Survival of the Fittest in the Digital Age

The next iteration of the business of insurance may cause even more fundamental upheaval in the C-suite than already endured.

The next iteration of the business of insurance may cause even more fundamental upheaval in the C-suite than already endured.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Stephen Applebaum, managing partner, Insurance Solutions Group, is a subject matter expert and thought leader providing consulting, advisory, research and strategic M&A services to participants across the entire North American property/casualty insurance ecosystem.

Every business these days needs a strong IT leader, but not all can afford one. A virtual CIO can fill the need in three key ways.

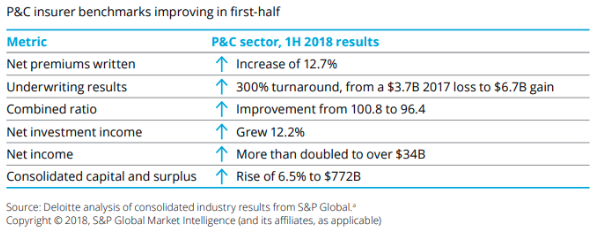

However, in the same report, Deloitte warns, “While 2018 and 2019 are shaping up to be banner years for insurers, some concerns are being raised about an economic slowdown, if not a full-fledged recession, as early as 2020.”

In other words, insurance businesses must be mindful of expenses if they wish to navigate the rough waters of a less lucrative market.

One of those cost areas is IT.

No matter the size or specialty of the insurance agency, IT affects operational efficiency, customer experience and compliance, among other areas.

Making the right decision in each is essential, but it cannot be done without a chief information officer (CIO), i.e., an experienced IT leader to identify bottlenecks, maintain compliance and ensure that your clients are satisfied with their digital experiences.

Unfortunately, not every insurance business can necessarily afford or access a CIO.

See also: How Virtual Reality Reimagines Data

However, these insurance businesses could leverage virtual CIOs (vCIO). The benefits of vCIO consulting cut across three major areas of relevance to your insurance business:

1. Complete IT Leadership

Be it patchy WiFi, computers breaking down or client portals crashing, these and other such IT issues will impede staff productivity. This can hamper your ability to sign on new clients as well as put existing client relationships under pressure.

A vCIO can bring a team of full-time IT experts to investigate your existing system to find the root causes that are derailing your operations and causing cybersecurity issues and compliance problems.

A vCIO can provide clarity of how your IT options -- be it systems, processes or training -- will both maintain productivity and meet strategic business goals.

2. Lower Costs

The average payroll cost of a CIO is $142,609 per year; salaries can range from $81,718 to $269,033 (Monster).

For small and medium-sized insurance agencies, that salary alone would be a significant spike to overhead. Moreover, these smaller agencies may not require a CIO around the clock, as a large outfit would.

This is where the cost advantage of a vCIO is key. Typically, vCIOs will charge a flat fee. A number of IT solutions for the insurance industry, such as managed services, actually include vCIO services as part of the agreement.

So, many small or medium-sized agencies leveraging managed IT services may not need to pay extra to access vCIO services.

3. Objective, Outside Look at Information Systems

Your IT manager may be a great asset, but IT has many different fields, with each field requiring dedicated experts.

Be it cybersecurity, mobile, cloud management, web development or something else, it’s good to have an outside expert to take a look.

See also: Insurance and Fourth Industrial Revolution

A vCIO can provide a neutral assessment. For example, a vCIO could come in and identify a gap in your compliance measures, thereby preventing you from getting hit by a fine. The vCIO could identify a glaring cybersecurity problem before it flares up into a costly technical (and legal) problem for your agency.

A vCIO may not be ideal for larger entities, which have exponentially greater technology needs, potentially across dozens -- or hundreds -- of offices. Larger entitites may also have many more custom technology systems, such as an on-premises data center or custom-coded internal and client-facing applications.

But every organization needs full-time access to a CIO to take ownership of your technology. Should something fail, you can’t afford to not have that leadership when you need it most.

However, in the same report, Deloitte warns, “While 2018 and 2019 are shaping up to be banner years for insurers, some concerns are being raised about an economic slowdown, if not a full-fledged recession, as early as 2020.”

In other words, insurance businesses must be mindful of expenses if they wish to navigate the rough waters of a less lucrative market.

One of those cost areas is IT.

No matter the size or specialty of the insurance agency, IT affects operational efficiency, customer experience and compliance, among other areas.

Making the right decision in each is essential, but it cannot be done without a chief information officer (CIO), i.e., an experienced IT leader to identify bottlenecks, maintain compliance and ensure that your clients are satisfied with their digital experiences.

Unfortunately, not every insurance business can necessarily afford or access a CIO.

See also: How Virtual Reality Reimagines Data

However, these insurance businesses could leverage virtual CIOs (vCIO). The benefits of vCIO consulting cut across three major areas of relevance to your insurance business:

1. Complete IT Leadership

Be it patchy WiFi, computers breaking down or client portals crashing, these and other such IT issues will impede staff productivity. This can hamper your ability to sign on new clients as well as put existing client relationships under pressure.

A vCIO can bring a team of full-time IT experts to investigate your existing system to find the root causes that are derailing your operations and causing cybersecurity issues and compliance problems.

A vCIO can provide clarity of how your IT options -- be it systems, processes or training -- will both maintain productivity and meet strategic business goals.

2. Lower Costs

The average payroll cost of a CIO is $142,609 per year; salaries can range from $81,718 to $269,033 (Monster).

For small and medium-sized insurance agencies, that salary alone would be a significant spike to overhead. Moreover, these smaller agencies may not require a CIO around the clock, as a large outfit would.

This is where the cost advantage of a vCIO is key. Typically, vCIOs will charge a flat fee. A number of IT solutions for the insurance industry, such as managed services, actually include vCIO services as part of the agreement.

So, many small or medium-sized agencies leveraging managed IT services may not need to pay extra to access vCIO services.

3. Objective, Outside Look at Information Systems

Your IT manager may be a great asset, but IT has many different fields, with each field requiring dedicated experts.

Be it cybersecurity, mobile, cloud management, web development or something else, it’s good to have an outside expert to take a look.

See also: Insurance and Fourth Industrial Revolution

A vCIO can provide a neutral assessment. For example, a vCIO could come in and identify a gap in your compliance measures, thereby preventing you from getting hit by a fine. The vCIO could identify a glaring cybersecurity problem before it flares up into a costly technical (and legal) problem for your agency.

A vCIO may not be ideal for larger entities, which have exponentially greater technology needs, potentially across dozens -- or hundreds -- of offices. Larger entitites may also have many more custom technology systems, such as an on-premises data center or custom-coded internal and client-facing applications.

But every organization needs full-time access to a CIO to take ownership of your technology. Should something fail, you can’t afford to not have that leadership when you need it most.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Jeremy Stevens works with Power Consulting to produce and edit content related to IT. He has spent more than half a decade working in the tech industry, covering topics such as hardware and software solutions for businesses, cloud technology and digital transformation.

For AI to be powerful, we must first abandon the knee-jerk focus on making the existing process more efficient while protecting profit streams.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Barry Thompson is a 35-year-plus industry veteran. He founded Risk Acuity in 2002 as an independent consultancy focused on workers’ compensation. His expert perspective transcends status quo to build highly effective employer-centered programs.

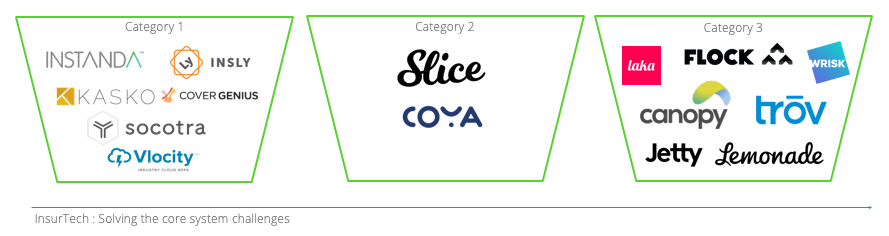

It's become clear that the lowest common denominator is the core system, most notably for policy admin and quote and buy.

A little more detail

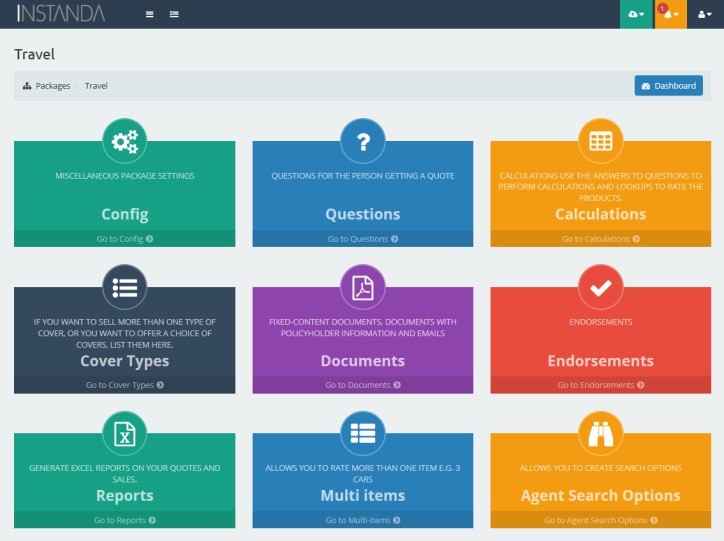

Category 1 — Instanda, for example, has 45-plus clients, from MGAs to insurers, that it has helped launch propositions and products to market in 8 to 12 weeks each, often less. Like everyone in this space, Instanda is cloud-native, sitting on Microsoft Azure, with the ability to spin up and down in a heartbeat. The screenshot below shows the simple, logical flow a business user can follow to create full insurance products, from rating questions and calculations to documents and endorsements. Adding to this, Instanda will quite happily deal with the first notice of loss (FNOL) phase for claims, passing then on to the client's in-house claims or TPA platform.

A little more detail

Category 1 — Instanda, for example, has 45-plus clients, from MGAs to insurers, that it has helped launch propositions and products to market in 8 to 12 weeks each, often less. Like everyone in this space, Instanda is cloud-native, sitting on Microsoft Azure, with the ability to spin up and down in a heartbeat. The screenshot below shows the simple, logical flow a business user can follow to create full insurance products, from rating questions and calculations to documents and endorsements. Adding to this, Instanda will quite happily deal with the first notice of loss (FNOL) phase for claims, passing then on to the client's in-house claims or TPA platform.

Category 2 — Slice not only has a cloud-based platform with ICS for policy and claims, it has the ability to write business in specific states. Built from the cloud down, Slice is outsourcing the speed-to-market challenge and has some great examples.

Category 2 — Slice not only has a cloud-based platform with ICS for policy and claims, it has the ability to write business in specific states. Built from the cloud down, Slice is outsourcing the speed-to-market challenge and has some great examples.

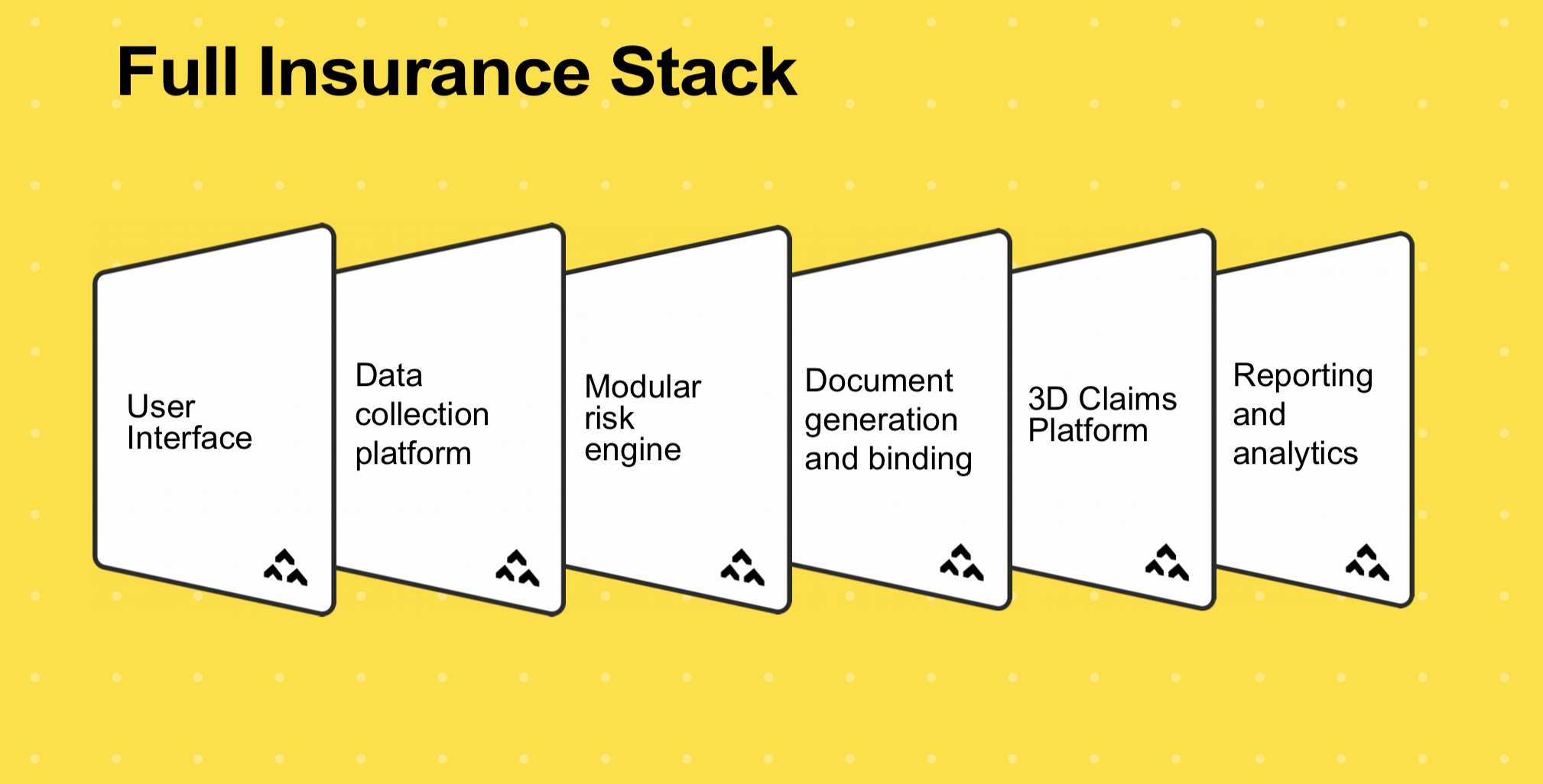

Category 3 — Finally, these folks have been on their merry way solving very specific challenges, whether it's Laka reinventing the business model while solving cycle insurance, or Flock with its head in the clouds with drone insurance or Canopy for Renters or MyUrbanJungle or Buzz or so many others. They have built in most cases an end-to-end platform focused on one line of business or one specific product. There is nothing stopping them leveraging this technology for another line. For example, what else could Flock insure that needed: location, real-time pricing, third-party data and much more? You guessed it: anything in the mobility space. And I probably wouldn't limit it there, either. Have a look at the Flock full insurance stack:

Category 3 — Finally, these folks have been on their merry way solving very specific challenges, whether it's Laka reinventing the business model while solving cycle insurance, or Flock with its head in the clouds with drone insurance or Canopy for Renters or MyUrbanJungle or Buzz or so many others. They have built in most cases an end-to-end platform focused on one line of business or one specific product. There is nothing stopping them leveraging this technology for another line. For example, what else could Flock insure that needed: location, real-time pricing, third-party data and much more? You guessed it: anything in the mobility space. And I probably wouldn't limit it there, either. Have a look at the Flock full insurance stack:

My view is that those in Category 3 are more likely to (will need to?) pivot into Category 1 or 2 in the search of scale, unless, of course, the business segment they have gone after is large enough. I would ask: How can I turn my platform and capability to broader and greater use?

Solving business challenges

I see insurers leveraging any number of these platforms depending on what their specific business challenge is to address new market pressures very quickly, whether they want:

My view is that those in Category 3 are more likely to (will need to?) pivot into Category 1 or 2 in the search of scale, unless, of course, the business segment they have gone after is large enough. I would ask: How can I turn my platform and capability to broader and greater use?

Solving business challenges

I see insurers leveraging any number of these platforms depending on what their specific business challenge is to address new market pressures very quickly, whether they want:

Insurers of the future will be assembled, not built. New platforms are an essential component in the rapid assembly process.There are, of course, a whole host of other categories across the entire insurance value chain that insurtech has been addressing. Many of these are incremental and address a specific problem area, whether it's making an efficiency play, helping price better, understanding risk differently, leveraging processing power, aggregating new data sources, addressing fraud, etc. We are merely at the tip of the iceberg still. I would love your perspectives.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Nigel Walsh is a partner at Deloitte and host of the InsurTech Insider podcast. He is on a mission to make insurance lovable.

He spends his days:

Supporting startups. Creating communities. Building MGAs. Scouting new startups. Writing papers. Creating partnerships. Understanding the future of insurance. Deploying robots. Co-hosting podcasts. Creating propositions. Connecting people. Supporting projects in London, New York and Dublin. Building a global team.

The massive increase in speed and the number of connected devices that respond seemingly instantly will bring important innovations.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

A typical excess & surplus lines (E&S) underwriter may review 16 to 20 submissions a day, so getting to the top of the pile is critical.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Jeff Canfield is SVP and head of E&S Casualty at Colony Specialty, part of Argo Group.

For International Women's Day, here are several ways insurers can build a more balanced workforce--and reap significant benefits.

While our industry has made great strides in recent years, we still have a long road before balance is achieved at the leadership level. A recent study found that women represent more than half of the industry’s entry-level positions, yet hold only 18% of its C-level roles.

These numbers are not uncommon; among all industries, only 79 women are promoted into manager positions for every 100 men. The disconnect starts early, and, as a result, just 1% of insurance organizations have a female CEO at the helm. The imbalance is further fueled by the industry’s gender wage gap, with women making just 62 cents for every dollar earned by men.

As the #BalanceforBetter campaign advocates, “gender balance is not a women’s issue, it is a business issue.” A balanced workforce results in more than a level playing field. It yields tangible business advantages that are key to staying ahead in today’s competitive and complex market.

See also: Why Women Are Smarter Than Men

Women remain underrepresented at the executive level across all industries, yet research consistently demonstrates their positive impact on business. A McKinsey study found that organizations in the top quartile of gender diversity at the executive level are 21% more likely to outperform their peers. Additionally, MSCI reports that, over a five-year period, U.S. companies on the MSCI World Index with at least three female directors achieved median gains of 37% on earnings per share.

For our industry to realize its full potential, insurers must develop diverse leadership teams that better mirror and relate to their customers and employees. With the insurance unemployment rate hovering between 1% and 2%, it is more important than ever for our industry to attract and retain top talent from all backgrounds.

Organizations that cultivate inclusion and intersectionality enterprise-wide are more likely to be seen as employers of choice in today’s candidate-driven market. In fact, on Fortune’s World’s Most Admired Companies list, the highest-ranked organizations had double the number of women in senior management than those that were ranked lowest.

There are several ways insurers can build trust while taking steps to realize a balanced workforce.

Embrace mentorship as a movement. Mentorship is a foundational element in helping break through the glass ceiling and building diverse and confident leaders. Through mentorships and sponsorships, women and members of other underrepresented groups gain access to senior leaders and role models that may not have otherwise been possible.

These can be internal programs or ones run through industry groups like Million Women Mentors, which aims to spark confidence in women and girls to succeed in STEM careers and leadership positions. Whether long-term or for a specific situation, these relationships can help propel women into manager roles and beyond, enabling them to move up the corporate ladder at a similar pace to men.

Create a culture of inclusion. Diversity of thought results in effective problem solving and more innovative ideas. Cultivate inclusivity through formal diversity and inclusion (D&I) programs and employee resource groups. By seeking out various points of view and effectively engaging and supporting employees of all backgrounds, teams benefit from unique viewpoints and healthy discourse. A greater sense of inclusion translates to an increase in decision-making quality, collaboration and perceived team performance.

Promote networking among women. Women helping and lifting up other women is vital to success. In fact, a commonality among most high-ranking women is a strong female-dominated inner circle, according to a recent study. Women whose networks are wide with strong female relationships at their core receive jobs at seniority levels that are 2.5 times higher than those who have smaller, male-centric networks. Female leaders are also more likely to surround themselves with other women. Credit Suisse found that female CEOs are 55% more likely to have women heading business units and are 50% more likely to have women as their CFOs.

Engage men as allies. A growing number of enlightened men are publicly advocating for women’s equity, standing as allies in identifying and breaking down barriers. In many organizations, male executives are spearheading employee resource groups and championing corporate D&I programs. By inviting men into the conversation and committing to open dialogue, organizations create shared ownership. A balanced insurance workforce will not be achieved through just one voice, but through a chorus of voices for change.

Hold leadership accountable. In an EY survey, only 39% of insurance leaders said their companies are formally measuring progress toward gender diversity, and just 8% shared that they have structured development programs in place for women. Additionally, Deloitte found that while 71% of organizations aspire to have an inclusive culture, their actual maturity levels are low. Implementing D&I programs is an important first step, yet true change will come as a result of organizations holding key decision makers accountable for setting and meeting goals.

See also: Survival Guide for Women in Insurtech

International Women’s Day is March 8; however, its spirit and mission extend throughout the year. Through mutual trust and respect, along with actionable steps and accountability, our industry can work to create a culture of inclusion and achieve balance beyond gender.

Looking to get involved? There are a number of insurance D&I organizations that join to support each other’s missions and events: STEMConnector’s Million Women Mentors Women in Insurance Initiative, Advancement of Professional Insurance Women (APIW), Business Insurance’s Diversity & Inclusion Institute, Dive In, Gamma Iota Sigma, Insurance Careers Movement, Insurance Industry Charitable Foundation (IICF) Global Women’s Conference, Insurance Supper Club (ISC) and Women’s Insurance Networking Group (WING).

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Margaret Resce Milkint is managing partner of the Jacobson Group. A member of the firm’s executive management team, she is a key ambassador in establishing strategic client relationships and broadening the firm’s reach and breadth of insurance talent solutions.

Innovation is moving into a phase, where insurtechs and incumbents are finally working together rather than circling each other warily.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Troy Vosseller is a co-founder of gener8tor, the parent company that organizes the OnRamp Insurance Conference. gener8tor is a turnkey platform for the creative economy that connects startups, entrepreneurs, artists, investors, universities and corporations.

Like the moon, mediation in workers' compensation proceeds in phases. Here’s a primer on what happens when.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Teddy Snyder mediates workers' compensation cases throughout California through WCMediator.com. An attorney since 1977, she has concentrated on claim settlement for more than 19 years. Her motto is, "Stop fooling around and just settle the case."

Bad news: Commercial general liability coverage no longer has sufficient cyber coverage. Good news: Cyber policy costs have plunged.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Keith Moore is CEO of CoverHound, a technology leader in both personal and commercial P&C insurance. In 2016, Moore founded CyberPolicy, which leverages CoverHound’s leading digital distribution platform as a "trusted adviser for curated choice."