Acquiring a new insurance customer takes effort. Well-thought-out advertising campaigns, cold sales outreach, and personalized discounts are primary levers for building trust and expanding the customer base. This is a time-consuming and costly affair. That's why, over the last few years, customer acquisition costs have risen by 222%. And brands today lose an average of $29 per new customer, up from $19 a decade ago.

While the exact figures may vary, especially for a highly variable expense such as insurance, one thing is clear. All that effort can be undone by just one negative claim experience. A recent policy research report by Which? exploring consumers' experiences of the insurance claims process found that:

- 48% making a claim experienced at least one issue

- 28% consumers felt their insurer's actions were unjust

- 24% said they didn't understand why their claims got rejected

The message is clear: a single bad claim experience can erode trust, trigger churn, and damage a brand's overall reputation, especially in health insurance. A claim denial can occur due to errors in paperwork, missing documents, undisclosed pre-existing conditions, or other technical reasons. But there's no question that denial is brutal.

In this article, we explore why claims experience often matters more than customer acquisition, especially in health insurance, and how insurers can prioritize it.

The Reality of Claims Experience in Healthcare Insurance

Policyholders need clarity, trustworthiness, responsiveness, and timely claim settlements. Instead, they often get a claims stage that is marred by delays, manual paperwork, opaque communication, lack of explainability, and even denials.

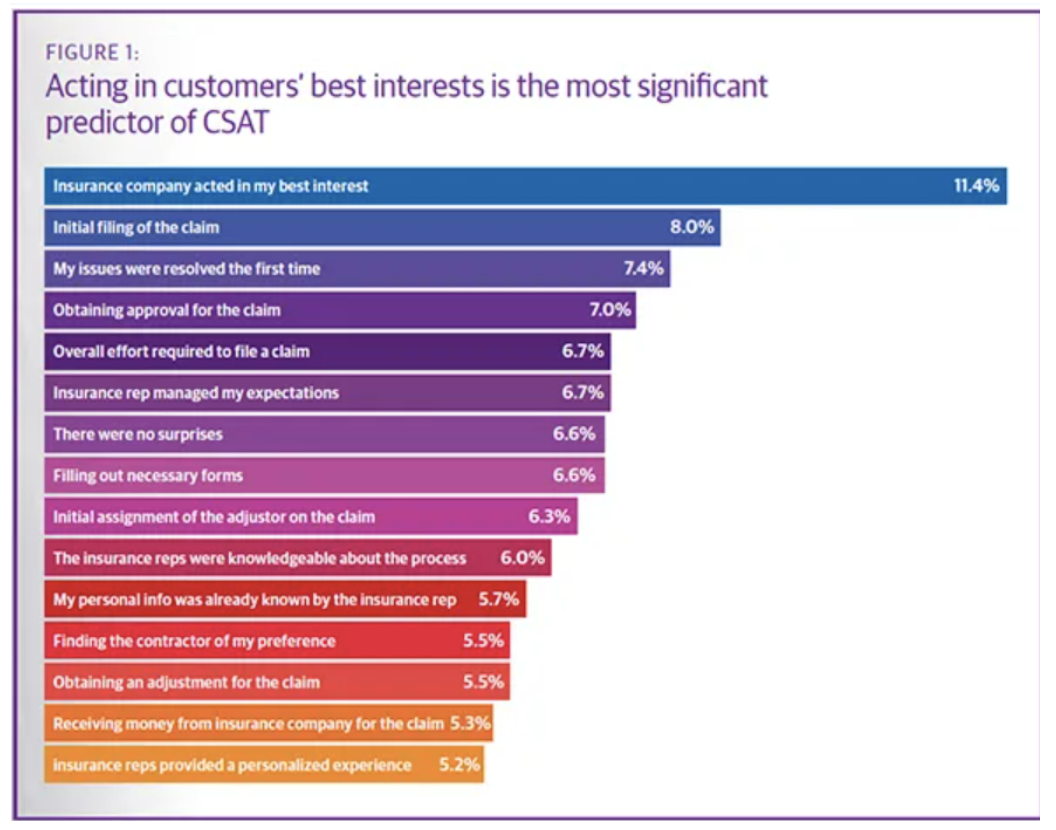

The TeleTech P&C Customer Satisfaction Survey highlights multiple factors, including how policyholders are treated, channel interactions, and the overall claims process. The most influential was, "my insurance company acted in my best interest."

Source: TeleTech Survey

This is the potential of a good customer journey, being there for the customer when they need you the most.

Where the Challenge Lies

It's not that insurers don't want to deliver superior customer experiences. However, that's just not possible today while operating on legacy CRM tools or spreadsheets. Processes are outdated, require repeated re-entry of customer data, are prone to errors, and are time-consuming. Also, these legacy, disparate systems offer no real-time insights into customer behavior or interactions, leaving insurers to guess based on historical patterns rather than available data, and customer behavior is dynamic and constantly evolving today.

The digital appetite is growing exponentially. Customers demand 24/7 brand availability. Customers want a self-service, AI-assisted portal. Instead of spending minutes on hold and then repeating every detail, they can now submit a claim through a conversational AI that's integrated with an insurance database and auto-populates the most relevant information. Also, this can help them check claim status in real-time, instead of calling up the agent to inquire about progress. This even empowers the employees, who can then focus on more innovative and complex tasks that machines can't replicate, like approving claims faster, offering empathy and transparency, and building stronger customer relationships.

AI-powered healthcare claims processing software can help. It streamlines claims processing, reduces administrative burden, and minimizes claim denials. With AI-driven insights and rule-based processing, insurers and providers can achieve a real-time, 360-degree integrated customer view, enabling them to take strategic initiatives to improve the customer experience.

Financial and Strategic Benefits of Prioritizing Claims Experience

Higher renewal rates and customer lifetime value (CLTV):

For health insurers, policy renewals constitute a significant source of recurring revenue. An insurer that is trusted in the market due to its higher claims settlement ratio, lowest rejection rate, and transparent communications will face far fewer challenges at renewal. This is far more effective than chasing individuals over calls, WhatsApp, or email, and it increases CLTV and brings predictable revenue streams.

Lower operational costs over time

Integrating new technology into a complex insurance process may seem complicated and costly, but a phased implementation can make it manageable, scalable, and beneficial. Unlike the traditional claims processing cycle, which involves manual paperwork, long wait times, and multiple checks, modern automated workflows lower operational overhead and reduce errors. AI-enabled claims management can reduce claims handling costs.

Less manual, repetitive work fosters employee satisfaction, and faster settlement leads to more satisfied customers. This makes claims operations both a service differentiator and a cost-saver.

Competitive differentiation and compliance

How do you build a competitive advantage in such a fierce market? Delivering outstanding claims experience can be a key. Most insurers are good at selling policies (acquisition), but they lack a strong retention strategy, especially in how to support a policyholder when they file a claim. An insurer that can offer a fast, fair, transparent, and smooth claims processing cycle would likely be a winner. Transparent claims handling can also help minimize customer complaints and fraud and optimize compliance and risk management.

Conclusion:

A healthcare emergency is already an emotional and physically exhausting experience for both the policyholder and their family. The last thing they want is a financial burden from an avoidable denied claim. The families shouldn't be chasing an insurance agent for a denied pre-authorization, especially when that policy covers the treatment costs. That said, incomplete/inaccurate patient information, healthcare plan changes, and submission errors can be among the other reasons for denied claims.

That's why a transparent, automated, and faster claims cycle can be the differentiator for businesses. Not only does it help boost operational efficiency by automating repetitive tasks, centralizing updated customer details, reducing data duplication, and increasing revenue streams, but most importantly, an AI-driven claims cycle helps an individual (the policyholder) in need. A smooth, caring, and empathetic claims handling means honoring the promise behind those sold policies when it counts.