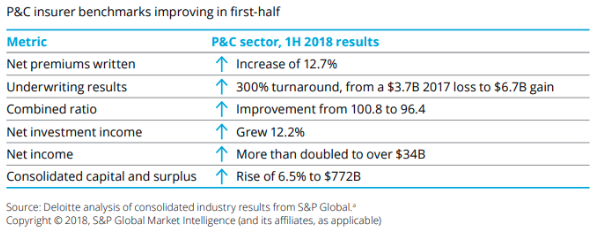

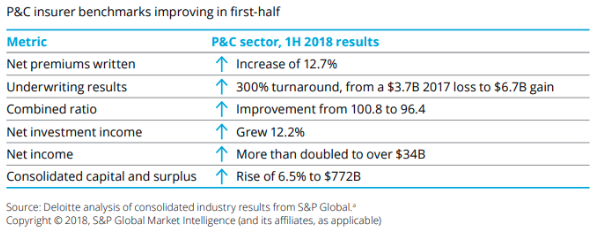

However, in the same report, Deloitte warns, “While 2018 and 2019 are shaping up to be banner years for insurers, some concerns are being raised about an economic slowdown, if not a full-fledged recession, as early as 2020.”

In other words, insurance businesses must be mindful of expenses if they wish to navigate the rough waters of a less lucrative market.

One of those cost areas is IT.

No matter the size or specialty of the insurance agency, IT affects operational efficiency, customer experience and compliance, among other areas.

Making the right decision in each is essential, but it cannot be done without a chief information officer (CIO), i.e., an experienced IT leader to identify bottlenecks, maintain compliance and ensure that your clients are satisfied with their digital experiences.

Unfortunately, not every insurance business can necessarily afford or access a CIO.

See also: How Virtual Reality Reimagines Data

However, these insurance businesses could leverage virtual CIOs (vCIO). The benefits of vCIO consulting cut across three major areas of relevance to your insurance business:

1. Complete IT Leadership

Be it patchy WiFi, computers breaking down or client portals crashing, these and other such IT issues will impede staff productivity. This can hamper your ability to sign on new clients as well as put existing client relationships under pressure.

A vCIO can bring a team of full-time IT experts to investigate your existing system to find the root causes that are derailing your operations and causing cybersecurity issues and compliance problems.

A vCIO can provide clarity of how your IT options -- be it systems, processes or training -- will both maintain productivity and meet strategic business goals.

2. Lower Costs

The average payroll cost of a CIO is $142,609 per year; salaries can range from $81,718 to $269,033 (Monster).

For small and medium-sized insurance agencies, that salary alone would be a significant spike to overhead. Moreover, these smaller agencies may not require a CIO around the clock, as a large outfit would.

This is where the cost advantage of a vCIO is key. Typically, vCIOs will charge a flat fee. A number of IT solutions for the insurance industry, such as managed services, actually include vCIO services as part of the agreement.

So, many small or medium-sized agencies leveraging managed IT services may not need to pay extra to access vCIO services.

3. Objective, Outside Look at Information Systems

Your IT manager may be a great asset, but IT has many different fields, with each field requiring dedicated experts.

Be it cybersecurity, mobile, cloud management, web development or something else, it’s good to have an outside expert to take a look.

See also: Insurance and Fourth Industrial Revolution

A vCIO can provide a neutral assessment. For example, a vCIO could come in and identify a gap in your compliance measures, thereby preventing you from getting hit by a fine. The vCIO could identify a glaring cybersecurity problem before it flares up into a costly technical (and legal) problem for your agency.

A vCIO may not be ideal for larger entities, which have exponentially greater technology needs, potentially across dozens -- or hundreds -- of offices. Larger entitites may also have many more custom technology systems, such as an on-premises data center or custom-coded internal and client-facing applications.

But every organization needs full-time access to a CIO to take ownership of your technology. Should something fail, you can’t afford to not have that leadership when you need it most.

However, in the same report, Deloitte warns, “While 2018 and 2019 are shaping up to be banner years for insurers, some concerns are being raised about an economic slowdown, if not a full-fledged recession, as early as 2020.”

In other words, insurance businesses must be mindful of expenses if they wish to navigate the rough waters of a less lucrative market.

One of those cost areas is IT.

No matter the size or specialty of the insurance agency, IT affects operational efficiency, customer experience and compliance, among other areas.

Making the right decision in each is essential, but it cannot be done without a chief information officer (CIO), i.e., an experienced IT leader to identify bottlenecks, maintain compliance and ensure that your clients are satisfied with their digital experiences.

Unfortunately, not every insurance business can necessarily afford or access a CIO.

See also: How Virtual Reality Reimagines Data

However, these insurance businesses could leverage virtual CIOs (vCIO). The benefits of vCIO consulting cut across three major areas of relevance to your insurance business:

1. Complete IT Leadership

Be it patchy WiFi, computers breaking down or client portals crashing, these and other such IT issues will impede staff productivity. This can hamper your ability to sign on new clients as well as put existing client relationships under pressure.

A vCIO can bring a team of full-time IT experts to investigate your existing system to find the root causes that are derailing your operations and causing cybersecurity issues and compliance problems.

A vCIO can provide clarity of how your IT options -- be it systems, processes or training -- will both maintain productivity and meet strategic business goals.

2. Lower Costs

The average payroll cost of a CIO is $142,609 per year; salaries can range from $81,718 to $269,033 (Monster).

For small and medium-sized insurance agencies, that salary alone would be a significant spike to overhead. Moreover, these smaller agencies may not require a CIO around the clock, as a large outfit would.

This is where the cost advantage of a vCIO is key. Typically, vCIOs will charge a flat fee. A number of IT solutions for the insurance industry, such as managed services, actually include vCIO services as part of the agreement.

So, many small or medium-sized agencies leveraging managed IT services may not need to pay extra to access vCIO services.

3. Objective, Outside Look at Information Systems

Your IT manager may be a great asset, but IT has many different fields, with each field requiring dedicated experts.

Be it cybersecurity, mobile, cloud management, web development or something else, it’s good to have an outside expert to take a look.

See also: Insurance and Fourth Industrial Revolution

A vCIO can provide a neutral assessment. For example, a vCIO could come in and identify a gap in your compliance measures, thereby preventing you from getting hit by a fine. The vCIO could identify a glaring cybersecurity problem before it flares up into a costly technical (and legal) problem for your agency.

A vCIO may not be ideal for larger entities, which have exponentially greater technology needs, potentially across dozens -- or hundreds -- of offices. Larger entitites may also have many more custom technology systems, such as an on-premises data center or custom-coded internal and client-facing applications.

But every organization needs full-time access to a CIO to take ownership of your technology. Should something fail, you can’t afford to not have that leadership when you need it most.Why to Consider a Virtual CIO

Every business these days needs a strong IT leader, but not all can afford one. A virtual CIO can fill the need in three key ways.

However, in the same report, Deloitte warns, “While 2018 and 2019 are shaping up to be banner years for insurers, some concerns are being raised about an economic slowdown, if not a full-fledged recession, as early as 2020.”

In other words, insurance businesses must be mindful of expenses if they wish to navigate the rough waters of a less lucrative market.

One of those cost areas is IT.

No matter the size or specialty of the insurance agency, IT affects operational efficiency, customer experience and compliance, among other areas.

Making the right decision in each is essential, but it cannot be done without a chief information officer (CIO), i.e., an experienced IT leader to identify bottlenecks, maintain compliance and ensure that your clients are satisfied with their digital experiences.

Unfortunately, not every insurance business can necessarily afford or access a CIO.

See also: How Virtual Reality Reimagines Data

However, these insurance businesses could leverage virtual CIOs (vCIO). The benefits of vCIO consulting cut across three major areas of relevance to your insurance business:

1. Complete IT Leadership

Be it patchy WiFi, computers breaking down or client portals crashing, these and other such IT issues will impede staff productivity. This can hamper your ability to sign on new clients as well as put existing client relationships under pressure.

A vCIO can bring a team of full-time IT experts to investigate your existing system to find the root causes that are derailing your operations and causing cybersecurity issues and compliance problems.

A vCIO can provide clarity of how your IT options -- be it systems, processes or training -- will both maintain productivity and meet strategic business goals.

2. Lower Costs

The average payroll cost of a CIO is $142,609 per year; salaries can range from $81,718 to $269,033 (Monster).

For small and medium-sized insurance agencies, that salary alone would be a significant spike to overhead. Moreover, these smaller agencies may not require a CIO around the clock, as a large outfit would.

This is where the cost advantage of a vCIO is key. Typically, vCIOs will charge a flat fee. A number of IT solutions for the insurance industry, such as managed services, actually include vCIO services as part of the agreement.

So, many small or medium-sized agencies leveraging managed IT services may not need to pay extra to access vCIO services.

3. Objective, Outside Look at Information Systems

Your IT manager may be a great asset, but IT has many different fields, with each field requiring dedicated experts.

Be it cybersecurity, mobile, cloud management, web development or something else, it’s good to have an outside expert to take a look.

See also: Insurance and Fourth Industrial Revolution

A vCIO can provide a neutral assessment. For example, a vCIO could come in and identify a gap in your compliance measures, thereby preventing you from getting hit by a fine. The vCIO could identify a glaring cybersecurity problem before it flares up into a costly technical (and legal) problem for your agency.

A vCIO may not be ideal for larger entities, which have exponentially greater technology needs, potentially across dozens -- or hundreds -- of offices. Larger entitites may also have many more custom technology systems, such as an on-premises data center or custom-coded internal and client-facing applications.

But every organization needs full-time access to a CIO to take ownership of your technology. Should something fail, you can’t afford to not have that leadership when you need it most.

However, in the same report, Deloitte warns, “While 2018 and 2019 are shaping up to be banner years for insurers, some concerns are being raised about an economic slowdown, if not a full-fledged recession, as early as 2020.”

In other words, insurance businesses must be mindful of expenses if they wish to navigate the rough waters of a less lucrative market.

One of those cost areas is IT.

No matter the size or specialty of the insurance agency, IT affects operational efficiency, customer experience and compliance, among other areas.

Making the right decision in each is essential, but it cannot be done without a chief information officer (CIO), i.e., an experienced IT leader to identify bottlenecks, maintain compliance and ensure that your clients are satisfied with their digital experiences.

Unfortunately, not every insurance business can necessarily afford or access a CIO.

See also: How Virtual Reality Reimagines Data

However, these insurance businesses could leverage virtual CIOs (vCIO). The benefits of vCIO consulting cut across three major areas of relevance to your insurance business:

1. Complete IT Leadership

Be it patchy WiFi, computers breaking down or client portals crashing, these and other such IT issues will impede staff productivity. This can hamper your ability to sign on new clients as well as put existing client relationships under pressure.

A vCIO can bring a team of full-time IT experts to investigate your existing system to find the root causes that are derailing your operations and causing cybersecurity issues and compliance problems.

A vCIO can provide clarity of how your IT options -- be it systems, processes or training -- will both maintain productivity and meet strategic business goals.

2. Lower Costs

The average payroll cost of a CIO is $142,609 per year; salaries can range from $81,718 to $269,033 (Monster).

For small and medium-sized insurance agencies, that salary alone would be a significant spike to overhead. Moreover, these smaller agencies may not require a CIO around the clock, as a large outfit would.

This is where the cost advantage of a vCIO is key. Typically, vCIOs will charge a flat fee. A number of IT solutions for the insurance industry, such as managed services, actually include vCIO services as part of the agreement.

So, many small or medium-sized agencies leveraging managed IT services may not need to pay extra to access vCIO services.

3. Objective, Outside Look at Information Systems

Your IT manager may be a great asset, but IT has many different fields, with each field requiring dedicated experts.

Be it cybersecurity, mobile, cloud management, web development or something else, it’s good to have an outside expert to take a look.

See also: Insurance and Fourth Industrial Revolution

A vCIO can provide a neutral assessment. For example, a vCIO could come in and identify a gap in your compliance measures, thereby preventing you from getting hit by a fine. The vCIO could identify a glaring cybersecurity problem before it flares up into a costly technical (and legal) problem for your agency.

A vCIO may not be ideal for larger entities, which have exponentially greater technology needs, potentially across dozens -- or hundreds -- of offices. Larger entitites may also have many more custom technology systems, such as an on-premises data center or custom-coded internal and client-facing applications.

But every organization needs full-time access to a CIO to take ownership of your technology. Should something fail, you can’t afford to not have that leadership when you need it most.