To address the life insurance gap and create more financial security, the industry needs to quickly move from low-tech working practices to a connected value chain of front-end engagement, streamlined routes to market, enriched data for reaching a wider audience and lower overhead costs.

We hear so much about digital transformation and the picky buying habits of millennials – it’s easy to stop listening. There are, however, some fundamental truths for the insurance industry that we can no longer ignore:

- They shop differently than the industry sells.

- They expect service levels that the industry doesn’t provide.

- They want to transact easily, wherever and whenever they want.

Of course, these observations about “the industry” are highly generalized. Carriers, distribution organizations and advisers recognize the need to modernize and are making progress with digitization initiatives, but the opportunity to bring financial security to millions while adding new revenue streams remains massive.

Let’s dig in.

Life insurance uptake in North America is on the decline according to LIMRA, which reported a drop of

nearly 30%, with remaining policyholders believing they do not have enough coverage. Moreover, millennials self-reported a 78% shortfall in life insurance coverage, according to a recent study by

New York Life.

This leaves a huge hole in the market:

Accenture estimates it to be around $12 trillion in missing coverage potential and $12 billion in revenue to be gained by serving it – just in the U.S.

How did we get here?

The distribution of individual insurance products in North America remains largely unchanged since the industry’s inception nearly a century ago.

Typically, life insurance coverage has been aimed at individuals with higher net worth, where higher premiums result in higher sales commissions. The sales lifecycle for reaching consumers, evaluating applications and determining levels of coverage takes the same amount time (typically months from lead to conversion) for both the younger, middle-income customer and the high-income customer in an older risk bracket – so brokers and carriers tend to focus where profit margins are more generous.

Yet, consumer shopping habits and expectations have changed dramatically, creating a big disconnect between insurance buyers and sellers.

Millennials shop differently than the industry sells

A recent report from

Morgan Stanley and the Boston Consulting Group cited a lack of efficiency as a major challenge for the industry, noting that “sales processes remain ‘old-school,’ cumbersome and inconsistent with the fast-evolving customer expectations that are now being set by digital leaders.”

See also: Making Life Insurance Personal

Consumers tend to think about life insurance when moving through key life events such as having a first child or buying a home – this is when we are most receptive. And while digital marketing provides an opportunity for industry players to be visible at these times, lead conversion continues to suffer from a sub-par customer experience: paper-based, manual processes that take a couple of weeks to close.

In addition, millennials don’t trust the insurance industry and its advisers: according to LIMRA,

about 38% of consumers rate the honesty and ethical standards of the insurance salesperson as very low or low.

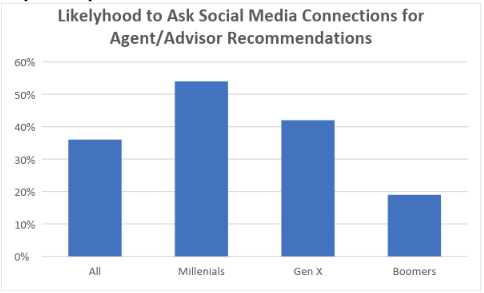

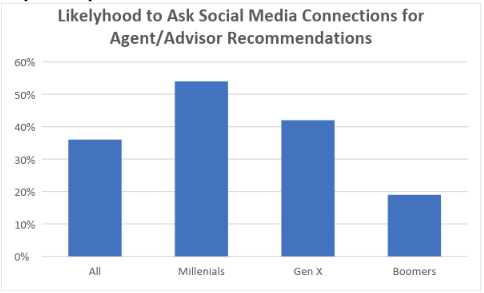

They do trust peers and social media:

[caption id="attachment_35259" align="alignnone" width="484"]

Source: LIMRA 2018 Insurance Barometer[/caption]

Millennials expect service levels that the industry doesn’t provide

In today’s on-demand world, consumers want to research and compare products online, whenever and wherever they want. In fact, consumers are even willing to share data in return for products and services that make our lives easier, according to Accenture’s recent

Global Financial Services Consumer Study. Millennials also want simpler, more intuitive solutions rather than the traditional, overly complex product suites, which the

Morgan Stanley and the Boston Consulting Group report finds are not resonating with today’s consumers.

The insurance industry now has a tremendous opportunity to deliver customer-centric, personalized service levels to today’s savvy consumers. The prevalence of available online data underscores the opportunity insurers have to use data end to end – from engagement and lead gen through distribution and pre-approved “buy-up” options. In addition, emerging technologies such as artificial intelligence can be employed to improve workflows and other operational efficiencies, so insurers have more bandwidth to meet the growing demands of this market.

Millennials want to transact easily, wherever and whenever they want

Millennials typically don’t want brokers coming to their homes or requiring multiple appointments that have to be scheduled during work hours or when taking care of families. Millennials expect to be able to transact digitally and to get confirmation in near real time. This is not to say that human-to-human insurance distribution isn’t valuable.. It absolutely is. But the experience of transacting must ultimately be easy, or the buying experience can become tainted.

Transforming insurance distribution for the 21st century

There is no doubt that the transformation is happening. The insurance industry is redefining how products are delivered while ensuring they are driven by customer requirements and not outdated processes and products.

On the front end, user engagement is critical. Consumers want to research and find real answers at their convenience. Carriers, brokers and agents want to be visible when consumers are interested in insurance products. Yet simply reaching a new audience with a good marketing strategy is not enough. Truly enabling potential customers to maneuver seamlessly through personalized information and the application process is where successful client acquisition occurs.

See also: Digital Distribution in Life Insurance

Advanced analytics can help insurers optimize the buyer’s journey by providing data on where in the conversion process people may drop off or disengage, so changes can be made to improve outcomes. In addition, the right data also can help insurers find upsell opportunities within the existing customer base by understanding the details of current coverage, where they might be lacking and how to upgrade policies quickly and easily. Analytics are also important to the underwriting process by recognizing customer demographics and the associated policy characteristics, for example.

On the back end, seamless communication and functionality between carriers, brokers and consumers is critical in shaping the customer experience. Deloitte’s 2019 Insurance Industry Outlook notes that the ability to manage all tiers of the insurer, broker and prospective customer transaction in real time, with direct access to core underwriting metrics, has increased conversion from

70% to 90% in North America.

Today’s consumer is willing to share experiences and has extremely high expectations when dealing with businesses providing a service. When consumers are making important financial decisions such as committing to a life insurance policy, it’s important that all aspects of engagement and interactions get it right the first time, so the industry can reach underserved markets, secure new revenue streams and deliver financial security to more people around the world.

Source: LIMRA 2018 Insurance Barometer[/caption]

Millennials expect service levels that the industry doesn’t provide

In today’s on-demand world, consumers want to research and compare products online, whenever and wherever they want. In fact, consumers are even willing to share data in return for products and services that make our lives easier, according to Accenture’s recent Global Financial Services Consumer Study. Millennials also want simpler, more intuitive solutions rather than the traditional, overly complex product suites, which the Morgan Stanley and the Boston Consulting Group report finds are not resonating with today’s consumers.

The insurance industry now has a tremendous opportunity to deliver customer-centric, personalized service levels to today’s savvy consumers. The prevalence of available online data underscores the opportunity insurers have to use data end to end – from engagement and lead gen through distribution and pre-approved “buy-up” options. In addition, emerging technologies such as artificial intelligence can be employed to improve workflows and other operational efficiencies, so insurers have more bandwidth to meet the growing demands of this market.

Millennials want to transact easily, wherever and whenever they want

Millennials typically don’t want brokers coming to their homes or requiring multiple appointments that have to be scheduled during work hours or when taking care of families. Millennials expect to be able to transact digitally and to get confirmation in near real time. This is not to say that human-to-human insurance distribution isn’t valuable.. It absolutely is. But the experience of transacting must ultimately be easy, or the buying experience can become tainted.

Transforming insurance distribution for the 21st century

There is no doubt that the transformation is happening. The insurance industry is redefining how products are delivered while ensuring they are driven by customer requirements and not outdated processes and products.

On the front end, user engagement is critical. Consumers want to research and find real answers at their convenience. Carriers, brokers and agents want to be visible when consumers are interested in insurance products. Yet simply reaching a new audience with a good marketing strategy is not enough. Truly enabling potential customers to maneuver seamlessly through personalized information and the application process is where successful client acquisition occurs.

See also: Digital Distribution in Life Insurance

Advanced analytics can help insurers optimize the buyer’s journey by providing data on where in the conversion process people may drop off or disengage, so changes can be made to improve outcomes. In addition, the right data also can help insurers find upsell opportunities within the existing customer base by understanding the details of current coverage, where they might be lacking and how to upgrade policies quickly and easily. Analytics are also important to the underwriting process by recognizing customer demographics and the associated policy characteristics, for example.

On the back end, seamless communication and functionality between carriers, brokers and consumers is critical in shaping the customer experience. Deloitte’s 2019 Insurance Industry Outlook notes that the ability to manage all tiers of the insurer, broker and prospective customer transaction in real time, with direct access to core underwriting metrics, has increased conversion from 70% to 90% in North America.

Today’s consumer is willing to share experiences and has extremely high expectations when dealing with businesses providing a service. When consumers are making important financial decisions such as committing to a life insurance policy, it’s important that all aspects of engagement and interactions get it right the first time, so the industry can reach underserved markets, secure new revenue streams and deliver financial security to more people around the world.

Source: LIMRA 2018 Insurance Barometer[/caption]

Millennials expect service levels that the industry doesn’t provide

In today’s on-demand world, consumers want to research and compare products online, whenever and wherever they want. In fact, consumers are even willing to share data in return for products and services that make our lives easier, according to Accenture’s recent Global Financial Services Consumer Study. Millennials also want simpler, more intuitive solutions rather than the traditional, overly complex product suites, which the Morgan Stanley and the Boston Consulting Group report finds are not resonating with today’s consumers.

The insurance industry now has a tremendous opportunity to deliver customer-centric, personalized service levels to today’s savvy consumers. The prevalence of available online data underscores the opportunity insurers have to use data end to end – from engagement and lead gen through distribution and pre-approved “buy-up” options. In addition, emerging technologies such as artificial intelligence can be employed to improve workflows and other operational efficiencies, so insurers have more bandwidth to meet the growing demands of this market.

Millennials want to transact easily, wherever and whenever they want

Millennials typically don’t want brokers coming to their homes or requiring multiple appointments that have to be scheduled during work hours or when taking care of families. Millennials expect to be able to transact digitally and to get confirmation in near real time. This is not to say that human-to-human insurance distribution isn’t valuable.. It absolutely is. But the experience of transacting must ultimately be easy, or the buying experience can become tainted.

Transforming insurance distribution for the 21st century

There is no doubt that the transformation is happening. The insurance industry is redefining how products are delivered while ensuring they are driven by customer requirements and not outdated processes and products.

On the front end, user engagement is critical. Consumers want to research and find real answers at their convenience. Carriers, brokers and agents want to be visible when consumers are interested in insurance products. Yet simply reaching a new audience with a good marketing strategy is not enough. Truly enabling potential customers to maneuver seamlessly through personalized information and the application process is where successful client acquisition occurs.

See also: Digital Distribution in Life Insurance

Advanced analytics can help insurers optimize the buyer’s journey by providing data on where in the conversion process people may drop off or disengage, so changes can be made to improve outcomes. In addition, the right data also can help insurers find upsell opportunities within the existing customer base by understanding the details of current coverage, where they might be lacking and how to upgrade policies quickly and easily. Analytics are also important to the underwriting process by recognizing customer demographics and the associated policy characteristics, for example.

On the back end, seamless communication and functionality between carriers, brokers and consumers is critical in shaping the customer experience. Deloitte’s 2019 Insurance Industry Outlook notes that the ability to manage all tiers of the insurer, broker and prospective customer transaction in real time, with direct access to core underwriting metrics, has increased conversion from 70% to 90% in North America.

Today’s consumer is willing to share experiences and has extremely high expectations when dealing with businesses providing a service. When consumers are making important financial decisions such as committing to a life insurance policy, it’s important that all aspects of engagement and interactions get it right the first time, so the industry can reach underserved markets, secure new revenue streams and deliver financial security to more people around the world.