Q&A With Google on Innovation, Risk

"We’re not the 'no' team—we’re not here to tell our colleagues how not to do things. We’re trying to enable innovation."

"We’re not the 'no' team—we’re not here to tell our colleagues how not to do things. We’re trying to enable innovation."

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Everyone wants to close a workers' comp claim quickly. That can save money -- but works against attempts to head off fraud.

If you are involved with workers' comp claims in any way, you undoubtedly have a stable of great stories to tell. Maybe you've seen the guy who claims he can barely walk yet finds the strength to run in a marathon. Or maybe you’ve seen the claimant who says he has never had any prior workers' compensation claims yet knows the workers' comp procedures better than most attorneys.

Watch Out for Those Sprinklers

Sheyla White, an office worker from Florida, alleged a sprinkler hit her in the head in October 2015. Unfortunately for her, the entire “injury” was captured on video. The video shows White sitting at her desk as a sprinkler part falls from the ceiling onto her desk, missing her. She pauses for a moment, looks around the room and picks up the device, slamming herself in the head with it. You can watch the edited video yourself here.

See also: Why So Soft on Workers Comp Fraud?

White was convicted of workers' compensation fraud in May 2017 after the employer turned the video over to the Florida Division of Investigative and Forensic Services. Legend has it that a young Isaac Newton was sitting under an apple tree when he was bonked on the head by a falling piece of fruit -- a 17th-century “aha moment” that prompted him to come up with his law of gravity. In retrospect, White would be a happier woman today if the revelation she received following her self-inflicted hit on the head was: “Don’t commit workers' comp fraud.” Hindsight is always 20/20; for White, foresight would have avoided three to five in the slammer.

Workers' Comp Fraud Is Serious

Despite the fun one can have while watching White’s viral video premier, workers' comp fraud is serious business. It drives up costs to employers, adds to the backlog of pending claims and creates an atmosphere where even legitimate claims are often scrutinized. According to a recent study by Business Wire Magazine:

Most states have agencies devoted to workers' compensation fraud. These agencies investigate both fraudulent claimants (trying to steal workers' compensation benefits) as well as employers who refuse to pay lawfully owed benefits to injured workers.

Why Is Workers Comp Fraud Rarely Prosecuted?

Sheyla White was caught and convicted, but this is truly the exception rather than the rule. I’ll admit that, from my jaded perspective as a workers' comp defense attorney, I see a lot of fraudulent claimants who go unpunished. If you have spent any amount of time in the trenches, you’ll probably agree with me.

Here's the problem: When claims are pending, what is the desire of almost every employer and insurance carrier? It's: How quickly can we close the file? While this perspective is usually effective in reducing the cost of an open claim, it is not effective in prosecuting fraud. Why? The easiest way to close a claim quickly is to present evidence of fraud to the claimant’s attorney for the purpose of reaching a quick and reasonably priced settlement. Claim over. Done. Time to move on to the next claim. And yet, doesn’t this process simply encourage more fraud and abuse? If my daughter wrecks my car and tries to hide it from me, do I “punish” her with bags of money? Claimants are often rewarded for their bad behavior, not punished, and once the bragging on social media begins others, too, are encouraged to start their own fraud journey.

See also: Workers Comp Ensnares the Undocumented

The other problem is the level of proof that is often required by state agencies to prosecute workers' comp fraud. Sure, it was easy to go after Sheyla White because there was video that couldn’t have been better staged by Steven Spielberg himself. But what about the thousands of claims where sexy video is not available to guarantee a quick and easy prosecution? Un-prosecuted fraud, like rabbits in spring, simply creates more of its own kind. The benefits, though, of a significant reduction in workers' comp fraud would be like manna falling from heaven. Now that I think about it, a metaphor based on objects falling from the sky is probably not the best way to end this.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

J. Bradley Young is a partner with the St. Louis law firm of Harris, Dowell, Fisher & Harris, where he is the manager of the workers' compensation defense group and represents self-insured companies and insurance carriers in the defense of workers’ compensation claims in both Missouri and Illinois.

Wait, you mean that when the insurance companies and the government teamed up for Obamacare, they actually made some mistakes?

Whether Trump can actually fix Obamacare remains to be seen, but he was right about one thing: Insurance premiums are on the rise. It’s estimated that in 2017 premiums will go up by approximately 24%.

Insurance companies like Aetna and UnitedHealthcare are pulling out of some markets after reporting significant losses, and other companies are significantly reducing the plans they offer.

But why exactly is this happening? What are the root causes?

While the issue is certainly complex, we do know some of the reasons costs keep rising. Here are seven primary reasons why Obamacare isn’t quite what everyone hoped.

Two Things You Need To Know

Before we depress you and make you worry about the future, let us give you two semi-good pieces of news. It’s not all gloom and doom.

The Increases Primarily Affect Those Who Purchase Their Own Insurance

Whether Trump can actually fix Obamacare remains to be seen, but he was right about one thing: Insurance premiums are on the rise. It’s estimated that in 2017 premiums will go up by approximately 24%.

Insurance companies like Aetna and UnitedHealthcare are pulling out of some markets after reporting significant losses, and other companies are significantly reducing the plans they offer.

But why exactly is this happening? What are the root causes?

While the issue is certainly complex, we do know some of the reasons costs keep rising. Here are seven primary reasons why Obamacare isn’t quite what everyone hoped.

Two Things You Need To Know

Before we depress you and make you worry about the future, let us give you two semi-good pieces of news. It’s not all gloom and doom.

The Increases Primarily Affect Those Who Purchase Their Own Insurance

First, it’s important to note that the rise in premiums primarily affects those who are purchasing their own insurance, like those who are self-employed. If you live in cubicle land or work for the man, you probably won’t feel the brunt of the increase in premiums.

Also, if you get your insurance through Medicaid, Veterans Affairs or Medicare, you probably won’t see much increase in your premiums.

However, those who shop in the insurance marketplace will find themselves staring at steeply increasing premiums. For now, you may be able to work from a beach while sipping a mojito, but soon you may need to start drinking Bud Light. Let’s hope that doesn’t happen. You may not be working for the man, but you’ll giving more money to the man.

Those Who Are Willing to Shop Around Will Probably Be Relatively Safe

If you get a government subsidy to offset the cost of your insurance premiums and are willing to shop around for a new plan, you may not be hurt by the increase in premiums. There are various plans available in the insurance marketplace, some more expensive than others. If you’re willing to switch to a new plan, you can probably find one that doesn’t gouge you so deeply.

But this is one of the problems with Obamacare. It usually covers a narrow selection of doctors and hospitals, and if you switch plans you may need to find a new doctor. If you’ve got challenging or complex health issues, this can be a big deal, especially if a particular doctor has been treating you for years. Unfortunately, this means that those who are in the worst health may get hit the hardest by the rate increases.

If you don’t want to switch plans, you always have the option of becoming independently wealthy. Of course, this can be a bit more difficult than switching plans unless you happen to have a rich relative.

See also: How to Push Back on Healthcare Premiums

Now let’s talk about why premiums are going up.

Reason #1: Predictions Weren't Very Good

First, it’s important to note that the rise in premiums primarily affects those who are purchasing their own insurance, like those who are self-employed. If you live in cubicle land or work for the man, you probably won’t feel the brunt of the increase in premiums.

Also, if you get your insurance through Medicaid, Veterans Affairs or Medicare, you probably won’t see much increase in your premiums.

However, those who shop in the insurance marketplace will find themselves staring at steeply increasing premiums. For now, you may be able to work from a beach while sipping a mojito, but soon you may need to start drinking Bud Light. Let’s hope that doesn’t happen. You may not be working for the man, but you’ll giving more money to the man.

Those Who Are Willing to Shop Around Will Probably Be Relatively Safe

If you get a government subsidy to offset the cost of your insurance premiums and are willing to shop around for a new plan, you may not be hurt by the increase in premiums. There are various plans available in the insurance marketplace, some more expensive than others. If you’re willing to switch to a new plan, you can probably find one that doesn’t gouge you so deeply.

But this is one of the problems with Obamacare. It usually covers a narrow selection of doctors and hospitals, and if you switch plans you may need to find a new doctor. If you’ve got challenging or complex health issues, this can be a big deal, especially if a particular doctor has been treating you for years. Unfortunately, this means that those who are in the worst health may get hit the hardest by the rate increases.

If you don’t want to switch plans, you always have the option of becoming independently wealthy. Of course, this can be a bit more difficult than switching plans unless you happen to have a rich relative.

See also: How to Push Back on Healthcare Premiums

Now let’s talk about why premiums are going up.

Reason #1: Predictions Weren't Very Good

Wait, you mean when the insurance companies and the government teamed up, they actually made some mistakes? But they both have such sterling reputations for efficiency!

It turns out that the health insurance companies underestimated how much it would cost them to insure those who weren’t already covered. A 2015 report found that insurance companies lost $2.7 billion in the individual market, in part because they had to cover more claims than expected. Insurance companies aren’t really in the business of losing money, and now they’re scrambling to make up for what they lost.

On top of this, those patients who are the sickest generate about 49% of the healthcare expenditures. This unequal distribution of costs complicates the estimates and means some companies are losing money.

Now that insurance companies actually understand the pools of patients, they’re adjusting premiums to account for the actual costs, which are way higher than they estimated.

Reason #2: Insurance Companies Are Bailing Out

Leading the way in the “Things That Aren’t Surprising” category is that many insurance companies are discontinuing plans that lose money. Additionally, some companies such as United Healthcare and Aetna are completely exiting some markets, leaving very little competition. In some states, there is a single insurance provider, allowing it to raise rates without consequence.

In 2017, it’s expected that the number of healthcare providers will drop by 3.9% in each state. As we all learned in introductory economics, less competition equals higher prices.

Reason #3: Healthcare Costs a Lot

Wait, you mean when the insurance companies and the government teamed up, they actually made some mistakes? But they both have such sterling reputations for efficiency!

It turns out that the health insurance companies underestimated how much it would cost them to insure those who weren’t already covered. A 2015 report found that insurance companies lost $2.7 billion in the individual market, in part because they had to cover more claims than expected. Insurance companies aren’t really in the business of losing money, and now they’re scrambling to make up for what they lost.

On top of this, those patients who are the sickest generate about 49% of the healthcare expenditures. This unequal distribution of costs complicates the estimates and means some companies are losing money.

Now that insurance companies actually understand the pools of patients, they’re adjusting premiums to account for the actual costs, which are way higher than they estimated.

Reason #2: Insurance Companies Are Bailing Out

Leading the way in the “Things That Aren’t Surprising” category is that many insurance companies are discontinuing plans that lose money. Additionally, some companies such as United Healthcare and Aetna are completely exiting some markets, leaving very little competition. In some states, there is a single insurance provider, allowing it to raise rates without consequence.

In 2017, it’s expected that the number of healthcare providers will drop by 3.9% in each state. As we all learned in introductory economics, less competition equals higher prices.

Reason #3: Healthcare Costs a Lot

Remember last year when the price of EpiPens started skyrocketing and people were saying, “We’ll die without them!” and the producer said, essentially, “Well, it stinks to be you!”? People got rightfully upset because that was a pretty low move to pull.

Unfortunately, rising medical costs aren’t just happening to EpiPens. Generally speaking, medical costs have been rising at about 5% each year, but some think they’re going to go up even more. Unfortunately, Obamacare is at least partially to blame for this.

Newer treatments tend to be very expensive, and now even the sickest people have access to health coverage. This, in turn, means that they have access to the pricey treatments they never had access to before. As their expenses are covered, overall costs for all people are increased.

As Sean Williams wrote:

Remember last year when the price of EpiPens started skyrocketing and people were saying, “We’ll die without them!” and the producer said, essentially, “Well, it stinks to be you!”? People got rightfully upset because that was a pretty low move to pull.

Unfortunately, rising medical costs aren’t just happening to EpiPens. Generally speaking, medical costs have been rising at about 5% each year, but some think they’re going to go up even more. Unfortunately, Obamacare is at least partially to blame for this.

Newer treatments tend to be very expensive, and now even the sickest people have access to health coverage. This, in turn, means that they have access to the pricey treatments they never had access to before. As their expenses are covered, overall costs for all people are increased.

As Sean Williams wrote:

The reason insurers are coping with substantially higher costs for Obamacare enrollees is actually pretty easy to understand. Prior to Obamacare's implementation, insurers had the ability to handpick who they'd insure. This meant people with pre-existing conditions, who were potentially costly for insurers to treat, could be legally denied coverage. However, under Obamacare insurers aren't allowed to deny coverage based on pre-existing conditions.Now could be the time to begin experimenting with those homeopathic cures we’ve been hearing about all these years, like rubbing cucumbers on our feet or bathing in olive oil. Purchasing hundreds of gallons of olive oil is probably cheaper than premiums will be. See also: More Transparency Needed on Premiums Reason #4: Some Government Subsidies for Insurers Are Ending Since 2014, the government has provided some subsidies to marketplace insurers that cover higher-cost patients. These subsidies significantly reduced the cost to insurance companies and made them more inclined to work through the problems. But this program is ending in 2017, and it’s expected that premiums will go up 4% to 7% as a result. Reason #5: It’s Not Easy to Fix a Giant Market

Unfortunately, fixing a giant market like health insurance isn’t simple. This should surprise absolutely no one. First, the government is involved. Fixing anything government is always a nightmare, taking years of meetings, proposals and backroom deals. Second, the healthcare industry is involved, which is only slightly less unwieldy than the government.

Getting both of these entities to actually make progress is like trying to convince an elderly person that rock ‘n roll doesn’t sound like pots and pans banging together.

Lots of solutions have been proposed, but a single, straightforward solution has not been adopted.

Reason #6: The Market Is Smaller Than Expected

Chalk this one up to yet another miscalculation by the government. It turns out that significantly fewer people are enrolled in the insurance marketplace than expected. Like, 50% less.

Young adults in particular aren’t signing up, probably due to the fact that the penalty for not signing up has only been around $150.

A smaller market means that insurance companies can't absorb the cost of particularly ill patients as easily. In larger cities, enough people may enroll to spread out the risks, but in smaller areas insurance companies are hit hard.

This, of course, causes insurance companies to pull out, increasing the problem even more.

Reason #7: The Rules Aren’t Helping Things

Unfortunately, fixing a giant market like health insurance isn’t simple. This should surprise absolutely no one. First, the government is involved. Fixing anything government is always a nightmare, taking years of meetings, proposals and backroom deals. Second, the healthcare industry is involved, which is only slightly less unwieldy than the government.

Getting both of these entities to actually make progress is like trying to convince an elderly person that rock ‘n roll doesn’t sound like pots and pans banging together.

Lots of solutions have been proposed, but a single, straightforward solution has not been adopted.

Reason #6: The Market Is Smaller Than Expected

Chalk this one up to yet another miscalculation by the government. It turns out that significantly fewer people are enrolled in the insurance marketplace than expected. Like, 50% less.

Young adults in particular aren’t signing up, probably due to the fact that the penalty for not signing up has only been around $150.

A smaller market means that insurance companies can't absorb the cost of particularly ill patients as easily. In larger cities, enough people may enroll to spread out the risks, but in smaller areas insurance companies are hit hard.

This, of course, causes insurance companies to pull out, increasing the problem even more.

Reason #7: The Rules Aren’t Helping Things

One of Obama’s big selling points for his healthcare plan was that insurance companies wouldn’t be able to deny coverage to those with preexisting conditions. This sounds great in the public square but doesn’t always work well in reality.

Currently, the government forces insurance companies to cover people but doesn’t offer the companies assistance when their costs exceed their revenues. If an insurance company doesn’t think it will make money, it will pull out faster than Donald Trump says something ill-advised.

See also: A New Way To Pay Long Term Care Insurance Premiums – Tax Free!

Conclusion

One of Obama’s big selling points for his healthcare plan was that insurance companies wouldn’t be able to deny coverage to those with preexisting conditions. This sounds great in the public square but doesn’t always work well in reality.

Currently, the government forces insurance companies to cover people but doesn’t offer the companies assistance when their costs exceed their revenues. If an insurance company doesn’t think it will make money, it will pull out faster than Donald Trump says something ill-advised.

See also: A New Way To Pay Long Term Care Insurance Premiums – Tax Free!

Conclusion

It’s easy to be critical of Obamacare, but we should also recognize the great things it has achieved. Many people who would never have received medical coverage have been able to get the treatments they desperately wanted.

Will the problems be fixed? Let's hope. But as we’ve seen, creating a solution that works for both consumers and insurance companies isn’t easy.

This article originally appeared at Life Insurance Post and has been republished with the permission of lifeinsurancepost.com.

It’s easy to be critical of Obamacare, but we should also recognize the great things it has achieved. Many people who would never have received medical coverage have been able to get the treatments they desperately wanted.

Will the problems be fixed? Let's hope. But as we’ve seen, creating a solution that works for both consumers and insurance companies isn’t easy.

This article originally appeared at Life Insurance Post and has been republished with the permission of lifeinsurancepost.com.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

John Hawthorne is a health nut from Canada with a passion for travel and taking part in humanitarian efforts. His writing not only solves a creative need but has also led to many new opportunities when traveling abroad.

This week will be fairly quick, because I'm touring Civil War battlefields with my daughters, the younger of whom will soon launch into a senior thesis on some aspect of the war, and I have a long drive to Vicksburg in my immediate future. But I wanted to pass on one observation that surprised me, despite my having read dozens of books on the war over the years: Seemingly small innovations can make all the difference.

We've all heard that the generals fight the last war, and that certainly showed in early tactics in the Civil War, when the lines of infantrymen firing and reloading in turn would have looked familiar to George Washington. But the generals gradually learned the value of entrenchments, and here's where small differences mattered.

When Union Gen. Ulysses S. Grant attacked the Confederates at Cold Harbor as he finally closed in on the Confederate capital of Richmond, VA, in mid-1864, he had success on the first day, when the Confederates had only had time to dig the sort of shallow trenches that were common early in the war. Emboldened, Grant ordered an overwhelming assault by his 108,000-man army the next day. His commanders couldn't bring their troops to bear in time, but Grant went ahead with the attack the morning of the day after that. By this point, though, the Confederates had time to build the better trenches that had evolved during the war, and going from two-feet deep to four-feet deep made all the difference. (Many of these trenches were so sturdy that they're readily visible more than 150 years later.) Grant's forces suffered 3,000 to 7,000 casualties in no time—the chaos made the number unusually hard to count—while throwing themselves against what turned out to be impenetrable barriers. One Confederate soldier who had been at the center of the attack wrote that it ended so fast that he barely knew anything had happened.

Mark Twain once said, "The difference between the right word and the almost right word is the difference between lightning and a lightning bug." And, in my experience, the same is true of innovation. I know a guy who almost invented the iPad (his startup was 10 years early) and almost founded eBay (his auction site took delivery of goods and shipped them, rather than just facilitating transactions, as eBay did).

The only way to increase your odds of finding lightning, not a lightning bug, is to experiment relentlessly, with as many possible combinations as you can. All sorts of small things—product features, user experience, etc.—can mean the difference between success and failure.

Until next week, here's wishing you a four-foot-deep trench, not a two-foot-deep one, as you innovate in this season of great change in the insurance world.

Cheers,

Paul Carroll,

Editor-in-Chief

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Paul Carroll is the editor-in-chief of Insurance Thought Leadership.

He is also co-author of A Brief History of a Perfect Future: Inventing the Future We Can Proudly Leave Our Kids by 2050 and Billion Dollar Lessons: What You Can Learn From the Most Inexcusable Business Failures of the Last 25 Years and the author of a best-seller on IBM, published in 1993.

Carroll spent 17 years at the Wall Street Journal as an editor and reporter; he was nominated twice for the Pulitzer Prize. He later was a finalist for a National Magazine Award.

This is not a question of which oversight is more appropriate, federal or state, but whether the status quo should be allowed to continue.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Bruce Heffner is general counsel and managing member for Boomerang Recoveries. He is an attorney with substantial business experience in insurance and reinsurance, underwriting, claims, risk management, corporate management, auditing, administration and regulation.

Microinsurance is a transversal opportunity for insurers to get closer to their clients, offering the right coverage at the right time.

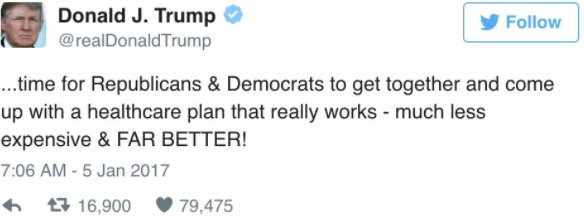

Above, you can see a good matrix that shows how some of the players are positioned on the market based on their sales approach and their distribution model. You’ve got the group in the lower left corner that has more of a standard pull approach regarding their customers and has stand-alone solutions, in most cases based on their own mobile app solutions. I am of the opinion that integration with partners in a plug-and-play approach is much more efficient in reaching potential customers out there.

By looking at the lower right corner, you can see how there are many solutions of this type but still using a pull commercial approach. Now the interesting part is when you start to mix the two sales approaches (between pull and push) and you get the well-known Asian insurer Tokio Marine, which has been on the market with its microinsurance solutions since 2010.

And finally we get to the upper right corner, where you can see the logo of Neosurance, the insurtech startup that I co-founded a little over a year ago. I personally believe that it’s really well-positioned based on the criteria that I find to be particularly relevant on the market today: selling microinsurance via push notifications that are sent to the user in an intelligent way thanks to an artificial intelligence machine learning system. Plus you’ve got great reach through the use of existing communities (they have their own mobile applications) with users that have homogenous interests.

We must consider a statement regarding the industry that has proven true for the last decades: “Insurance purchase is not exciting; insurance is sold not bought!”

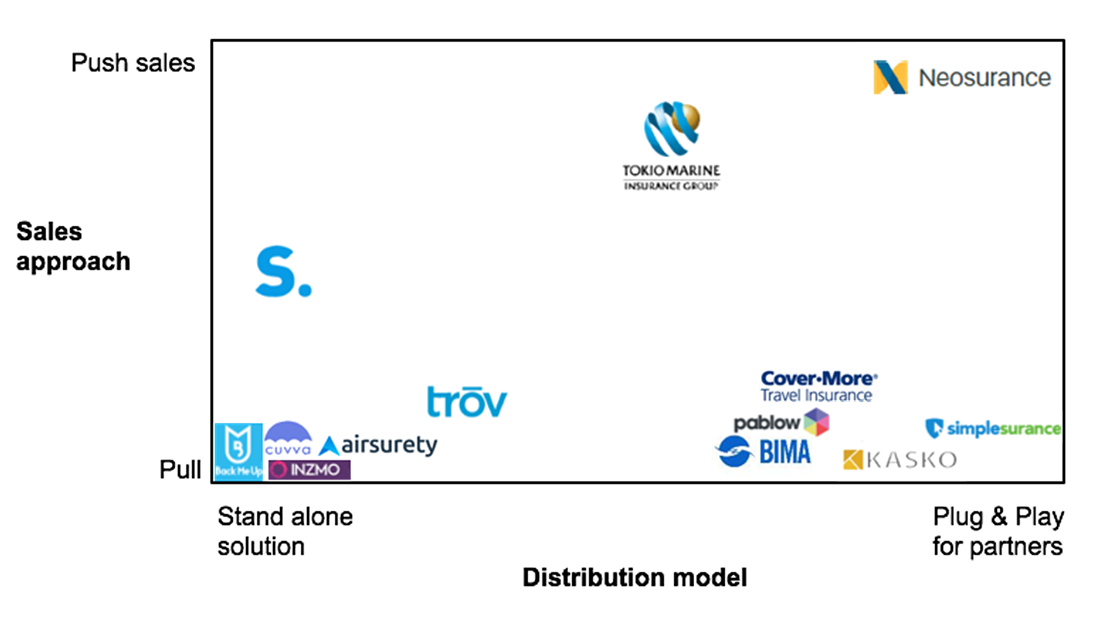

The average attention human span has been dropping: from 12 seconds in 2000, to 8 seconds in 2013. We’re slowly transforming into pretty goldfish, happily living in our bowls.

Above, you can see a good matrix that shows how some of the players are positioned on the market based on their sales approach and their distribution model. You’ve got the group in the lower left corner that has more of a standard pull approach regarding their customers and has stand-alone solutions, in most cases based on their own mobile app solutions. I am of the opinion that integration with partners in a plug-and-play approach is much more efficient in reaching potential customers out there.

By looking at the lower right corner, you can see how there are many solutions of this type but still using a pull commercial approach. Now the interesting part is when you start to mix the two sales approaches (between pull and push) and you get the well-known Asian insurer Tokio Marine, which has been on the market with its microinsurance solutions since 2010.

And finally we get to the upper right corner, where you can see the logo of Neosurance, the insurtech startup that I co-founded a little over a year ago. I personally believe that it’s really well-positioned based on the criteria that I find to be particularly relevant on the market today: selling microinsurance via push notifications that are sent to the user in an intelligent way thanks to an artificial intelligence machine learning system. Plus you’ve got great reach through the use of existing communities (they have their own mobile applications) with users that have homogenous interests.

We must consider a statement regarding the industry that has proven true for the last decades: “Insurance purchase is not exciting; insurance is sold not bought!”

The average attention human span has been dropping: from 12 seconds in 2000, to 8 seconds in 2013. We’re slowly transforming into pretty goldfish, happily living in our bowls.

So the insurer has to address the current context, which has dramatically changed with the arrival of mobile and then smartphone technology. Get the customer’s attention by using the same channels that they use and talk to them in their language.

Insurance should adapt to the customer’s habits and environment. The best way to do that in my opinion is by selling microinsurance that has a short duration with a push approach. Know what the customer needs before he or she does! Then you’ll be able to give the right insurance coverage, when the clients need it, directly on their smartphones. The trick here is being able to avoid annoying the customers with offers that do not interest them directly, in the wrong moments. To avoid that ,you would need to use a system that can give you insight into the lifestyle and preferences of the users.

A good microinsurance solutions has to be able to create a seamless digital customer experience by reading and interpreting customer behaviors and emotions. The aim here is to create a win-win situation for customers and insurers alike. And push microinsurance has just what it takes. For customers: always close at hand when they need to be protected, with the possibility of buying personalized microinsurance on the spot directly from the smartphone. For the insurer, it’s still very much uncharted territory to be explored but can also raise profitability levels significantly while avoiding moral hazard. This comes as a consequence of having a digital salesforce that sells insurance in a smart way because of AI and machine-learning capabilities and can reach the connected generation right where they like to spend most of their time: on their smartphones.

See also: Microinsurance Has Macro Future

Recent studies reported that millennials are currently the most underinsured generation and are the least likely to have health, rental, life and disability insurance.

So, what’s the magical combination for winning their attention? The key is to reach them with the right message, at the right time, on a device where they swipe, tap and pinch 2,617 times a day: their smartphone. Moreover, millennials are just the tip of the iceberg: The "connected generation" is the single most important customer segment. Empowered by technology, they search out authentic services that they use across platforms and screens, whenever and wherever they can.

We believe in a new distribution paradigm for the insurance sector: to stimulate the emotional need of protection, when the insurance coverage is not compulsory. Our artificial intelligence engine delivers a push suggestion at the right time with the right offer to provide a simple solution to this protection need, a promise easy to understand and convenient to purchase. We work with insurers and reinsurers to create insurance propositions while developing a streamlined purchasing process.

So the insurer has to address the current context, which has dramatically changed with the arrival of mobile and then smartphone technology. Get the customer’s attention by using the same channels that they use and talk to them in their language.

Insurance should adapt to the customer’s habits and environment. The best way to do that in my opinion is by selling microinsurance that has a short duration with a push approach. Know what the customer needs before he or she does! Then you’ll be able to give the right insurance coverage, when the clients need it, directly on their smartphones. The trick here is being able to avoid annoying the customers with offers that do not interest them directly, in the wrong moments. To avoid that ,you would need to use a system that can give you insight into the lifestyle and preferences of the users.

A good microinsurance solutions has to be able to create a seamless digital customer experience by reading and interpreting customer behaviors and emotions. The aim here is to create a win-win situation for customers and insurers alike. And push microinsurance has just what it takes. For customers: always close at hand when they need to be protected, with the possibility of buying personalized microinsurance on the spot directly from the smartphone. For the insurer, it’s still very much uncharted territory to be explored but can also raise profitability levels significantly while avoiding moral hazard. This comes as a consequence of having a digital salesforce that sells insurance in a smart way because of AI and machine-learning capabilities and can reach the connected generation right where they like to spend most of their time: on their smartphones.

See also: Microinsurance Has Macro Future

Recent studies reported that millennials are currently the most underinsured generation and are the least likely to have health, rental, life and disability insurance.

So, what’s the magical combination for winning their attention? The key is to reach them with the right message, at the right time, on a device where they swipe, tap and pinch 2,617 times a day: their smartphone. Moreover, millennials are just the tip of the iceberg: The "connected generation" is the single most important customer segment. Empowered by technology, they search out authentic services that they use across platforms and screens, whenever and wherever they can.

We believe in a new distribution paradigm for the insurance sector: to stimulate the emotional need of protection, when the insurance coverage is not compulsory. Our artificial intelligence engine delivers a push suggestion at the right time with the right offer to provide a simple solution to this protection need, a promise easy to understand and convenient to purchase. We work with insurers and reinsurers to create insurance propositions while developing a streamlined purchasing process.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Andrea Silvello has more than 10 years of experience at internal consulting firms, such as BCG and Bain. Since 2016, Silvello has been the co-founder and CEO of Neosurance, an insurance startup. It is a virtual insurance agent that sells micro policies.

Some startups list their fees on the company website and clearly evidence commissions on customer quotes.

This level of detail provides the customer with highlights of financial arrangements and improves financial transparency in the customer-broker-insurance company relationship.

The future of transparency?

Even though the insurtech industry has been progressing very swiftly, not every major insurtech startup is a roaring success. SME customers can now compare commercial insurance products and services on offer, while improving their knowledge of products and service costs.

See also: Is Transparency the Answer in Healthcare?

Commercial insurance brokers can lead transparency efforts by initiating frank conversations with customers about the true costs of products and customer-specific services and negotiate commissions and fees accordingly. However, as noted in my previous operations and product development articles, brokers, insurers and reinsurers must simultaneously review existing operations to create better efficiencies, reduce costs and improve customer services. These changes can be achieved through cutting-edge transformation programs, investment in new technologies or partnerships with insurtech companies.

Why is a simultaneous review important? Because customers are not only bearing the costs of current broker commissions and fees via premium payments, they are also bearing the high costs of supporting antiquated commercial insurance operations. Let’s improve all levels of service and transparency in the commercial insurance buying cycle and help customers make better informed decisions!

This level of detail provides the customer with highlights of financial arrangements and improves financial transparency in the customer-broker-insurance company relationship.

The future of transparency?

Even though the insurtech industry has been progressing very swiftly, not every major insurtech startup is a roaring success. SME customers can now compare commercial insurance products and services on offer, while improving their knowledge of products and service costs.

See also: Is Transparency the Answer in Healthcare?

Commercial insurance brokers can lead transparency efforts by initiating frank conversations with customers about the true costs of products and customer-specific services and negotiate commissions and fees accordingly. However, as noted in my previous operations and product development articles, brokers, insurers and reinsurers must simultaneously review existing operations to create better efficiencies, reduce costs and improve customer services. These changes can be achieved through cutting-edge transformation programs, investment in new technologies or partnerships with insurtech companies.

Why is a simultaneous review important? Because customers are not only bearing the costs of current broker commissions and fees via premium payments, they are also bearing the high costs of supporting antiquated commercial insurance operations. Let’s improve all levels of service and transparency in the commercial insurance buying cycle and help customers make better informed decisions!

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

David V. Cabral is the founder and managing director of Artemis Specialty Ltd., a consulting firm that helps clients develop new products, reduce risk, improve operational efficiencies and increase profits.

Even though the insurtech industry has been progressing very swiftly, not every major insurtech startup is a roaring success.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Robin Roberson is the managing director of North America for Claim Central, a pioneer in claims fulfillment technology with an open two-sided ecosystem. As previous CEO and co-founder of WeGoLook, she grew the business to over 45,000 global independent contractors.

It’s hard to play in the same game on workers' comp when one of you is at Dodger Stadium in L.A. and the other is at Angel Stadium in Anaheim.

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Teddy Snyder mediates workers' compensation cases throughout California through WCMediator.com. An attorney since 1977, she has concentrated on claim settlement for more than 19 years. Her motto is, "Stop fooling around and just settle the case."

In most organizations and most cultures, change management is not about the change; it’s all about the management (control of change).

Get Involved

Our authors are what set Insurance Thought Leadership apart.

|

Partner with us

We’d love to talk to you about how we can improve your marketing ROI.

|

Mike Manes was branded by Jack Burke as a “Cajun Philosopher.” He self-defines as a storyteller – “a guy with some brain tissue and much more scar tissue.” His organizational and life mantra is Carpe Mañana.