Companies should review their use of intercompany reinsurance, through either individual or pooled quota share agreements. If insurance companies (particularly in the property & casualty (P&C) sector and possibly health maintenance organization (HMO) sector) can do this correctly, they can achieve capital and back-office operational efficiencies without disrupting "business-as-usual" front office operations.

Inter-company reinsurance efficiency opportunities

PwC sees opportunities for:

- Companies that have intercompany reinsurance pools or quota share agreements in place to become more efficient, and

- Companies that do not currently use or have limited intercompany pooling and quota share to expand the use of these concepts.

Increasingly, regulators are open to these modifications, provided policyholders are not put at a disadvantage.

A well-designed intercompany reinsurance structure can result in a number of efficiencies. Specifically, by establishing 100% quota share or 0% retrocession pooling agreements, a group of P&C companies can move all retention to a single "lead" company. The goal is to have the lead company retain the bulk of the insurers' capital and investment portfolios while ceding companies maintain only minimum surplus levels. The lead company would become the only company where capital needs to be actively managed and would have a larger, consolidated investment portfolio.

Companies (particularly P&C) that retain a relatively large number of legal entities after simplification may find a single pooling agreement more straightforward than managing multiple affiliated reinsurance agreements. However, multiple quota share agreements may streamline future changes for events such as divestitures and acquisitions. Note that multiple agreements transferring business back and forth between the same legal entities will need review and most likely simplification. In those instances where centralization of capital with the lead company is not possible (e.g. mutual affiliations, regulatory requirements), the pool percentage should follow the capital position of all participants (including the lead company). Even companies that have significantly simplified their corporate structure can tie their remaining legal entities together with a common-sense pooling agreement that supports their operating strategy.

Key benefits

- Diversification of underwriting results and earnings by legal entity: Pooling enables a larger spread of risk, allowing for less variable earnings and more predictable dividend streams by legal entity. For 0% net retention structures, including 100% quota share, the lead company enjoys the same diversification.

- Improvement in capital position or financial strength ratings: If this is not the case already, the companies will be rated on a pooled (p) or reinsured (r) grouped basis, reflecting their combined financial strength. Additionally, this increase in financial size and diversification can improve the A.M. Best capital adequacy ratio (BCAR).

- More efficient capital management: Companies can better centrally manage capital while retaining minimum required capital in pool/quota share participants and allocating premiums based on surplus capacity. This can help insurers manage premium to surplus ratios. Pooling and quota share also provide more efficient access to total capital by centralizing capital and avoiding dividend traps in subsidiaries.

- Operational efficiencies: Pooling integrates various businesses' finance and back-office operations, can provide momentum for more standardized and centralized reporting functions and can reduce frictional costs associated with the record-to-report function. Some potential efficiencies include: fewer intercompany agreements; lower audit fees from increased materiality thresholds and a combined statutory audit; consolidated regulatory exam; a more streamlined investment management function; and simplified reporting requirements (for 0% net retention agreements).

- Marketing and branding: Some companies have been able to go to market as a group entity (particularly by affiliations of mutuals), which carries a larger financial size category (FSC). FSC is particularly beneficial for mid-size companies trying to gain market share in the broker market for commercial lines.

Challenges

While insurers operate within similar structures and against similar pressures, every company is different. There are a few common challenges we have encountered with our clients while designing and implementing intercompany pooling and affiliate reinsurance:

- Disparate organizational groups, processes, and technologies: Affiliate reinsurance requires results from potentially disparate processes that may have different timing and data quality. Recording pooling entries may prove especially difficult for companies on multiple general ledgers. For the close, the combined pool is only as strong as its weakest link. This will be especially evident with subsidiaries that may have a streamlined close process but are dependent on other participants to close their books. We have seen companies undertake significant close process improvements to operate efficiently in a pooling agreement. This can be somewhat alleviated by structuring multiple affiliate quota share agreements in place of a pooling arrangement.

- Additional requirements for generally labor intensive processes: It is not uncommon for insurers to have significant manual processes for calculating incurred but not reported losses (IBNR) or producing relevant disclosures such as Schedule P and F. Having distinctly different timing of key calculations and inputs can be a burden that all participants have to share.

- Data management and quality issues: Companies that generally operate in silos, on separate ledgers, different chart of accounts or even make inconsistent use of chartfield values can find it more operationally difficult to execute pooling and difficult to leverage automated solutions.

- Blending different businesses within results: Disparate operations and reporting groups that previously performed duties related to specific lines of business may find it difficult dealing with the new assumed business. For example, certain reporting disclosures required only for specific lines may become applicable to all participants in the pool.

Thinking "outside the box" to maximize value

Optimizing the benefits of affiliate reinsurance may result in arrangements that have previously been considered non-traditional, or at least lacking significant industry precedents. We encourage companies to maintain an open dialogue with regulators and rating agencies and believe that demonstrating a positive impact to operations, financial strength and overall policyholder benefits, outweighs lack of precedent.

- Centralizing capital and gross written business, where possible, is often the preferred structure for P&C companies: Zero-net-retention arrangements are a way to improve capital efficiency. While we have generally seen these structured as 100% quota share reinsurance, it may also be also possible to structure or modify a traditional pooling agreement to cede 100% of written premium to a lead company, with a 0% or minimal retrocession. Some key benefits we have seen include:

- Capital management efficiencies - 0% net retention structures allow for minimum retained capital across the legal entities, centralizing on a lead company. This streamlines the capital management process and can simplify asset/liability management.

- Financial reporting efficiencies - Centralizing net written business on a lead company can significantly reduce overall reporting requirements across the organization. Legal entities with 0% net business can discontinue certain laborious schedules (e.g. Schedule P Parts 2-4) and other reporting requirements for net business. Similarly, by retaining minimum capital on legal entities, investment disclosures can be simplified (e.g., fair value disclosures). Overall, we have seen companies reduce the statutory annual reporting pages by 50%, which can be compelling for larger organizations.

You should work with regulators to shift capital to the lead company in the most efficient way (usually at the inception of the pooling agreement).

- There are benefits for certain lines of business that have traditionally not been considered for pooling:

- HMOs - Requirements for HMOs to have legal entity domicile in each state in which they do business yields a corporate structure with a large number of thinly capitalized companies. Pooling can improve the capital efficiency, as well as reduce some other operational burdens. While this does not have significant industry precedent (within affiliated pools), we see no reason an agreement would be disallowed solely because an HMO is involved.

- Significantly different business - Removing preconceived constraints allows further expansion of potential opportunities and related benefits. We have assisted companies implementing agreements that have a mix of significantly different lines in the pool and have seen specialty insurance business (e.g. excess and surplus, program, crop, reinsurance, etc.) pooled with mainstream personal and commercial insurance. While there can be related challenges, if there are tangible benefits to diversification, then those challenges can be justified and overcome in the long run.

- The lead insurer does not have to be the parent company. In the same spirit of thinking outside the box for pool participants, we have found the lead company may not always be an obvious choice, particularly where all participants share percentage retention in the pool. The selection of the lead company should take into consideration the following:

- Licensing - Requires licensing in all domiciled states of pool participants, all states of participants for retrocession and for all lines of business.

- Domicile and regulatory environment - It is preferable to choose a lead company in a state of domicile where the organization has a favorable relationship with the regulator. Existing reinsurance arrangements or recent business restructurings are helpful. It is also critical to maintain open dialogue and communication with the regulator.

- Capital size and efficiency - For larger companies or those with a more complex corporate structure, this can be a more difficult decision. Consider the efficiency of passing excess capital to an ultimate parent and avoid potential dividend traps. It is not always a parent company or the largest company that is best-suited to be the lead company.

- Marketing and branding - For some companies, branding and marketing may become a factor in choosing the lead company. Some highly acquisitive companies may find certain lead companies inconsistent with their branding strategy.

Key considerations

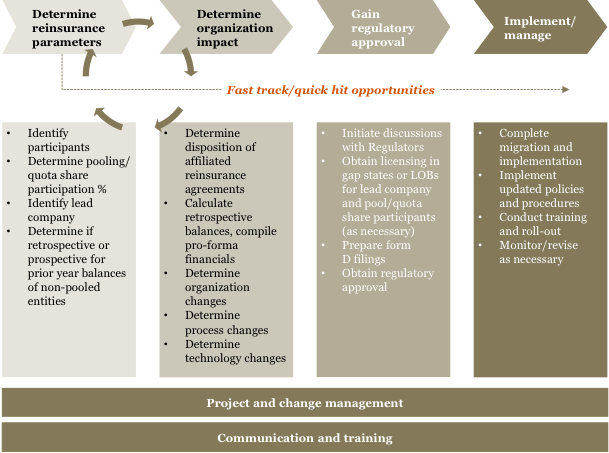

We believe that intercompany pooling and quota share arrangements need to align with a company's objectives and strategy and must be operationally feasible. It is often beneficial to have a third-party perspective that is not biased toward specific ingrained processes or behaviors. In particular:

- Assess how well your people, process and technology can meet new demands.

- Look beyond finance to consider various internal stakeholder perspectives, including actuarial, risk, investment, reinsurance and business leaders, as well as external constituents such as regulators, rating agencies and investors.

- Because of the breadth of people, process and technology that will be affected, we recommend implementing a senior-level steering committee to oversee and drive design and implementation.

In conclusion

There can be tangible benefits from re-evaluating or implementing intercompany pooling and affiliate reinsurance. This can further streamline the corporate structure, based on pre-determined objectives and supporting parameters. We encourage insurers to keep an open mind when designing pool parameters, including lead company selection. Maintaining an open dialogue with regulators and rating agencies is critical, particularly when setting a precedent with a particular pooling arrangement.