The IoT Insurance Observatory has found that a large portion of the policies using driving data for tailoring renewal prices have not resulted in any bad driver penalties.

So, are these telematics portfolios destroying value instead of creating it?

The reality is that there is value created on these portfolios, but the value is not tied to pricing. And some of the pricing approaches are even reducing that value.

First, there are many examples of the risk self-selection impact of all the telematics-based products around the world. Even if two customers seem to be equal based on their characteristics, the one who accepts the telematics product has a lower probability of generating a loss. The stronger the monitoring message on the product storytelling, the higher the self-selection effect. The most statistically robust study is on the Italian auto insurance market, where this risk self-selection effect has accounted for 20% of the claim frequency. In this market, telematics products currently represent more than one-fifth of the personal lines auto insurance business, and the storytelling of the product is hugely focused on monitoring and customer support at the moment of a crash.

Other than risk self-selection, three other telematics-based use cases have been exploited by insurers.

Some international insurers have reinvented their claims processes through telematics data: Their new paradigm is fact-based, digital and real-time. Insurers such as UnipolSai have introduced tools for their claim handlers that allow a quicker and more precise crash responsibility identification and have been providing precious insights to support the activity of all the actors involved in the claim supply chain (both loss adjusters and doctors).

See also: Is Usage-Based Insurance a Bubble?

A second well-demonstrated telematics use case is the change of driver behavior. VitalityDrive introduced by the South African insurance company Discovery Insure is the first insurance telematics product entirely focused on promoting safer behavior. All the product features—from gas cash-back (up to 50% of fuel spending per month) to active rewards through the app (including coffee, smoothies and car wash vouchers)—are contributing to the risk reduction of the book of business and to increased retention of the best risks.

Both the Italian and South African experiences have even been characterized by the insurers’ ability of enhancing the insurance value proposition by adding telematics-based services bundled to the auto insurance coverage. The fees paid by customers for these services almost offset all the costs of the telematics services on the insurers’ income statements

Based on the experience of the IoT Insurance Observatory, global insurance telematics best practices have generated more value through these four use cases than through pricing as of today. So, the sum of the self-selection effect, the claim cost reduction and the economic impact of changes of behavior allows an insurer to provide an important up-front discount at the same level for all the new telematics-based policyholders.

This relevant level of up-front discount -- 20% or more -- has been able to drive the adoption (overcoming any eventual customer privacy skepticism) because it fits with the customer desire to save money, contrasting the low adoption rates generated for more than a decade in the U.S. where up-front discount offers are typically only 5%.

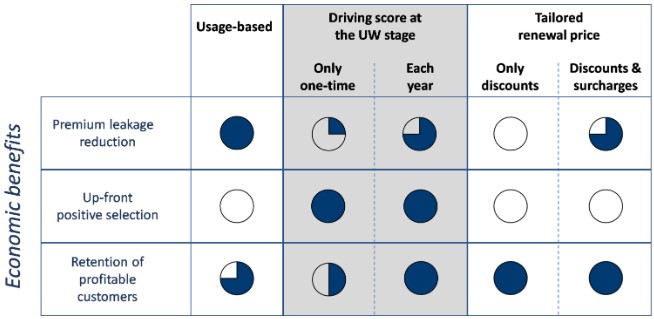

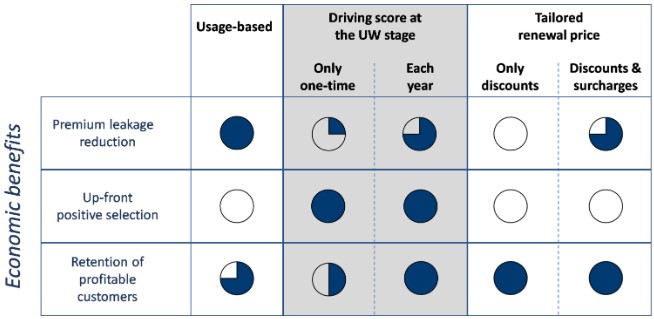

The discount should be maintained, on average, at the same level at the renewal stage. Moreover, an additional economic value can be generated—at each pricing level—by providing additional discounts to the best policyholders and reducing the discount to the worst ones.

This is what the international best practices are doing today.

The IoT Insurance Observatory has found that a large portion of the policies using driving data for tailoring renewal prices have not resulted in any bad driver penalties.

So, are these telematics portfolios destroying value instead of creating it?

The reality is that there is value created on these portfolios, but the value is not tied to pricing. And some of the pricing approaches are even reducing that value.

First, there are many examples of the risk self-selection impact of all the telematics-based products around the world. Even if two customers seem to be equal based on their characteristics, the one who accepts the telematics product has a lower probability of generating a loss. The stronger the monitoring message on the product storytelling, the higher the self-selection effect. The most statistically robust study is on the Italian auto insurance market, where this risk self-selection effect has accounted for 20% of the claim frequency. In this market, telematics products currently represent more than one-fifth of the personal lines auto insurance business, and the storytelling of the product is hugely focused on monitoring and customer support at the moment of a crash.

Other than risk self-selection, three other telematics-based use cases have been exploited by insurers.

Some international insurers have reinvented their claims processes through telematics data: Their new paradigm is fact-based, digital and real-time. Insurers such as UnipolSai have introduced tools for their claim handlers that allow a quicker and more precise crash responsibility identification and have been providing precious insights to support the activity of all the actors involved in the claim supply chain (both loss adjusters and doctors).

See also: Is Usage-Based Insurance a Bubble?

A second well-demonstrated telematics use case is the change of driver behavior. VitalityDrive introduced by the South African insurance company Discovery Insure is the first insurance telematics product entirely focused on promoting safer behavior. All the product features—from gas cash-back (up to 50% of fuel spending per month) to active rewards through the app (including coffee, smoothies and car wash vouchers)—are contributing to the risk reduction of the book of business and to increased retention of the best risks.

Both the Italian and South African experiences have even been characterized by the insurers’ ability of enhancing the insurance value proposition by adding telematics-based services bundled to the auto insurance coverage. The fees paid by customers for these services almost offset all the costs of the telematics services on the insurers’ income statements

Based on the experience of the IoT Insurance Observatory, global insurance telematics best practices have generated more value through these four use cases than through pricing as of today. So, the sum of the self-selection effect, the claim cost reduction and the economic impact of changes of behavior allows an insurer to provide an important up-front discount at the same level for all the new telematics-based policyholders.

This relevant level of up-front discount -- 20% or more -- has been able to drive the adoption (overcoming any eventual customer privacy skepticism) because it fits with the customer desire to save money, contrasting the low adoption rates generated for more than a decade in the U.S. where up-front discount offers are typically only 5%.

The discount should be maintained, on average, at the same level at the renewal stage. Moreover, an additional economic value can be generated—at each pricing level—by providing additional discounts to the best policyholders and reducing the discount to the worst ones.

This is what the international best practices are doing today.UBI Is Not Usage-Based--Sorry!

Usage-based pricing is a fascinating topic for insurers, with great potential. The potential, however, is not yet the reality.

The IoT Insurance Observatory has found that a large portion of the policies using driving data for tailoring renewal prices have not resulted in any bad driver penalties.

So, are these telematics portfolios destroying value instead of creating it?

The reality is that there is value created on these portfolios, but the value is not tied to pricing. And some of the pricing approaches are even reducing that value.

First, there are many examples of the risk self-selection impact of all the telematics-based products around the world. Even if two customers seem to be equal based on their characteristics, the one who accepts the telematics product has a lower probability of generating a loss. The stronger the monitoring message on the product storytelling, the higher the self-selection effect. The most statistically robust study is on the Italian auto insurance market, where this risk self-selection effect has accounted for 20% of the claim frequency. In this market, telematics products currently represent more than one-fifth of the personal lines auto insurance business, and the storytelling of the product is hugely focused on monitoring and customer support at the moment of a crash.

Other than risk self-selection, three other telematics-based use cases have been exploited by insurers.

Some international insurers have reinvented their claims processes through telematics data: Their new paradigm is fact-based, digital and real-time. Insurers such as UnipolSai have introduced tools for their claim handlers that allow a quicker and more precise crash responsibility identification and have been providing precious insights to support the activity of all the actors involved in the claim supply chain (both loss adjusters and doctors).

See also: Is Usage-Based Insurance a Bubble?

A second well-demonstrated telematics use case is the change of driver behavior. VitalityDrive introduced by the South African insurance company Discovery Insure is the first insurance telematics product entirely focused on promoting safer behavior. All the product features—from gas cash-back (up to 50% of fuel spending per month) to active rewards through the app (including coffee, smoothies and car wash vouchers)—are contributing to the risk reduction of the book of business and to increased retention of the best risks.

Both the Italian and South African experiences have even been characterized by the insurers’ ability of enhancing the insurance value proposition by adding telematics-based services bundled to the auto insurance coverage. The fees paid by customers for these services almost offset all the costs of the telematics services on the insurers’ income statements

Based on the experience of the IoT Insurance Observatory, global insurance telematics best practices have generated more value through these four use cases than through pricing as of today. So, the sum of the self-selection effect, the claim cost reduction and the economic impact of changes of behavior allows an insurer to provide an important up-front discount at the same level for all the new telematics-based policyholders.

This relevant level of up-front discount -- 20% or more -- has been able to drive the adoption (overcoming any eventual customer privacy skepticism) because it fits with the customer desire to save money, contrasting the low adoption rates generated for more than a decade in the U.S. where up-front discount offers are typically only 5%.

The discount should be maintained, on average, at the same level at the renewal stage. Moreover, an additional economic value can be generated—at each pricing level—by providing additional discounts to the best policyholders and reducing the discount to the worst ones.

This is what the international best practices are doing today.

The IoT Insurance Observatory has found that a large portion of the policies using driving data for tailoring renewal prices have not resulted in any bad driver penalties.

So, are these telematics portfolios destroying value instead of creating it?

The reality is that there is value created on these portfolios, but the value is not tied to pricing. And some of the pricing approaches are even reducing that value.

First, there are many examples of the risk self-selection impact of all the telematics-based products around the world. Even if two customers seem to be equal based on their characteristics, the one who accepts the telematics product has a lower probability of generating a loss. The stronger the monitoring message on the product storytelling, the higher the self-selection effect. The most statistically robust study is on the Italian auto insurance market, where this risk self-selection effect has accounted for 20% of the claim frequency. In this market, telematics products currently represent more than one-fifth of the personal lines auto insurance business, and the storytelling of the product is hugely focused on monitoring and customer support at the moment of a crash.

Other than risk self-selection, three other telematics-based use cases have been exploited by insurers.

Some international insurers have reinvented their claims processes through telematics data: Their new paradigm is fact-based, digital and real-time. Insurers such as UnipolSai have introduced tools for their claim handlers that allow a quicker and more precise crash responsibility identification and have been providing precious insights to support the activity of all the actors involved in the claim supply chain (both loss adjusters and doctors).

See also: Is Usage-Based Insurance a Bubble?

A second well-demonstrated telematics use case is the change of driver behavior. VitalityDrive introduced by the South African insurance company Discovery Insure is the first insurance telematics product entirely focused on promoting safer behavior. All the product features—from gas cash-back (up to 50% of fuel spending per month) to active rewards through the app (including coffee, smoothies and car wash vouchers)—are contributing to the risk reduction of the book of business and to increased retention of the best risks.

Both the Italian and South African experiences have even been characterized by the insurers’ ability of enhancing the insurance value proposition by adding telematics-based services bundled to the auto insurance coverage. The fees paid by customers for these services almost offset all the costs of the telematics services on the insurers’ income statements

Based on the experience of the IoT Insurance Observatory, global insurance telematics best practices have generated more value through these four use cases than through pricing as of today. So, the sum of the self-selection effect, the claim cost reduction and the economic impact of changes of behavior allows an insurer to provide an important up-front discount at the same level for all the new telematics-based policyholders.

This relevant level of up-front discount -- 20% or more -- has been able to drive the adoption (overcoming any eventual customer privacy skepticism) because it fits with the customer desire to save money, contrasting the low adoption rates generated for more than a decade in the U.S. where up-front discount offers are typically only 5%.

The discount should be maintained, on average, at the same level at the renewal stage. Moreover, an additional economic value can be generated—at each pricing level—by providing additional discounts to the best policyholders and reducing the discount to the worst ones.

This is what the international best practices are doing today.