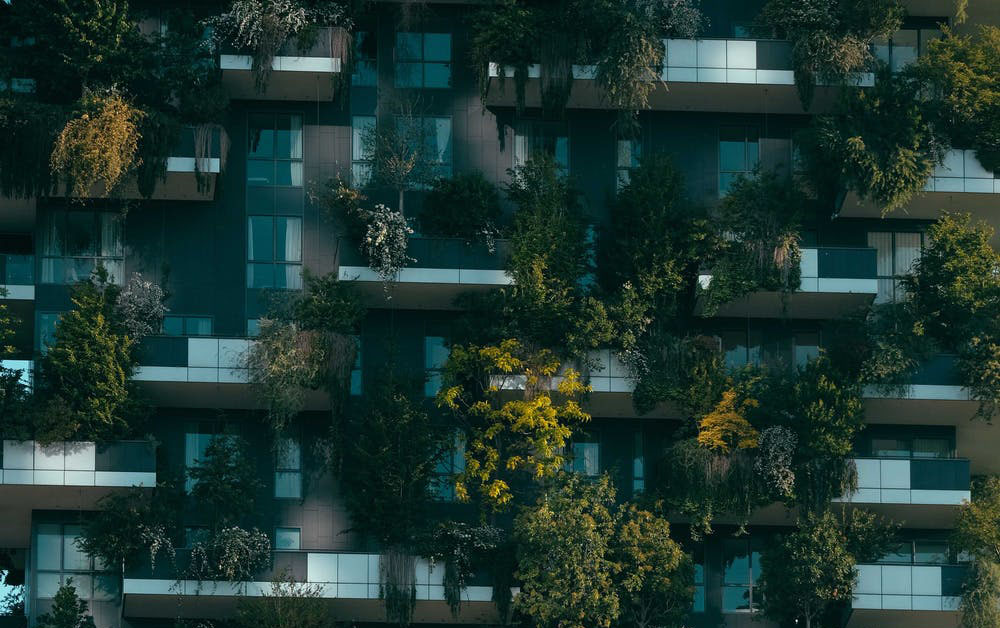

Here, we extend this line of inquiry by turning to the vanguard of personalization in insurance, namely the Internet of Things, and exploring the progress it has made within European insurance. IoT is the final frontier of customer-centricity in the sense that it takes insurance into the real world on a real-time basis, placing the customer literally, and not just figuratively, at the center.

If Europe is marginally further along the journey of customer-driven disruption than our other regions, as we have suggested, then we would expect IoT to be marginally ahead, as well. And while the technology is making strides the world over, our stats do place Europe above trend on the IoT-for-insurance adoption curve, at least in terms of current platform implementation (more details in our dedicated

Internet of Things section), and the pre-eminence of the continent in this field is borne out by much of our broader research.

While Internet of Things was not a priority area that Europe led on in our

insurer priorities section (it came second behind Asia-Pacific), Europe did achieve top spot for mobile, customer-centricity and claims – which form a constellation very auspicious for IoT-enabled business models and innovation.

Margaris tends to agree on the importance of IoT for European insurers, and Halkett, as we have already mentioned, credits the U.K. market as having fostered the development of in-car telematics.

"The IoT development (expected to reach $20.8 billion by 2020, according to Gartner Inc forecast) should help a new insurance to emerge, increasing customer-centricity and decreasing costs. An example of IoT impact on insurance is wearable tech, a passive way to monitor health and wellbeing, in real time and for everything. By identifying those who seem to be looking after themselves, insurers can drive premiums down for them." — Minh Q Tran, general partner at AXA Strategic Ventures

The real opportunity consists not just in personalized experience à la retail but in personalized pricing, so that the price customers pay reflects their real-world usage as captured by connected devices.

It is thus that personalization and premium-price reductions actually go hand in hand; rather than requiring two strategic thrusts, they can be part of one IoT-enabled customer-centric approach. These two Ps – price and personalization – are the two main advantages enjoyed by insurtechs, so insurers looking to the future, and to future-proof themselves, should definitely be taking an interest in IoT.

See also: Global Trend Map No. 15: Products

While still only a minority of insurers in Europe have a strategy on usage-based insurance (UBI), this is in line with our other key regions; we expect to see this percentage rise dramatically across the board over the coming years. Auto, home and health are the leading lines across all our regions in terms of the expected IoT benefits, though the benefits of sensor networks in other lines should not be ignored.

Auto is an example of a line that has already been extensively transformed by IoT in the form of telematics. This area is home to solutions of varying sophistication, from smartphone apps to "black boxes" built into cars. Depending on the richness of data coming from in-car sensors, a variety of insurance use cases and business models are enabled.

The one that most immediately jumps to mind is UBI, incorporating dynamic pricing and driving behavior modifications. By making customers’ premiums dependent on how they drive, insurers both encourage better driving (which is good for everybody) and lower the cost of premiums, which helps to get more people, more affordably, on the road.

"The joy of all insurance is the same: the financial desire of the insurance company is completely aligned with customers’ needs. So nobody wants to have crashes! The consumer doesn’t want to have crashes, and the insurance company would like to reduce the risk on their books," Halkett says. "

With telematics, you really get to do that; it’s not only that you get to understand the risk of the individual consumer, it’s that you get to influence that risk, so the risk that you write does not have to be the risk that you keep."

Even if premium prices remain the same, a premium with the potential for reduction is an infinitely more saleable proposition than the fixed-price alternative. And it is not solely up to drivers to educate themselves – insurers can take a much broader tutelary role by communicating tips and advice on a continuing basis. In this way, companies like Insure The Box are much more than just providers of telematics.

"We take customers, and then we make them safer drivers," Halkett says, "a

nd we do that via communications, online portals and via direct messages to the consumers, all the time rewarding safer driving behaviors."

From language courses to money-saving apps, gamification has proven itself time and time again to be a powerful force for bringing about positive outcomes, and the case with telematics is no different. The key is to engage the customer via whichever touchpoints are the most natural and offer the highest level of trust and engagement.

Insurers should not therefore conceive IoT solely in terms of inbound traffic (data traveling from customer devices to their back office) but also as a means of achieving higher engagement for their outbound messaging (from insurers to customers). Halkett points out the potential of connected home devices, such as the voice-enabled Amazon Alexa, for initiating contact with consumers in a world where "mobile" refers to much more than portable telephones.

"Automated data capture through IoT does not just help insurers preempt claims, it also helps mitigate losses and improve customer service when claim events do occur, by rooting out fraudulent or inflated claims and enabling faster turnaround of legitimate ones. Provided customer privacy concerns form part of the discussion, there is no reason why connected claims cannot be a win-win for everyone." — Mariana Dumont, head of new projects at Insurance Nexus

Beyond facilitating UBI models and continuous customer engagement, IoT solutions also give insurers detailed insight into what is actually happening on the ground on a second-by-second basis. Admittedly, this requires a lot of data and sophisticated models and, in telematics for example, is certainly a lot more than just detecting high G-forces.

Indeed, Halkett recounts an example from the early days of Insure The Box, where a spike in G-forces triggered an accident alert but actually turned out to be nothing more than the forceful slamming of one of the car doors. Nowadays, though, the company can reliably detect the telltale signs of accidents and other claim events from the incoming stream of black-box data in real time and react accordingly. With motor accidents, speed is of the essence, so being able to dispatch an ambulance instantaneously to the scene can be the difference between life and death: the ultimate in claims loss mitigation.

This data is also useful in the inverse case, where insurers want to demonstrate that an accident has not in fact occurred (and that, therefore, an associated claim is fraudulent).

The business case for IoT in claims is self-evident; as we recall from our

Internet of Things post, a majority of our respondents selected claims as one of the areas best-placed to benefit from IoT. Further still, in our stats on

claims, a majority of respondents believed that IoT would affect the claims department, and a majority also acknowledged having a high level of focus on claims loss mitigation.

The immediate access that IoT gives to data, which does not have to be sought out and gathered but simply ends up in insurers’ back-end systems as a matter of course, is driving the development of automated, or straight-through, claims-handling. We found a reasonable incidence of automated claims-handling among our European respondents, whose claims departments also expressed a strong focus on customer experience.

In the context of continually expanding horizons, we asked ourselves what the next stage of dynamic real-time insurance might be. Continuing this section’s particular focus on the auto line, we of course cannot ignore the amount of chatter around autonomous driving and what it means for the insurance industry.

While some believe that autonomous driving may eliminate the auto line, the truth of the matter is that human error is not the sole source of catastrophic events on the road.

"You don’t just eliminate all risks by making your vehicles autonomous," Halkett points out.

"And that’s before you even start to think about what you’d need to do to have an entirely autonomous ecosystem. The environment is going to have to have so many significant changes before it can support current autonomous functionality, and the journey between now and 100% autonomous – even if that does happen, and it’s not certain it will – is not straightforward at all, and there will be lots of different forms of mobility between now and then."

Halkett underlines rural and city driving as two key hurdles to be overcome on the way to full autonomy. For now and the immediate future, she believes there is food for thought enough in the intermediate stages between today’s conventional cars and the putative point of total autonomy in the future:

"We’re going to have multiple different vehicles, some with ADAS systems, some with minor help for driving in there and some with barely more than a glorified cruise control, up to fully autonomous vehicles, all on the road at the same time with drivers behind the wheel with very differing levels of experience and expectations for that driving, too.

"And what they are going to want from their insurance is a seamless product that just covers them for whatever they’re going to do – that is the reality of what the insurance industry is facing over the next 10-20 years."

Instead of focusing exclusively on different degrees of autonomy within what is essentially a private ownership paradigm, Halkett believes insurers should also be looking laterally, at emerging mobility formats:

"I would be looking at things like ride-sharing, things like shared ownership and different forms of vehicles, before we ever got to the point of complete autonomy," she concludes.

Driving Connected Insurance Models Across the Continent

Our exploration of Insurance IoT and telematics has so far leaned toward the U.K. But what sort of progress have new-age insurance models made across the continent as a whole?

Another country that currently boasts plenty of IoT buzz is Italy. Our influencer Matteo Carbone, of the Connected Insurance Observatory, draws attention to the telematics leadership shown by the Italian market, citing the nation’s 2.4 million connected cars (as of the start of 2016), compared with 3.3 million in the U.S. and 0.6 million in the U.K.

However, to compare IoT progress in blanket fashion across different national markets and insurance lines can be like comparing apples and oranges with pears and plums, given the uncategorizable variety of the problems IoT solves and the sheer number of different business models it enables.

In Italy, for example, telematics boxes have been mandatory in all new cars for several years now, as a result of legislation aimed at reducing fraudulent whiplash claims. Such legislation does not currently exist in the U.K., but, as we have pointed out, the U.K. telematics market could be considered a front-runner in other respects.

"Italy is recognized as the most advanced auto insurance market at the global level for telematics. Leveraging the experience of the auto business, the country is affirming its position as a laboratory for the adoption of this new paradigm by other business lines." — Matteo Carbone, founder and director at Connected Insurance Observatory

Leaving aside the question of who leads and who trails, one thing is certain: that IoT-based solutions for insurance, both within the auto line and beyond, are only going to become more prevalent as the unit cost of sensors comes down and the demonstrable savings from the technology rise further.

"The cost of technology is coming down all the time, and customer understanding is going up," Halkett says. "

So the business model becomes easier and easier for a wider portion of the market. Consumers in other countries will more readily adopt these sorts of technology-led products, and insurance markets are becoming more sophisticated, as well."

To continue with our auto focus, we can see how the advantages of in-car telematics – whether we are talking road safety, lower premiums or counter-fraud – are advantages for people of every age in every market, so there is no fundamental limit on the applicability of the technology.

"At some point in time, everyone is going to get connected. People will feel more empowered as they have a greater control on preventing risk events. This will be the origin of the new business model. In some countries, insurers don’t have a high level of trust because they are establishing conditions and changing prices, and the relationship is only one way. This is going to change, because in the future clients will have their data as an asset." — Cecilia Sevillano, head of partnerships, Smart Homes, at Swiss Re

This is not to say that the specific use cases will be the same everywhere. Halkett believes that the technology will bring about a bigger quantum leap, from a road-safety and world-health point of view, in those countries where infrastructure currently lags.

"I think when you stand back and start looking at the benefits of telematics, there’s an awful lot that could be used in different markets for very different reasons," she says.

"For example, if you look at the accident alert service and it tells you when someone has had a serious road accident – that would be so useful in rural areas in poorer countries which perhaps do not have the same infrastructure or the same emergency services as we do in the U.K. And to have that pinpointed alert would be even more valuable in countries where not everyone has a mobile phone and hospitals are perhaps less accessible."

This is a classic case of high-end technology bringing the full benefits of insurance to the lower-end market, a recurring theme across our other regional profiles, as well; underdeveloped markets, especially when they lack the burden of legacy systems, have a chance to catch up with and even leapfrog more established markets.

Margaris believes that this will be the case, not just for IoT adoption but for innovation more generally, in those parts of Europe that are currently less developed.

"The truth of the matter is that in less affluent countries you will see a faster adoption of insurtech because it’s cheaper and more personalized than what the incumbent insurance players offer," he says. "

Furthermore, I believe that the richer the countries, the less there is a need by consumers to adopt the cheaper business models that are offered by fintech and insurtech startups. So, therefore, I would say, the more developed the country, the longer it will take for innovative technology and business models to be adopted."

Looking beyond Europe for other emerging markets with leapfrogging potential, Margaris points to Africa as a ready-made example, referring specifically to mobile technology:

"Look at Africa, where with a normal phone – not even a smartphone – you can already transfer money, you can do anything," he comments. "

Because with low incomes, you will find a greater need for innovation."

This forms an unfavorable contrast with some established markets, and Margaris sees his native Switzerland as a case in point:

"In Switzerland, where I live, there is a lesser need for innovative business models because people have enough money. Not everyone is well-off, of course, but in general, there’s such a comfort level that people say, the status quo works well, so we don’t need to go for fintech or insurtech solutions that are or might be cheaper or better."

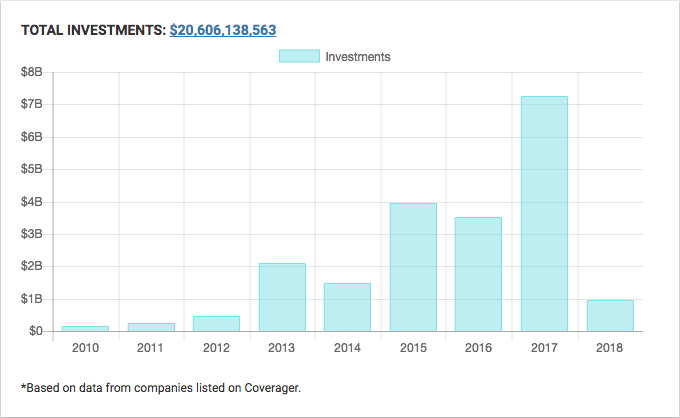

Margaris picks out insurtech and AI as two growth areas towards which sizeable investments are currently flowing, with London and Berlin being the premier European hubs. As for how the insurer-insurtech confrontation will play out, he points to the case of fintech – which has a couple of years’ lead on insurtech – as a likely indicator of how things will go here as well.

See also: Global Trend Map No. 16: Regions

"If we look at fintech, which is in a more advanced phase than insurtech, you see a clear trend of cooperation, meaning partnership or outright buying by incumbents. I think this will also happen to the insurtech space," he explains.

While this prognosis (cooperation winning out over competition) is generally positive for insurers, Margaris believes that in some ways insurers have it more difficult than banks:

"Banking has the same issues, but banks are much more experienced with customer interaction on a daily basis, while, with insurance, usually you talk to an insurance agency once a year, like when you have a claim. So legacy technology and the insurtech industry as a whole is worrisome for the insurance industry, but it’s also an opportunity."

"Insurtech will offer new ways to harness IoT potential, with use of AI and machine learning. Through partnerships with these startups, incumbents can definitely accelerate their modernization. And this is a win-win situation as insurtechs have technological expertise and, in return, insurance leaders can provide them the one resource which they lack: money." — Minh Q Tran, general partner at AXA Strategic Ventures

This compromise between incumbents and new entrants, at least for now, stems from the fact that neither has all the ingredients to win outright. While we pointed out the two trump cards of insurtechs in Part I our our Europe profile (price and personalization), let’s now examine the advantages enjoyed by incumbent insurers.

"Insurers have the customers, they have the money and they have the brand," Margaris says. "

They can adapt quickly and say: OK, let’s take the cutting-edge technology, and we can make it happen."

He gives the pharma industry by way of an analogy:

"The pharma industry spends billions on R&D and innovation. At the end, most of them – the big pharma players – who have much more experience in this field of innovation, they buy biotech companies and integrate. Because what the big guys do well is selling and distribution. If you give an insurance company a great product, they know how to make the most out of the potential. Incumbents and insurtech startups have to play to each other’s strengths.’

Halkett agrees that traditional insurers have plenty to offer as part of any insurance model of the future, in particular the sheer volume of data, insights and expertise that they have at their disposal. However, she questions whether today’s incumbents are structured in such a way as to make the most out of these assets.

There may need to be a move away from a centralized model toward more of an ecosystem play, with the insurer overseeing different components of a technology stack. Insure the Box is itself an example of this, being owned as it is by Aioi Nissay Dowa Insurance Europe, which is the ultimate bearer of risk and also has a long-standing partnership with automotive OEM Toyota.

"The insurtech discussion all too often centers on the premise that shiny new startups will win at the expense of the tired old incumbents. Many see the battleground between them being at the distribution end of the customer journey. For me, the insurtech opportunity extends all the way along the value chain." — Nick Martin, fund manager at Polar Capital Global Insurance Fund

At the end of the day, it is not a case of either/or with the partnership and insurtech-domination models, and we are likely to see some insurtechs eventually make it big alongside insurer-insurtech tie-ups.

"It will happen. We’ve seen the Googles, Amazons, Facebooks of this world, and we’ll see the same thing occur in insurtech, whereby some will become huge players. However, I believe we will see more partnerships or acquisitions because it’s very hard to scale," Margaris concludes.

As ever, you can read ahead straight away and gain access to all our global trends, key themes and regional profiles, by

downloading your complimentary copy of the full Trend Map whenever you like.