Why Is Data on U.S. Property So Poor?

The quality of data on U.S. property improved for 15 years -- then progress stopped. Why? Can't insurtech fix the problem?

The quality of data on U.S. property improved for 15 years -- then progress stopped. Why? Can't insurtech fix the problem?

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Matthew Grant is the CEO of Instech, which publishes reports, newsletters, podcasts and articles and hosts weekly events to support leading providers of innovative technology in and around insurance.

To be reminded of the power of insurance these days, I just have to step out the front door. I live about 80 miles south of the Camp Fire in northern California, and, even at this distance, the effect is obvious. The color of the air—not something I usually notice—sometimes reminds me of Mordor in the "Lord of the Rings" movies.

These fires, like every natural disaster, also serve as a reminder of how far we need to go as an industry, and not just to show people the value of insurance and narrow the "protection gap." We need to innovate to provide better, much cheaper policies that will be bought, not sold. We also need to find new business models, including ones based on helping people head off claims—if not from natural disasters, then at least from more controllable issues.

To that end, I encourage you to read a survey on innovation readiness that we did with The Institutes, which you can download for free here. The survey, led on our end by Guy Fraker and Paul Winston, shows that companies are making measurable progress but are still struggling, then provides a five-point checklist to overcome the common problems.

The Institutes will shortly unveil an insurance innovation curriculum, developed with Guy Fraker, that can help you build a culture of innovation and attack point #5 on that checklist: Encouraging employee participation. When the curriculum is ready for release, we will provide more details.

In the meantime, you might want to refer back to two detailed pieces from Guy that I've previously highlighted, on what's wrong and what's right with current innovation efforts. You can find them here and here.

As always, let me know if you have questions or if we can help.

In any case, let's all continue to hope and pray that the fires throughout California are contained as quickly as possible, with no more loss of life, and that all those affected can start to pull their lives together again as quickly as possible, assisted by the very best efforts of the insurance industry.

Have a safe week.

Paul Carroll

Editor-in-Chief

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Paul Carroll is the editor-in-chief of Insurance Thought Leadership.

He is also co-author of A Brief History of a Perfect Future: Inventing the Future We Can Proudly Leave Our Kids by 2050 and Billion Dollar Lessons: What You Can Learn From the Most Inexcusable Business Failures of the Last 25 Years and the author of a best-seller on IBM, published in 1993.

Carroll spent 17 years at the Wall Street Journal as an editor and reporter; he was nominated twice for the Pulitzer Prize. He later was a finalist for a National Magazine Award.

Used together, these tools -- listening, learning and leading -- can make the construction site a much safer place indeed.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Both raise legal issues that could cause surprising consequences. So could the heavy emphasis on turning insurance into a commodity.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Bruce Heffner is general counsel and managing member for Boomerang Recoveries. He is an attorney with substantial business experience in insurance and reinsurance, underwriting, claims, risk management, corporate management, auditing, administration and regulation.

Critical thinking is not a gene. Yes, it comes more naturally to some, but it is teachable (much of the time).

Critical thinking is not a matter of accumulating information. A person with a good memory and who knows a lot of facts is not necessarily good at critical thinking. A critical thinker is able to deduce consequences from what he knows, and he knows how to make use of information to solve problems, and to seek relevant sources of information to inform himself.So how do you build THAT? 5 Ways to Build Your Team’s Capacity to Think Critical thinking is not a gene. Yes, it comes more naturally to some, but it is teachable (much of the time). Here are a few ways to get started. 1. STOP being the hero. It’s hard. Who doesn’t love being superman? Particularly when you know EXACTLY what to do. It’s even harder if your boss is a superman, too, and you’re the go-to guy. There’s a certain rush from jumping in and doing what must be done at exactly the right time. And it can’t hurt, right? The worst you’re going to get after your superman intervention is a THANK YOU and a developmental discussion six months from now, saying you need to build a bench. But here’s what we hear offline. “She’s great. But she’s a do-er. I’d put her in my lifeboat any time. But her team is weak.” See also: How to Pick Your Insight Team Great leaders don’t have weak teams. Great leaders take the time to slow down just enough even during times of crises, to bring others along and help them rise to the occasion. Great leaders aren’t heroes, they’re hero farmers. 2. Connect what to why (more often than you think is practical or necessary). Yes, you can overload your team with TMI (too much information), but the truth is I’ve NEVER heard a manager complain that the boss overexplained “why.” It’s impossible to have great critical thinking if you’re not connected to the big picture (including key challenges). If you want your team to exercise better judgment, give them a fighting chance with a bit more transparency. 3. Expose them to messy discussions. It’s tempting to think we must have it all figured out before wasting our team’s time. But if you’re really working to build leadership capacity, it’s also important to sometimes bring your folks in BEFORE you have a clue. Let them see you wrestle in the muck and talk out loud. “We could do this … but there’s that and that to consider … and also the other thing.” 4. Hold “Bring a Friend” staff meetings. An easy way to do #3 is through “Bring a Friend” staff meetings. Once in a while, invite your direct reports to bring one of their high-potential employees along to your staff meeting. Of course, avoid anything super-sensitive, but be as transparent as possible. Every time I’ve done this, we’ve had employees leaving the meeting saying, “I had no idea how complicated this is,” and “Wow, that sure gave me a different perspective.” See also: The Keys to Forming Effective Teams 5. Ask strategic questions (and encourage them to go research the answers).

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Karin Hurt helps leaders achieve breakthrough results without losing their soul. She is a keynote leadership speaker, a trainer and one of the award-winning authors of Winning Well: A Manager’s Guide to Getting Results Without Losing Your Soul. Hurt is a top leadership consultant and CEO of Let’s Grow Leaders. A former Verizon Wireless executive, she was named to Inc. Magazine’s list of great leadership speakers.

The ability to gather and parse massive amounts of data has changed how insurers and their customers regard the trust relationship.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Tom Hammond is the chief strategy officer at Confie. He was previously the president of U.S. operations at Bolt Solutions.

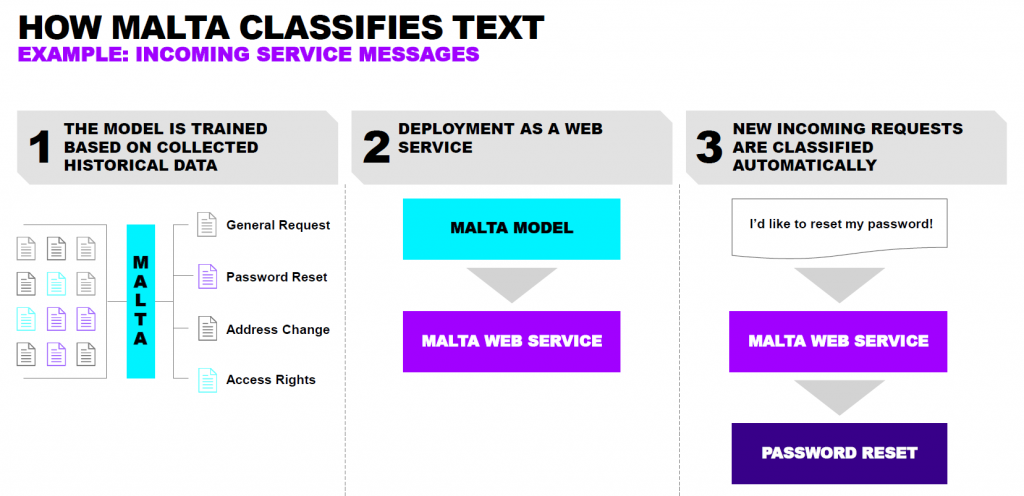

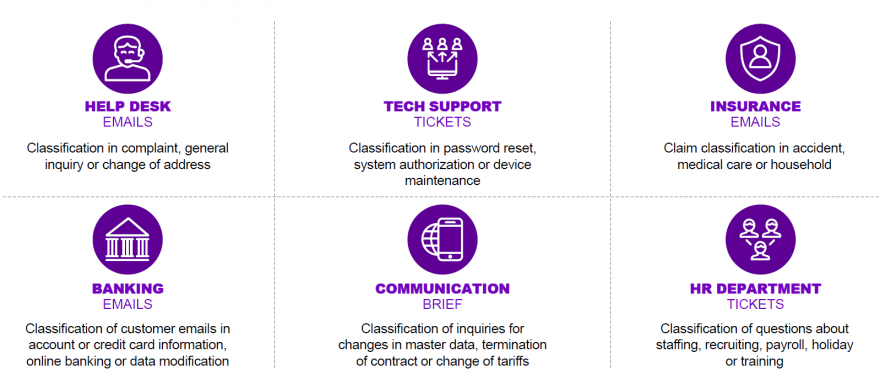

Now, insurers can automate the analysis and classification of incoming text by applying machine learning and using historical data.

How to manage the increase in incoming unstructured information is a key challenge in the insurance industry—we explore how Accenture’s Machine Learning Text Analyzer can achieve this using historical data.

How do you approach customer service and policy administration within your organization? In this blog post, I’ll demonstrate how artificial intelligence (AI) and a raised AIQ can help you get the most out of your data. (For the other articles in this series, click here.) To do this, I’ll discuss how insurers can use machine learning to analyze texts. How can insurers use AI in customer service and policy administration? The customer service and policy administration workforce can make their lives easier by using AI to: How does MALTA work in customer service and policy administration?

MALTA can analyze any incoming documents, for example when customers send their policy documents via email.

These documents can be analyzed and classified using natural language processing methods and machine learning algorithms. MALTA is also trained with historical data, which enables it to classify, understand and extract information.

In the next step, MALTA links your customer’s policy document to business processes, prompting different functions to take action. Depending on the business and architecture set-up, MALTA or the output of the API triggers a process chain, a robot or an agent so that the necessary processing steps can be executed.

How does MALTA work in customer service and policy administration?

MALTA can analyze any incoming documents, for example when customers send their policy documents via email.

These documents can be analyzed and classified using natural language processing methods and machine learning algorithms. MALTA is also trained with historical data, which enables it to classify, understand and extract information.

In the next step, MALTA links your customer’s policy document to business processes, prompting different functions to take action. Depending on the business and architecture set-up, MALTA or the output of the API triggers a process chain, a robot or an agent so that the necessary processing steps can be executed.

See also: In Age of Disruption, What Is Insurance?

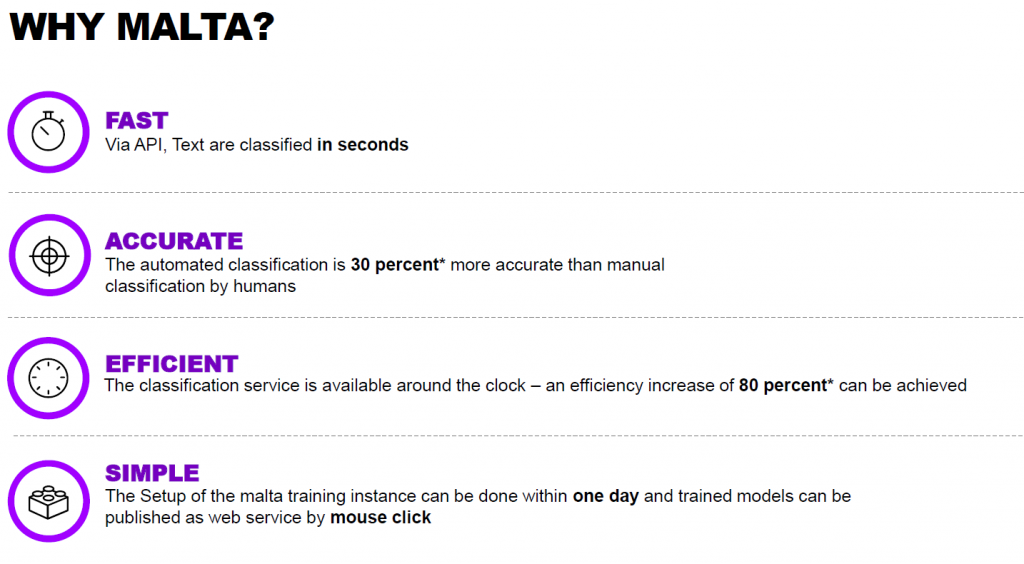

Benefits of MALTA

MALTA is flexible, customizable, independent, multilingual, state-of-the-art and end-to-end; using Accenture’s machine learning text analyzer, insurers can:

See also: In Age of Disruption, What Is Insurance?

Benefits of MALTA

MALTA is flexible, customizable, independent, multilingual, state-of-the-art and end-to-end; using Accenture’s machine learning text analyzer, insurers can:

Are you ready to power up your business with AI? Download the report on How to boost your AIQ for more insight.

Are you ready to power up your business with AI? Download the report on How to boost your AIQ for more insight.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Want to be here tomorrow? Heed Peter Drucker's advice: “There are only two functions in business: marketing and innovation.”

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Mike Manes was branded by Jack Burke as a “Cajun Philosopher.” He self-defines as a storyteller – “a guy with some brain tissue and much more scar tissue.” His organizational and life mantra is Carpe Mañana.

Two companies have begun making it as easy to get an online workers' comp quote as it is for personal lines insurance.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Karen Furtado, a partner at SMA, is a recognized industry expert in the core systems space. Given her exceptional knowledge of policy administration, rating, billing and claims, insurers seek her unparalleled knowledge in mapping solutions to business requirements and IT needs.

For insurers, the insurtech bubble is a great thing. Venture capitalists are funding the R&D that insurers have refused to fund themselves.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Matthew Josefowicz is the president and CEO of Novarica. He is a widely published and often-cited expert on insurance and financial services technology, operations and e-business issues who has presented his research and thought leadership at numerous industry conferences.