Myth Busting on GDPR Insurance Policies

If companies with as many resources as Google are facing fines related to GDPR, how can far smaller businesses address this risk?

If companies with as many resources as Google are facing fines related to GDPR, how can far smaller businesses address this risk?

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

You won’t have all the answers--you don’t yet know all the questions--but begin a crisis management process with your families and firms.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Mike Manes was branded by Jack Burke as a “Cajun Philosopher.” He self-defines as a storyteller – “a guy with some brain tissue and much more scar tissue.” His organizational and life mantra is Carpe Mañana.

Choosing the right policy handling application may unlock significant value; the wrong one may impose a strategic constraint for years.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Millennials need a better guide–from education through policy selection–and easy access to information, anytime and anywhere.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Cara McFarlane is the global solution marketing manager for Hyland’s insurance vertical. Her mission is to effectively position Hyland as the leading content services platform within the insurance market by sharing best practices that accelerate insurers’ digital strategy across their enterprise.

Lots of people are to blame for the fire that gutted Notre Dame. But where were the insurers?

When I moved to Brussels with the Wall Street Journal/Europe in the mid-1980s, my father called a friend who had lived there to ask what his 25-year-old single son needed to know about the city. The friend replied: "Brussels is for people with families, but Paris is a short train ride away."

I spent countless weekends in Paris during my three years in Brussels. The first landmark I visited: Notre Dame. The last landmark I visited before moving back from Europe: Notre Dame. The profundity of the place grabbed me and held me. I sometimes sat and read in the plaza in front, just to soak in the ambiance that the bustling tourists created, even when I didn't go inside.

How was fire allowed to gut this treasure?

I'm reminded of a colleague at the WSJ who was an investigative reporter known for seeing the world in black and white. The joke was that his ultimate lede would be: "There are a lot of bad people in the world. Here are their names...."

I want names, people to blame.

But the role of the insurance industry, unlike journalism, is to restore a situation to where it was before a tragedy and then to help prevent future ones, not to identify villains. So:

The restoration part is covered because the Catholic church, the French government and a host of wealthy patrons have rallied to the cause. They won't be able to reproduce the lumber from 13,000 trees that was aged through an intricate process for 50 years before being used in the part of the ceiling that came to be known as "the forest," and they won't reproduce the elaborate carpentry there that helped make Notre Dame a marvel in the Middle Ages. But they will restore Notre Dame well, and we will all enjoy it again. The cathedral that survived the French Revolution (during which statues were publicly beheaded) and two world wars will add another chapter to its history.

That leaves us with the question: How do we prevent future catastrophes?

Prevention requires, first, acknowledging the breadth of the problem. We can't just protect iconic churches like Notre Dame, the cathedral at Chartres and Westminster Abbey, then declare victory. This article catalogs the threat to monuments throughout Western Europe, noting that questions need to be asked "about the state of thousands of other cathedrals, palaces and village spires that have turned France—as well as Italy, Britain and Spain—into open air museums of Western civilization."

Second, we need to be far more aggressive about identifying risks, especially during the precarious, frequent renovations, such as the one that's been taking place at Notre Dame. As this New York Times article details, officials at Notre Dame were complacent. They convinced themselves that 850-year-old timber would burn slowly. (Not even close.) They eschewed firewalls and sprinkler systems because of esthetics. Officials installed a sensitive alarm system but decided they would only summon firemen after a guard verified the alarm, which meant climbing a narrow stairway that would take a fit person six minutes. In the event, the guard dispatched after the first alarm sounded at Notre Dame didn't see a fire, so it wasn't until a second alarm and a second climb into the attic that the blaze was spotted—31 minutes passed between the sounding of the first alarm and the call to the fire department.

Third, we must take advantage of modern digital tools as much as possible. At Notre Dame, a medieval scholar used tripod-mounted lasers four years ago to create a model of every aspect of the cathedral, accurate to within a 50th of an inch, that will guide the restoration. He didn't live to see the extraordinary value of his work, but others can and should build similar models of other landmarks.

The reaction to the fire added a factor to risks, at least related to landmarks, that I confess I didn't see coming but that needs to be considered, even though it will be hard to mitigate. Almost as soon as the fire started, conspiracy theorists began spreading the baseless claim that Islamic extremists had started the blaze at the Catholic holy place. When megadonors offered to finance the restoration, some raised an outcry about how other worthy causes were being neglected. What about the three black churches in Louisiana that had been intentionally burned down? Even, what about the water system in Flint, Michigan?

I'm sad that a fire to a majestic, historic monument can't just be dealt with as a tragedy on its own terms. But I'm happy that more than $2 million has now been donated for the rebuilding of those churches in Louisiana, and that Notre Dame should now get the care it deserves so it can awe and inspire the next 30 or more generations. Let's see if we, as the authorities on risk management, can't do better by the many other touchstones of our civilization.

Cheers,

Paul Carroll

Editor-in-Chief

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Paul Carroll is the editor-in-chief of Insurance Thought Leadership.

He is also co-author of A Brief History of a Perfect Future: Inventing the Future We Can Proudly Leave Our Kids by 2050 and Billion Dollar Lessons: What You Can Learn From the Most Inexcusable Business Failures of the Last 25 Years and the author of a best-seller on IBM, published in 1993.

Carroll spent 17 years at the Wall Street Journal as an editor and reporter; he was nominated twice for the Pulitzer Prize. He later was a finalist for a National Magazine Award.

There are four steps that insurance organizations can take to assess their inventory of communications and optimize the content that lies within.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Patrick Kehoe is EVP of product management at Messagepoint.

He has over 25 years of experience delivering business solutions for document processing, customer communications and content management.

As more states adopt cybersecurity laws for insurers, carriers can begin to practice what they preach and get their own cybersecurity right.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Matt Cullina is head of global cyber insurance at Transunion.

He brings over 25 years of experience in cyber services, insurance research, development, and claims management. He previously served as managing director of global markets and CEO at Cyberscout.

If we innovate and design products in silos, we create great individual products -- but do we miss the big picture?

We create a fragmented and poor end-to-end experience for customers, leaving them to do all the hard work.

We may as well buy products from multiple providers (which in most cases we do). There are very few composite carriers that have got this right (or are moving toward an integrated approach).

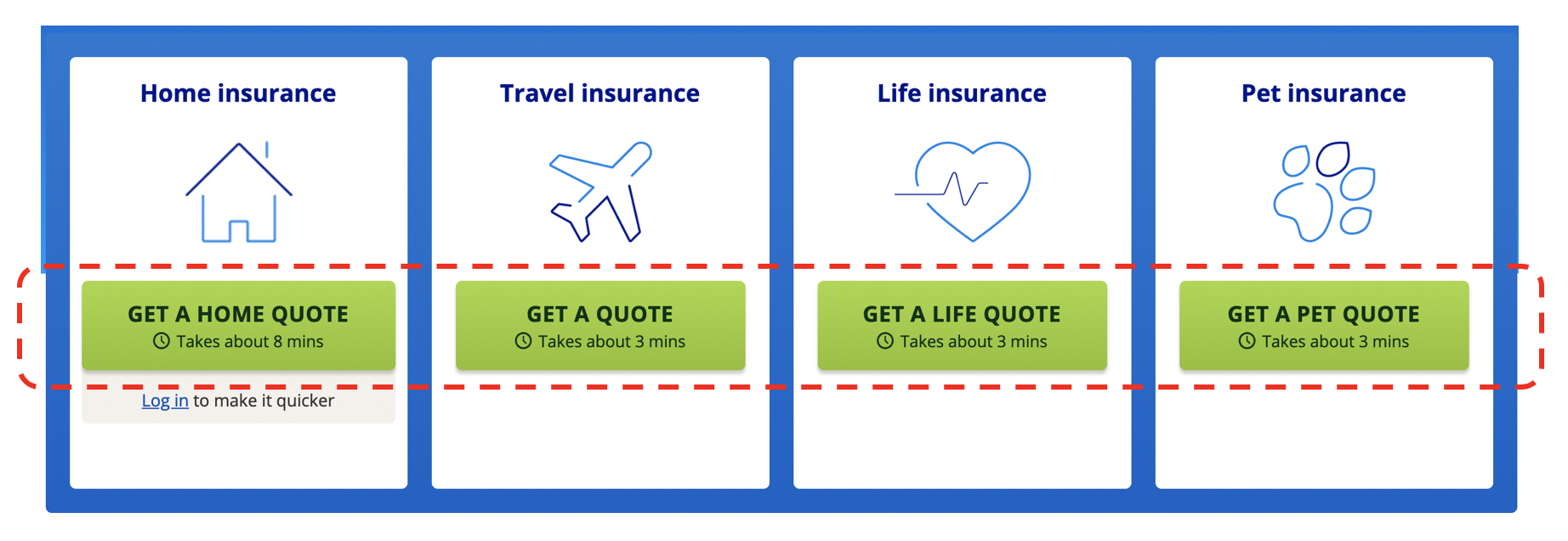

We make the problem worse by advertising in the same silos (in the U.K., at least) on our price comparison sites and focus on how long it takes to get cover: home insurance in eight minutes, travel in three and life insurance in three. LV did a study saying we spend more time choosing our annual holiday than we do buying life insurance. That just seems mad to me!

We create a fragmented and poor end-to-end experience for customers, leaving them to do all the hard work.

We may as well buy products from multiple providers (which in most cases we do). There are very few composite carriers that have got this right (or are moving toward an integrated approach).

We make the problem worse by advertising in the same silos (in the U.K., at least) on our price comparison sites and focus on how long it takes to get cover: home insurance in eight minutes, travel in three and life insurance in three. LV did a study saying we spend more time choosing our annual holiday than we do buying life insurance. That just seems mad to me!

How are we meant to engage with customers or get them to fall in love with what we are offering? We need new methods!

See also: So, You Want to Work With Insurtechs?

When Is Insurance NOT Insurance?

I am a firm believer of falling in love with the things we want. I don’t want:

How are we meant to engage with customers or get them to fall in love with what we are offering? We need new methods!

See also: So, You Want to Work With Insurtechs?

When Is Insurance NOT Insurance?

I am a firm believer of falling in love with the things we want. I don’t want:

For insurers, the next question is: Do I need to own those services, or could I just partner with multiple other providers to focus on the right outcome? Think about emergency home repair in your home policy or legal cover on your motor cover. These are still at a product level but not owned by the insurer themselves.

The key question is - What did the customer come out to buy in the first place?

Step out a level and start to aggregate the thinking at the customer (need), level not the (individual) product level.

One of my favorite examples is Peugeot's Just Add Fuel. It plays to many things for me -- from mobility as a service to brilliant orchestration of the end-to-end things you need to drive: servicing, tax, roadside assistance, tires and, of course, insurance. Super-convenient and hassle-free!

I call the Peugeot approach embedded and invisible insurance. Many folks don't like this term or general principle, asking what happens to all the spending on identity, brand and direct marketing. Will regulators like the approach -- is it transparent enough?

The winner will be the most efficient manufacturer. A great example of this is CoverGenius, which is integrating to the commerce level, not making the customer do the swivel chair integration! Hear from Mitch Doust, too, on the InsurTech Insider podcast here on what they are up to and how they enable embedded insurance experiences for their customers.

See also: Predicting the Future of Insurtech

A great example from another industry on removing barriers for customers comes from Match.com. Any single parents wanting to go on a date get up to three hours babysitting free of charge. Now, I’m not single, but finding a babysitter is nearly impossible where we live.

Beyond Insurance

So let's assume for one minute that the top half of my customer circle is filled with tens of insurance products that we all have. Now expand to look at the services we engage with on a regular basis and are likely to love as little as insurance. I quickly arrive at utilities and banking, with many lessons and observations that I think can be worked through for insurers, too.

Utilities

It’s fair to say we love these (read: care as little) as much as we do insurance. It’s pretty much a commodity product with some big legacy incumbents and some startups. Sound familiar? The startups have some unique and interesting propositions, be it great user experience (Bulb is my favorite), 100% renewable energy or something else. There are price comparison sites helping you find the best/cheapest option based on your usage and preferences. But just like insurance, there is a level of inertia that limits people from switching energy providers.

That said, there are a number of things going on here that may, just may, have material impacts for how we engage insurers. Specifically, automatic provider switching!

There’s been a whole host of firms pop up and offer this service. In the U.K., we have Labrador, Flipper, WeFlip and now AutoSergi from the price comparison website giants themselves, plus many others.

With Flipper, you pay a monthly subscription of just £2.50 to automatically flip to lower-cost providers, but it's free until you have made savings. In the U.S.. you have BillShark, and this is just the tip of the iceberg. The Guardian ran a piece late last year on how we can help people change providers for the best deal, in some cases saving £1,500 per year. There are easily 10-plus players in this space now, although not without challenge. I recall Flipper has been to the brink and back, and, just this month, it's reported that Labrador has gone bust (here).

Challenges aside, take the idea of auto switching to insurance?

Would most of us actually care if our journey out was insured to a different provider to the journey back, or house insured with provider X one month and a different one the next?

The Final Ingredient in the Cake: Banking

As much as I love all of the new Neo Banks and challenger capabilities such as Starling, Monzo, Yolt, Emma and hundreds of others, my life seems to take place on my credit card.

While I have moved to a Neo Bank (and properly moved, shutting down my old account), it does pretty much what I had before. Yes, maybe with a shinier interface. Yes, in a more engaging way. But I have my money in, and then bills out. It's not that complicated. What sets my bank apart is the Market Place, which enables access to insurance through a number of providers, as well as many other services and utilities to make use of the open banking and transactional data.

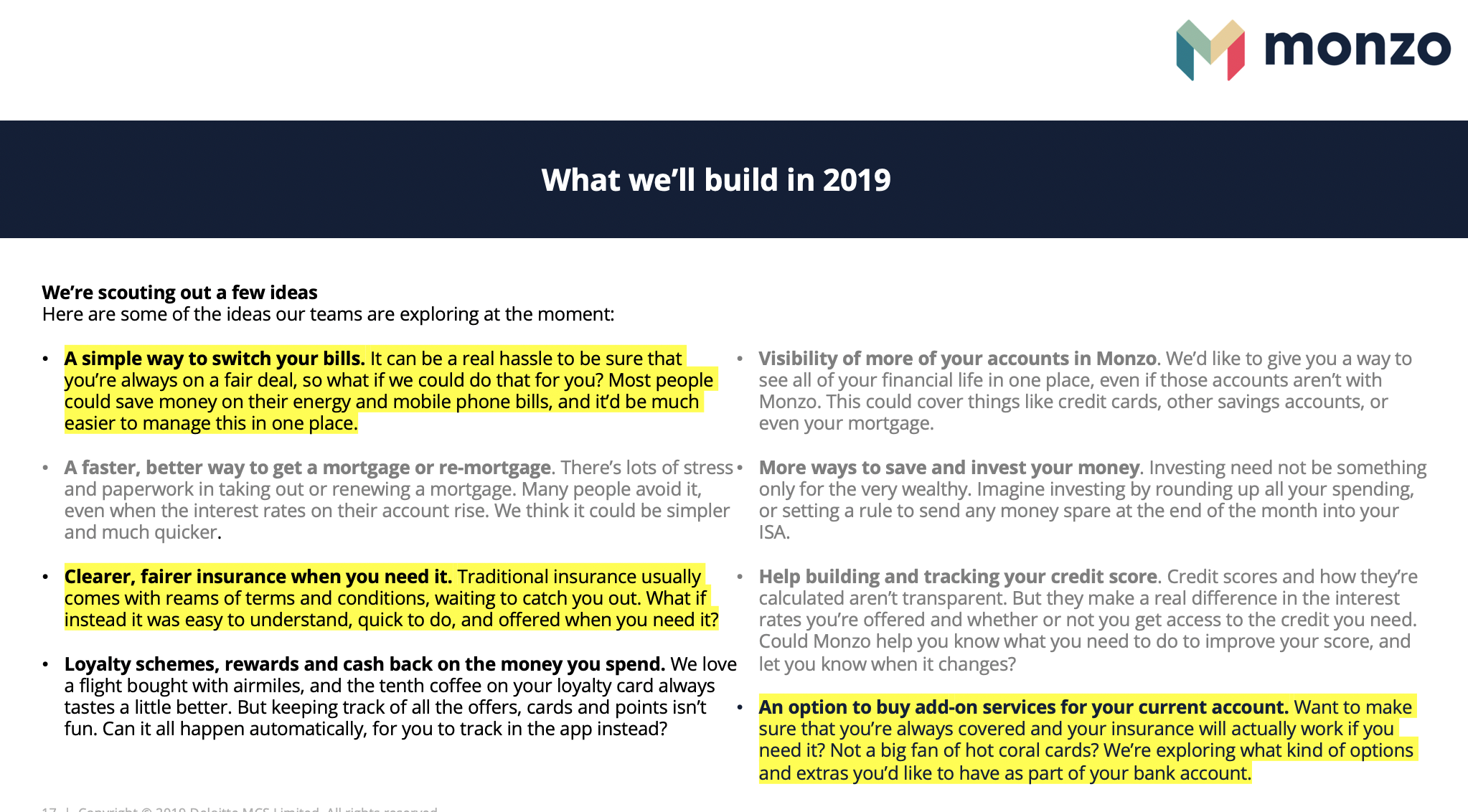

Another New Bank, Monzo, which could be valued at $2 billion if the latest rumored raise is correct, has an iconic following for its Hot Coral card. The more than 1.5 million customers give Monzo an opportunity to service this customer base with more than just banking. In a recent blog, Monzo talked about services that could be added: bill switching, clearer fair insurance and much more.

For insurers, the next question is: Do I need to own those services, or could I just partner with multiple other providers to focus on the right outcome? Think about emergency home repair in your home policy or legal cover on your motor cover. These are still at a product level but not owned by the insurer themselves.

The key question is - What did the customer come out to buy in the first place?

Step out a level and start to aggregate the thinking at the customer (need), level not the (individual) product level.

One of my favorite examples is Peugeot's Just Add Fuel. It plays to many things for me -- from mobility as a service to brilliant orchestration of the end-to-end things you need to drive: servicing, tax, roadside assistance, tires and, of course, insurance. Super-convenient and hassle-free!

I call the Peugeot approach embedded and invisible insurance. Many folks don't like this term or general principle, asking what happens to all the spending on identity, brand and direct marketing. Will regulators like the approach -- is it transparent enough?

The winner will be the most efficient manufacturer. A great example of this is CoverGenius, which is integrating to the commerce level, not making the customer do the swivel chair integration! Hear from Mitch Doust, too, on the InsurTech Insider podcast here on what they are up to and how they enable embedded insurance experiences for their customers.

See also: Predicting the Future of Insurtech

A great example from another industry on removing barriers for customers comes from Match.com. Any single parents wanting to go on a date get up to three hours babysitting free of charge. Now, I’m not single, but finding a babysitter is nearly impossible where we live.

Beyond Insurance

So let's assume for one minute that the top half of my customer circle is filled with tens of insurance products that we all have. Now expand to look at the services we engage with on a regular basis and are likely to love as little as insurance. I quickly arrive at utilities and banking, with many lessons and observations that I think can be worked through for insurers, too.

Utilities

It’s fair to say we love these (read: care as little) as much as we do insurance. It’s pretty much a commodity product with some big legacy incumbents and some startups. Sound familiar? The startups have some unique and interesting propositions, be it great user experience (Bulb is my favorite), 100% renewable energy or something else. There are price comparison sites helping you find the best/cheapest option based on your usage and preferences. But just like insurance, there is a level of inertia that limits people from switching energy providers.

That said, there are a number of things going on here that may, just may, have material impacts for how we engage insurers. Specifically, automatic provider switching!

There’s been a whole host of firms pop up and offer this service. In the U.K., we have Labrador, Flipper, WeFlip and now AutoSergi from the price comparison website giants themselves, plus many others.

With Flipper, you pay a monthly subscription of just £2.50 to automatically flip to lower-cost providers, but it's free until you have made savings. In the U.S.. you have BillShark, and this is just the tip of the iceberg. The Guardian ran a piece late last year on how we can help people change providers for the best deal, in some cases saving £1,500 per year. There are easily 10-plus players in this space now, although not without challenge. I recall Flipper has been to the brink and back, and, just this month, it's reported that Labrador has gone bust (here).

Challenges aside, take the idea of auto switching to insurance?

Would most of us actually care if our journey out was insured to a different provider to the journey back, or house insured with provider X one month and a different one the next?

The Final Ingredient in the Cake: Banking

As much as I love all of the new Neo Banks and challenger capabilities such as Starling, Monzo, Yolt, Emma and hundreds of others, my life seems to take place on my credit card.

While I have moved to a Neo Bank (and properly moved, shutting down my old account), it does pretty much what I had before. Yes, maybe with a shinier interface. Yes, in a more engaging way. But I have my money in, and then bills out. It's not that complicated. What sets my bank apart is the Market Place, which enables access to insurance through a number of providers, as well as many other services and utilities to make use of the open banking and transactional data.

Another New Bank, Monzo, which could be valued at $2 billion if the latest rumored raise is correct, has an iconic following for its Hot Coral card. The more than 1.5 million customers give Monzo an opportunity to service this customer base with more than just banking. In a recent blog, Monzo talked about services that could be added: bill switching, clearer fair insurance and much more.

With All These Ingredients, How Do We Make Cake?

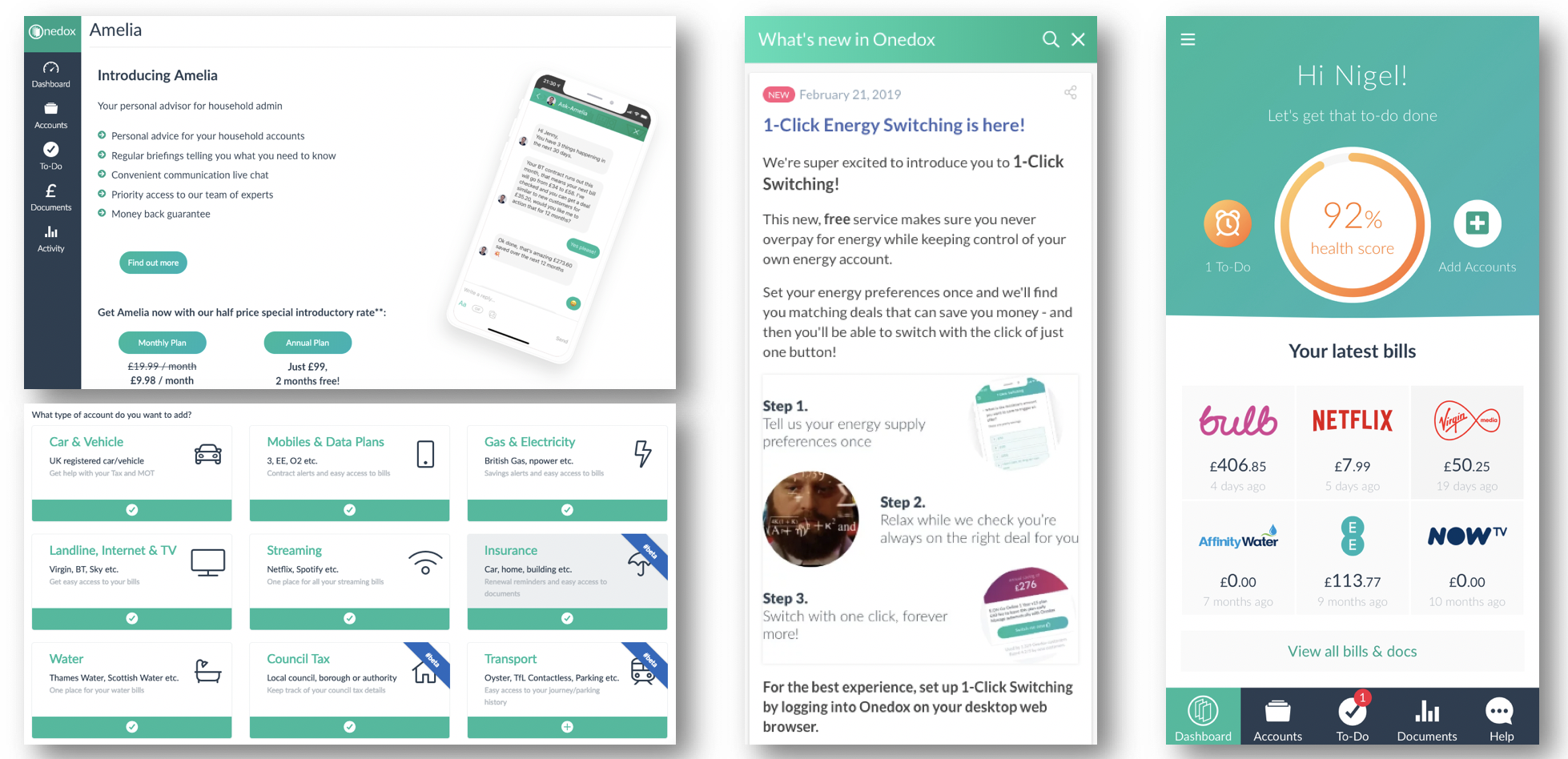

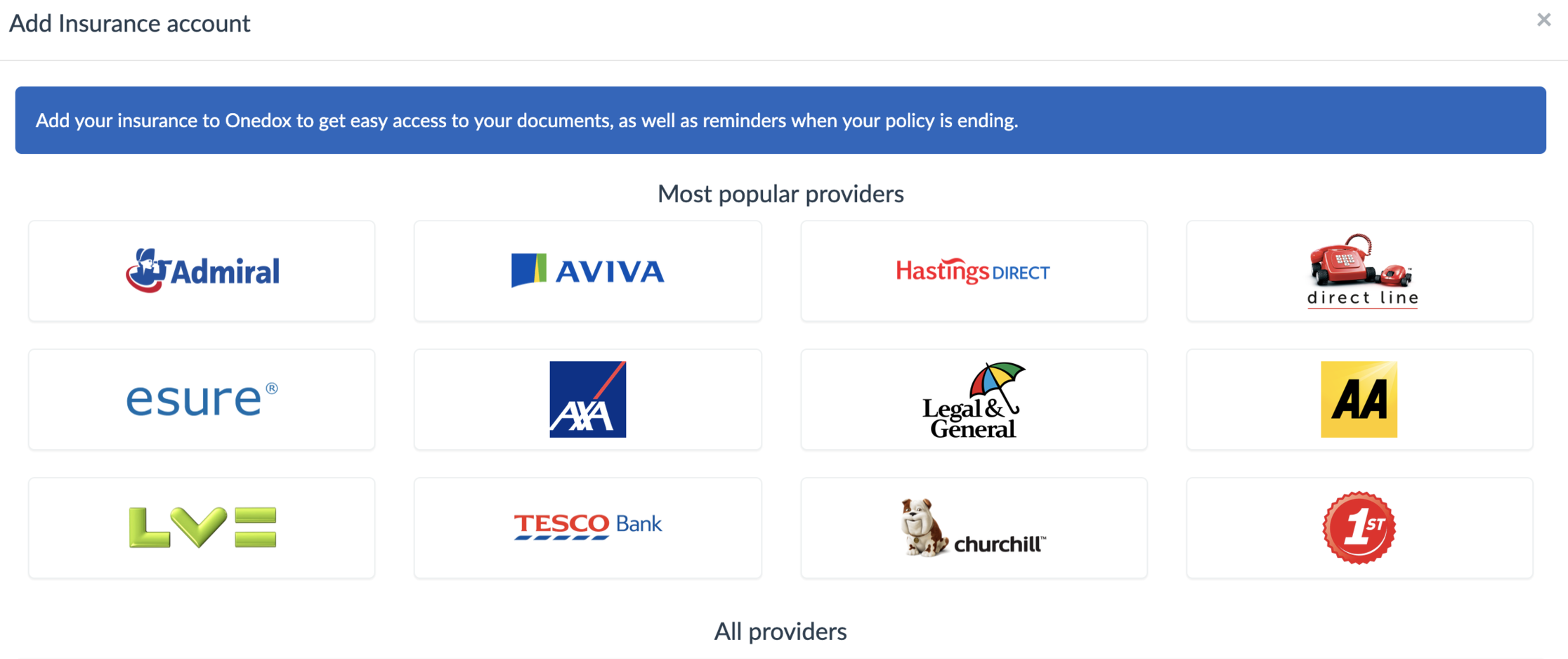

Many all-in-one services already exist. One of my favorites is Onedox, which wraps all of the above into a single service and has a website and app that allow you to add:

With All These Ingredients, How Do We Make Cake?

Many all-in-one services already exist. One of my favorites is Onedox, which wraps all of the above into a single service and has a website and app that allow you to add:

I can add multiple providers, I get one-click energy switching and a neat app to store all this stuff in one place, rather than log into my separate providers and accounts.

See also: 3 Insurtech Trends Accelerating in 2019

Keep going. Add insurance providers (below) and soon insight through open banking. See here for the vision on that particular one.

I can add multiple providers, I get one-click energy switching and a neat app to store all this stuff in one place, rather than log into my separate providers and accounts.

See also: 3 Insurtech Trends Accelerating in 2019

Keep going. Add insurance providers (below) and soon insight through open banking. See here for the vision on that particular one.

I find Onedox super helpful and already notice behavior changes, in that I don't need to go to any of the other providers. Youtility is another that was recently featured in the national press.

So, who will own the customer of the future?

We want our time back. Period. For insurers, this means that we can no longer offer something people can't fall in love with, or want last in the chain of thoughts. We have to find ways to blur the lines. Why can't insurers take the front foot on this one, creating and orchestrating partnerships that add value?

Summary

I have a few key questions that keep coming up again and again:

I find Onedox super helpful and already notice behavior changes, in that I don't need to go to any of the other providers. Youtility is another that was recently featured in the national press.

So, who will own the customer of the future?

We want our time back. Period. For insurers, this means that we can no longer offer something people can't fall in love with, or want last in the chain of thoughts. We have to find ways to blur the lines. Why can't insurers take the front foot on this one, creating and orchestrating partnerships that add value?

Summary

I have a few key questions that keep coming up again and again:

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Nigel Walsh is a partner at Deloitte and host of the InsurTech Insider podcast. He is on a mission to make insurance lovable.

He spends his days:

Supporting startups. Creating communities. Building MGAs. Scouting new startups. Writing papers. Creating partnerships. Understanding the future of insurance. Deploying robots. Co-hosting podcasts. Creating propositions. Connecting people. Supporting projects in London, New York and Dublin. Building a global team.

While millennials may appear to be a poor target for insurers today, their fortunes will change over the next 10 years.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Michael Sauber is vice president of marketing at Instec, a provider of underwriting, policy and billing systems for commercial property and casualty insurers and program administrators. He has launched over 40 products and two software ventures.

55% of surveyed participants admit to checking social media while behind the wheel, and 25% said they’ve even recorded a video.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Andrea Leptinsky is a 15-year news veteran with experience in community journalism, automotive reporting and traffic safety marketing. She started as managing editor at DriversEd.com in 2017.