Over the past few weeks, as I've watched the developments in the pandemic and its repercussions in the global economy, I keep coming back to one of my favorite Winston Churchill quotes. It came in November 1942, after the Allies had won the Second Battle of El Alamein, setting them up to sweep German troops out of North Africa and starting to reverse the tide that had run so hard against the Allies for more than three years. Putting the victory in context, Churchill said, in his blunt way: "Now, this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning."

That's about where I think we are now. We certainly aren't at the end of devastation from the pandemic and can't even see the beginning of the end from here, but we may have reached the end of the beginning.

The danger of the pandemic itself isn't even remotely gone, and we need to be very careful that it doesn't come sweeping back. But I suspect that we're entering a new stretch that will last six months or so, until we either learn that we have a vaccine or learn that we don't. During that stretch, I think the insurance industry will need to adopt a sort of hybrid approach both for how companies view internal operations and for how they view customers, many of which will be open for business -- but only cautiously.

The best news is that the lockdowns seem to have worked. A study just published in the journal Nature estimated that they prevented 60 million COVID-19 cases in the U.S. -- some 30 times the roughly 2 million that have been diagnosed -- and 285 million cases in China. Another study published in Nature took a different approach but found a similar effect in 11 European countries: The study estimated that lockdowns saved 3.1 million lives, including 500,000 in the U.K., and reduced infection rates by 82%.

We're also learning things about this mysterious killer that could help us manage its dangers. For instance, it now seems that we're unlikely to pick up the virus by touching surfaces and that we're much less likely to contract it from people with whom we interact outdoors. Though no magic drug or other treatment has appeared, doctors are learning a great deal about how COVID-19 kills and are fine-tuning their approaches. For example, we've learned that this coronavirus doesn't just attack the lungs, as other coronaviruses do; ventilators aren't as crucial as once thought, while treatments for blood clots and "cytokine storms" can be important.

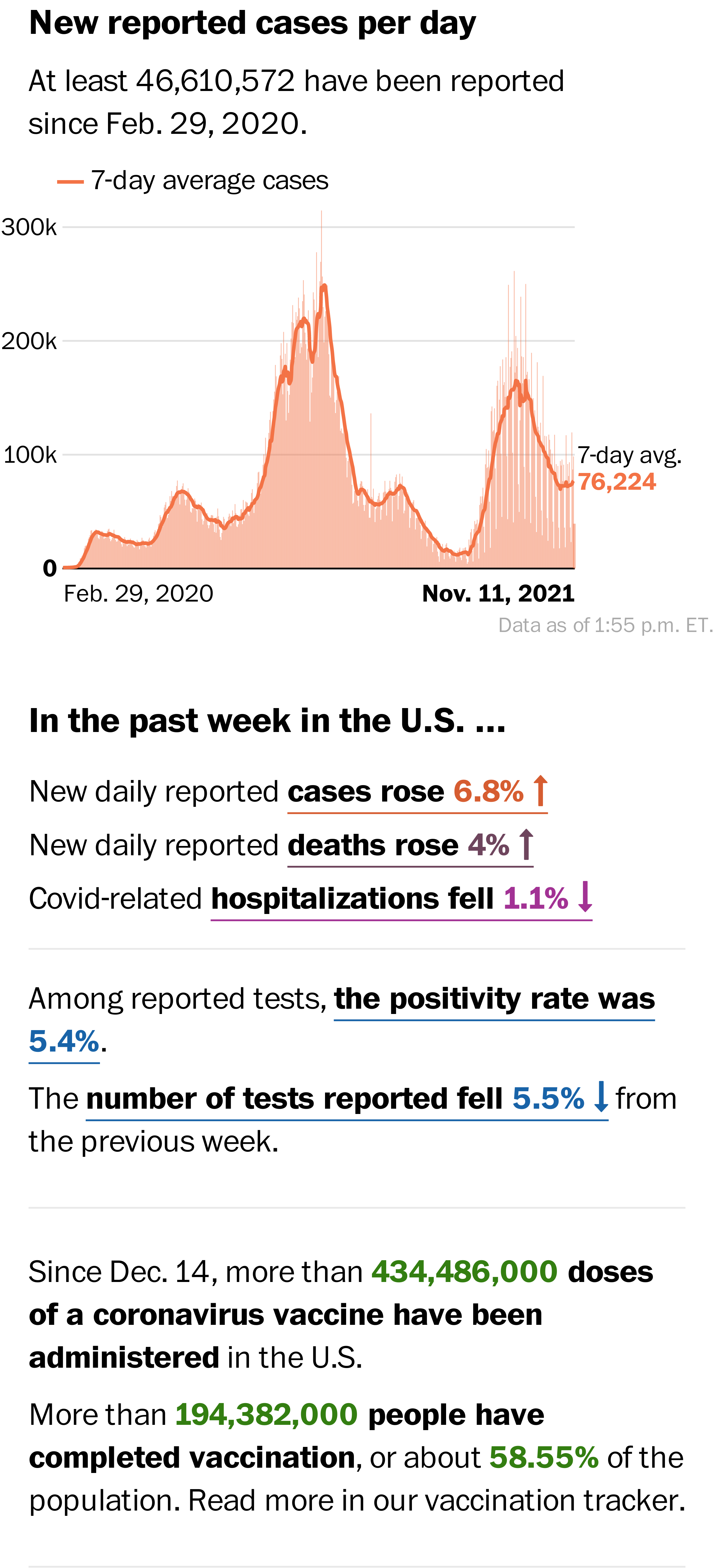

Still, the pandemic continues to expand globally, with more than 7 million cases now reported and over 400,000 people dying. Even in the U.S., where the curve has been bent well downward, there isn't the sort of straight-up, straight-down path seen in some countries that acted earlier or were stricter about their lockdowns. Here is the latest count of daily deaths from the Washington Post:

When you break the count down by state, the slow decline looks even weaker. You see that the vast majority of the improvement nationally has come because hot spots, especially in the Northeast, have been extinguished. Much of the rest of the country has been flat or even seen increases in the daily count of new cases and in deaths. While dire predictions about Florida and Georgia don't seem to have been borne out despite relatively lax lockdowns, Arizona and Texas, both of which reopened early, have seen surges in cases and hospitalizations.

National capability for testing has steadily improved but still isn't where health authorities have said it needs to be. In the face of massive complexity, government officials seem to have given up on even trying to build massive networks for contact tracing. So the tools aren't even in place yet to deal quickly and decisively with new outbreaks.

Yet the country seems to have decided to move on. So, move on we will, in however halting a fashion (at least unless there is a dramatic resurgence in COVID-19 cases).

What will this world look like in what seems likely to be several months of limbo, and how should we manage our businesses during this stretch?

From an internal standpoint for insurers, I'm not sure that much will change. Some people will return to some offices, but much of the work will continue to be done remotely. As much as possible, sales will still be handled remotely. So will claims. Companies will continue to take this opportunity to accelerate their move to digital and become more efficient -- this McKinsey article lays out an aggressive agenda for the next 90 days and says companies have a rare opportunity to shape the behavior of their customers; insurers should note that 35% of their customers now interact with them online, up from 27% just since the start of the pandemic.

How the rest of the economy functions is much harder to predict. Restaurants and hotels are reopening, but at maybe half-speed or even quarter-speed. Offices will reopen -- sort of. The healthcare system will head back toward normal, as those who deferred care will return to their doctors; there will likely be pent-up demand for a while. Stores will re-emerge, especially if no evidence contradicts the current thinking about the lack of transmissibility from brief contact with surfaces, but restrictions will apply. (So, yes, Jeff Bezos will still win.) In the fall, it seems that schools will have to reopen, because distance learning didn't work.

And so on. From a business standpoint, the only answer I know of for uncertainty is agility, so I think insurers will have to be unusually agile for the next several months. You don't want to zag when your customers zig. I suspect that workers' comp carriers will face particular pressure, as we see just how many COVID-19 claims are filed against employers and how regulators and courts treat defenses. Auto insurers will also be flying somewhat blind for a while because driving patterns will be in flux. Yes, traffic will pick up, but it likely won't be the same -- you get lots of fender benders in rush-hour traffic, so what happens if rush hour goes away, or at least changes because fewer people go to the office and go at staggered times to minimize clustering that might lead to infections?

There seems to be some optimism about how quickly the economic recovery will happen, especially if you trust stock markets. (Here is a piece from Fortune that takes a much more sophisticated look at the various scenarios for recovery.) But I don't see a firm recovery until the virus is vanquished, whether through a vaccine, a treatment or some other huge diminution of the danger. The hope seems to be that lifting the lockdowns will make the economy snap back, but we learned this week that the U.S. recession actually began in February, before the lockdowns. People won't act a certain way just because we tell them they can; they have to feel safe doing so, and I don't think we're there yet.

While it's not entirely clear what comes next, even if we really are at the end of the beginning, it's safe to say that we're in a phase where rapid change is happening and big opportunities are in front of us. Although I'm far more likely to quote Churchill than Lenin, I think a Lenin quote pretty well summarizes what we're going through: "There are decades where nothing happens; and there are weeks where decades happen."

"Weeks" is too strong, but I'd say we're in a stretch of months where decades may happen.

Stay safe.

Paul

P.S. Here are the six articles I'd like to highlight from the past week:

10 Tips for Moving Online in COVID World

As cyberattacks on small to mid-size businesses escalate, cyber insurance presents an opportunity to rebuild an agency book of business.

How to Train Remote Workers as Teams

While we may not be playing golf or having an office party for a while, let your team bond over a virtual activity on Zoom or Skype.

How to Fight Rise in Cyber Criminals

IT security standards have sometimes been lowered or suspended for work at home in the pandemic, resulting in cyber security exposures.

BCPP Proposal: Summary, Key Risks

The industry's proposal for a Business Continuity Protection Program raises risks related to compensating businesses during pandemic lockdowns.

Addressing the Rise in Topical Prescriptions

Insurers must help injured workers on topical prescriptions and compounds with the ultimate goal of returning them to work and more productive lives.

Tech Lets Freight Adjust to Pandemic

Freight carriers face extraordinary pressure to rush essential goods to market. Traditional human- and phone-driven processes can't keep up.