Amid all the investment activity in the insurance industry, I distinguish two types of startups by using a very straightforward – and I believe a black-and-white, legal – perspective: If a firm must comply with insurance regulations then it is an insurance firm, and not a technology firm, regardless of what technology it uses to get and keep customers.

Why all the activity? Why is the insurance industry a target for transformation or a destination for disruption for investors?

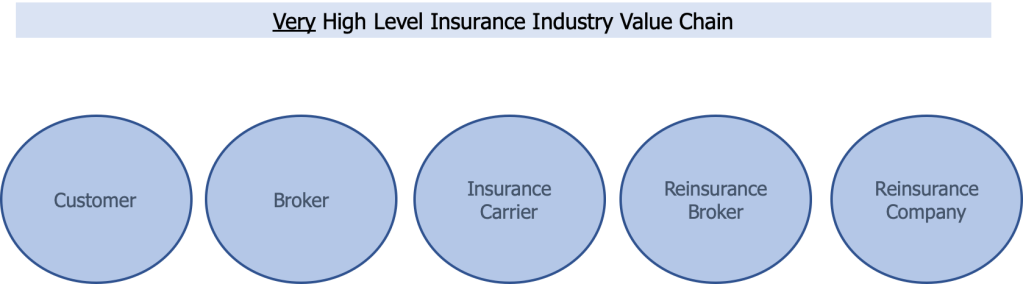

VCs, other investors and the startup entrepreneurs view the trillion-dollar global insurance industry as a group of (very) old companies using (very) old processes to conduct commerce. From their perspective, the industry is an extremely large addressable market of companies that are seriously out of touch with the realities of how commerce is, and should be, conducted in the mobile, digital, connected marketplace in the Internet era.

For investors, it is an industry ready to be plundered!

Brokers: the sweet spot of many startups

Quite a few of the insurance startups are targeting insurance brokers as a sweet spot to be disrupted. And a sweet spot it is. Estimates from various sources put the number of agents and brokers in the U.S. insurance industry at between 300,000 and 400,000.

See also: Agents, Brokers Are Dead? Not So Fast!

[Note: For the purposes of this post, I will use the term "broker" to mean either insurance broker or insurance agent. I agree that I’m taking liberties doing that.]

Brokers: target for transformation

There is an important fact about insurance brokers: Customers can’t legally purchase insurance without using one.

I believe that investors forget that brokers are legally required in the purchase of insurance, think that fact (i.e. the law) will change to the benefit of the startup they are invested in, are ignorant of the fact or willingly ignore the fact.

(If you’re wondering … Yes, I believe there are VCs or other investors who would willingly and illegally ignore insurance regulatory requirements and related laws.)

The key question is: Can the insurance broker space be disrupted or transformed?

My answer is no.

I believe the broker space can’t be disrupted, as in, broken apart, thrown into disorder or interrupted in their normal course or unity.

Customer-Broker Paths

However, I believe the broker space can be transformed.

Specifically, the customer-broker paths can be transformed. In reality, through the applications of technology through the decades, these paths have been transformed, are being transformed and, I suggest, will continue to be transformed.

See also: What a Safer World Means for Brokers

Consider the visual below. The visual captures past, existing and potential future customer-broker paths. But keep in mind two points:

- Even through the process of transformation, the broker (whether person or algorithm) remains because the broker is legally required in the insurance purchase.

- The transformation is about transforming the path between customer and broker but is not about transforming the role (or the essence of the role) of the broker.

The history of customer-broker paths is founded on face-to-face (F2F) meetings, whether in the customer’s home, in the broker’s office, at car dealerships or in banks.

Beyond F2F paths, technology has acted as an interface that has eliminated time and distance between the customer and the broker. But whether at the other side of a computer screen, via a mobile app, through an email or using a chatbot on an insurer web portal, there must be a broker present to sell the insurance line of business. Even algorithms used as brokers have to comply with the requisite insurance regulations: no leprechauns, no pixie dust, no magic.

Technology redefines the existing paths, introduces new paths and makes the activities enabling any of the customer-broker paths both more effective and more efficient.

The technologies, whatever they are, do not, of course, replace the broker even if they make the broker appear in a virtual reality or in Second Life or "embed" the broker in a hologram.