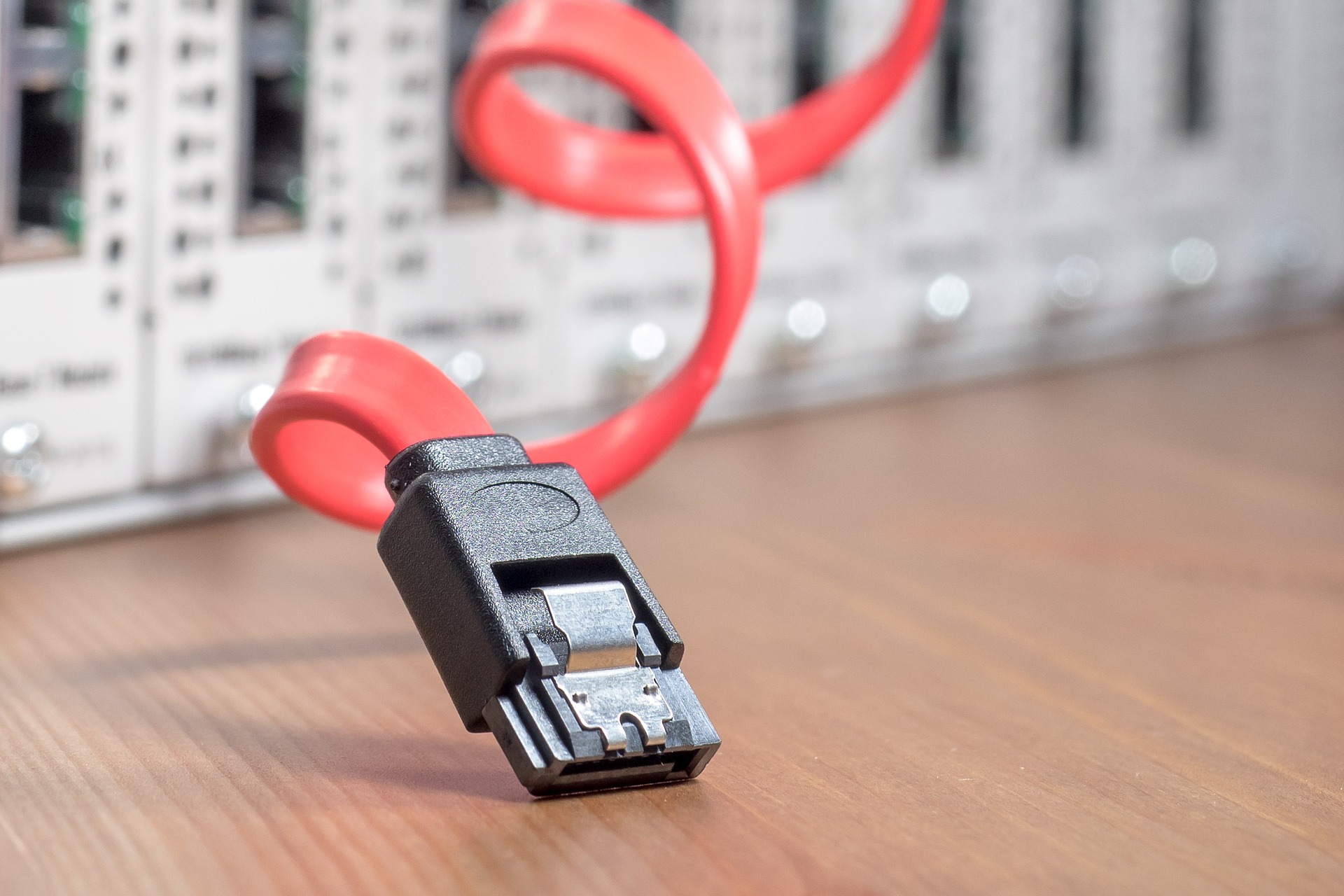

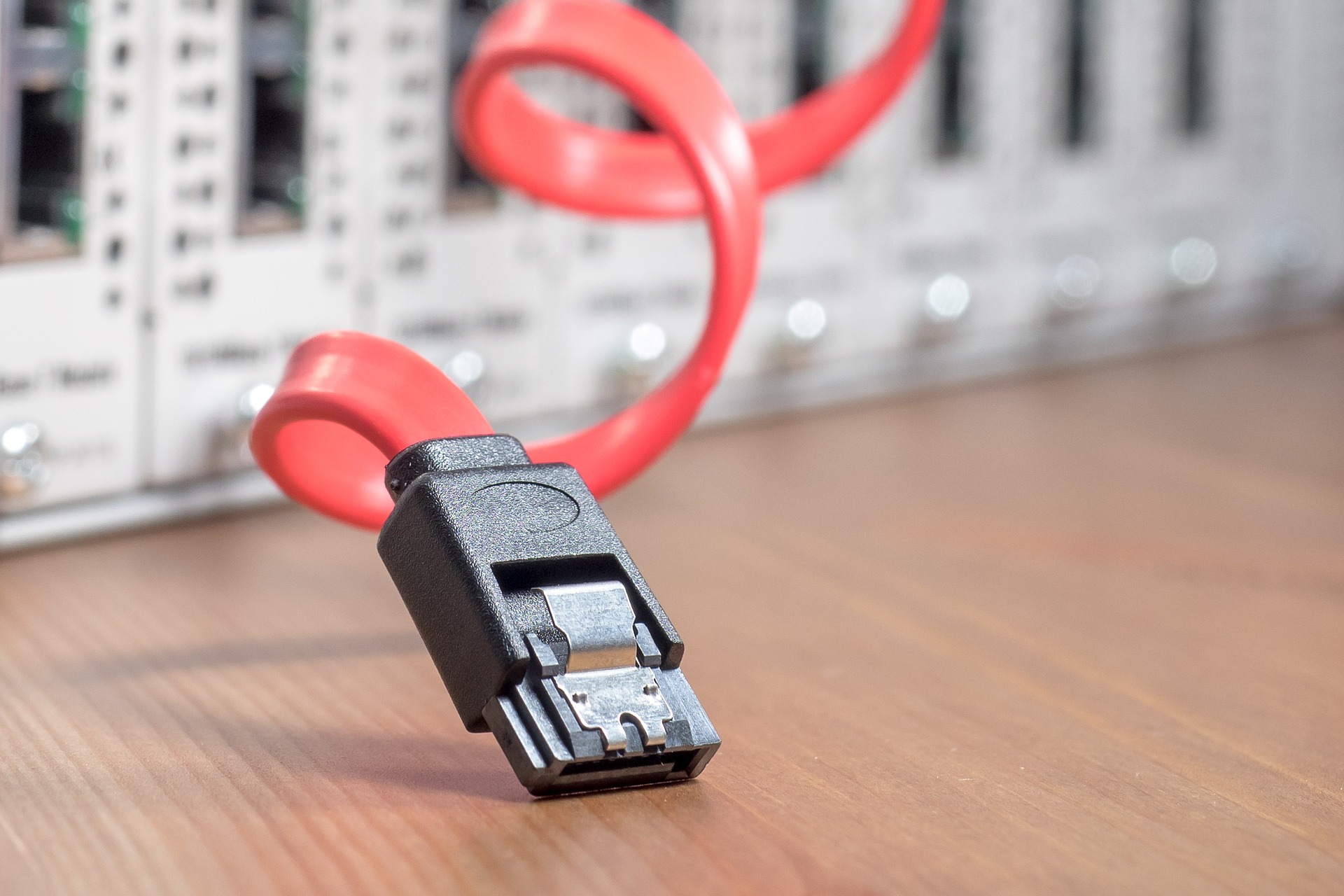

Why More Attacks Via IoT Are Inevitable

The attacks will likely become larger and more sophisticated, using hundreds of thousands of already-compromised devices.

The attacks will likely become larger and more sophisticated, using hundreds of thousands of already-compromised devices.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Your starting point is January 2017. Your destination is January 2020. There will be numerous hazards along the road.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

If too many people are unable to adapt quickly to rapid change, they will push back and create upheaval.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

If you think customer focus is enough, please stop, put your smartphone down and back away from the table.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

The question on new technology usually is: Why should we adopt it? A better question may be: What happens if you don't?

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

In North America, the lack of understanding of the new customer puts $1.4 trillion of premium at risk in L&A and P&C.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Research into 2,500 large corporate failures found that many big decisions are doomed as soon as they come off the drawing board.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Zeroing in on technical countermeasures first is looking at the problem upside-down. Culture is the place to start.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Byron Acohido is a business journalist who has been writing about cybersecurity and privacy since 2004, and currently blogs at LastWatchdog.com.

It is crucial to seize that window because, culturally, the newcomer has credibility and deference not usually afforded to existing employees.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Culture (the idea that “We’ve always done it this way”) and not technology stands in the way of an automated process -- and a breakthrough.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|