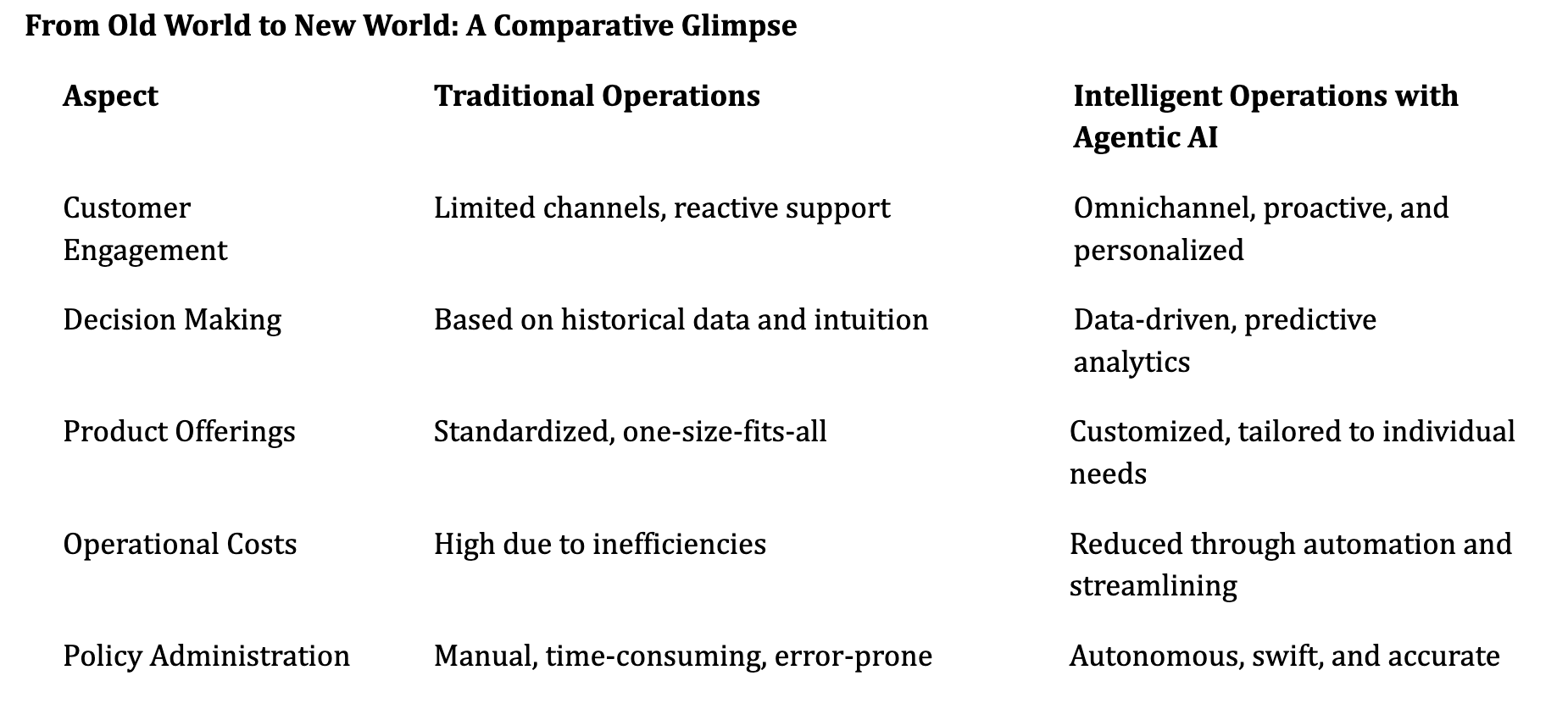

In today's fast-paced digital landscape, insurance carriers stand at a crossroads. Traditional operations—burdened by siloed systems and manual workflows—are no longer sustainable. Outdated models not only slow decision-making but also erode customer trust and inflate operational costs. The path forward is clear: Embrace intelligent, AI-driven operations that cut through complexity, deliver real-time insights, and elevate both efficiency and experience.

Intelligent Operations: The Strategic Advantage

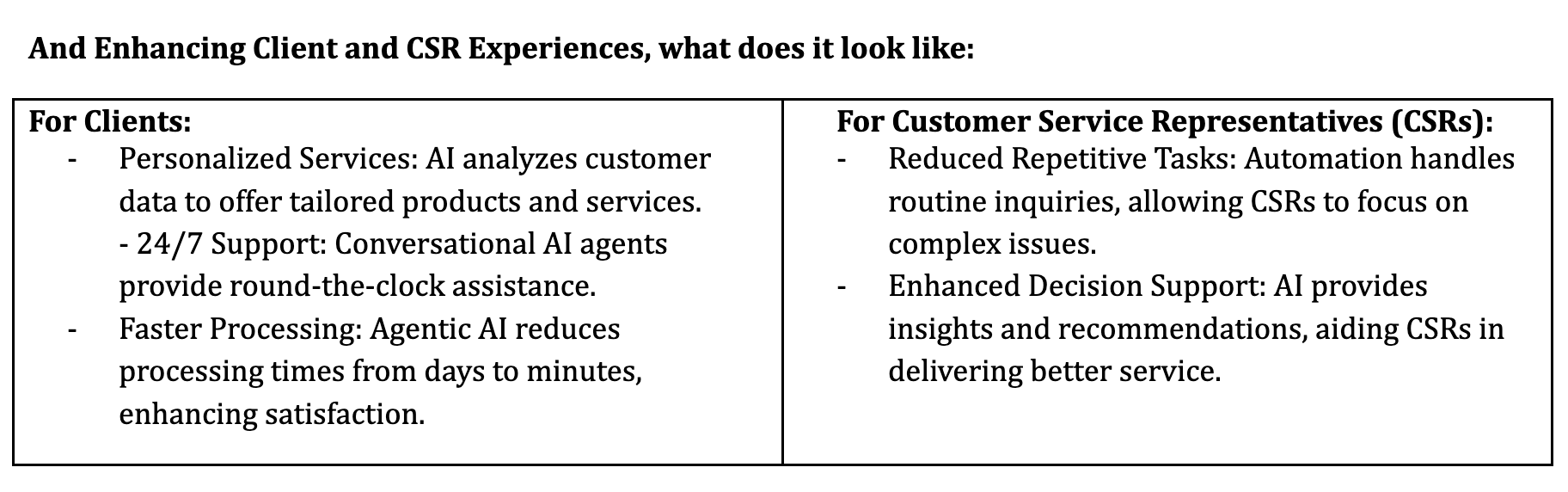

Intelligent operations are not just a tech trend— they are the new foundation for competitive advantage. By leveraging agentic AI, machine learning, and real-time analytics, insurers can automate decision-making, streamline processes, and hyper-personalize customer interactions. Agentic AI, in particular, represents a breakthrough: autonomous, purpose-driven agents that learn, adapt, and act independently to deliver outcomes at scale. According to McKinsey, insurers implementing AI are achieving up to a 25% reduction in operational costs and a 25% boost in customer satisfaction—a leap in both efficiency and impact.

The Time for Transformation Is Now

The urgency to act has never been greater. Customer expectations have shifted—demanding instant, seamless, and personalized service across every channel. Legacy systems and fragmented processes simply can't keep up. Meanwhile, insurtech disruptors and digital-native competitors are setting a new bar for agility and innovation. To stay relevant, traditional carriers must reimagine their operations through the lens of intelligent automation. Those that move now will lead the future of insurance. Those that don't risk being left behind.

Taking the First Step: Initiating the Transformation

Embarking on this journey requires a structured approach:

- Assess Current Operations: Identify areas where inefficiencies exist and where AI can have the most impact.

- Set Clear Objectives: Define what success looks like—reduced processing times, improved customer satisfaction, or cost savings.

- Collaborate With Experts: Partner with technology providers specializing in insurance digital transformation.

- Pilot and Scale: Start with pilot projects, gather insights, and then scale successful initiatives across the organization.

- Foster a Digital Culture: Encourage continuous learning and adaptability among employees to embrace new technologies and processes.

The Cost of Inaction: Risks of Not Embracing Intelligent Operations

Insurers that delay modernization face mounting risks. Without embracing AI and digital-first solutions, organizations fall behind more agile competitors, struggle with inefficient legacy systems, and expose themselves to regulatory challenges. Operational inefficiencies lead to increased costs, delays, and errors, while outdated systems make compliance more difficult. Most critically, customer dissatisfaction grows as digital expectations rise—leading to churn and a decline in brand trust. The absence of AI-driven insights also means missed opportunities to identify emerging trends and evolving customer needs.

Enhancing Job Satisfaction Through Intelligent Operations

Intelligent operations don't just transform systems—they elevate people. By automating routine tasks, employees are freed to focus on higher-value, strategic work. Upskilling becomes part of the journey, as staff gain new digital competencies that enhance their career prospects and value in a rapidly evolving industry. Streamlined processes also improve work-life balance by reducing burnout and enabling more meaningful contributions. The result: a more engaged, capable, and future-ready workforce.

From Chaos to Clarity: A Strategic Imperative

The transition from fragmented, traditional operations to intelligent, AI-enabled clarity is more than a technology upgrade—it's a strategic imperative. Insurers that embrace agentic, AI-powered, and digital-first operations position themselves to deliver faster, smarter, and more personalized experiences. In doing so, they unlock greater agility, customer satisfaction, and sustainable growth in a competitive landscape that favors innovation and responsiveness.