Let's say you're reviewing a claim file. You see a medical record. Then, a few pages later, you see it again. Same doctor, same date, same content. But wait, this second one has a fax stamp in the corner. Or maybe a scribbled set of initials. Or a different date in the footer. Is that a duplicate?

Your gut might say yes. Your system might say no.

Welcome to the strange world of workers' comp duplicity, a world where two records can be 99.9% identical and still be treated as unique by the very software designed to detect sameness.

What Most People Don't Know About Duplicates

We tend to think of duplicates as obvious. Copy and paste. Carbon copies. But in the land of medical records, things get trickier.

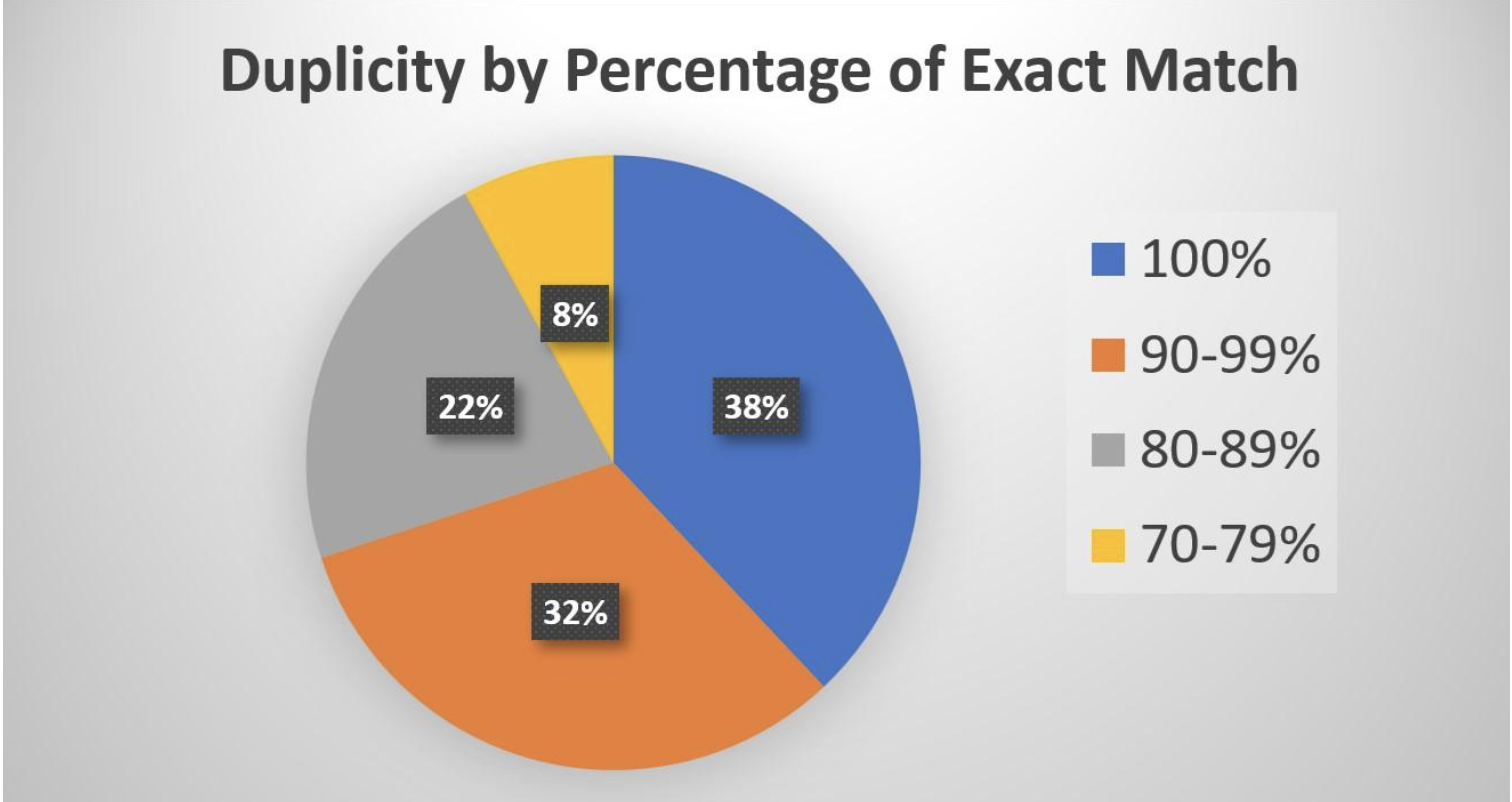

Did you know that only 38% of duplicates in workers' comp are exact matches? The other 62% are "soft duplicates" or "near duplicates" — records that look the same to the human eye but fly under the radar of most third party administrator (TPA) and carrier systems because of minor formatting or metadata differences.

Some of the most common disguises include:

- Fax headers

- Page numbers that shift

- Highlighting or handwriting

- Updated logos

- Minor changes to margins, headers, or timestamps

To a human reviewer, these differences are irrelevant. To most legacy systems, they're enough to confuse or cause them to be missed entirely.

Why This Matters

Every time a duplicate sneaks into a claim file, it costs time. Adjusters scroll, reread, and second-guess. Defense attorneys over-prepare. Bill reviewers re-review. And in MLPRR-reimbursed cases, carriers can end up footing a much larger bill than necessary.

In one real California case, duplicate medical records caused a $58,000 MLPRR overcharge for a well-known TPA that claimed to have a "duplicate removal system" in place. No one caught the error until after reimbursement.

It's not just an efficiency problem. It's a clarity problem. It's a cost problem. It's a "why is this case so hard to close?" problem.

The worst part? Most teams don't even know it's happening.

The Philosophical Side of the Problem

This isn't just a technical issue. It's an identity crisis.

In workers' comp, there's no need to include duplicates. The reason carriers and TPAs spend such a significant amount on redundant records is because their current systems aren't removing them efficiently.

Most systems default to pixel-by-pixel comparisons or simple hash-matching, which means that one extra date stamp on a medical note can mean the difference between a clean file and a bloated one.

Judges at the Division of Workers' Compensation (DWC) have taken notice. They're looking for carriers, TPAs and law firms that address this wasteful spending. The problem has become so central to efficiency and fairness that industry experts are developing more sophisticated solutions.

It's time we evolve our understanding of what counts as a duplicate. And more importantly, it's time we stop letting outdated tools decide for us.

So What's the Fix?

Advanced tools are emerging that study the problem deeply, not just what duplicates are, but what duplicity looks like in the real world. These solutions don't just match PDFs. They evaluate semantic meaning, formatting shifts, and intent. They understand that sameness in workers' comp is a spectrum and address the inherently computing-intensive challenge of document comparison, where each page must be compared against all others. For context, a 1,000-page document demands a staggering 499,500 comparisons to identify all forms of variation across text and images.

These advanced tools can find all of the 62% that get missed. They can restore clarity to chaotic files. They can save hours of adjuster time and weeks of attorney time and eliminate unnecessary review work.

And yes, such solutions exist.