The COVID-19 pandemic has obviously accelerated the development of the healthtech and insurtech industries. Let’s look at these changes and certain corresponding innovations in more detail and see what we can expect in 2021.

Healthtech

In general, the existing healthcare system turned to various modern and necessary digital tools to perform the following crucial tasks:

- make predictions concerning the disease’s spread;

- collect and analyze vast amounts of data;

- diagnose and treat patients remotely.

And due to the spread of COVID-19 pandemic, the sector has developed rapidly in multiple directions. Among the most notable are:

- Remote monitoring;

- Telehealth;

- Artificial intelligence technologies.

It’s not surprising that providers advocate for integrating more data sources and new patient matching methods, from telehealth to big data analytics, to build effective coordination concerning COVID-19 tracing and valuable testing.

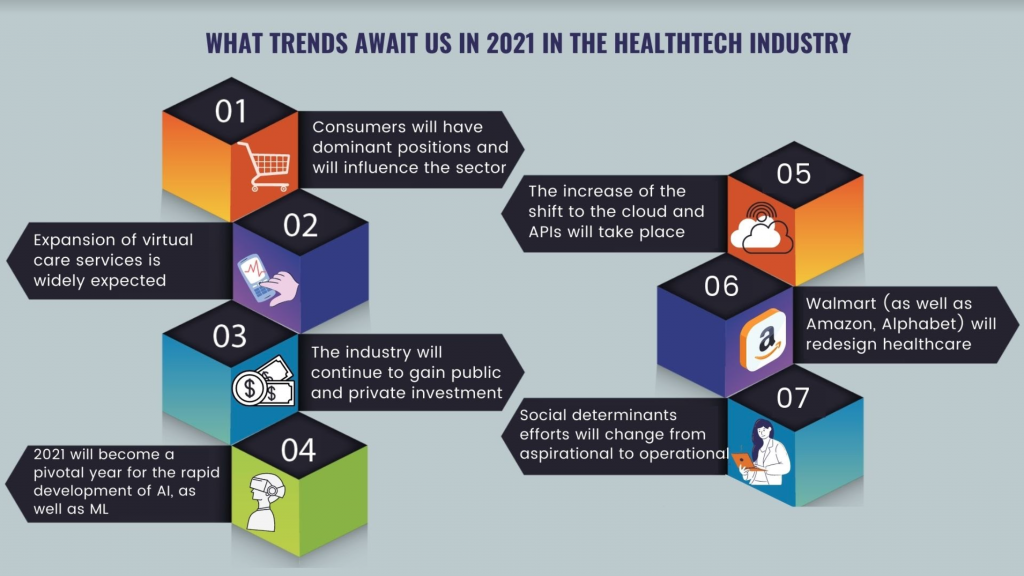

What trends await us in 2021 in healthtech?

1. Consumers will have dominant positions and will influence the sector in 2021.

Healthcare will be restructured according to patient needs and expectations. More and more healthcare providers understand the necessity and even indispensability of digital and virtual healthcare in the post-COVID world. So, healthcare organizations will have to leverage technologies to help their patients in their day-to-day life – smart devices, omnichannel communication tools, intensive machine learning and many others.

Let’s look at a concrete example. In an article for Everyday Health, Vivian Lee, the president of platforms for Verily Life Sciences, describes cooperating with the federal government in the creation of Project Baseline, a tool to screen for coronavirus risks, while also working with universities and employers to create programs that provide detailed testing, competent symptoms’ tracking and data analytics. An app lets users to check any symptoms and schedule lab tests.

Such virtual systems extend beyond COVID-19 uses. For example, Verily's technology has been used by Onduo, a virtual diabetes clinic that tries to help patients lower their A1C levels and develop vital health habits.

2. Expansion of virtual care services is widely expected.

In the same article, Deneen Vojta, the executive vice president of research and development at UnitedHealth Group, said virtual health will direct patients to more self-care. This may lead them to rely on doctor services only in more essential cases.

According to Sarahjane Sacchetti, Cleo CEO (in an article in Fierce Healthcare), in 2021 we will see increased use and efficacy of virtual services that had been seen as in-person only: postpartum, maternity, pediatric. Understanding the necessity of virtual health services, employers will offer flexible and convenient benefits to support employees (and drive productivity).

Indeed, many companies are looking to expand healthcare service.

3. The industry will continue to gain public and private investment.

Digital health has already received a surge of private and public investment during the pandemic. At the same time, modern digital health companies are going to become more comprehensive, which will attract even more.

4. 2021 will become a pivotal year for the rapid development of artificial intelligence, including machine learning.

The healthcare industry will pay attention to the benefits of machine learning in highly scalable solutions. AI has a vital ability to identify trends and sequences in data gathering and analytics that human beings can’t.

Hospitals are going to become smarter, says Kimberly Powell, vice president, general manager of NVIDIA Healthcare, in the same article in Fierce Healthcare. Smart cameras and speakers will help them to automate many activities. This, in turn, will help to increase operational efficiency and to improve virtual patient monitoring.

See also: New Picture of Total Digital Health

5. The shift to the cloud and APIs will increase.

Modern, cloud-based systems give providers the opportunity to access necessary patient’s data practically anywhere. They also enable telehealth and much better care coordination.

Application programming interfaces (APIs) will continue to play a significant role in healthcare data exchange, improving data analytics while allowing for important medical research and innovative ways to access electronic health records (EHRs).

However, on top of technological challenges there is always a challenge related to regulatory policies. Colin Anderson, lead developer at Tactuum, told our chief growth officer, Timothy Partasevitch, in an interview:

“The past year, as terrible as it has been, there are some good things that have come out of it. And that is the NHS [National Health Service] and U.K. government as a whole, realized what they are missing out on by not embracing the technology. We have got the ability to implement more streamlined healthcare through technology, and we’ve got the expertise to do it really quickly as well.”

Colin added that a new winner in healthtech could be “having patient records being available to actual patients themselves, so they can have a secure app with all their records on it that can be shared with their healthcare provider, whether that be their local [general practitioner] or a surgeon.”

6. Walmart (as well as Amazon and Alphabet) will redesign healthcare.

Andy Arends, vice president at NTT Data Services, says Walmart can establish great healthcare facilities within a reliable, low-cost and no-frills environment. As a result, Walmart could become not only a certain health plan but also the provider and create its own insurance distribution.

7. Social determinants efforts will change from aspirational to operational.

Megan Callahan, vice president of healthcare at Lyft, says there are predictable calls to action in the industry to form a more standardized approach to measuring and collecting data on social determinants of health.

Insurtech

Now let’s look at the predictions of different experts concerning how insurtech will grow and evolve in 2021.

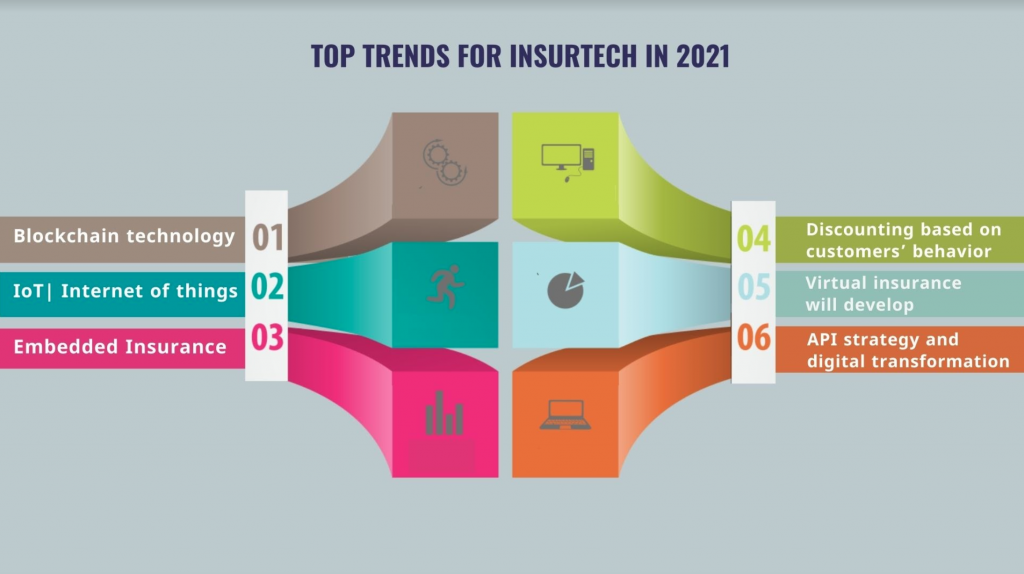

Top trends for insurtech in 2021

1. Blockchain

Many experts are confident that blockchain technology will become a leading component of insurtech. Incorporating blockchain with encryption can better protect important medical records and other sensitive information against cybertheft.

Insurers will have to calculate all long-term environmental and economic costs. And, due to lack of regulation, an opportunity for fraud and scram could appear.

2. IoT (Internet of Things)

Internet of Things devices such as Apple’s smartwatch and Amazon’s Echo are going to reach an estimated $43 billion by 2023. Integration of IoT can help not only consumers but also insurers, by accelerating and simplifying the claims and underwriting process while reducing costs and expanding business. The technology can let insurers stay in touch with their customers, strengthening the relationship, and form partnerships with other companies to cross-sell services and products.

But smart technologies can be attacked by cybercriminals and hackers and require considerable investment.

3. Embedded insurance

In 2021, more insurance products will be embedded in the purchases and experiences customers are having online. Tesla, for instance, has announced its own insurance product, so all willing can purchase a car and insurance, specifically tailored to the vehicle, in one experience.

4. Discounting based on customer behavior

Many experts say that in 2021 we will see really creative programs, with smart technologies being used to offer customers special discounts according to their individual behaviors.

In an article for Benzinga, Brett Jurgens, co-founder and CEO of Notion, a Comcast company, says greater discounts could be offered for clients who use devices, such as modern smart sensors, in different water-prone locations or for better coverage across the home or whole property.

See also: 1 Million Digital Life Presentations

5. Virtual insurance

Insurers are ready to leverage augmented, virtual and extended reality solutions to meet their customers’ and employees’ needs.

6. API strategy and digital transformation

With APIs, insurance companies can benefit from better internal systems and data integration, streamlining the claims management process and speeding the resolution of claims. APIs allow for flexible and powerful technology platforms, which can consume and share large volumes of data while linking insurers with a huge number of customers and partners. Insurers that fail to build valuable APIs into their platforms will not be competitive.

Bryan Falchuk, founder and managing partner at Insurance Evolution Partners, said:

“I see the data in any system as having to be available to all other systems. This is table stakes today, and, as an industry, we are still lagging here. APIs are the preferred way to enable this if each function has a different system, but the industry is still struggling. There are new solutions coming out that can ride on top of legacy platforms or newer platforms that aren’t as API-friendly to solve the problems of standardizing data and making it available to other systems. They’re often built as low-code/no-code solutions, making hesitation in adopting them even harder to justify. Yet we do. This is where I try to help carriers I work with to see a) customers increasingly will not stand for re-entry of information or you not having a complete view of them when they come to you, and b) the means to solve for this exist today.

"For example, if you use a modern [customer relationship management system], based in the cloud, it can publish and consume data from many different sources through APIs. But what if those sources aren’t built to communicate that way? Or, what if they are, but the APIs aren’t very good (as I’ve often found to be more the case than a stark inability to use APIs)? We don’t need to stop there, and can instead see if there is another path to bring the data trapped in disparate systems together without having to go through a multi-year, multiple-tens-of-millions (or hundreds or millions) of dollars effort to replace a legacy system.

"Many carriers that were resistant have started to see on the back of pandemic-driven lockdowns and remote work that they simply must change. And the speed with which the industry virtualized its workforce was a good reminder that we can change much faster than we thought we could. Luckily, we also have the tools to get there now.”

So, obvious changes have occurred in healthtech and insurtech. And they will develop further in 2021. Modern healthcare and insurance companies must adapt.