12.5% of U.S. GDP passes through the ports, and the labor dispute could get worse.

With spring fast approaching, the continuing labor dispute at 29 West Coast ports could affect the ability of suppliers and retailers to stock seasonal merchandise. The backlog of ships at these ports — exacerbated in some instances by work slowdowns and closures — has delayed deliveries of agricultural and manufactured inputs and goods, depleted inventories and potentially harmed businesses across several industries.

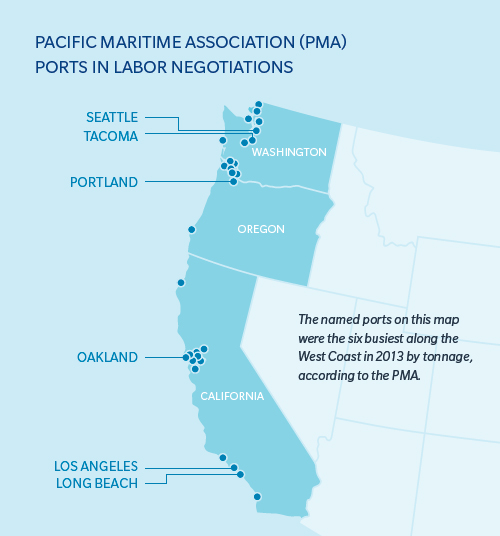

This situation has resulted from a seven-month impasse between the International Longshore and Warehouse Union and the Pacific Maritime Association, which represents shipping lines and port terminal operators, following the expiration of their labor contract. The White House dispatched Labor Secretary Thomas Perez to San Francisco to reinvigorate negotiations, which resumed on Feb. 17. Previous talks had stalled over the process for arbitrating allegations of work slowdowns, discrimination and other issues.

The economic damage from port disruptions could be significant. According to the National Retail Federation, cargo moving through the 29 involved ports represents 12.5% of U.S. gross domestic product. In recent earnings calls, several publicly traded retailers have identified the labor impasse as a potential risk, noting the possible impact on seasonal merchandise. Food and beverage distributors, meanwhile, have reported that port delays have led to spoilage of perishables. And parts shortages attributed to congestion at West Coast ports have led some auto manufacturers to announce plans to halt or cut back production.

Although the reinvigorated talks have brought some hope for a quick resolution, retailers and other affected businesses should still consider taking steps to mitigate potential losses from continued disruptions and future work slowdowns, stoppages, or strikes. Specifically, you should:

- Diversify your supply chain. The work slowdowns and port closures, coupled with the potential for a strike, have led many businesses to diversify their ports of entry, turn to domestic suppliers or make raw material and finished product substitutions as necessary. Although such actions may bring financial and other costs, they may enable your company to remain competitive until the dispute is resolved. If you have identified alternate suppliers or workaround procedures, consider implementing those strategies and engaging additional or alternate resources now. If you have not identified such resources, now is the time to do so.

- Develop crisis management and business continuity strategies. If they are not already significant, the business implications for your organization may soon become so. Consider activating your crisis management and other business incident response teams. Your teams should think about the immediate impacts and workarounds from the current situation and forecast potential impacts should these interruptions continue or a strike occur, allowing a strategy to be developed and executed.

- Review your insurance coverage. Some insurance coverage — such as marine cargo and property damage policies with extensions for business interruption (BI) and contingent business interruption (CBI) — may only respond in the event of a strike or port disruption where there is also actual physical damage to insured cargo or property. Your organization should review whether it has or consider obtaining the following additional coverage options:

- Voyage frustration endorsements to marine cargo policies, which can provide coverage for ground transportation costs and other extra expenses in the event that a shipment is diverted to an alternative port. Such endorsements do not typically provide indemnity for lost sales, contractual penalties or other financial losses.

- “Seasonal merchantability” coverage, which can sometimes be added to marine cargo policies. This coverage provides indemnification for actual loss in sales as a result of a delay in arrival of goods but may not respond in the event of a strike and usually comes with a lengthy waiting period.

- Trade disruption insurance (TDI), supply chain insurance and specialty BI insurance policies, which can protect against supply chain disruptions resulting from a variety of causes, including embargoes, acts of terrorism, windstorms and other natural catastrophes, supplier bankruptcy and other events.

For more information, read

West Coast Port Disruptions: Insurance and Risk Management Implications.