When IBM introduced its original PC in August 1981, threatening to wipe out the little companies that were already in the market, Steve Jobs had upstart Apple take out a full-page ad in the Wall Street Journal whose headline was: "Welcome, IBM. Seriously." The cheeky ad helped brand Apple, and we all know that the story had a happy ending for the company: Its market value now exceeds $1 trillion, while IBM, whose market cap amounted to three-quarters of the entire computer industry's in the early 1980s, now stands at less than an eighth of Apple's value.

A modern-day ad fight has now started in the insurtech world, as State Farm tweaked Lemonade, and Lemonade responded. State Farm has begun running TV ads that mock Lemonade (by implication, though not by name) and its use of chatbots to interact with customers. Here is the ad, suggesting that Lemonade's technology is no match for State Farm's 48,000 agents. Lemonade responded via a more modern medium (natch), tweeting: "Wait, @StateFarm , did you just fork out millions of your customers' premiums on an attack ad against @Lemonade_Inc and bots? As in, the country’s biggest insurance company is feeling the heat and getting A-listers to bash technology?" Lemonade has even paid to promote the video on YouTube and via other social channels, claiming the ad has backfired on State Farm.

We think the companies are on a crucial topic, so, rather than have them just retreat to their corners, a la Apple and IBM back in 1981, or simply amp up their ad budgets, we're inviting them to a public debate via webinar that we would moderate. We just reached out last night, so it may take a while to sort this out, but stay tuned for details. In the meantime, I'm going to start a discussion on the topic in the Inventing the Future of Risk and Insurance group that I moderate on our Innovator's Edge platform and that you can find here. (If you haven't already signed up for free access to IE, you can do so quickly here.) I'm going to invite to the discussion some heavy hitters among both incumbents and insurtechs.

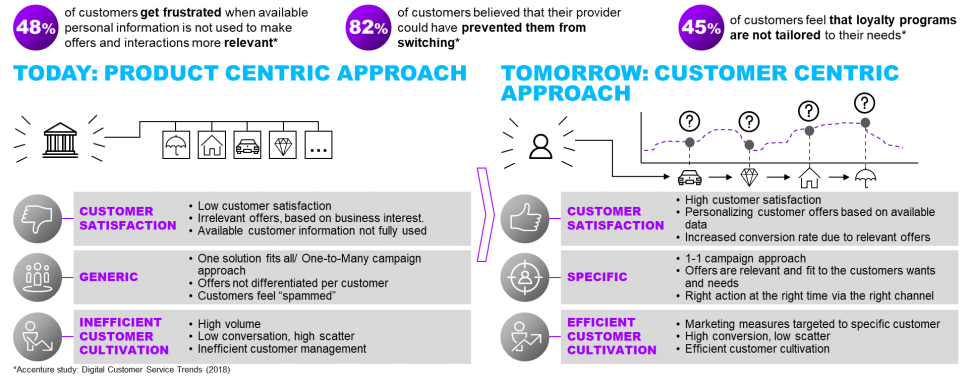

I'm not so interested in who will win the marketing fight or whose business model is better—though the two companies could probably sell tickets to the fight, along with a lot of popcorn. I'm very intrigued by how quickly technology should be integrated into interactions with customers.

I've had a long-held bias against things like chatbots because I first had people singing the praises of natural language processing to me in the mid-1980s, when I started covering the technology world for the Wall Street Journal, and NLP was so very not ready for prime time. Even with all the improvements since then, chatbots still lack empathy -- they'll immediately tell you how to fill out the forms to collect on a life insurance policy but not really grasp how to deal with someone who has just had a family member die. Chatbots learn, but... a Microsoft bot set up on Twitter had to be quickly shut down because it learned racism and cussing, not exactly what Microsoft had hoped. The potential for abuse is such that California recently enacted a law requiring that chatbots identify themselves as AIs if used in selling or in politics.

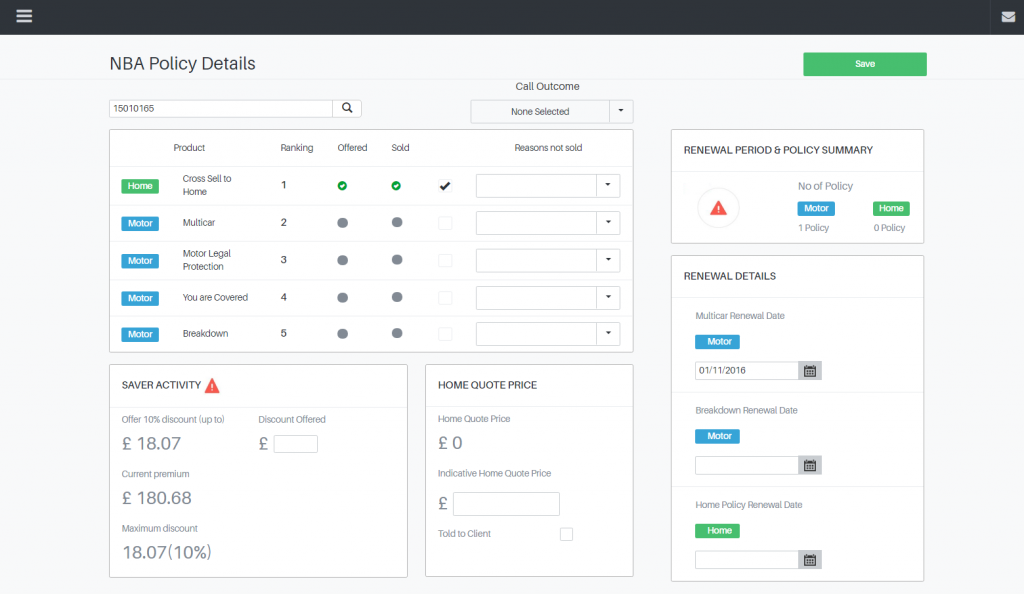

Still, I much prefer dealing with companies via chat—no wait time, no getting passed around; I can keep doing whatever I'm doing on my computer and just interact as necessary. And the use of technologies such as chatbots fit the Clay Christensen model of disruption, which I think is mostly right. He says disruption happens when an innovator takes over a slice of the business that isn't very complicated and doesn't matter much to incumbents, then grabs another slice and another and.... In the case of chatbots, I think there are plenty of things that could be handled faster by technology and that the agents would be happy to hand off, such as questions about when a payment is due, whether it has been received and what the status of a claim is. Then the chatbots can grow from there. McKinsey has done lots of work showing that automation doesn't wipe out entire jobs; it automates pieces of jobs, in this case the more mundane aspects of agents' work and of call centers.

But State Farm and Lemonade could surely change my thinking. As I said, stay tuned.

Paul Carroll

Editor-in-Chief