AUGUST 2021 FOCUS OF THE MONTH

Cognitive Technologies

FROM THE EDITOR

Cognitive computing is a funny beast. Every time you hit your target, you find that another pops up off in the distance.

When I first saw a demonstration of speech recognition, some 30 years ago, I was mightily impressed that the computer understood a few words. If I had seen what would be possible today, I'd have been stunned. But now? Oh, that's just Siri or Alexa. And why didn't auto-correct guess exactly what I wanted to say?

Something like artificial intelligence is also hard to get our heads around because of the halo it has. At a mention of AI, we tend to think of some all-knowing creature that can solve all our problems. (Or we think of some dystopian scenario such as those in Minority Report or War Games, where an AI run amok could overwhelm humanity.)

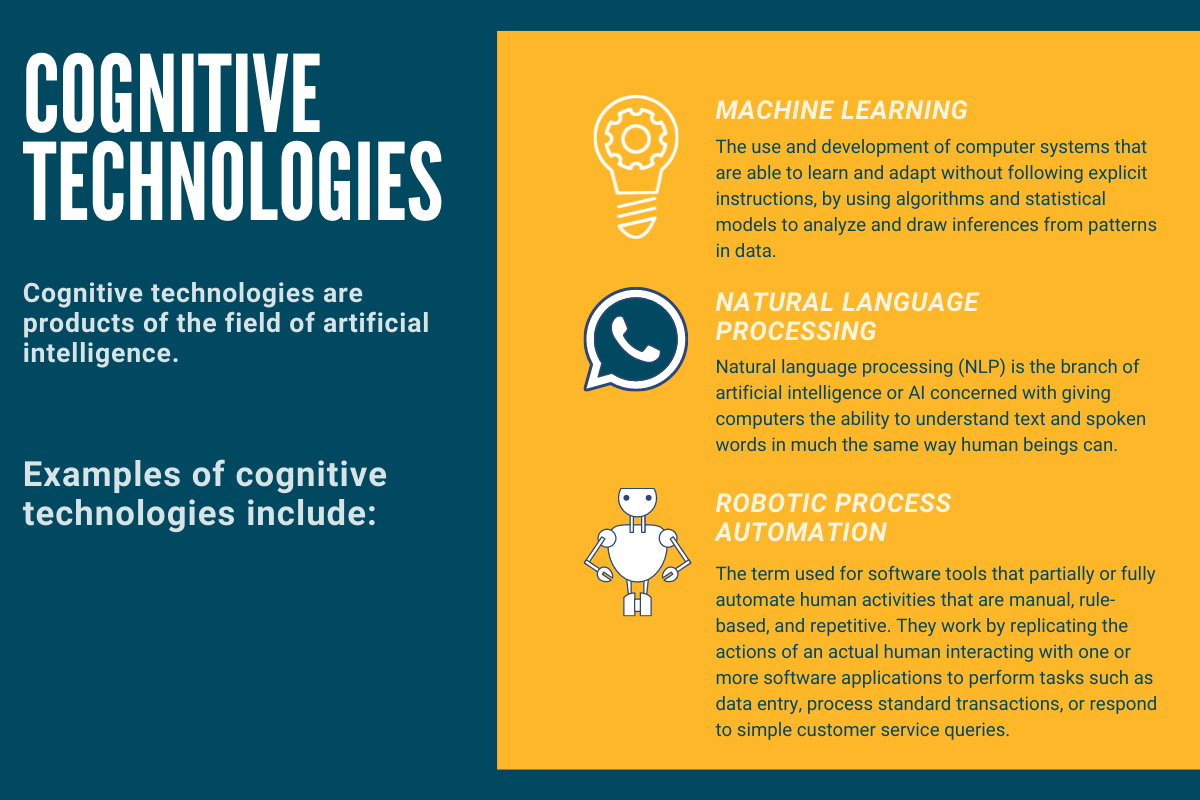

In fact, AI and other cognitive computing techniques such as machine learning and advanced data analysis are simply tools. They are remarkably powerful tools, perhaps the most important we have, but they are just tools. Sometimes, they don't even work -- lots of attempts to use AI to predict the course of the pandemic failed because there just wasn't enough known about the virus to provide the right data to the computers.

Fortunately, the insurance industry seems to be coming to grips with cognitive computing and using the techniques to address specific problems and opportunities, rather than viewing cognitive computing as an all-encompassing solution. The tools are addressing specific issues in underwriting and claims, by incorporating data from new sources and generally speeding the process. The tools are allowing for better understanding of customers, especially as more of the interactions with them are digitized, providing loads of data for analysis. And so on.

I'm optimistic that we'll solve those problems soon. And then it'll be time for the next set.

- Paul Carroll, ITL's Editor-in-Chief

6 QUESTIONS FOR JIM MCKENNEY

WHAT TO READ

WHO TO KNOW

Get to know this month's FOCUS article authors:

Christophe

|

Matteo

|

Isabelle

|

Ryohei

|

Karin

|

Simon

|

Sathyanarayanan

|

Interested in sponsoring ITL Focus or learning about other promotional opportunities? Contact us