Ask 10 people what direct contracting (DC) is in healthcare, you’ll get 10 different answers. It’s not a clearly defined term. When doing research for her master’s thesis on "Employer-Provider Direct Contracting" at Georgetown University, Lisa Elder found that “there is no research on the effectiveness of direct contracting.” She had to rely mostly on anecdotal studies of DC and the marketing language of employee benefits firms that had tried it. Her takeaway: There is no consensus on how to define direct contracting in healthcare.

This is a problem for employee benefits advisers who want to communicate what direct contracting’s benefits (previously referred to as direct-pay programs) are for their clients.

What Direct Contracting Should Not Involve

So, what should DC look like? Let’s begin by being very clear on what it should not involve.

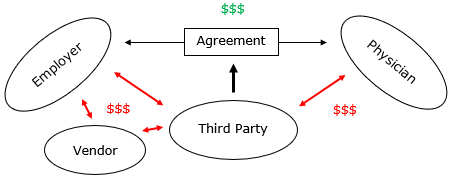

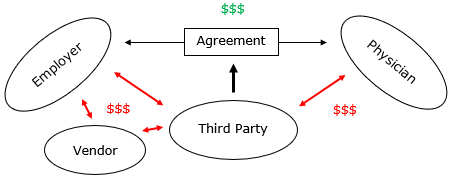

There are too many arrows. There’s nothing “direct” about this model. It’s a dishonest contract: a relationship of three (or more if a vendor is involved), not the two that the name implies.

Yet many employee benefits brokers offer this type of arrangement, replete with the administrative fees that such an arrangement entails. Those fees can add up quickly. Say a benefits broker or vendor charges 10% of the cost of care for implementing the agreement and uses a TPA that charges 15% for facilitating the employer-physician relationship.

See also: 4-Step Path to Better Customer Contacts

The cost of a $20,000 knee surgery replacement would balloon to $25,000 because of unnecessary third-party fees, leaving less value for the employer and physician. Yes, using a preferred provider organization (PPO) that discounted off a $55,000 charge for inpatient knee surgery would be even worse. But creating a less-bad PPO network via an improper “direct” contract shouldn’t be the goal for employers.

The Right Way to Implement Direct Contracting

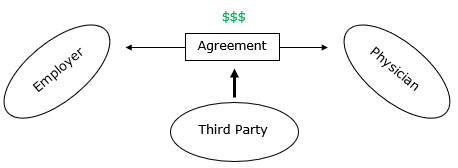

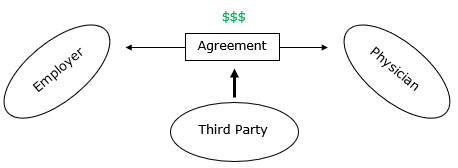

A DC agreement should look direct—like this.

Think of it this way: Once a direct contract is in place, it should remain in place if you, the benefits adviser, were to disappear tomorrow. That requires a great deal of forethought in how the DCs are written, but it’s the right way to implement direct contracting. Establishing a DC this way maximizes and preserves value between your clients and their physicians. That, in turn, goes a long way toward demonstrating your value and commitment to transparency as an adviser.

3 Tips to Help Ensure “Direct” Contracting

Real direct contracting has the potential to revolutionize the healthcare experience for employers by stripping out third parties that don’t add value. Your job as a benefits adviser is to ensure that DC is simplified, streamlined and truly direct. Here are a few tips on doing that:

- Use Medicare prices as a benchmark for establishing reimbursement rates. 130% for physicians and 150% for facilities has worked well for Wincline in its DC client relationships. The true beauty of DC is that employers and physicians can sit down and discuss the price and value related to exchanging services.

- Ensure that payment to physicians is timely (≤14 days). One of the biggest selling points for physicians on embracing DC agreements is that they won’t have to spend time and resources collecting payment for their services.

- Make clear to employees that, under DC, member cost share is waived. Provide incentives to employees to use outpatient facilities rather than hospitals by eliminating their deductibles and co-pays if they do.

See also: 3 Major Areas of Opportunity

Have more questions on how to become a forward-thinking leader on direct contracting in the benefits advisory space? Check out our

guide on direct contracting (be sure to download our whitepaper) and drop us any thoughts you have about DC.

There are too many arrows. There’s nothing “direct” about this model. It’s a dishonest contract: a relationship of three (or more if a vendor is involved), not the two that the name implies.

Yet many employee benefits brokers offer this type of arrangement, replete with the administrative fees that such an arrangement entails. Those fees can add up quickly. Say a benefits broker or vendor charges 10% of the cost of care for implementing the agreement and uses a TPA that charges 15% for facilitating the employer-physician relationship.

See also: 4-Step Path to Better Customer Contacts

The cost of a $20,000 knee surgery replacement would balloon to $25,000 because of unnecessary third-party fees, leaving less value for the employer and physician. Yes, using a preferred provider organization (PPO) that discounted off a $55,000 charge for inpatient knee surgery would be even worse. But creating a less-bad PPO network via an improper “direct” contract shouldn’t be the goal for employers.

The Right Way to Implement Direct Contracting

A DC agreement should look direct—like this.

There are too many arrows. There’s nothing “direct” about this model. It’s a dishonest contract: a relationship of three (or more if a vendor is involved), not the two that the name implies.

Yet many employee benefits brokers offer this type of arrangement, replete with the administrative fees that such an arrangement entails. Those fees can add up quickly. Say a benefits broker or vendor charges 10% of the cost of care for implementing the agreement and uses a TPA that charges 15% for facilitating the employer-physician relationship.

See also: 4-Step Path to Better Customer Contacts

The cost of a $20,000 knee surgery replacement would balloon to $25,000 because of unnecessary third-party fees, leaving less value for the employer and physician. Yes, using a preferred provider organization (PPO) that discounted off a $55,000 charge for inpatient knee surgery would be even worse. But creating a less-bad PPO network via an improper “direct” contract shouldn’t be the goal for employers.

The Right Way to Implement Direct Contracting

A DC agreement should look direct—like this.

Think of it this way: Once a direct contract is in place, it should remain in place if you, the benefits adviser, were to disappear tomorrow. That requires a great deal of forethought in how the DCs are written, but it’s the right way to implement direct contracting. Establishing a DC this way maximizes and preserves value between your clients and their physicians. That, in turn, goes a long way toward demonstrating your value and commitment to transparency as an adviser.

3 Tips to Help Ensure “Direct” Contracting

Real direct contracting has the potential to revolutionize the healthcare experience for employers by stripping out third parties that don’t add value. Your job as a benefits adviser is to ensure that DC is simplified, streamlined and truly direct. Here are a few tips on doing that:

Think of it this way: Once a direct contract is in place, it should remain in place if you, the benefits adviser, were to disappear tomorrow. That requires a great deal of forethought in how the DCs are written, but it’s the right way to implement direct contracting. Establishing a DC this way maximizes and preserves value between your clients and their physicians. That, in turn, goes a long way toward demonstrating your value and commitment to transparency as an adviser.

3 Tips to Help Ensure “Direct” Contracting

Real direct contracting has the potential to revolutionize the healthcare experience for employers by stripping out third parties that don’t add value. Your job as a benefits adviser is to ensure that DC is simplified, streamlined and truly direct. Here are a few tips on doing that: