Product Managers Needed for Analysis?

Some data science teams have matured beyond offering advice and are making products. Do they need a data science product manager?

Some data science teams have matured beyond offering advice and are making products. Do they need a data science product manager?

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Paul Laughlin is the founder of Laughlin Consultancy, which helps companies generate sustainable value from their customer insight. This includes growing their bottom line, improving customer retention and demonstrating to regulators that they treat customers fairly.

Trying to detangle the spider-web information systems that exist in organizations today is a lot like bargaining with a four-year-old.

If you have ever experienced detangling a four-year-old’s hair, you know it is a mess! The amount of fighting and screaming along with negotiations (I will give you ice cream), sometimes threats (no iPad for you) that go into that process can be unbelievable. The situation is not so different a scenario when we try to detangle the spider-web systems that exist in organizations today. Business folks fight with IT, have back-door negotiations with leadership about priorities and engage in countless back-and-forth exchanges of business requirements. Sound familiar? How can organizations cope in a “detangle” situation? Here are three recommendations:

1. Comb through your systems one small section at a time. If you have tried to comb through a large section of tangled hair, what happens? You get stuck, or your comb breaks. If you comb a small section at a time, you could effectively detangle. Take one part of your process, application, module, etc. and determine ways to streamline the operation. “Eat the elephant one bite at a time” to ensure you won’t get stuck in your innovation and transformation efforts or end up in a mental asylum.

See also: Creating Win-Win-Win Scenarios

2. Use a detangle spray. I love detangle spray! Taking a small section of the hair and applying the detangle spray makes the combing faster. Here is where I would recommend organizations look at outside help. Is there a service like virtual transformation office that can expedite your transformation or innovation efforts? Transformational consultants are of a different breed. They cut through the BS; if they don’t, you don’t have the right one working for your organization. These folks bring outside technology, industry-level perspectives and agile processes to act as a “detangler” in your initiatives. For most organizations, operational needs tend to outweigh innovation efforts. An external perspective can ensure organizations are looking beyond the operations and focusing on innovation.

3. Chop it off. Chopping off the hair was my final resort with my toddler’s hair. I went to the barber and had her hair cut. Why? It was just too painful to continue to maintain. With your spider-web systems, you will come at a point where you have to say good-bye--good-bye to your green screen friends, VB screens from the early 2000s and old funky .asp apps. Are there startups that you can bring to your organization to provide new tech that can eliminate multiple legacy applications? At Benekiva, we pride ourselves on eliminating four to nine systems leveraged by claims staff to process one claim. How many systems are your teams using to complete a task or work unit? You may not be ready to chop everything off, but you can do it gradually. Change takes time.

See also: Culture Side of Digital Transformation

Disrupting is the name of the game for all organizations. Even if you are a giant company, you have to keep up or you risk going bald, at which point no amount of combing, spraying or chopping will help.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Bobbie Shrivastav is founder and managing principal of Solvrays.

Previously, she was co-founder and CEO of Docsmore, where she introduced an interactive, workflow-driven document management solution to optimize operations. She then co-founded Benekiva, where, as COO, she spearheaded initiatives to improve efficiency and customer engagement in life insurance.

She co-hosts the Insurance Sync podcast with Laurel Jordan, where they explore industry trends and innovations. She is co-author of the book series "Momentum: Makers and Builders" with Renu Ann Joseph.

While Americans know that driving after smoking or ingesting marijuana is dangerous, one-fourth of them admit to doing so.

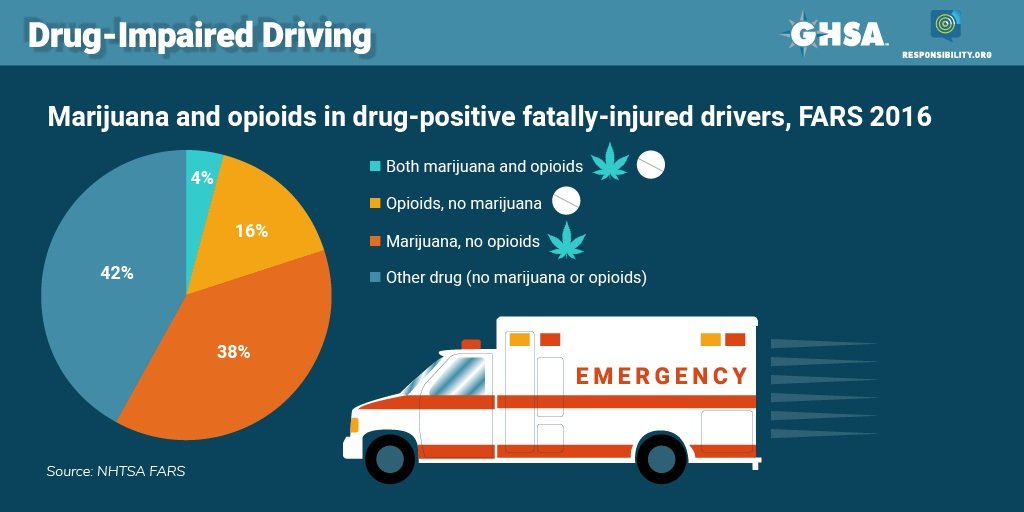

A 2018 Governors Highway Safety Association study, Drug-Impaired Driving: Marijuana and Opioids Raise Critical Issues for States, found that, in 2016, 44% of fatally injured drivers with known results tested positive for drugs, up from 28% just 10 years prior. More than half of these drivers had marijuana, opioids or a combination of the two in their system.

The best way to reduce drugged driving, according to Mothers Against Drunk Driving (MADD), is the use of standardized field sobriety testing (SFST), the foundation of impaired driving detection and enforcement for 800,000 law enforcement officials across the country. Some states, however, do not require SFST training for officers assigned to patrol functions.

As MADD says: Myths and misinformation are part of the problem. Get the facts—and share them with your loved ones, especially young adults. Why? More than one-third of teens mistakenly believe they drive better under the influence of marijuana.

The 2019 Cars and Cannabis survey was conducted online using Survey Monkey. One thousand and sixty-three participants were polled, spanning the U.S., with the U.S. driving population represented by the 997 respondents who, before completing the survey, answered that they have a driver’s license. The demographics of those polled represented a broad range of household income, geographic location, age and gender.

This article was originally published on DriversEd.com.

A 2018 Governors Highway Safety Association study, Drug-Impaired Driving: Marijuana and Opioids Raise Critical Issues for States, found that, in 2016, 44% of fatally injured drivers with known results tested positive for drugs, up from 28% just 10 years prior. More than half of these drivers had marijuana, opioids or a combination of the two in their system.

The best way to reduce drugged driving, according to Mothers Against Drunk Driving (MADD), is the use of standardized field sobriety testing (SFST), the foundation of impaired driving detection and enforcement for 800,000 law enforcement officials across the country. Some states, however, do not require SFST training for officers assigned to patrol functions.

As MADD says: Myths and misinformation are part of the problem. Get the facts—and share them with your loved ones, especially young adults. Why? More than one-third of teens mistakenly believe they drive better under the influence of marijuana.

The 2019 Cars and Cannabis survey was conducted online using Survey Monkey. One thousand and sixty-three participants were polled, spanning the U.S., with the U.S. driving population represented by the 997 respondents who, before completing the survey, answered that they have a driver’s license. The demographics of those polled represented a broad range of household income, geographic location, age and gender.

This article was originally published on DriversEd.com.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Andrea Leptinsky is a 15-year news veteran with experience in community journalism, automotive reporting and traffic safety marketing. She started as managing editor at DriversEd.com in 2017.

There are lots of reasons why fires get out of control, and it turns out the biggest issue is a lack of real-time information.

In 2018, there were over 6,000 wildfires in California alone, destroying well over 10,000 structures, producing over $9 billion in property damage and claiming the lives of at least 88 people. Horrific. But there’s hope. More than 95% of the wildfires in California are controlled within the first 24 hours and are contained to 10 acres or less. In other words, fewer than 5% of wildfires grow out of control and move into day 2, producing most of the devastation. And improvements in technology can help us tackle that 5%.

I say that after having had the privilege of being invited to a workshop hosted by the Gordon and Betty Moore Foundation, in collaboration with the University of Maryland, last week. (Yes, that Gordon Moore, co-founder of Intel and author of what has come to be known as Moore’s law.) The workshop pulled together 28 of the smartest people I have ever met, all committed to curbing the impact of wildfire, not only in California, but also across the globe.

There are lots of reasons why fires get out of control, and it turns out the biggest issue is a lack of real-time information. The best technology available to the commanders making strategic decisions and firefighters in the field gives them information that is usually six to 12 hours old. Fire can do a lot in six to 12 hours.

The workshop identified a number of technologies that could greatly improve the information flow, three of which stood out to me: offerings from Planet Labs, Jupiter Intelligence and Descartes Labs.

Planet Labs has deployed a pearl-like string of shoe-box-sized satellites that provide an image of the entire globe every 24 hours. The image is accurate to about three meters—you won’t be able to pick out a person, but if you’re looking for anything as big as a pick-up truck or bigger, you’re good—and will let firefighters watch for danger.

Jupiter Intelligence provides a supercomputer platform that models potential dangers from one hour to 50 years out and could be used to monitor fires in near-real-time.

Descartes Labs combines data from lots of different sources, including sensors and imagery, and refines that data so it can be used for modeling that can spot and monitor potential problems as well as actual fires.

The folks at the workshop are committed to pulling together these and other technologies to better understand the traits (weather, terrain, vegetation, humidity, wind, etc.) that might signal the right conditions for an uncontrollable wildfire. The group will also integrate technologies and other capabilities to provide firefighters with real-time data about a fire and its movement.

We have written many times in this commentary about how technology is moving insurance and risk management into a predictive and (we hope) preventive role, rather than simply helping us get better at responding after losses occur, and that change will need to extend beyond technological improvements. I learned last week, for instance, that we are probably a decade behind in controlled burns. We should be control-burning about 2 million acres per year to limit wildfires, but we have been control-burning only approximately 100,000 acres a year for a long while. No wonder there is so much fuel to feed those wildfires. (Some environmentalists may push back on the need for controlled burning, but the wildfires seem to have created a new level of realism all around. Unless we’re going to unleash tens of thousands of goats on our forests, controlled burns are the only alternative.)

As always, we in the insurance industry can help. While the data we use for making decisions about risk and pricing may not be the same as what authorities need to prevent or fight fires, there is significant overlap, and we must all work together in this time of acute need.

I’d love to hear any thoughts about what the Moore/Maryland group or we as an industry should be doing in the face of the wildfire threat.

Wayne Allen

CEO

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Insurance Thought Leadership (ITL) delivers engaging, informative articles from our global network of thought leaders and decision makers. Their insights are transforming the insurance and risk management marketplace through knowledge sharing, big ideas on a wide variety of topics, and lessons learned through real-life applications of innovative technology.

We also connect our network of authors and readers in ways that help them uncover opportunities and that lead to innovation and strategic advantage.

If you find yourself claiming that your agency wins by providing better service, you really need to rethink your message.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Kevin Trokey is founding partner and coach at Q4intelligence. He is driven to ignite curiosity and to push the industry through the barriers that hold it back. As a student of the insurance industry, he channels his own curiosity by observing and studying the players, the changing regulations, and the business climate that influence us all.

The amount of low-hanging fruit with few costs and high impact for both the customer experience and optimized operations is incredible.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Deb Smallwood, the founder of Strategy Meets Action, is highly respected throughout the insurance industry for strategic thinking, thought-provoking research and advisory skills. Insurers and solution providers turn to Smallwood for insight and guidance on business and IT linkage, IT strategy, IT architecture and e-business.

As a safety manager, what’s the best practice for managing the ever-decreasing road capacity along with the host of new exposures?

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Tony Hughes is a commercial auto product manager at Safety National, with more than 15 years of experience in operations, claims, product management and underwriting. His comprehensive knowledge about the auto insurance industry results from having worked in related fields in the 1990s.

Connected insurance is the biggest potential for transformation that insurance has witnessed since the invention of the computer.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Graham Proud works closely with insurer senior-management teams to identify the challenges and solutions in bringing about transformation. Proud produces a number of white papers, webinars and major industry events to reflect the industry's latest trends.

The big Google investment suggests it sees a great future for independent agents. So, what's the verdict after six months?

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Mark Breading is a partner at Strategy Meets Action, a Resource Pro company that helps insurers develop and validate their IT strategies and plans, better understand how their investments measure up in today's highly competitive environment and gain clarity on solution options and vendor selection.

If companies with as many resources as Google are facing fines related to GDPR, how can far smaller businesses address this risk?

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|