Subrogation is a relatively manual, time-consuming process often requiring physical checks to be mailed on a claim-by-claim basis between insurers. Sounds laborious, doesn’t it? That’s because it is.

In 2018 alone, the total amount of dollars demanded and issued through the subrogation process was over $9.6 billion for all insurance carriers, and multiple sources of data increase the potential for fraudulent claims. According to Claims Journal, up to 10% of claims costs for U.S. and Canadian insurers are attributed to fraudulent claims.

With so many disparate parties, including claimants, carriers, third-party adjusters (TPAs), law firms, recovery companies and regulatory entities, involved in the process, subrogation is in desperate need of innovation. Fortunately, emerging technologies are providing solutions.

In this post-COVID world, with reduced dependency on physical location, the digitization of insurance has caused a significant ripple effect for businesses in subrogation, including those involved in risk management and data protection.

The Proverbial Silver Bullet?

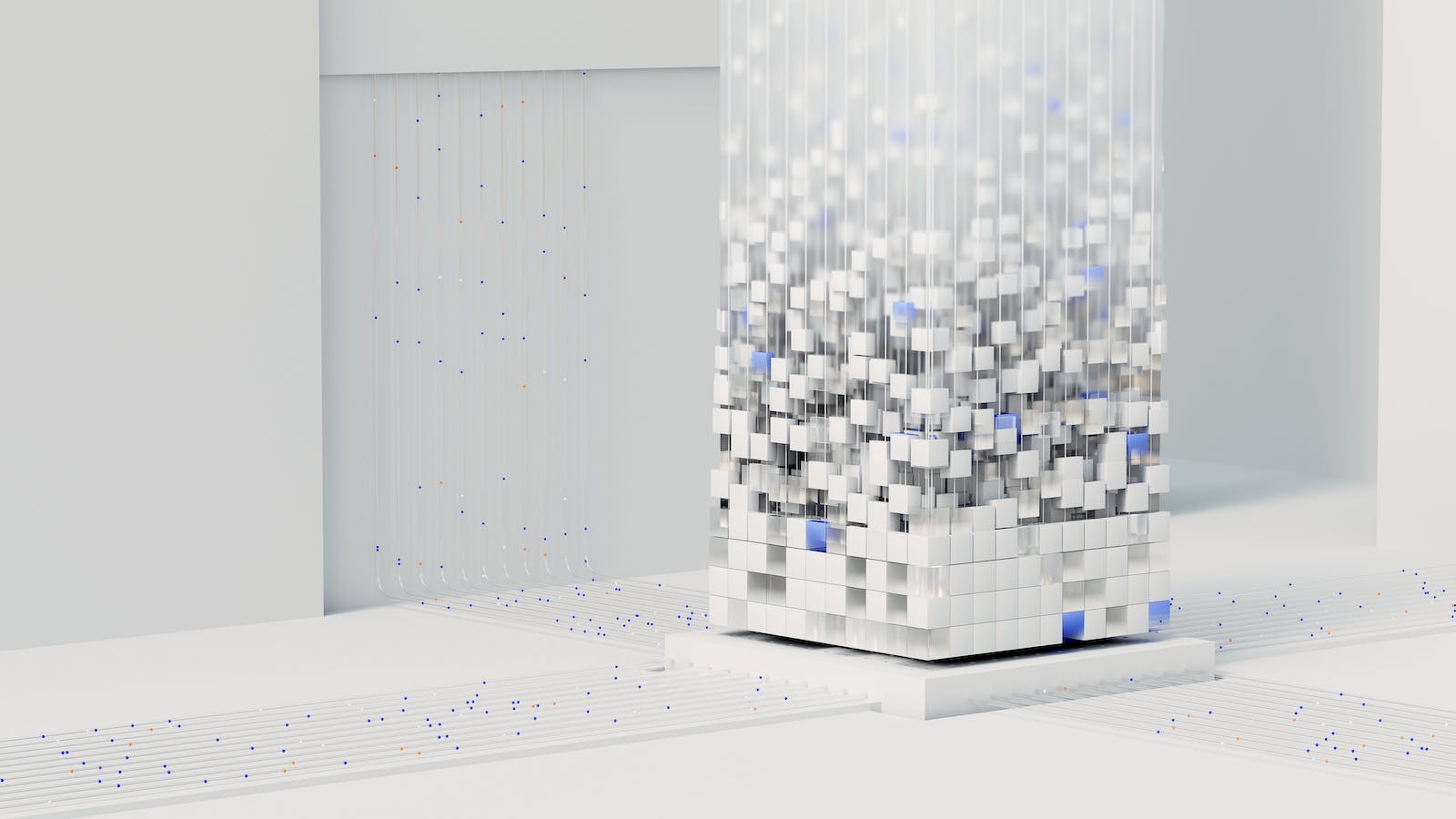

Blockchain, or distributed ledger technology (DLT), can help insurers drive more efficient processes, including use of new “smart” contract models.

Smart contracts allow insurers to enforce agreements by storing business rules in programing code and have them execute automatically once the required terms are met. Smart contracts can significantly reduce the cost of "netting." Netting is a process when two insurance companies give visibility into corresponding liability and recovery efforts. Today, this process can take days or weeks or months. With transparency provided by blockchain, the netting process can occur in real time. And, this is a huge cost and compliance savings for carriers, as well as for the entire ecosystem.

Blockchain employs consensus management to manage risk pools, underwriting and claims payments. The contract is digitally signed on the blockchain, providing all parties a single version of the contract, eliminating the possibility for version mismatch or misinterpretation.

Security

Due to the nature of DLT, blockchain can automate transactions and allow multiple organizations to share data securely. Data is stored on multiple machines, making it essentially “public.” In this scenario, it becomes incredibly difficult for a hacker to alter the content of the data because it would have to be done on every node simultaneously.

Data is more secure because blockchain networks store data in a format that cannot be replicated or tampered with. Each block of information is also stamped with a unique alphanumeric hash key, which contains information about that block and all the ones that proceeded it. If one block is altered in any way, it will be immediately apparent by comparing it with others in the chain.

See also: Breakthrough for Blockchain?

Transparency

Blockchain technology is providing new ways of carrying out data exchanges that are more secure and transparent than ever before. The ability to make these transactions without a central authority enables better serving customers by removing the bottlenecks and inefficiencies that come with outdated manual processes.

Having stakeholders house their data on a blockchain creates a shared source of truth, which would facilitate data-sharing, reduce costs and decrease the likelihood of errors. By creating a single source of truth, a blockchain solution would eliminate data redundancy, reduce the potential for errors and speed the process by eliminating the need for continual information requests. An automated blockchain payment solution would eliminate the need for reconciliations, improve audit quality and reduce the potential for payment fraud.

In addition to claims processing, a blockchain payment solution can streamline operations, improve accuracy and reduce costs across the value chain in such areas as agent/broker commissions and incentives, premium receivables, premium refunds at cancellation and service provider/vendor payments.

Blockchain employs smart contracts and consensus management to manage risk pools, underwriting and claims payments. The contract would be digitally signed on the blockchain, thus providing all parties a single version of the contract, eliminating the possibility for version mismatch or misinterpretation. Blockchain provides immutability by design. And, each party owns their ledger and a record of unconsumed evidence. Decentralized transactions (with common access to a ledger that has a secure audit trail) provides an improved basis for non-repudiation, governance, fraud prevention, financial data and reporting.

The Future of Subrogation – Sponsored by Blockchain

Blockchain is poised to rewrite the rules of competition in the subrogation industry by streamlining operations, enabling data to be shared seamlessly with external stakeholders and disrupting traditional business models and intermediaries.