Happy New Year!

I figure we should dub this year "Hindsight." After all, hindsight is 20/20, right? So, let's imagine it's Dec. 31, 2020, and we're looking back on the year. What will we see that the industry accomplished?

Having read a bazillion forecasts over the holidays, I think lots of prognosticators are on the right track. Yes, there will be loads more AI, more use of big data/insurtech in underwriting, more chatbots and other technology in customer relations. Yes, insurance will become more modular, as companies figure out how to plug in the industry's best, say, claims technology and process rather than using just home-grown systems. No, Big Tech doesn't look likely to do a cannonball into insurance and splash all the water out of the pool, though Big Tech will probably continue to do deals like Amazon's move into distributing pharmaceuticals and pull away certain buckets of profits.

But I think 2020 will be most notable because the industry will start to get better in an even more important way than has been described in the forecasts I've read. I believe the industry will begin to get better at... getting better.

I trace this concept back to Doug Engelbart, a monumental figure in the history of computing. In 1968, he held what has become known as The Mother of All Demos, which laid the groundwork for graphical user interfaces, hyperlinks (as in, the World Wide Web) and networked computers. He even hand-carved a scrolling device out of wood, which came to be known as a mouse because the wire running out the back of the little brown block looked like a tail.

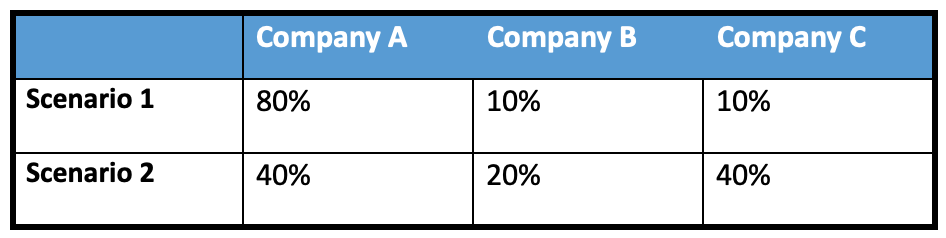

Engelbart also contributed seminal thinking on a variety of topics, including what he described as A, B and C processes in corporations. Every company has A processes; they're how the business is run. Good companies, he said, also have B processes—ways of making the A processes better. Great companies, he argued, also have C processes—ways of improving the B processes that improve the A processes. In other words, great companies keep getting better at getting better.

(Quick aside: About 20 years ago, when I lived in Silicon Valley, I attended a birthday party at a neighbor's house and struck up a conversation with an elderly gentleman who seemed a bit left out. We got talking about innovation—that's what you did in Atherton in those days—and I mentioned that I had just published an article on A, B and C processes in a magazine I edited. He said, "But that's my idea." I corrected him: "No, that idea came from Doug Engelbart." He said, "And I'm Doug Engelbart." He was, too. He lived next door to my friend.)

I believe that 2020 could mark the year when the insurance industry makes a breakthrough in getting better at getting better.

We've been in heavy innovation mode for several years now, so we're learning about what works and what doesn't.

If you're an incumbent engaging with an insurtech, no, you can't operate on your normal planning cycle. By the time you pull together your annual technology road map and tee the insurtech up for your quarterly budget review to see what funds are available, that insurtech has gone belly up. It needed to make payroll by Friday. Seven months ago.

We've also learned about the sorts of tools, such as the cloud and X-as-a-service, that can speed innovation. We've become more attuned to what technologies are available outside our companies and maybe picked up a bit of experience on how to incorporate them. We've seen the need for small, focused innovation teams and for quick, inexpensive prototypes that can let us test customer reaction in the wild.

In Engelbart terms, we began several years ago with those A processes. Then we engaged B processes and began to innovate on those A processes. Now, we know enough about those attempts at B processes, those attempts at innovation, to set up ways to systematically improve on them, too.

That's my hope, at least, as we embark on 2020.

May the year treat us all well.

Paul Carroll

Editor-in-Chief