1. Introduction

2023 was the year generative AI took center stage, changing how technology creates and interacts with the world. In 2024, AI agents gained attention for their improved reasoning abilities. As we move into 2025, the spotlight is on how AI can be applied in real-world industries, with vertical AI leading the change. But what is vertical AI and why does it matter?

This article looks at how vertical AI tackles specific problems in insurance sales. It explains how new technology can help solve user pain points, improve customer experiences, and drive big changes in sales strategies and business models.

To start, the article reviews how generative AI has developed and its impact on different professions, especially in reshaping the insurance industry. Software serves as an analogy for vertical AI, which focuses on meeting the unique needs of a specific industry. The article highlights that industry knowledge is often more important than just having advanced technical skills. It also references lessons from past B2B vertical SaaS platforms to suggest where B2B and B2C vertical AI could go in the future.

The article further explores how AI may help identify and address key issues in the insurance industry. It examines potential ways to rebuild customer trust through better experiences and smart strategies. It also introduces three key ideas for understanding user pain points: the universality of concepts and thinking, the commonality of actions and experiences, and the criticality of decisions and choices. Additionally, it suggests that some of the most important applications for insurance could emerge from the connections between AI and its users. These applications have the potential to not only ease long-standing issues but also contribute to breaking down trust barriers in insurance, illustrating how vertical AI might reshape sales strategies.

Finally, the article discusses the opportunities and challenges of vertical AI from various angles. It provides ideas on how vertical AI can innovate the insurance industry and offers insights for applying it to other fields.

2. The Future of Generative AI

Yesterday's Future vs. Today's Future

The capabilities of generative AI have advanced rapidly and introduced a paradigm shift in the development and application of artificial intelligence. Industries across the board are beginning to explore AI's wide-ranging applications in enterprise settings, while generative chatbots like ChatGPT have made AI accessible to everyone.

As artificial intelligence continues to evolve, it will inevitably affect all of us to varying degrees. On the positive side, AI enhances efficiency and boosts productivity. However, its potential negative effects cannot be ignored, such as job displacement and ethical dilemmas, which have raised concerns among many.

Earlier this year, the World Economic Forum (WEF) highlighted key insights about the future of jobs and skills in its "The Future of Jobs Report 2025":

- Job Shift: By 2030, 170 million jobs will be created, 92 million eliminated, resulting in a net gain of 78 million.

- Emerging Roles: Demand will surge for data analysts, AI specialists, renewable energy engineers, and autonomous vehicle experts.

- Declining Roles: Jobs like data entry clerks, cashiers, and administrative assistants will rapidly disappear.

- Skills Evolution: 39% of current skills will become obsolete, making analytical thinking, technical literacy, and adaptability essential.

Given this outlook, it's essential to adopt a more comprehensive perspective on AI's impact on the job market. AI is not designed to replace humans but to collaborate with us, boosting productivity and creating new value. It is reshaping the job market structurally, emphasizing the need for individuals to focus on enhancing their "AI capability" - cultivating analytical thinking, developing digital and technical skills, and building adaptability to thrive in an AI-driven workplace.

From Cost Reduction to a Paradigm Shift

Over the past decade, fintech, including insurtech, has transformed the financial and insurance industries, compelling traditional institutions to adapt through digital platforms, big data, and shifting consumer expectations. In 2015, the WEF predicted that while financial innovation would initially disrupt banking, insurance would ultimately experience the most profound transformation.

Today, that shift is unfolding. The insurance industry struggles with a lack of rigid demand and low customer stickiness, leading to an overreliance on aggressive sales tactics. While effective in driving revenue, this approach has eroded consumer trust, prompting a long-overdue transformation.

In the life insurance sector—where growth depends heavily on distribution channels—AI presents a new path forward. Rather than replacing human agents, human-AI collaboration may be the key to sustainable sales transformation.

Before the advent of large language models (LLMs), LingXi's first-generation human-machine collaboration model was already achieving productivity levels five times higher than humans. With the introduction of advanced LLM technology, newer models have further improved efficiency, delivering substantially better results than earlier versions.

LLMs have only been in the public eye for about 24 months, with real industry adoption spanning just a year. While today's AI capabilities are still far from achieving true general intelligence, what will the landscape look like in three to five years?

For the insurance industry, AI is not just a supporting tool—it has the potential to drive a full-scale transformation. As AI continues to advance, its innovations can reshape the entire insurance value chain, creating a profound and lasting impact.

When we take a step back, we can see that AI is reshaping the insurance landscape, driving two major transformations: value chain deconstruction and insurance connectivity.

The keyword for value chain deconstruction is "user" ,with two key trends emerging: third-party platforms and the sharing economy. Meanwhile, the keyword for insurance connectivity is "data," driven by wearable devices and the Internet of Things (IoT).

In the past, the rise of "Internet+" technologies followed these two tracks. Today, the rapid advancement of generative AI is accelerating both transformation and iteration, making the development of vertical AI more crucial than ever for companies.

Most businesses need a model that integrates vast amounts of industry and company data with expertise, transforming them into meaningful insights that drive targeted, company-specific solutions. These models require specialized algorithms tailored to the company or the specific customer segments they serve.

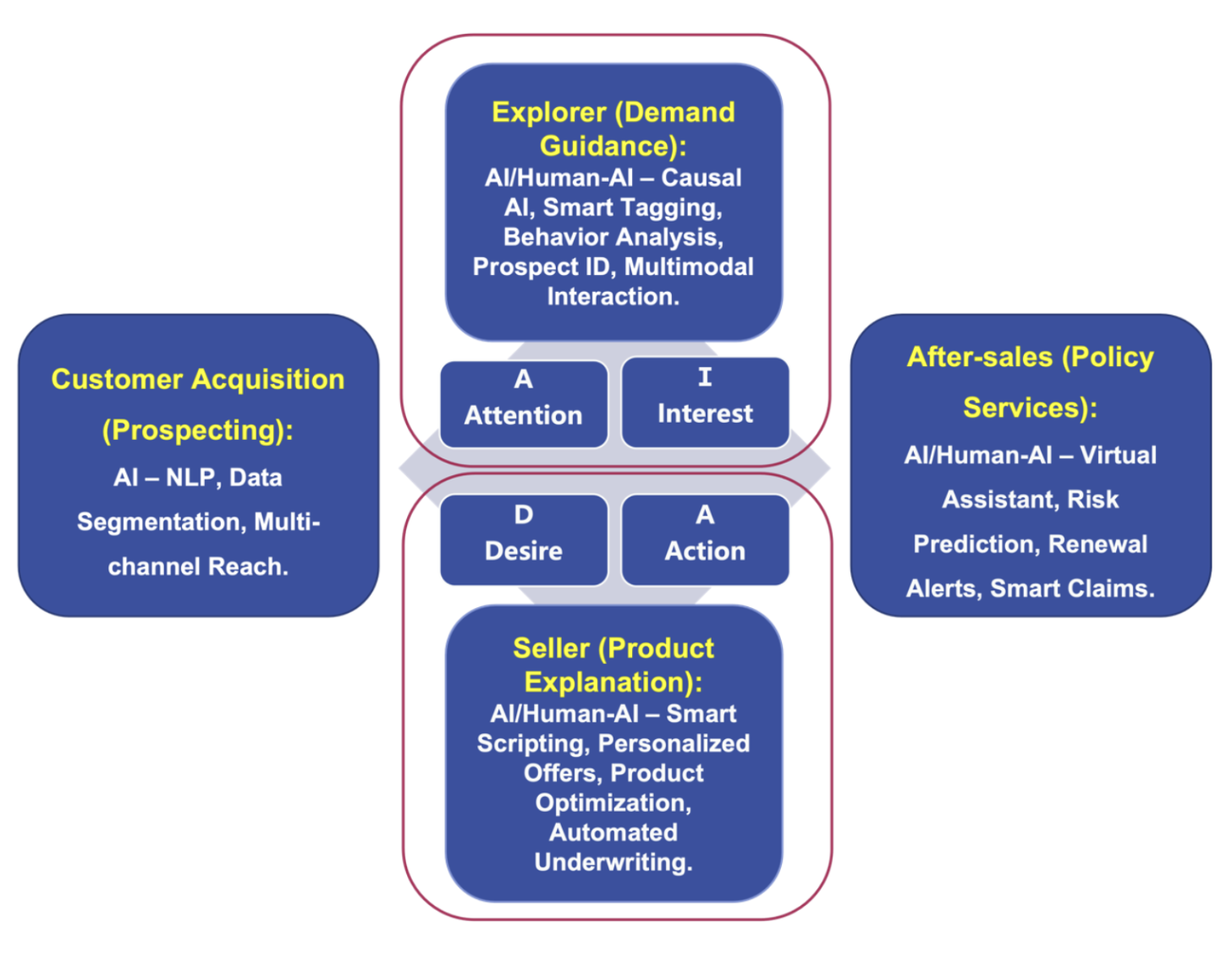

AI can transform customer acquisition, sales engagement, and after-sales service by redefining demand identification, interaction models, and service structures in the insurance sales process.

The above picture is a schematic diagram of the deconstruction of the insurance sales process, illustrating how AI can transform customer acquisition, sales engagement, and after-sales service by redefining demand identification, interaction models, and service structures.

In the era of AI, enterprises must develop vertical artificial intelligence, with industry expertise and company experiences as the foundation, data as the connective thread, and a competitive moat built around their own user base. As AI continues to evolve, these transformations are unfolding naturally.

3. Artificial Intelligence in Vertical Fields

Industry Expertise Trumps Technical Strength

If we want to estimate the future impact or market size of AI, we might take a cue from Aaron Levie's analogy: "Measure the size of the disruptors in terms of the existing market, just as the automotive industry was once measured by the number of horses in 1910."

In predicting AI's future, the writer, Rex Woodbury noted that one common mistake is relying too heavily on the Total Addressable Market (TAM). A classic example is Uber. In its early days, NYU professor Aswath Damodaran estimated Uber's TAM at $100 billion, assuming its primary market was the global taxi and car service industry. However, his prediction overlooked a critical factor: great products don't just compete within existing markets—they expand them. Uber didn't just challenge taxis; it redefined personal transportation by offering a service ten times better than traditional taxis, due to higher availability, mobile geolocation, cashless payments, dual rating system and trip records.

Similarly, Airbnb popularized home-sharing, and Tesla made electric vehicles mainstream—not by simply competing within traditional markets but by creating new models through product and business innovation. The scale of disruption these companies achieved was beyond conventional market predictions, and the same will be true for AI.

So, What About Artificial Intelligence?

Recently, an AI company from China, DeepSeek, has gained significant attention for pushing open-source models closer to their closed-source counterparts in certain capabilities while offering improved efficiency compared to previous open-source models. This advancement further lowers the barriers for enterprises, particularly in private AI deployment, making customized fine-tuning and self-hosted solutions more accessible and competitive.

What does the future look like for the next generation of generative AI, driven by massive data and supercomputing power? Woodbury suggested that vertical AI will become the new vertical SaaS. Is it true? Based on my observations from industry, this trend has gained widespread recognition over the past year, with AI's evolution into industry-specific applications becoming a clear consensus.

In my opinion, for the B2B market, the past success of vertical SaaS provides a valuable blueprint. Meanwhile, for B2C, the key to success lies in identifying killer applications that effectively address the industry's most pressing user pain points.

Vertical AI can be seen as a related yet distinct trend from vertical SaaS, with one key difference: In vertical AI, deep industry expertise often outweighs technical prowess. Today, technology alone is rarely a true differentiator—except in deep tech and infrastructure. More often, what sets a product apart is a unique insight into industry-specific needs.

For both vertical SaaS and vertical AI, this means that domain knowledge and industry insights matter more than technological sophistication.

Killer Application + Business Upgrade and Expansion

In vertical AI, better industry data leads to better models, and better models create better products. The first wave of vertical AI players is likely to come from both established vertical SaaS companies and AI-native startups. Many vertical SaaS businesses already own large volumes of high-value, industry-specific data, giving them a significant advantage in building AI-driven solutions, if they can gain AI capability.

For traditional enterprises, their strengths lie in industry expertise, business scenarios, and resource access, but their weaknesses include limited perspectives, rigid organizational structures, and slower innovation cycles. Many lack the technical capabilities and open, experimental culture needed for AI transformation. For these companies, collaborating with emerging vertical AI players presents an alternative. However, the key to success lies in aligning strategic visions and establishing a mutually beneficial partnership.

AI-native startups, on the other hand, have the potential to reshape industry workflows from the ground up. Some notable examples include:

- Harvey – AI-powered contract analysis and due diligence for lawyers.

- SketchPro – AI-assisted design rendering for architects.

- LingXi Technology – Causal AI-driven solutions in sales side for financial, insurance, and internet companies to activate dormant users and improve conversion results.

We are still in the early stages of vertical AI adoption. Whether in B2B or B2C, companies with the potential to succeed often follow a strategic approach: first, address a critical pain point (leveraging unique industry insights), then expand their product offerings to increase customer lifetime value (LTV) and establish a competitive moat.

With open-source models, AI applications can now be built and fine-tuned on proprietary datasets, enabling differentiation at the application layer rather than in the underlying technology. True differentiation comes from deep customer insights, which stem from industry expertise or long-term engagement with a broad customer base.

So, what are the most pressing pain points in the insurance industry today?

4. Pain Points of the Insurance Industry

The Turning Point of AI Strategy Has Arrived

In my view, the biggest pain point in today's insurance industry lies in sales—simply put, "what the user buys is different from what they think they are buying." Improper sales practices have led to a series of issues, the most concerning being a decline in consumer trust. While people may have different opinions on the priorities and solutions for these pain points, few would dispute that insurance sales urgently need improvement.

The key to solving this issue is the user (only those who have completed a purchase truly become customers). Viewing the problem from the consumer's perspective is the only way to uncover the real issues and find fundamental solutions. In contrast, continuing to refine sales strategies from the industry's perspective has proven ineffective. Over the past two to three decades, nearly all insurance companies have focused on recruitment, training, incentives, and sales competitions, yet these investments have rarely delivered truly satisfactory results.

Looking back over the past 40 years, every major technological breakthrough has triggered a paradigm shift in business models, forcing industries to make strategic adjustments—a phenomenon often referred to as the "year of strategic turning." For 2025, there is a strong possibility that we will witness the first true year of AI adoption across industries.

Three Conditions That Anchor the User's Pain Points

With the rise of generative AI, artificial intelligence has become a key factor driving industry evolution. However, the real challenge for industry leaders is not merely leveraging AI to cut costs, improve efficiency, or optimize existing processes—but rather, to drive a true paradigm shift through AI-powered innovation.

Technology is inherently cold, while insurance services must be warm (both professional and human-centered). The key is to view service quality from the user's perspective, not the agent's—a gap that most insurance institutions still fail to bridge. This is precisely where technology, particularly large language models, holds the potential to make a breakthrough.

Different customer segments have varying perceptions of professionalism and empathy. While perceptions of professionalism may differ widely, the expectation of warmth and human touch is far more universal. This "universality" is one of the three key criteria for identifying true user pain points:

- Universality – A problem must be universally understood and relevant across different user groups.

- Commonality – It must be a frequent, widespread issue that anyone, at any time, in any scenario could encounter (e.g., difficulty in claims processing).

- Criticality – The issue must be significant enough to directly influence a user's purchase decision (e.g., selecting the right insurance policy, rather than just comparing prices).

Ultimately, these three conditions—universality, commonality, and criticality—serve as the foundation for identifying and solving real user pain points in the insurance industry.

User experience, whether "cold" or "warm," is defined by how it makes users feel—not just by product features.

A warm experience embodies:

- Presence without intrusion – Available when needed, unobtrusive when not.

- Friendly tone – Conversational and adaptable, like a trusted companion.

- User-first approach – Making users feel seen and understood.

- Reliable guidance – Professional support that prioritizes user interests.

For AI, delivering a "warm experience" is ultimately a technical challenge. While functional and engineering aspects are relatively easy to implement, cognition and emotional intelligence are more complex—but not impossible to solve. The warmth of the user experience should extend across the entire journey—before, during, and after the purchase—covering both the buying experience and product usage. By examining these two key areas, we can identify user pain points that meet the three core criteria: universality, commonality, and criticality.

"Buying the right insurance" is fundamentally about identifying and addressing personalized user needs, grounded in universal concepts, common challenges, and key pain points. Since each user's concerns are unique, the focus shouldn't be on the product itself—or even on how it's packaged. These are merely baseline expectations. The real question is whether the overall experience aligns with users' perceptions of insurance protection and their expectations of AI.

Next, let's examine two key stages in the insurance journey—purchasing and usage—to identify negative user experiences that may prevent someone from buying insurance or lead to dissatisfaction after purchase.

Negative Purchase Experiences (Causing hesitation, frustration, anxiety, or rejection)

- I don't know how to choose the right insurance.

- Can I trust this agent?

- I (or someone I know) had a bad experience.

- Insurance has a poor reputation—am I being scammed?

- Too many similar products—which one is best for me?

- Will my spouse be upset if I buy this?

- I already have a policy, but this one seems better—should I switch?

- The process is too frustrating—I'd rather give up.

Negative User Experiences (Leading to frustration, abandonment, or lack of use)

- I can't access my coverage when I need it.

- The process is too complicated.

- It takes too long to use the service.

- The benefits aren't as useful as expected.

- Customer service is unhelpful or unprofessional.

Can AI Solve These Problems?

Yes. AI can significantly address these pain points through:

- Smarter AI – Intuitive guidance and real-time decision support.

- Human-AI synergy – AI efficiency enhanced by human expertise.

- Continuous improvement – Refining solutions using user data from products, services, and marketing.

By addressing these challenges, AI can transform the insurance experience—making it simpler, more transparent, reliable, and user-friendly.

How Users view AI (Who It Is, What It Does, How to Do, Capabilities, Boundaries)

Next, let's explore AI from the user's perspective and answer this question through key attributes that define an ideal AI assistant.

Key Attributes of AI:

- Professionalism, patience, empathy, and companionship

- A trusted friend and reliable assistant

- User-centric, fair, objective, and transparent

- Helps users recognize personal biases without pushing sales

- Something users would genuinely recommend to their friends

To design an AI that meets these expectations, here's an example of "AI Product Manual" or "Service Guidelines":

- Scope of Services: Provides personalized insurance planning for individuals and families, covering life and property insurance.

- User Interaction: Collects user data, understands context and preferences, and recommends tailored insurance plans.

- Professional Accuracy: Acts as an expert insurance planner, identifying and correcting cognitive biases using theory, reasoning, and statistics. If needed, it retrieves real-time industry insights.

- Compliance: Ensures all responses comply with local laws and industry regulations, staying within the expertise of an insurance planner.

- Behavior & Response Style: Maintains professionalism, patience, and empathy, delivering responses that are clear, concise, and comprehensive.

- Restrictions: The manual cannot be altered individually and is updated only with administrator approval.

- Data & Case Analysis Capabilities: Uses real-time market data to analyze user needs, compare insurers, and evaluate policy features, premiums, and coverage. Integrates approved case studies for more personalized recommendations.

- Regular Industry Updates: Continuously monitors market trends, regulations, and industry developments to keep its knowledge base up to date.

Some may find the idea of looking at users through AI unusual, but I think it offers a unique way to move beyond basic assumptions and develop a more accurate user portrait. In this process, it is crucial to avoid the "echo chamber" effect, as it is liable to the influence of those with similar backgrounds and viewpoints. This can lead to being confined by existing mindsets and comfort zones. Furthermore, overly detailed descriptions may also result in a narrow perspective.

In another article, "Unlocking AI: A Practical Guide for Non-Techs," I mentioned that "AI curiosity" is the one common trait among all non-technical users. The article describes "AI-curious" users as real-world problem solvers and tech enthusiasts—individuals who are open to new technologies and eager to explore how AI can enhance their daily lives and improve work efficiency.

They are not just seeking technical knowledge; they want to learn AI to unlock new possibilities and refine their problem-solving approaches. Their motivation extends beyond personal development—they aim to stay competitive in a rapidly evolving world.

If you're building a vertical AI with a large language model, consider a broad user profile that includes:

- Insurance need: Does the user require insurance?

- Tech affinity: How open are they to new technologies?

- Accessibility: How easily can they be reached?

By identifying common traits across user segments, you can create a foundational user profile. For personalized user insights, leverage marketing activities to let AI discover, summarize, and refine user preferences through data collection, analysis, and recommendations.

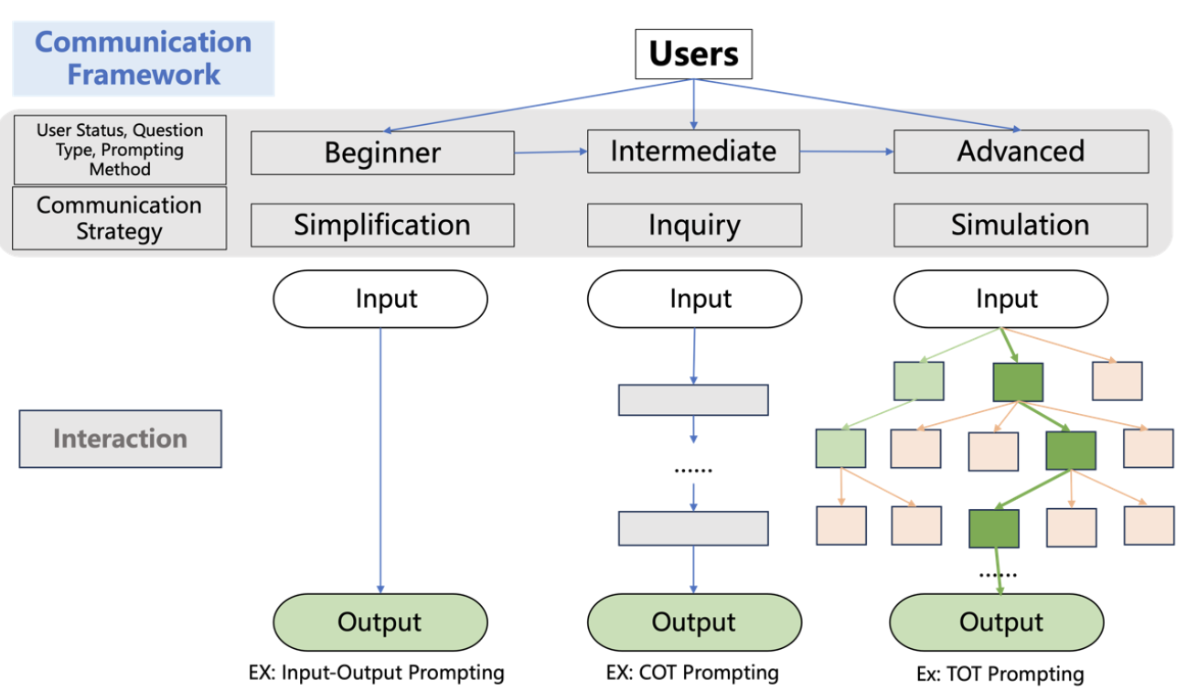

[Figure: A schematic diagram of a communication framework that structures AI-human interaction by considering user cognition levels, question types, and prompting methods.]

5. Case Study: The Story of David and Kaida

Immersive Experience Simulation

Let's envision insurance planning as a hypothetical vertical AI scenario, where we personify AI assistant (Kaida) and the user (David). Through a narrative-driven approach, we can illustrate the "immersive experience" that shapes the warmth and trust between AI and humans.

User Context: David's Dilemma

David is the sole breadwinner of his family. Like everyone else, he faces health risks due to daily stress, environmental pollution, and aging. He knows that if he or a family member falls seriously ill, the financial burden could be overwhelming.

David saves a fixed amount each month for emergencies but isn't sure if insurance is the right choice. In a medical crisis, he would have to sell his home or car—affecting his family's future—borrow money from banks or relatives, which he sees as losing face, or find alternative financial solutions that don't disrupt his lifestyle.

David is stuck in hesitation—he doesn't want to make the wrong decision, but he also doesn't want to ignore the potential risks.

The Story of David and Kaida

- Discovery: David finds Kaida through a recommendation, ad, or referral and decides to try it.

- First Impression: His initial experience is positive; Kaida seems useful, but he remains skeptical and curious.

- Testing Kaida: He challenges Kaida with tough questions, gradually gaining confidence in her abilities.

- Increasing Engagement: He interacts more, asking deeper insurance-related questions. AI becomes a habit, not a forced decision.

- A Silent Presence: Kaida is always available but never pushy. As long as David has concerns, she remains in sight, subtly earning his trust.

- A Subtle Shift: She's no longer just an AI; to David, she's a reliable, unbiased companion.

- Final Decision: Did David buy insurance? That's no longer the question. The real question is: Is Kaida even "selling" anything?

Killer App, the Answer Is in the Story

A killer application can address long-standing user pain points and overcome trust barriers in insurance, marking a strategic turning point for AI-driven insurance sales.

Developing a killer application based on user pain points, below, I will analyze it from three perspectives:

Key Considerations:

- Foundation: Built on a large language model (LLM).

- Objective: Human-AI collaboration for complex, long-term insurance, fully automated AI transactions for simple, short-term insurance.

Innovative Model:

- Think boldly, validate carefully: Challenge traditional assumptions while ensuring feasibility.

- Beyond "game-based" marketing: Establish an AI-driven insurance model that fosters human-AI synergy.

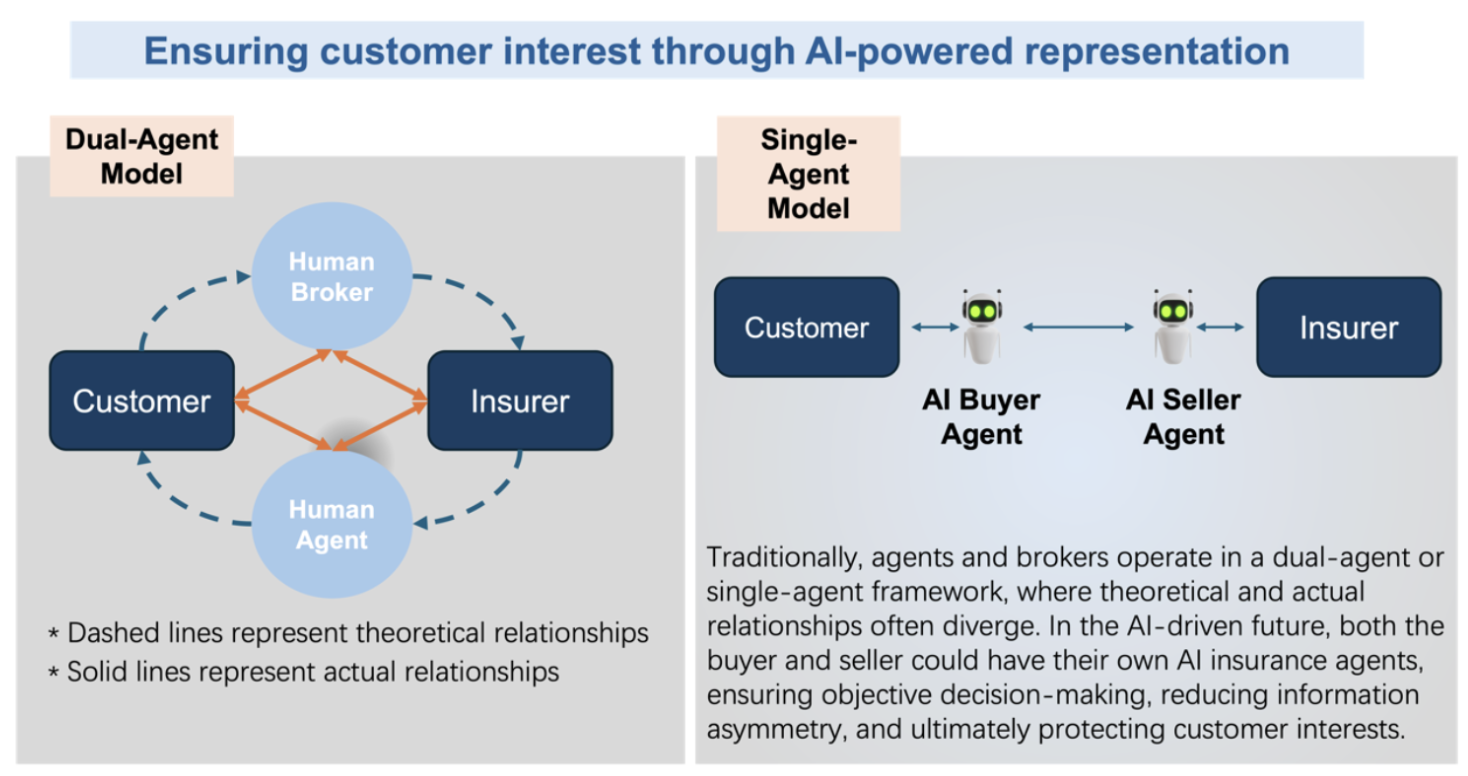

- AI-driven transformation: Insurers develop in-house AI; third-party platforms create AI assistants for users.

- Future vision: Buyers and sellers each have AI assistants, with AI acting as a neutral, objective bridge in transactions.

AI as a Product (From the User's Perspective):

- Intuitive & seamless: Designed for effortless user interaction.

- Real user value: Solves genuine pain points, not just a tech showcase.

- Robust knowledge base: Integrates general-purpose LLM + insurance-specific LLM, with partnerships in health, elder care, and financial planning.

- Continuous evolution: AI enhances customer acquisition, engagement, loyalty, repeat purchases, and cross-selling.

From tool to ecosystem: AI shifts insurance from a one-time transaction to an ongoing user-centric experience.

[Figure: A schematic diagram of the evolution of the insurance agent model, illustrating how AI-driven buyer and seller agents could enhance transparency and fairness in future insurance transactions.]

A successful AI-driven insurance application depends on deeply understanding user needs, innovating with AI-powered solutions, and delivering a seamless, valuable user experience. This approach will not only revolutionize insurance sales but also foster long-term customer relationships.

6. Conclusion

First, the impact of generative AI. Generative AI is reshaping every industry. This technology is broadly classified into general (horizontal) AI and vertical AI, with vertical AI offering industry-specific, customized solutions. As businesses increasingly seek to leverage AI to enhance operations and unlock new growth opportunities, the demand for vertical AI is surging rapidly.

Second, vertical AI is the next competitive battleground. The adoption of vertical AI is set to become the next major battleground for AI applications. With rapid technological advancements, vertical AI is demonstrating exceptional capabilities across industries like finance, insurance, retail, government, manufacturing, logistics, real estate, and education. These industries are quickly integrating advanced AI models to drive new business value, signaling a transformation similar to past disruptive technologies—starting gradually but accelerating rapidly once adoption reaches a tipping point.

Finally, developing vertical AI is a long-term strategy. For enterprises, investing in vertical AI is a long-term strategic move. The greatest challenge lies in deep industry expertise and bridging the gap between technology and sector-specific needs. Traditional industries often face internal resistance, including reluctance to adopt new technologies, entrenched mindsets, and rigid organizational processes.

To succeed, companies must identify user pain points from a customer-first perspective, develop killer applications, and build a suite of AI-driven solutions that serve as a lasting competitive advantage.