Transparent health reinsurance may now emerge as one crucial and in all probability uncontemplated reform of the government shutdown crisis. The shutdown drew attention to a perfect storm: legislators, impotent to distribute patronage to donors and sponsors dependent on a malfunctioning health care system animated by the best of intentions as Congresswoman Nancy Pelosi (D-Calif.) pointed out in the House recently yet now so overburdened with special interest profit taking that it fails too many participants.

Transparent health reinsurance fills a missing link achieving health freedom and presents nonpartisan solutions addressing Democratic leadership challenges to Republican Senate and House majorities to bring forward workable healthcare policy.

Traditional reinsurance affords risk transfer, often with defined risk exposure parameters, percentages, and ratios for certain lines of risk (treaty reinsurance), facilitates specified claim reimbursements, and frees insurer capital, otherwise set aside for catastrophic claims, for investment. And, it accommodates negotiated deal making for specific policies an insurer may seek to reinsure (facultative reinsurance). It typically mitigates insurer exposure for large scale natural disasters and sustains reinsurer solvency during incidents impelling insurer reimbursements for exceptionally catastrophic claims.

Transparent health reinsurance, by contrast, assures, constitutes, and advances marketplace solutions to "managing risk in connection with healthcare costs," absorbing applicants, and legislating and implementing public policy in synch with technology and the times. The approach is equally ideal for health freedom as it is for remediating current, partisan, patronage system shortfalls.

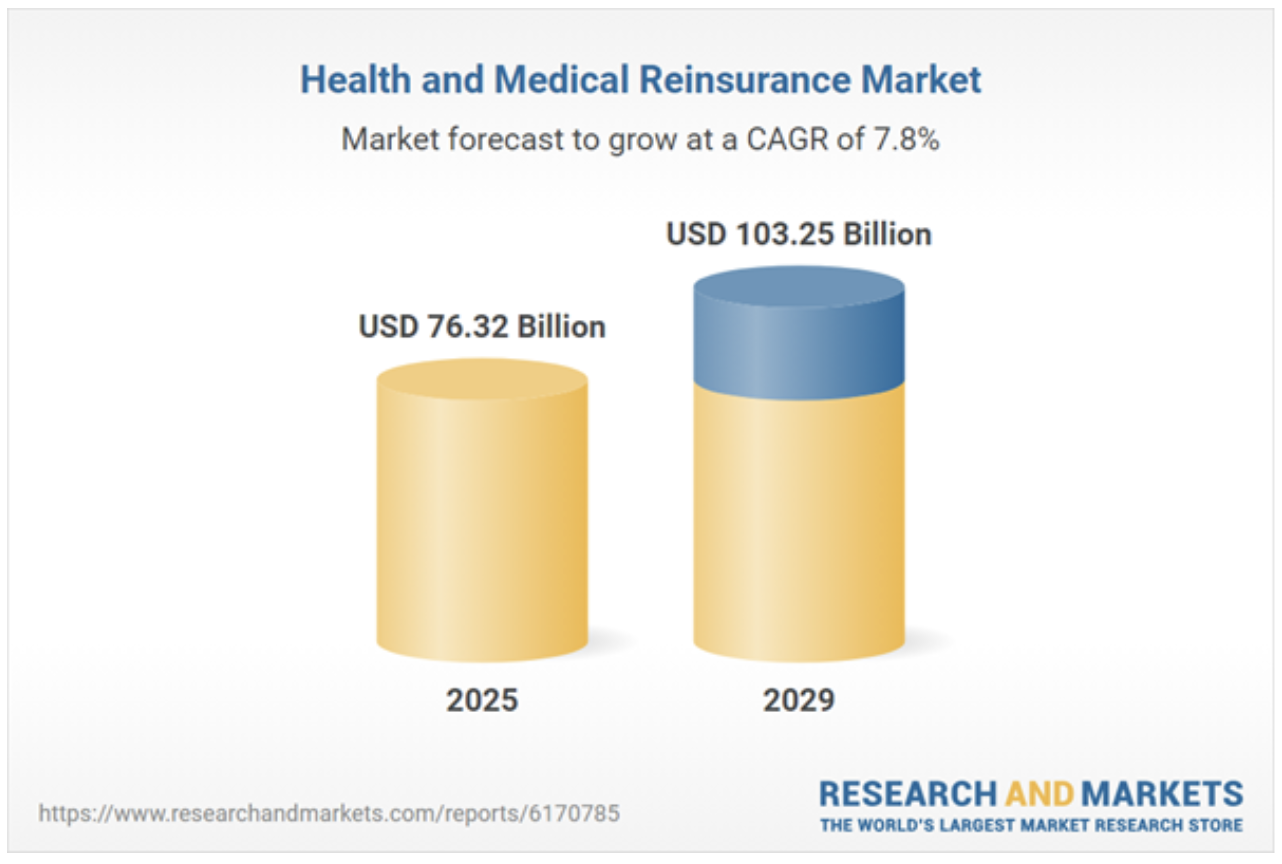

Timing could not be more propitious. Health and Reinsurance Market Report 2025, a Research and Markets expert report, forecasts that "health and medical reinsurance market size… will grow to $103.25 billion in 2029 at a compound annual growth rate (CAGR) of 7.8%. In the forecast period, growth is expected to be supported by the expanding adoption of digital health platforms, increasing demand for customized reinsurance models, greater participation by self-insured employers, a stronger focus on financial risk mitigation, and rising awareness of reinsurance benefits among smaller insurers. Key trends anticipated include innovations in underwriting models, the development of AI-powered risk assessment tools, increased investment in data analytics and automation, and advancements in health claim management systems."

Transparent health reinsurance, in consequence, now embodies an instance in which corporate and public interests align for consumer welfare.

Health reinsurance innovators enjoy appreciable investment opportunities. "At Qatar Investment Authority [Qatar's sovereign wealth fund], we believe healthcare investments should aim to solve big problems for societies – and the businesses that are doing this are the ones that should thrive and survive…. QIA…can provide patient capital…This long-term approach to growth works best for our partners and aligns with our mandate," Dr. Mohamad Ghanem, QIA healthcare head, observes.

Market liberalization through transparent health reinsurance would also achieve President Trump's vision of empowering citizens to become entrepreneurs with their health care. Transparency animates voluminous data markets, which would enable all market participants to monetize the value of their information. These liberalizations should generate new revenues for all participants.

"Affordability" characterizes contemporaneous sensibilities, and transparent health reinsurance expedites and decongests easy passes to reasonable costs, rational profits, competitive prices, and high quality.

For instance, transparent health reinsurance could compensate outcomes. So doing would provide incentives for physicians to treat and cure patients.

Instead, contemporaneous health insurance compensates services. Just about everything palliates symptoms and protracts illness while patients struggle to get and be well.

As importantly, transparent health reinsurance can initiate systemic reforms by creating and rationalizing markets to address cost and price, key Trump Administration goals and concerns. So doing would liberate and empower all participants to loosen and break the shackles of current health insurance by vastly increasing market reach, size, and variety.

Like the old saw that doing good is doing well, transparent health reinsurance creates wide varieties of new products for the insurance and reinsurance industries 1) rewarding physician, health care provider, institution and hospital supply, and 2) responding to health care consumer demand.

For instance, transparent health reinsurance could broaden insurance coverage for homeopath physicians, whose remedies are often as, if not more, effective than allopathic pharmaceuticals at a fraction of those costs achieving timely cures rather than dependencies on recurrent symptomatic treatments.

There would, of course, be some heavy lifting. Homeopathy is all constitutional while allopathy focuses on addressing and, ideally, curing symptoms afflicting specific systems in one's body. So, pricing and coding integrating homeopathy would have to be conceptualized and tested, and it would have to achieve practitioner, insurance industry and patient consensus and adoption.

National Institutes of Health Director Jay Bhattacharya is especially insightful on systemic health reform in a wide ranging conversation.

The current state of health insurance is vastly more expensive than the original 2010 legislation. Key Obamacare risk coverage, notably risk corridors, went by the wayside. Premiums, point of service costs, and taxes are all higher. Legislator and regulator are each distinctly prey to industry capture. And, going forward, ever ballooning taxpayer contributions and higher health care insurance prices loom.

Unless we do something.