Since the first “Five Dispatches from InsurTech Survival Island,” I've been partnering with Adrian Jones and in recent months with Sri, to analyze quarterly statutory statements of the most relevant U.S. P&C full-stack insurtech carriers. The principal goal has been to influence the dialog, debate and deliberations in the insurtech space debate, and to promote a fact-based perspective for the discussion. Even as we continue to write about the future of insurance, about a year ago, I declared my love for “old insurance KPIs” in this widely read article. While futurologists distanced from assessing P&L statements might disagree, many readers have liked the usage and explanation of insurance KPIs (key performance indicators) in the context of innovation. We are pleased to see more industry experts and authors join us in crunching numbers, assessing issues and taking a fact-based view on insurance innovation. We were especially pleased to see even some executives of insurtech startups talk about core KPIs in the context of their innovative business models. So, we entered 2020 with a belief we had accomplished our mission to spark a P&L, fact-based dialog in the insurance innovation space.

Surprisingly, neither Q3 ‘19 nor Q4 ’19 financials got any attention from analysts, and some friends pinged us suggesting we continue the series for the foreseeable future. We hear you loud and clear, and we will continue to publish these digests based on assessing the fundamentals of the insurtech players in the context of the broader insurance industry. We are back!

Our journey continues here today with an analysis of the insurtech trio’s financial performances and to share our humble assessment of the competitive posture and advantage for these three innovative startups.

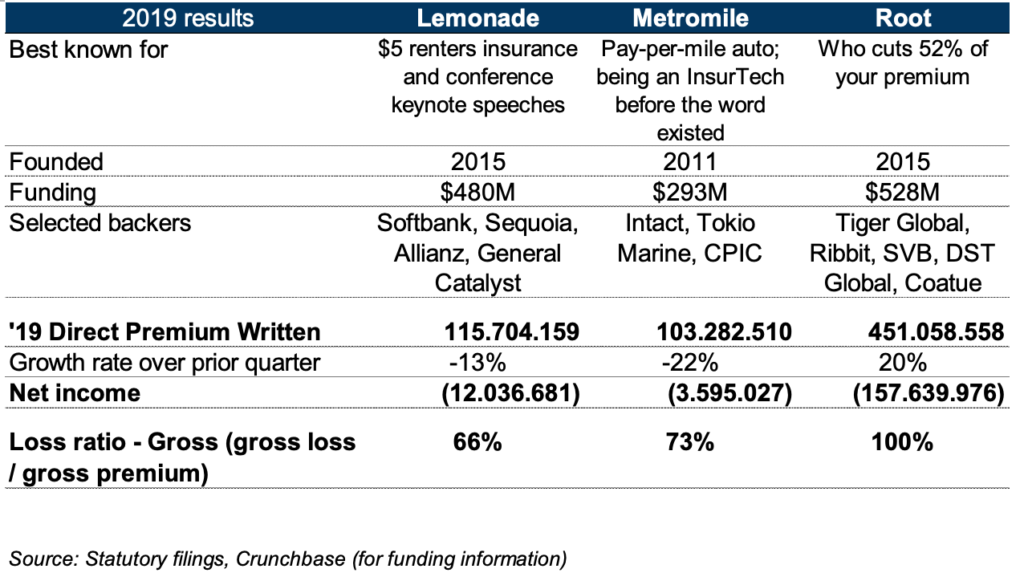

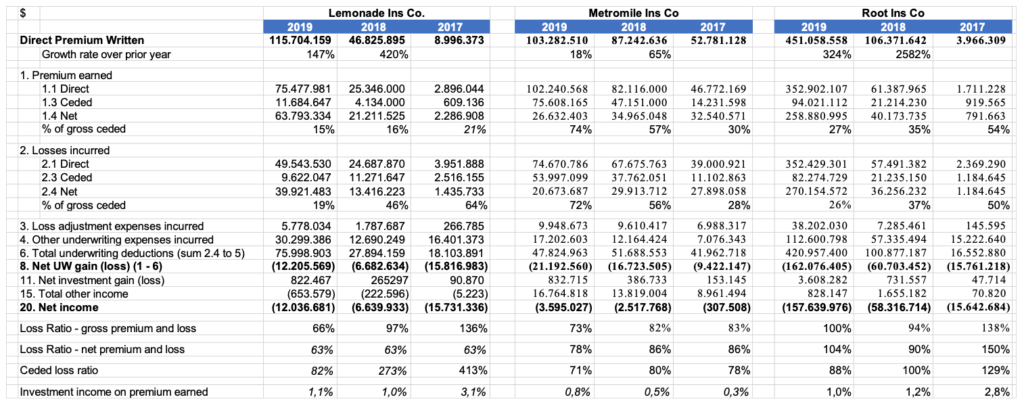

Key Financials

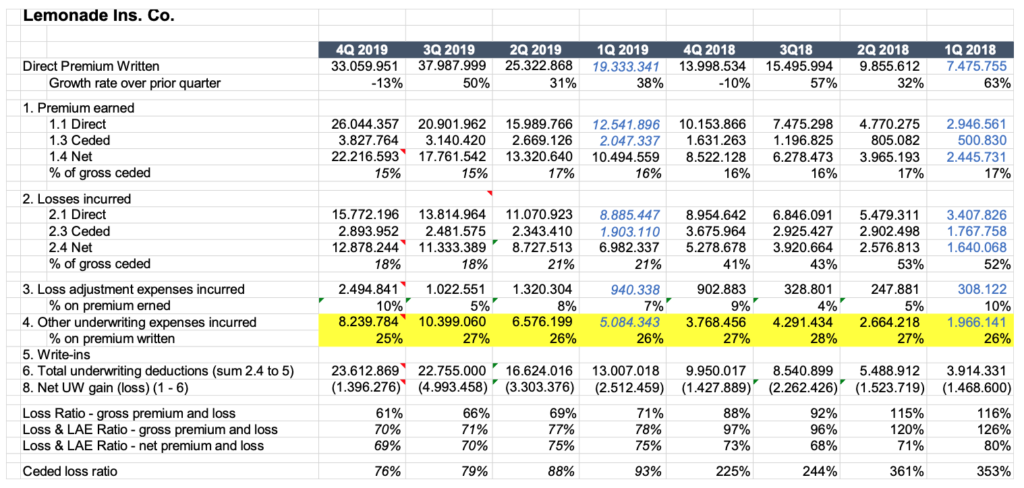

Let’s start as we typically do, with a look at the core financials. Frequent readers might recall our snapshot view that lists the core financial metrics for the three players. As you read this summary, we would like to remind you that we do not comment on the cost side of the equation and that we suggest our readers not believe in the cost side because of the “goals seek triumph” issue I discussed in this article from last year.

Observations:

“To each his own.” This phrase probably sums up best how we view the distinction between Lemonade, Root and Metromile. We see the three players take three different paths to customer relevance and financial performance:

- Metromile: An auto insurer with modest growth that has only partially closed the profitability gap with the market (73% loss ratio vs 64% market average). This, to us, does not seem the story you would expect from a startup in the growth phase.

- Lemonade: A home insurance company that has improved the technical sustainability of its business, partially closing the profitability gap with the market (66% vs 58% for the market) and showing a promising trajectory. However, it has sacrificed along this journey the expectations many had for this “market disruptor.” The $480 million of funding has created a book of business that still accounts for just 0.1% for the U.S. homeowners insurance market. The $115 million in revenue is a far cry from the “massive disruption effect” that was expected during the debut.

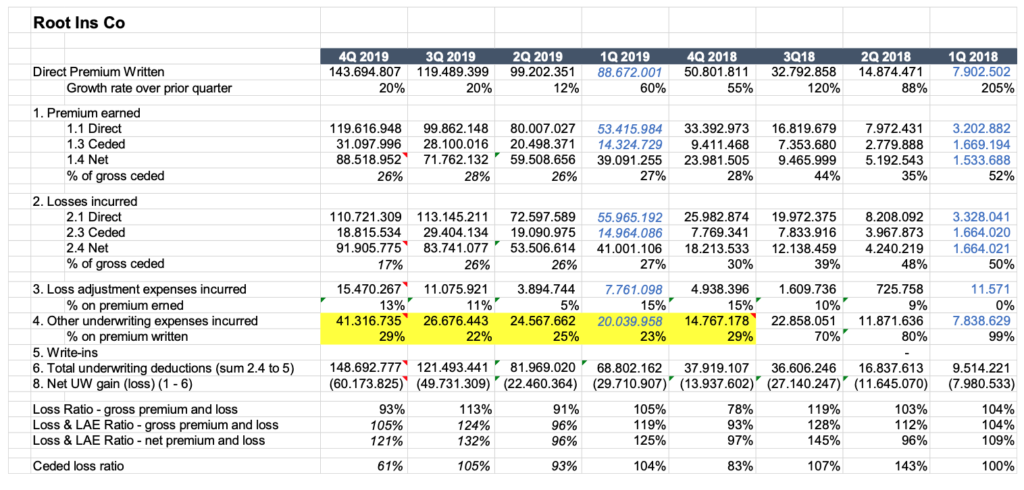

- Root: An auto insurer that continues its journey of exponential growth (the portfolio is three times bigger at the end of 2019 than it was at the end of 2018) but is paying in claims the same amount collected as premium. The company appears to be using the $350 million Series E funding from DST Global and Coatue in August 2019 to cover expenses. This company, too, accounts for less than 0.2% of the auto insurance market.

See also: Cloud Computing Wins in COVID-19 World

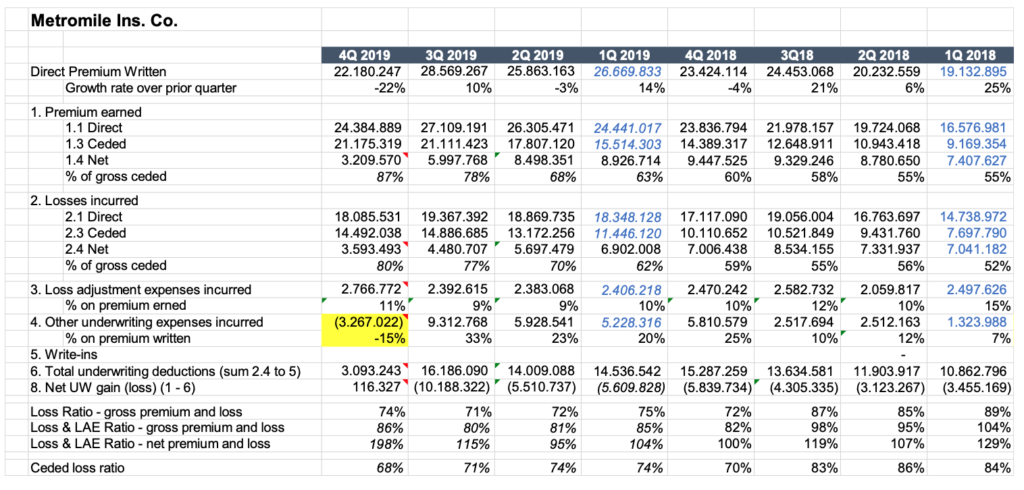

Let’s take a closer look at the loss ratios:

- Metromile’s loss ratio has been stable in the lower 70s for all of 2019. The company started selling its claims tools to other insurers, but the performances on its own book do not tell a great story for this new business. More broadly, the usage of telematics data on claim processing has shown potential to reduce the loss ratio at an international level. If an insurer has to choose a provider for telematics-based claims, it makes more sense to use one that has achieved results. A carrier would probably feel more comfortable using something like the G-evolution services that have already provided competitive advantages on Groupama Italy’s auto portfolio.

- Root ended 2019 with a 100% loss ratio, paying out in claims effectively an amount equivalent to the premiums received. While Q4 '19 saw a loss ratio at 93% compared with 113% in the prior quarter, and 91% in the second quarter, the technical profitability has not yet shown a consistent improvement. It is interesting to see how the loss ratios are fairly consistent in the core lines of business: auto liability and auto physical damage. In 2018, auto liability showed a loss ratio not too far from the market average, but physical damage showed a terrible loss ratio, above 120%. The folks at Root are smart, and we believe they are deliberately underpricing the risks to attract customers. Theoretically, telematics could allow them to improve their loss ratio through behavioral change, and the use of data in claims processing could let them anticipate the FNOL and enhance the effectiveness of the claim handling processes. It seems they have still ignored this potential, instead focusing only on a few weeks of monitoring, but these strategic options seem achievable.

- Lemonade has been on a trajectory of improving loss ratios over the last few quarters. From a loss-ratio of 88% in Q4 ‘18 to a loss-ratio of 61% in Q4 ‘19, loss-ratios have always improved. Lemonade celebrated the use of advanced, AI-powered fraud detection in ensuring "bad risks”are caught, assessed and filtered out. Looking to the slowdown of their growth, an increase in pricing seems to be the main driver of this technical profitability recovery.

In the last article, we highlighted the “pricing war.” So, let’s take a closer look at the top line generated by these different approaches to reach a sustainable loss ratio:

- Root’s quarter-over-quarter growth rate appears to have “settled” at around 20%, which is lower than past performances. Looking back over a two-year horizon, 2019's quarter-over-quarter growth rate seems rather sedate compared with 2018. However, in absolute numbers, in the latest quarters the company has increased written premium by $20 million (from $99 million to $119 million) and $24 million (from $119 million to $144 million). These represent their third and second best quarterly increases, after the $38 million increase achieved in Q1 ’19 (from $51 million to $89 million). With Root now available to more than 65% of the U.S. driving population (‘18 new states contributed 29% of the ‘19 growth, and ‘19 states for a further 17%), it remains to be seen how the company can continue to capture customers switching for cheaper prices. Root has also started to cross sell the customer base with renter insurance.

- Lemonade's growth has slowed: After healthy growth quarter over quarter from Q1 ‘19 through Q3 ‘19, we saw a reversal in Q4 ‘19. The 13% reduction in Q4 ‘19 was worse than the 10% reduction between Q4 ‘18 and Q3 ‘18. One year ago, Lemonade said, we “messed up an entire quarter” because premium growth turned negative, when in fact the company generated its best quarterly loss ratio ever (and it has happened again!).

- Metromile underwritten premiums grew only by $3 million in Q3 ‘19 (compared with Q2 ‘19), and in Q4 ’19 the company had, in absolute numbers, its worst quarter since Q3 ’18. This to us is a clear sign that the company's product likely attracts only users who drive infrequently or never drive.

Cost Position

We are also not able to compare their real costs. As we discussed earlier, the companies are not reporting all of their costs in the yellow book any more, and therefore true cost positions cannot be judged. As an example, Metromile's stated underwriting expenses in the fourth quarter of the year went down, similar to movement we saw in the fourth quarter of 2017.

Our humble opinion

Let’s be frank. From these figures only Root is showing the trajectory expected for a startup in the growth phase. Even with gaps on the technical sustainability of its portfolio, the company has a profitability improvement opportunity driven by better usage of telematics data. If the team builds mastery in usage of telematics data for behavior change and claims management, this venture could find the “root” for sustainable growth. With this focus and strategy, the company really wouldn’t need to invent anything fundamentally different. There are best practices on behavior change and claims management the company can emulate from players like Allstate (U.S.) and Discovery Insure (South Africa) and UnipolSai and Groupama (Italy) respectively.

Continuing on the telematics topic, Metromile’s equity story seem less exciting. Customer appeal toward pay-per-use continues to be limited at best. Uncertainty of a fluctuating premium over the period of coverage is a barrier for adoption. This model is attracting only customers who drive infrequently and focus on saving on their insurance premium costs.

The long tail of excitement with the disruption buzzword continues to characterize Lemonade’s march in this trio. The charity giveback - which has fascinated many commentators over the past years and which I described in detail in one past article with Steve Anderson - accounted for 1.3% of the 2018 premiums last year and 1.8% of the 2017 premiums; i.e., a pretty inexpensive public relations and marketing tool. On a different note, plans to cross-sell and offer pet insurance appear to be well thought out and fit with the equity story for a startup at their stage. Finally, the expansion into the German market generating appears to be another checkmark on the “to do list” of the “perfect startup.” Net-net, Lemonade’s story appears to excite industry commentators more than it excites customers!

(I've already earned the title of “cynic” from the Lemonade founder for a similar statement a year ago.)

What paths will each of these insurtechs take now, and how will they get there? Will COVID-19 change everything?

See also: Will COVID-19 Disrupt Insurtech?

Another question on everyone’s mind is probably this: What will be the impact of the temporary lockdowns? As we look ahead into expected results from Q1-2020, we expect to see COVID-19 play out in a few different ways:

- We expect Metromile to be the most affected because its product is based on a "per mile" computation basis. Analysts are already reporting, that mid-March to the end of the April, "miles driven" were reduced by 50%. With millions of U.S. residents spending a couple of months in lockdown, we expect the Metromile top line will shrink in Q1 ’20. The company has already laid off employees, including the entire marketing team.

- Root has announced a "stay at home" bonus similar to many other auto insurance carriers. Root's incentives are based on a measured 20% or more reduction in driving in April and May. With the lockdown, the company's try-before-you-buy approach probably takes more time to be completed, so their growth will be affected.

- We do not currently expect any change in the coverage needs or customer behavior for the core products that Lemonade provides. We do, however, expect that macroeconomic issues like increasing unemployment, underemployment and reduction in disposable incomes will lead on one side to some customers seeking lower prices through competitive shopping but, on the other hand, customers who have never considered or bought renters insurance policies possibly continuing to ignore the need and shun the product. Industry watchers will recall Lemonade’s claim on effectively attracting first-time buyers of rental insurance. We expect this claim to be tested.

From a broader P&L perspective, we also expect to see Q1 ’20 investment income to be depressed.

Looking ahead to the rest of the year from my exile in a downtown Atlanta hotel, I have already articulated my thoughts about futurologists who are designing a future based on their own self-image over the past few weeks. (Note: There have been tons of articles and webinars claiming that “nothing will be as before” and announcing the triumph of both digital distribution channels and pay-per-use telematics.) I am skeptical about any long-term structural changes brought about by a few weeks of lockdown. Sri, on the other hand, believes that, while the “target state” of consumer behavior and expectations may not be known for a while, the COVID-19 crisis will cause at least some segments of consumers to fundamentally rethink their risk management and insurance solution needs. He also expects changes in sectors like commercial real estate to push commercial insurance companies to rethink products, pricing and positioning in the commercial sector.

As we sign off this quarterly dispatch, many U.S. states are reopening their economies. We hope to be back soon to discuss insurance innovation on the stage of a big conference and to never have to comment again on the impact of a lockdown!