While we all long for a return to normal once we tame the coronavirus, when it comes to healthcare in the U.S., we can't go back to normal. "Normal" didn't work.

It will take a while for the new contours of healthcare and health insurance to appear, because the focus must stay for now on the acute, short-term dangers to our physical and economic well-being. But the policy fights will come.

When they do, they will have to produce at least a national layer of public health capabilities so that, next time (and we all seem to now realize that there will be a next time), individual states and healthcare systems won't have to fend for themselves so much. The fights will also accelerate trends in the healthcare world that are moving toward health care, rather than sick care, and will change the roles of many of the players in the industry, likely including the mammoth health insurers.

The need for more public health capabilities is obvious from just a cursory look at how the U.S. experience with COVID-19 compares with that of many other developed countries. Taiwan, for instance, has had only seven deaths. (I'd tell you what multiplier to use for that total to account for the difference between Taiwan's population and ours, but what's the point when Taiwan has had so few deaths that some people can probably name them all?) South Korea, with about a sixth our population, has had 263 deaths and is down to nearly zero new cases. Germany, with more than 8,100 deaths, at about a quarter of our population, has done far worse than South Korea and Taiwan, but has fared much better than the U.S. and is seeing almost no new cases. The country has only 5.8% unemployment, while economists say the U.S. is on its way to 25%, so Germany, like South Korea and Taiwan, has seen far less economic disruption than we have. Yes, Spain, Italy and France have done worse than the U.S. in deaths per 100,000 people, but all have their curves headed to zero for daily new cases while the U.S., despite recent progress, is still above 20,000 new cases each day. Only the U.K., among major European countries, has both performed worse than the U.S. in deaths per 100,000 and has failed to drastically reduce the number of new cases.

So, even in today's hyper-politicized world, it's hard to escape the conclusion that the U.S. has handled the pandemic poorly. The questions for the future will be: Why? And, more importantly, what can prevent a recurrence?

A significant chunk of the blame will accrue to the federal government, which received increasingly strong signals of danger through January but did little to build testing capability or to take containment measures until well into March. But there's also a systemic problem with our healthcare system, at least in terms of our ability to respond to a pandemic.

While South Korea responded to the pandemic almost immediately by setting up drivethrough centers in parking lots where anyone could be tested for free, the U.S. system is, "Call your doctor." That doesn't work especially well under the best of circumstance, because individual doctors and their health practices have to figure out what guidelines to use for testing and have to fight for supplies, while interacting with health insurers and local, state and federal authorities. The process just takes too long when you're dealing with a virus so contagious that one case can produce 59,000 new cases in less than two months (based on the R0, or R-naught, of three that seems to be the rule of thumb for the coronavirus at the moment).

Then you add in that many people who don't have a doctor to call. Some 44 million Americans don't have insurance, and a further 38 million have limited enough insurance that they likely don't have a strong relationship with a doctor. Because about half of Americans get their insurance through employers, even those with insurance become vulnerable as a pandemic devastates the economy and people are laid off -- like the 36 million Americans who have filed unemployment claims since the pandemic began. How can you do testing through a "Call your doctor" program when maybe a third of the country doesn't have a doctor to call?

The U.S. briefly tried a South Korea-like system of mass testing. You may recall the Rose Garden announcement in mid-March of a website that Google was supposedly developing that would soon direct people across the country to testing centers in parking lots of major retailers. But the problems were just too hard, and the administration quickly moved on from the plan. The last I read, the website was still just a test in a few counties in California, and testing centers had been set up in only five parking lots.

It seems clear that, where future pandemics are concerned, there needs to at least be a national overlay on the current system. That overlay needs to include detailed planning ahead of time so we can go straight to the South Korea model of widespread national testing, no matter who someone's doctor is or whether the person has insurance. The funding needs to be ample and permanent -- no raiding the cookie jar even if we go 15 or 20 years before another crisis. It seems we also need to agree on what kinds of restrictions on business and individual movement are philosophically acceptable, so we avoid a repeat of the current situation, where a health crisis has somehow become a partisan issue devolving into debates about who's more patriotic.

I hope we can get to the sort of "germ games" that Bill Gates has been promoting for five years, as he has repeatedly warned that a pandemic would show up soon enough. His idea is that, just as the military conducts war games, why wouldn't we conduct similar exercises to make sure we're ready for the viral threats that, as we're now all painfully aware, can cost the lives of many tens of thousands of people just in the U.S. and create trillions of dollars of economic damage?

I hope, too, that we won't just stop with planning for the next pandemic, because the current crisis has brought into sharp relief some major problems that we can start to solve even as we're throwing trillions of dollars at the acute, short-term issues. I saw, up close and personal, how this can work when I was involved in a Stimulus Act project at the Department of Energy in 2010. The leaders were charged with getting $36.5 billion into the economy as quickly as possible but took a very strategic focus and, in the midst of the chaos, made a series of investments that have helped drive prices way down for solar, wind, batteries, electric vehicles and more in the ensuing decade. The same strategic approach can be taken now with our healthcare system.

In particular, it's clear that we have to do something about "health equity," which may finally get the attention it deserves because of the hugely disproportionate effect of COVID-19 on minorities. Because of some occasional work I've done with the American Medical Association, I've heard for a while about "the death gap" -- the fact that people born in one part of Chicago have a lifespan 30 years longer than those born just eight miles away -- and it's nice to see that unconscionable disparity get national attention, including on the editorial pages of the New York Times. There's no simple solution, because so much of the disparity relates to what are known as the social determinants of health. (Even if you have access to healthcare, what does it matter if you don't have the money to buy a refrigerator and can't afford to eat well?) But we can start by building on the need for pandemic coverage to make sure everyone has access to a minimum standard of care.

If the dominoes start to fall, then we can look at a broader issue: the need to switch from sick care to health care. At the moment, healthcare providers get paid for each service or medicine they provide, so they focus on sick people and help them get better. But the goal with the pandemic is to keep people from becoming infected in the first place, and some of that prevention thinking needs to infuse the whole system. Healthcare providers are actually much more inclined at the moment to get away from fee-for-service, because so many people are avoiding any interaction with the healthcare system that they can, for fear of coming in contact with those infected with the coronavirus. That fee-for-service income has dried up. If doctors were paid a sort of subscription fee for keeping patients healthy, medical practices wouldn't be suffering so much. In addition, the pandemic has helped telemedicine finally come into its own. It offers a way to keep doctors in touch with patients easily, going well beyond that seven-minute annual visit that is the way many of us experience healthcare now.

Switching away from fee-for-service and increasing the use of telemedicine means changing payment models, which finally brings us to the health insurers.

They take a beating these days for two main reasons. First, the insurers catch much of the blame for the fact that the U.S. spends twice as much per capita on healthcare than other major economies while getting average care. Second, while everyone wants and needs health insurance, nobody likes it. Dealing with health insurance is simply painful.

In this case, they have the potential to lead the way. While they can't be expected to do anything deliberately that would cut into their lush profits, they can easily drive adoption of telemedicine and use that as the tip of the spear in efforts to move away from sick care and toward health care, earning good will without much change to their business models.

Even if insurers choose not to lead, the pandemic will drive others to demand change, so the insurers might end up following.

Cheers,

Paul

P.S. Here are the Six Things I want to highlight from the past week:

Firms' Top Priorities During the Pandemic

Change management, flexibility and risk management have exposed their critical importance.

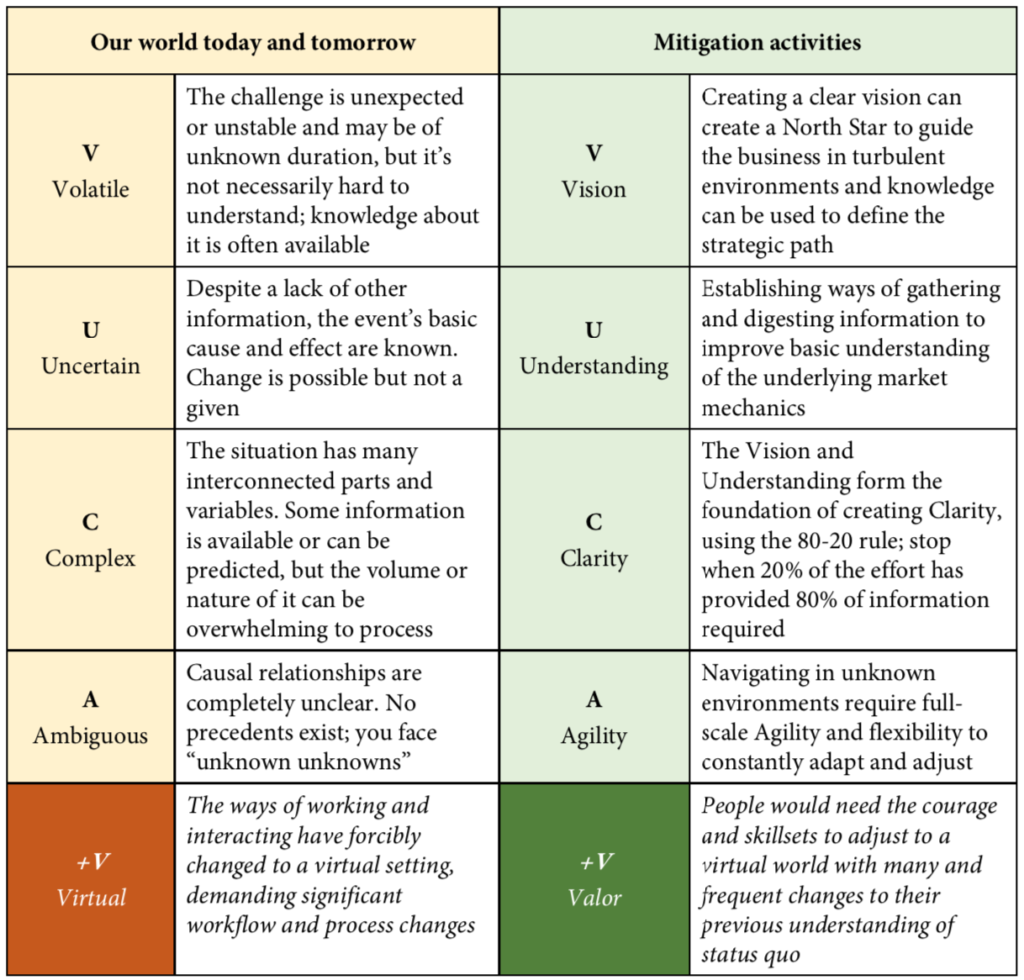

How to Adapt to a VUCA+V World

In a world they haven’t seen before, insurers must do what they haven’t done before if they want to stand a chance to succeed.

Access to Care, Return to Work in the Pandemic

Beyond the pandemic, claims teams will need to know how to prioritize medical care for injured workers.

Hurricane Season: More Trouble Ahead?

As if COVID-19 isn't tough enough, the Atlantic hurricane season looks to be active, with a higher probability of named storms making landfall.

Getting Back to Work: A Data-Centric View

By the time the world gets to the new normal, insurers must have created an "information mesh."

The Pandemic and a New Ecosystem

As much as we all wish coronavirus had never happened, it has supercharged innovation in the insurance industry.