Over the last decade, businesses have placed tremendous focus on improving the safety of their products, their establishments and the services they provide to their customers. They have taken advantage of data, technology and enhanced risk management practices driving safety and quality. Yet we continue to see extreme verdicts, social inflation and “hell hole jurisdictions” in the liability arena. The question is, what more can be done?

In this paper, we will analyze the trends in liability and auto losses, both litigated and non-litigated, and provide guidance on tactics to manage those losses.

Key findings:

- Nuclear verdicts continue to be a concern for the business and insurance community. Just one of these verdicts can have

a major impact on individual programs. Media coverage and advertisement of these verdicts may motivate increased litigation that, in turn, creates an increased burden on carriers and companies. - Litigation costs continue to rise.

- There are more attorney-represented claims at first notice of loss.

- The “social inflation” factor is real and is likely driving some of the increasing litigation cost.

- Litigation avoidance practices will reduce liability claim costs and increase control over the litigation rate.

- Plaintiffs’ bar has become increasingly coordinated in approach and strategy in tort suits. An awareness of how plaintiffs’ strategies have evolved is a critical part of defending any claim.

- Advocacy and early intervention are important factors in mitigating the likelihood that claims could evolve into more expensive disputes.

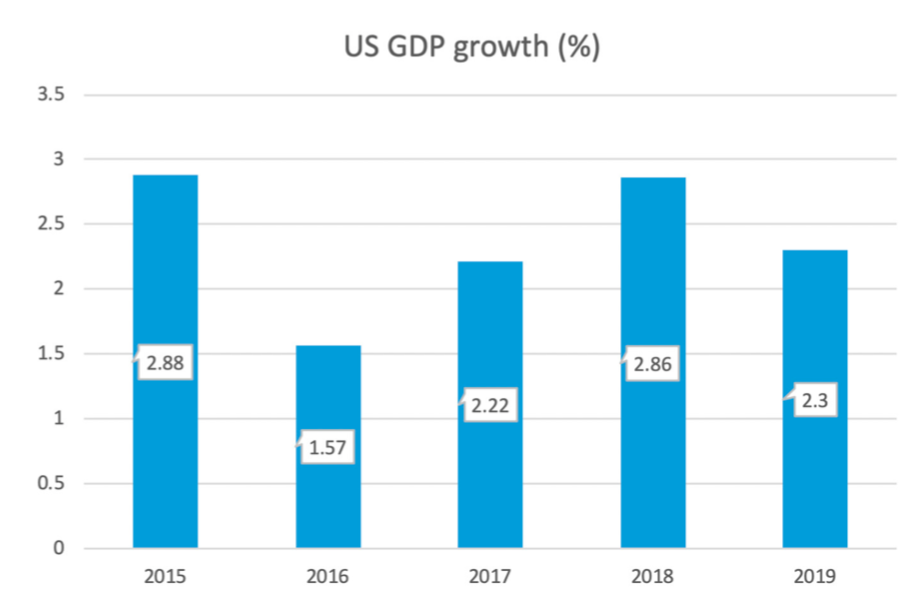

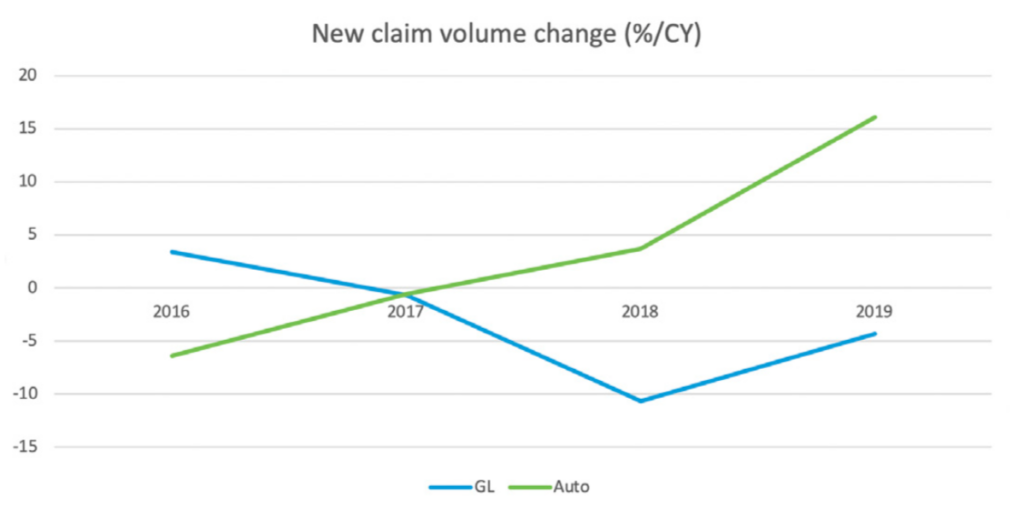

Despite GDP growth, we have seen an average decrease in general liability (GL) claims of 2.7% per year over the last five years (See figure 2). With the increased amount of transportation services (e.g., restaurant and retail delivery and ride-sharing services) and improvement in the economy, auto liability (AU) claims continue to increase in frequency. However, this increase is significantly less than the increase in related exposure growth.

Most liability and auto claims reach an amicable resolution without litigation or attorney involvement. When the parties cannot agree on resolution, the impact is substantial. The majority of the total paid for both GL and AU is attributable to disputed cases. In fact, 0.1% of all GL claims with total incurred losses over $500,000 make up 29% of total paid losses. For AU claims, 1% with values over $100,000 make up 60% of total paid losses. Clearly, even when litigation is a small fraction of the total claim volume, litigation and the largest value claims have a sizeable impact on ultimate values.

Given the impact that litigation and disputed claims have on results and incurred losses, the best outcomes for claims may be a case

of “timing is everything.” As claims mature through their life cycle, litigation rates increase. Several factors drive this result, including lack of communication, lack of understanding and poor resolution strategy. We will delve more into these drivers and the prevention and control tactics for litigation, later in this paper.

Litigation trend:

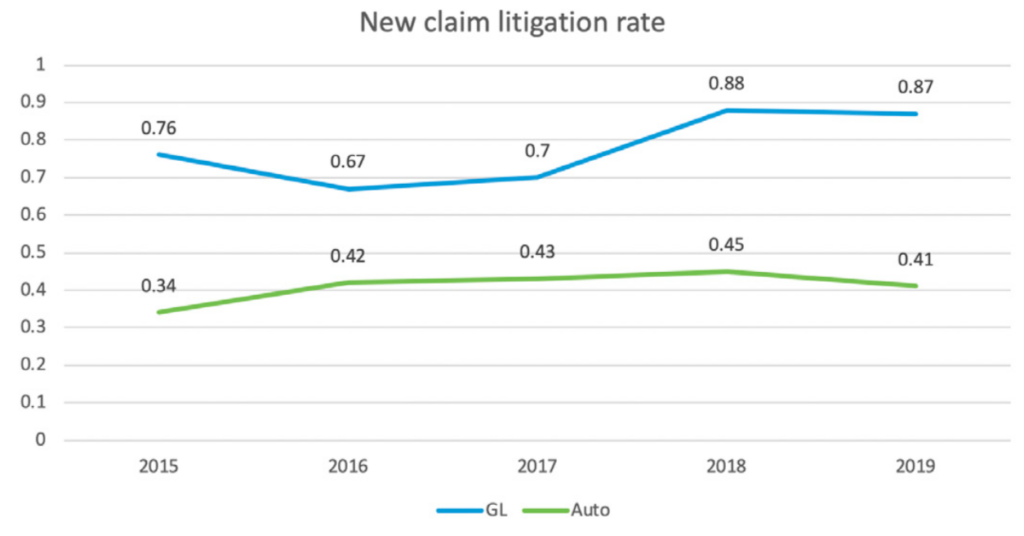

As a percentage of the whole, the litigation rate on new GL and AU claims is extremely low. (See figure 3).

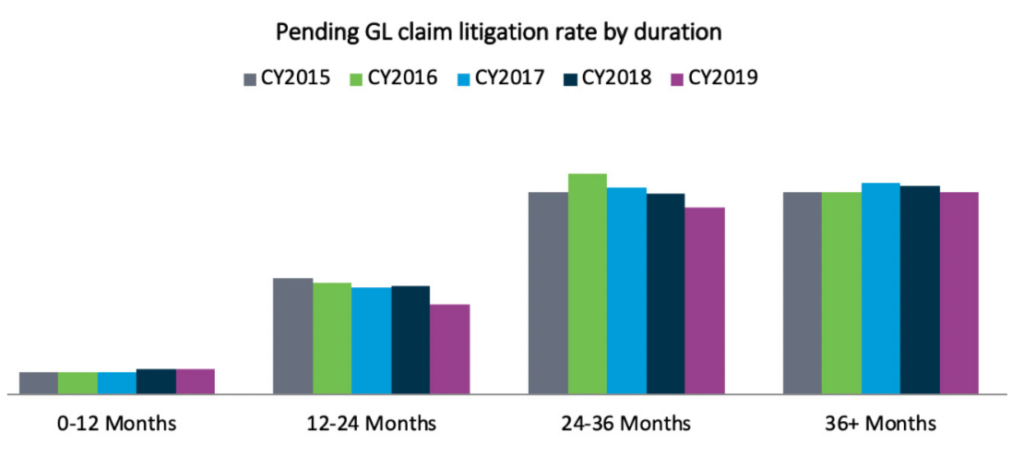

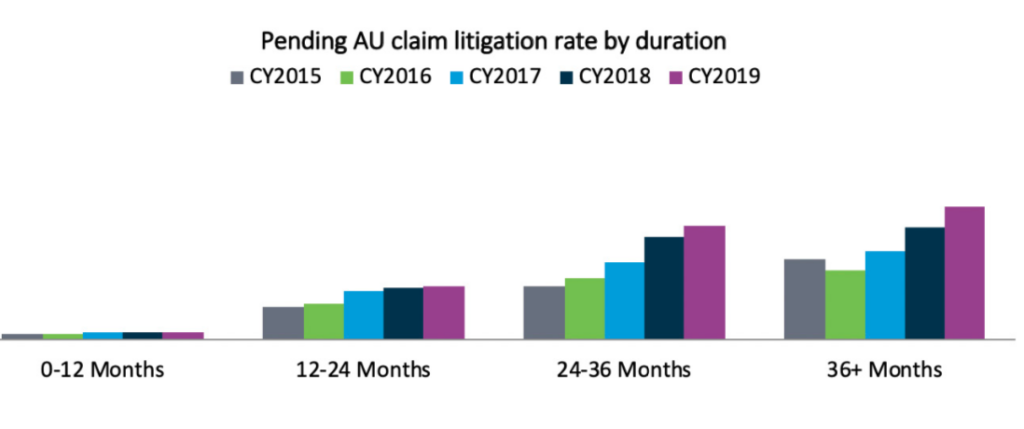

As expected, however, the litigation rate increases significantly with claims that remain open after the initial year. (See figures 4 and 5). Despite this, the percentage of litigated liability claims has been declining in the last three years. (See figure 4).

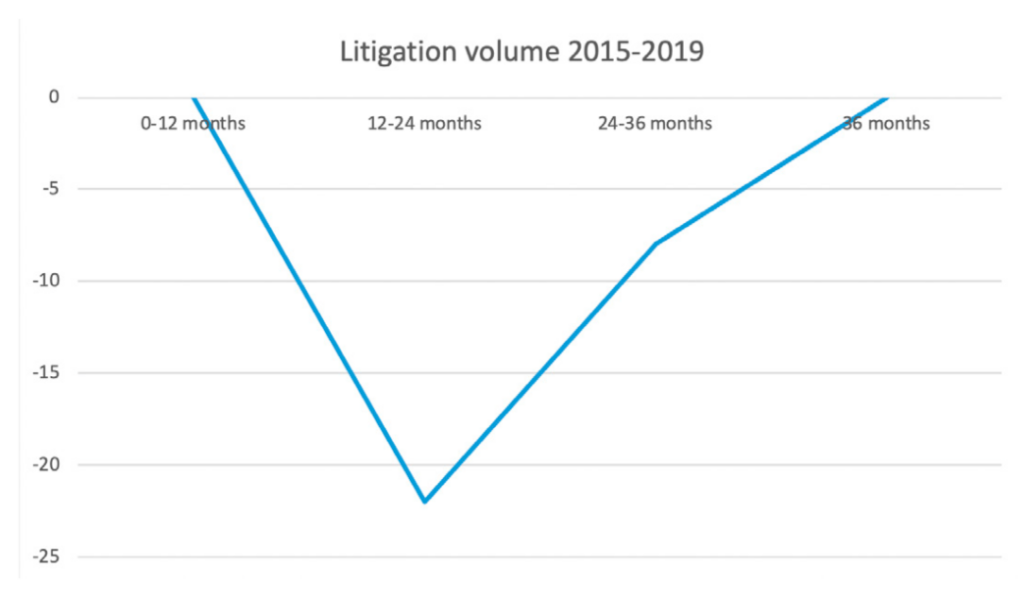

As noted in figure 6, incoming litigation rates have remained flat

in the 0-12 month and 36-month development points while the 12-24 month and 24-36-month development points are seeing decreases. The two factors that favorably affected this include: the focus on resolving cases earlier in the life cycle; and the reduction in cases that continue in litigation past year three. Additionally, as already noted, there has been an increase in cases with attorney representation at first notice of loss. Although this has been viewed as a troubling trend, early attorney involvement can move cases to resolution earlier and makes access to information via discovery and negotiations quicker, resulting in faster evaluations and resolutions.

Perspectives on casualty litigation trends

In recent years, controlling the costs and outcomes of litigated cases, especially when left to juries to decide, has become increasingly challenging. At one end of the spectrum, the more egregious outcomes often referred to as “nuclear verdicts,” are commonly viewed as those cases with jury awards greater than $10 million. Another way to evaluate these cases is where the outcomes are “unexpected,” because the results were either not anticipated or considered a worst-case scenario. There are, of course, cases that have a true value of $10 million or more. But those are not the cases that are the focus of this discussion; it is the cases where a verdict is rendered far beyond what has been typical in similar circumstances.

Apart from large outlier cases, there are a growing number of cases that present unprecedented financial and reputational risk. And while these trial outcomes may be viewed as “affordable” to the defendants and insurers in specific cases, they are nonetheless often startling, considering their improbability.

In 2013, the insurance industry noticed a marked increase in auto loss frequency, which was especially concerning given that a 25-year decline in auto collision frequency was reversing. That 25-year trend was largely related to the increasing safety-related improvements in vehicle design. In subsequent industry studies, among 26 variables found to be correlated to the increase, the number of lawyers per million population was a significant variable. Since then and through 2019, plaintiffs’ lawyers continue to appear to be focusing on auto loss claims given the increased frequency. A detailed report by the Casualty Actuarial Society elaborates on this premise.

Industry-wide GL trends also reflect deteriorating conditions, with most GL costs attributable to litigated claims. It is noteworthy that, among four key drivers in a recent Milliman report on the GL line, two were related to litigation: litigation funding and the increase in jury award frequency and severity. The report noted that the ratio of non-economic to economic damages is increasing. In addition, Advisen maintains a large general and products liability loss dataset that reveals that plaintiffs’ attorneys have increasingly coordinated to create strategies that drive higher verdicts.

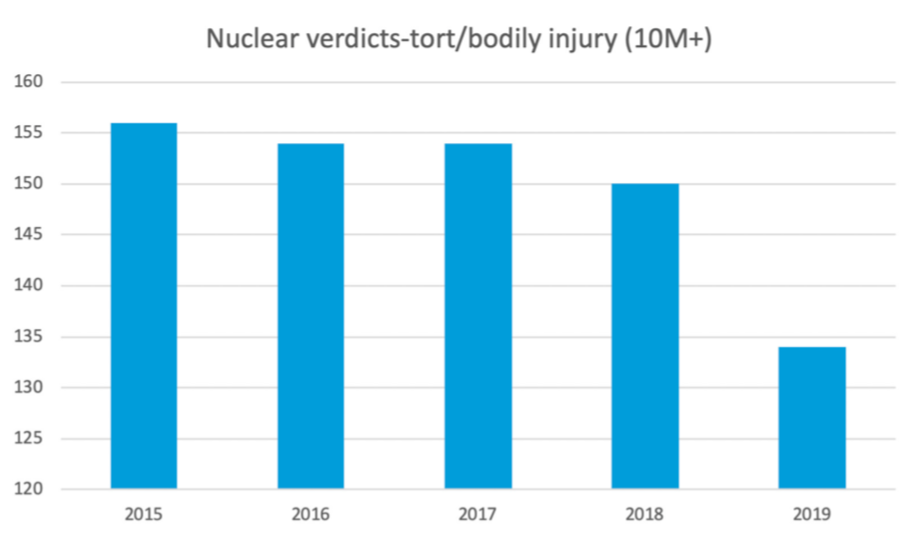

So how significant is the nuclear verdict risk? The chart below lays out the number of these verdicts for the past five years.

(See figure 7).

The total number of these verdicts has decreased over the past two years and is well below the five-year average. However, that decrease is countered by the increase in the value of those verdicts. According to one nationwide source of verdicts and settlements, for 2015, the largest verdict, in a wrongful death action in Florida, was over $844 million. By contrast, the largest verdict for 2019 was $8 billion for a Risperdal verdict against Johnson & Johnson in Pennsylvania (later reduced to $6.8 million). The next largest was for over $2 billion in a Roundup case (cancer allegedly caused by weed killer) in California.

So, the challenge with nuclear verdicts is not just about industry impact, but more about the impact an individual verdict can have on a business, insurer or individual. Additionally, the challenge is about the influence (including social inflation) these extreme awards have on other juries, who have become accustomed to hearing large award figures in the media and have had their perceptions changed.

See also: 5 Liability Loss Mega Trends

Many verdicts are reduced after trial by a court or by the parties through settlement negotiations. In addition, some jurisdictions have punitive damage caps or non-economic damage caps that can also come into play in reducing jury awards. Regardless, when the judgments are reported, often by eye-catching media stories, the damage may be done. It is the rare case where a reduction in a jury award will be front-page news.

In the report from the Institute for Legal Reform titled “Costs and Compensation of the U.S. Tort System,” the authors found that total costs and compensation paid in the U.S. tort system were $429 billion, or 2.3% of U.S. gross domestic product (GDP). Of this amount, 57% went to plaintiffs, with the balance being the cost of litigation, insurance and other risk transfer costs

Of the $429 billion:

- $250 billion (58%) is attributable to commercial and general liability exposures;

- $160 billion (37%) to auto exposures; and,

- $19 billion (4%) to medical malpractice litigation exposures.

Florida had the highest costs as a percentage of GDP (3.6%). When measured as the cost per household, the states with the highest costs (California, Florida, New York and New Jersey) were greater than $4,000 per household (versus $2,000 for the lowest-cost states).

The Institute for Legal Reform conducted a survey of over 1,300 general counsel/senior litigators, who ranked these elements as the most significant indicators of the litigation environment in states:

- Enforcing meaningful venue requirements;

- Overall treatment of tort and contract litigation;

- Treatment of class action suits and mass tort claims;

- Consolidation suits;

- Damages arguments;

- Proportional discovery;

- Effective use of scientific and technical evidence;

- Trial judges’ impartiality;

- Trial judges’ competence;

- Juries’ fairness; and,

- Quality of appellate review.

Additional Analysis

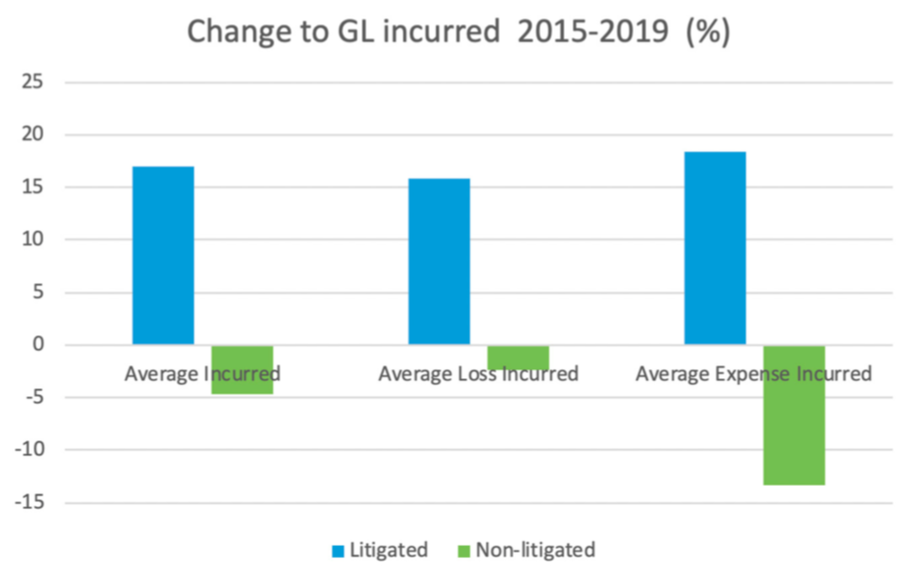

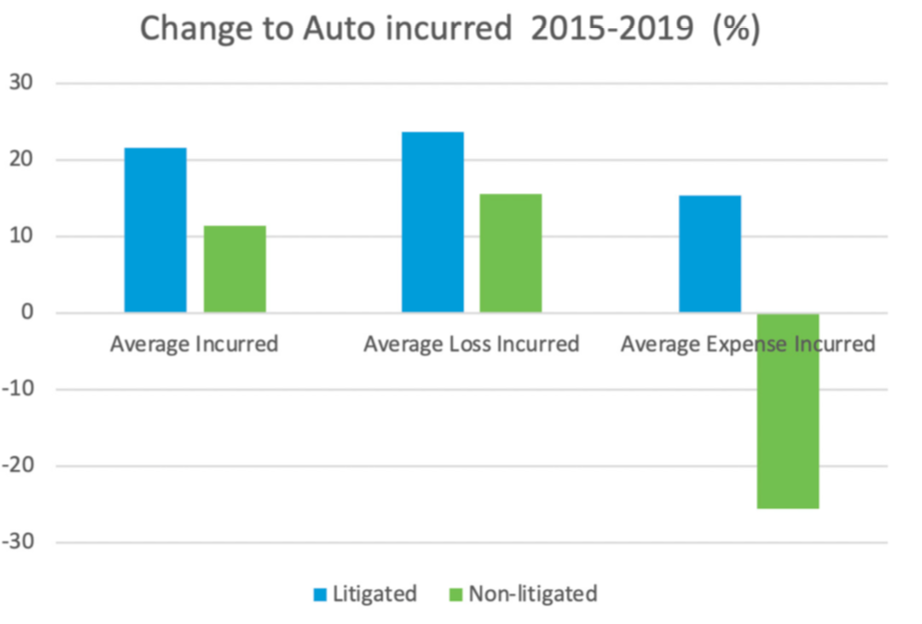

Not only are the loss cost and expense for litigated claims larger than non-litigated, as anticipated, the incurred amount for both damages and expense for litigated claims has been trending up for several years. This contrasts with the incurred trend for non-litigated claims, which has been on the decline in recent years for AU and GL. So, not only are litigated claims more expensive than non-litigated, they continue to get more expensive relative to incurred costs for non-litigated claims from previous years.

Figures 8 and 9 show increase in cost by % for each of the categories noted.

Influences

Social inflation, nuclear verdicts, trucking accidents, “reptile brain” and litigation funding are among the more common topics frequently discussed as drivers of current litigation trends. Industry trends are notoriously difficult to predict, given the lack of broad, readily available and consistent data across various jurisdictions, industries, lines of business and carriers.

Without a doubt, litigation has a measurable impact on overall claim outcomes. As already noted, litigation rates generally increase the longer claims are open. Not only are litigated claims more expensive than non-litigated, they continue to get more expensive when measured by incurred costs compared with previous years. Additionally, the duration of both AU and GL litigated claims substantially exceeds non-litigated claims, including the likelihood of adverse reserve development over time for litigated claims. As a result, the industry focus on avoiding and mitigating litigation

is appropriate, particularly because the trend of costly litigation

is accelerating across calendar years. The largest verdicts and settlements continue to represent a small percentage of the total claim volume, yet they also continue to have a significant impact on overall results.

Companies have a number of tools they can use to control litigation and avoid high-liability verdicts. The focus should be on resolving claims at an earlier date, particularly in the first 12 months of a claim. The risk and cost of litigation both increase dramatically thereafter. Use predictive modeling to identify claims likely to become litigated and ensure an aggressive workflow to push for defense and resolution if appropriate. Recognition by claims professionals of the risks and red flags for outlier verdicts is critical to ensure that defense counsel is prepared to manage these risks and to move cases through trial when necessary.

Because nuclear verdicts are so few and can happen anywhere, the ability to predict them remains challenging. Thus, the focus should remain on sound litigation avoidance tactics, proven litigation management tools and strong preparation for trial.

Emerging tactics and best practices for litigation

There are a variety of factors, strategies and tactics that can affect the exposure to outsized or unexpected results in civil litigation, as well as improve the outcomes of more routine litigation.

- Attorney selection — To have an effective settlement strategy, it is critical that counsel be willing and able to try cases. Use of data-based attorney scorecards and evaluations helps identify the best attorneys for various types of cases. Anecdotal opinions about counsel are not adequate for this challenging litigation environment—the data is critical to identifying the best counsel for each claim.

- Leveraging artificial intelligence (AI) and predictive analytics — The best way to avoid the risk of nuclear verdicts is to avoid unnecessary litigation. Using data to identify claims likely to end up in litigation and to focus early on those claims for settlement is a key to reducing litigation costs and risk.

- Attitudes toward corporations — One of the growing challenges with litigation is an increasingly negative perception of corporate defendants among some jurors. Millennials in particular are often identified as holding unfavorable views of these defendants. This must be accounted for not just in jury selection but throughout the life of the claim. Also, it is important at trial to ensure that corporate defendants have a “human face” either through witnesses or presence of a corporate representative throughout trial.

- Mitigating the “reptile brain” tactic — There is debate among defense counsel about whether this is in fact a new or exceptional concern. It is not a new theory — but does seem to have the focus of at least some plaintiff attorneys. The tactic is really about fear and using it to create a reaction in the jury. Identifying those plaintiffs’ attorneys that are planning on using this approach (this will often be apparent from discovery) and planning accordingly is critical.

- Mitigating anchoring tactics — “Anchoring” occurs when an individual depends on an initial piece of information to make subsequent judgments. This tactic can result in large awards based on a large damage number presented by plaintiff. It is worth considering whether it is appropriate for the defense to talk about the actual amount of damages at trial rather than try to defend against plaintiff’s number. This strategy is controversial, however, and it should be approached cautiously given the risk of a “split-the- difference” outcome.

- Mitigating “third party funding” tactics — This is an increasing trend in litigation in the U.S. and seems to be exacerbating the trend of larger verdicts. Some jurisdictions and courts have begun to allow discovery into these funding relationships, and defense counsel should be exploring that thoroughly when allowed.

- Case evaluation — One thing that seems to have clearly changed since the advent of the “social inflation” phenomenon is that the likelihood of a better outcome later in the life of a claim in terms of total cost has decreased. The days of a favorable settlement at the 11th hour seem to be the exception now. As a result, it is critical to have an early and thorough understanding of the case and its value.

- Settlement approach — The obvious and effective way to manage litigation costs is to avoid them. As noted above, it is critical to be prepared to try cases. However, it is just as critical to identify and resolve the cases that should not or need not be tried. The key is not to change how you handle cases, but how you think about them and to create a cost/benefit analysis of trial. This requires not only an appropriate case evaluation but an honest evaluation of the related issues. Key questions should include:

- How long does it take to get a trial date in the jurisdiction?

- How long do trials typically last?

- How much will trial itself cost?

- What pre- or post-judgment interest might attach to a verdict that might be appealed?

- What are the other costs to the defendant, including business interruption, reputation, etc.?

- Win or lose, what is the likely cost of appeals or additional negotiations if needed?

- Is it likely a party will continue to litigate after a verdict?

- Will there likely be attempts to impose a cap on damages or have it removed?

See also: COVID-19 Highlights Gaps, Opportunities

Summary

The bottom line is that some cases are appropriate for trial, and some are not. With the risk of nuclear verdicts, some that seem to shock even seasoned litigators, until there’s a clear understanding of what verdicts are likely to go “nuclear” it is prudent to have a plan in place to limit litigation only to those claims that should be litigated to verdict.

To free time to focus litigation efforts on cases that will go to trial, claims teams must improve their ability to identify cases for resolution and resolve them at the appropriate time. A case that gets to the eve of trial and settles then with no change in evidence or information is an outcome that should be avoided. That is a case that could have settled earlier.

Identifying cases to resolve requires focus by claims professionals as well as the effective use of data, predictive modeling, attorney scorecards and other tools. Timing is critical; once a claim has gone into litigation, even if the ultimate settlement amount is the same, the overall cost will increase due to litigation and defense costs.

In those cases that do go into litigation, a litigation plan must be developed and provided. Claim teams must take a direct hand. The “litigation plan” obviously must incorporate counsel’s evaluation of the claim, steps to take in the litigation process and, just as critically, a “resolution plan” to make sure that the discussion gets redirected back to conclusion—whether the case ultimately is tried or settled.

Throughout the litigation, the discussion of the claim should always include the resolution plan for those cases that should or could resolve. The resolution plan must have concrete steps, and not just follow an automatic path without a clear plan tailored to each case.

Risks associated with GL and AU claims can be managed to allow for predictable outcomes, even in an environment with “social inflation,” “nuclear verdicts” and tough jurisdictions. Numerous resources, tools and best practices are available to ensure that a very small percentage of claims do not drive oversized verdicts while ensuring an appropriate approach to dispute resolution.