Is insurance broken and in need of rescue?

That was the question I recently asked myself while hiring a rental car to visit the infamous "White Line" mountain bike trail in beautiful Sedona, AZ.

When I discovered the full Hertz insurance cover was going to cost me double the price of the actual car hire, I couldn't help but relay my shock to the salesperson. She proceeded to tell me about customers' typical reaction to the accompanying insurance cover purchase, and three things, from the conversation, stuck in my mind:

- Many customers opt not to take the liability cover even though it leaves them quite exposed.

- A surprisingly high percentage of customers ask for a refund on their insurance payments, at the end of the rental period, if they didn't need to make a claim!

- Customers are generally very distrustful of the insurance product they are buying. Customers are often unsure whether it will actually cover their needs if they have to make a claim.

To my mind, this random conversation captured three big problems the insurance industry currently faces:

Problem #1: Consumers often don't value insurance

Insurance is quite an unusual product. Except for maybe a coffin and a fire extinguisher, it's the only purchase I can think of that you make but hope to never have to use.

Let's face it. Buying insurance is usually an uninspiring "grudge purchase." Tedious paperwork, arcane questions, having to think about what can go wrong in your life. Is it any wonder that the experience is up there with a visit to the dentist? Of course, the reality is that should your home be destroyed in a storm or should you be involved in a car accident deemed to be your fault (especially with third-party injury) insurance can be the saving grace preventing potential financial ruin.

Problem #2: Consumers don't always understand insurance

After going through the pains of considering the potential financial impact of personal tragedy, you are rewarded with the product: a paper contract. Not just any old paper contract, but a long-winded, very conditional and often confusing document. How exciting! Again, is it any wonder that insurance customers can't or don't want to take the time to understand the precise nature of what some deem to be the world's most boring product?

Problem #3: Consumers generally don't trust insurance companies

To highlight the trust issue, I turn to the most popular definition of "insurance company" from the crowd-sourced Urban Dictionary:

Insurance Company: "An affiliation of pirate-gamblers who accept bets called premiums. The dollar amounts of the premiums are non-negotiable, but the amounts of the claim settlements, should the company lose the bet, are rarely delivered without argument."

While the quoted source may be a parody, I believe the underlying inclination signifies the typical level of distrust that consumers have of insurance.

See also: Where Will Unicorn of Insurtech Appear?

Don't get me wrong. I believe insurance plays a critical role in our lives, and insurance companies can provide a great service as well as a very rewarding career path. But, when it comes to the general consumer view of insurance, there seems to be an issue.

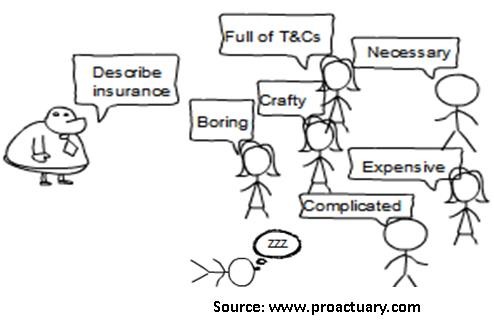

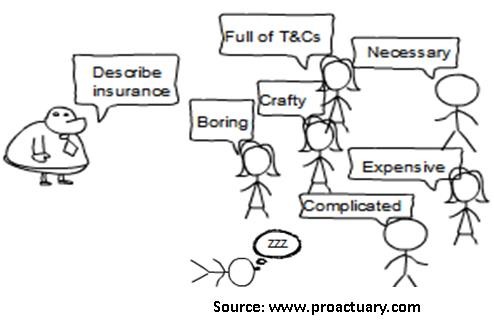

Ask 10 random people on the street to describe "insurance" in three words, and you can be nearly sure at least one person will allude to issues of distrust

Insurtech to the rescue?

So what is the industry doing to solve these problems?

It appears that the nimble insurance technology startups (insurtechs) are playing a large part in leading the way in attempting to overcome these issues.

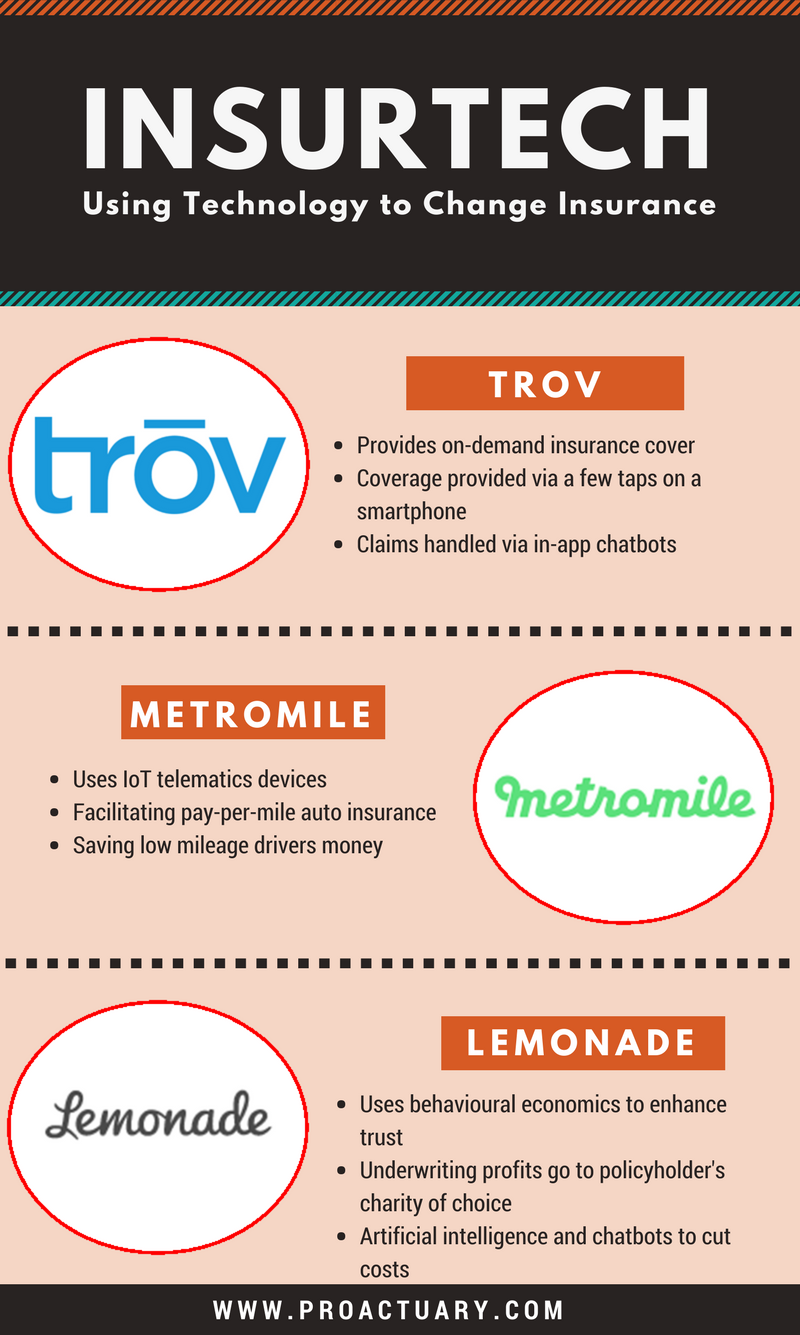

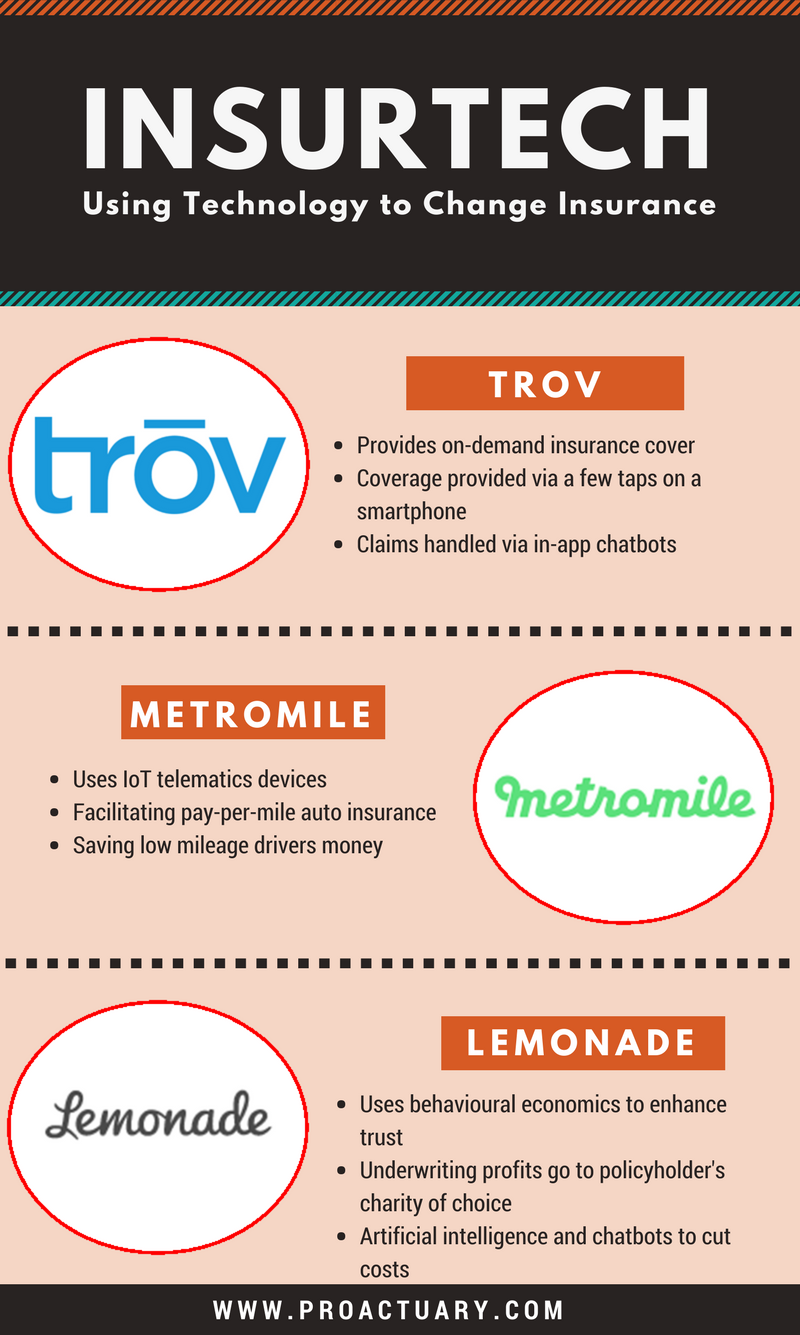

Below are three insurtech companies focused on addressing these issues and arguably changing the insurance world for the better:

Solution # 1: Improved Value - Metromile

Telematics has been around for a few years now, particularly in Italy, the U.K. and the U.S.

Onboard car technology is used to monitor and potentially assess the driving behavior of each individual driver, thus moving insurance from a pooled pricing model to a more individual specific model, one where the underlying policyholder risk is more closely monitored.

These telematics technology devices (also known as a “black box”) are able to pick up a number of diverse driving metrics such as:

- mileage

- location

- time of day

- driving frequency

- behavior around hazardous zones

- speed

- rates of acceleration

- braking habits

This information can then be considered in a more accurate and individualized pricing model, one that potentially allows the previously trapped (i.e pooled) policyholder to break free from his or her age or gender (non-EU) status, etc. and prove worthy as a safe driver that is a good risk and unlikely to have an accident and hence claim.

Low-mileage drivers, as well as young male drivers, can benefit, and this is the market that Metromile has targeted.

The usage-based customization of insurance certainly seems to be keeping customers happy, with policyholders reporting they feel like they are getting a fairer deal. After all, should a low-mileage, safe driver really be subsidizing a riskier driver just because they share common old-school rating factor characteristics?

Metromile has been forging ahead with this lifestyle app-based continuous digital engagement model since 2011. And the company shows no signs of slowing down. In late 2016, the company raised a further US$150 million in funding through which it acquired a carrier enabling the company to now underwrite its own policies.

Solution #2: Simplicity and Understanding - Trov

The Trov promise:

"As simple as Tinder and as beautiful as Airbnb" — Scott Walchek: CEO of Trov

Trov provides on-demand insurance for personal items that can be toggled on and off via a few simple taps from your phone. The company aims to give the mobile generation easy protection that they can enjoy

"without worrying about rigid policies and confusing fine print."

In addition, Trov seems to be jumping on the personalized cover bandwagon - treating policyholders as individuals instead of an average risk within a cohort. The flexible app gives customers the option to tweak their cover toward their own personal circumstances. As one customer put it:

"Why pay for an expensive insurance plan designed to cover your worldly belongings when all you really care about is your mountain bike and your laptop?"

"Protect just the things you want - exactly when you want - entirely from your phone" — Trov website

This simplicity and flexibility seems certain to appeal. I personally like the idea of being able to quickly and easily protect my mountain bike by getting temporary insurance for the times when I do actually take it out and use it. And if a claim is required, it's all handled via an in-app chatbot. Insurance for the smartphone generation indeed!

While I do wonder how Trov counters fraud (given the ability to so easily turn the cover on and off), as we are living in the age of convenience, it would seem that this model is sure to appeal beyond just tech-savvy millennials.

Solution #3: Enhanced Trust - Lemonade

Lemonade is the poster child of insurtech, or at least the king of savvy insurtech marketing. When the company shouts about paying a claim in three seconds, using AI not actuaries and bots not brokers, it certainly makes one stand up and take notice. Lemonade began selling insurance nearly two years ago and has now amassed a sizable level of funding and following. The companyy promised to bring trust back into the insurance world - the way it should be and how it was in the beginning.

The tools of their trade: behavioral economics and artificial intelligence.

The promise to the customer: simplicity, convenience and affordability.

But back to the trust issue. How is Lemonade approaching it? The business model attempts to disrupt the cycle of distrust between the insurer and the insured. This is done by separating the pool of risk capital from the company's own 20% flat fee. Essentially this model aims to remove the incentive for the insurer to minimize claim payouts on the basis that doing so will not affect its bottom line (the remaining 80% claim pot gets paid out to small peer groups under a giveback scheme, after some unavoidable expenses such as reinsurance cover).

Basically, the deal is: Trust us to pay out your claim quickly, with minimal fuss and without any sneaky "catching you out in the fine print" shenanigans, and we will trust you to only claim if it's genuine.

"Knowing that every dollar denied to you in claims is a dollar more to your insurer brings out the worst in us all… Since we don’t pocket unclaimed money, we can be trusted to pay claims fast and hassle-free. As for our customers, knowing fraud harms a cause they believe in, rather than an insurance company they don’t, brings out their better nature too. Everyone wins." — Dan Ariely, chief behavioral officer at Lemonade

The behavioral implication, with the removal of potential conflict, is that the enhanced two-way trust will drastically reduce fraudulent claims. This, combined with the operational cost efficiency savings from AI and technology will allow the company to have happy customers and still make a sustainable profit.

At least that's the theory.

See also: Convergence in Action in Insurtech

Now, while I love what they are doing, I'm not entirely convinced their model is altogether different from some of the smaller mutuals, especially those that still maintain some level of social bonds. Maybe I'm biased because Lemonade doesn't seem to like actuaries, but I also wonder whether the company's pricing, underwriting and risk management will allow its loss ratios to stay low enough to not affect their 20% flat fee over the long term. It takes some time for reality to test the theory, in insurance. So I, for one, will be watching the Lemonade space with interest.

Conclusion

So is insurance really broken and in need of fixing?

Let's not forget what insurance is all about. In essence, insurance is about the pooling and sharing of risk. Swapping an uncertain, and potentially large, outgo for a small(er) more certain outgo (the premium). This is unlikely to change, and insurance companies obviously already do this.

But, I do believe, there is a need to modernize, especially in relation to the customer experience. I don't see insurtech companies causing a complete revolution. But they are likely to play a big part in the evolution of insurance.

What do you think? Does insurance need to evolve? Is insurtech the answer to the customer experience issues? Are these insurtechs all marketing talk and lacking substance? Will the asset-rich insurance incumbents ultimately lead the way in the unfolding tech world evolution?

This post first appeared on the ProActuary blog here. Ask 10 random people on the street to describe "insurance" in three words, and you can be nearly sure at least one person will allude to issues of distrust

Insurtech to the rescue?

So what is the industry doing to solve these problems?

It appears that the nimble insurance technology startups (insurtechs) are playing a large part in leading the way in attempting to overcome these issues.

Below are three insurtech companies focused on addressing these issues and arguably changing the insurance world for the better:

Solution # 1: Improved Value - Metromile

Telematics has been around for a few years now, particularly in Italy, the U.K. and the U.S.

Onboard car technology is used to monitor and potentially assess the driving behavior of each individual driver, thus moving insurance from a pooled pricing model to a more individual specific model, one where the underlying policyholder risk is more closely monitored.

These telematics technology devices (also known as a “black box”) are able to pick up a number of diverse driving metrics such as:

Ask 10 random people on the street to describe "insurance" in three words, and you can be nearly sure at least one person will allude to issues of distrust

Insurtech to the rescue?

So what is the industry doing to solve these problems?

It appears that the nimble insurance technology startups (insurtechs) are playing a large part in leading the way in attempting to overcome these issues.

Below are three insurtech companies focused on addressing these issues and arguably changing the insurance world for the better:

Solution # 1: Improved Value - Metromile

Telematics has been around for a few years now, particularly in Italy, the U.K. and the U.S.

Onboard car technology is used to monitor and potentially assess the driving behavior of each individual driver, thus moving insurance from a pooled pricing model to a more individual specific model, one where the underlying policyholder risk is more closely monitored.

These telematics technology devices (also known as a “black box”) are able to pick up a number of diverse driving metrics such as:

So is insurance really broken and in need of fixing?

Let's not forget what insurance is all about. In essence, insurance is about the pooling and sharing of risk. Swapping an uncertain, and potentially large, outgo for a small(er) more certain outgo (the premium). This is unlikely to change, and insurance companies obviously already do this.

But, I do believe, there is a need to modernize, especially in relation to the customer experience. I don't see insurtech companies causing a complete revolution. But they are likely to play a big part in the evolution of insurance.

What do you think? Does insurance need to evolve? Is insurtech the answer to the customer experience issues? Are these insurtechs all marketing talk and lacking substance? Will the asset-rich insurance incumbents ultimately lead the way in the unfolding tech world evolution?

This post first appeared on the ProActuary blog here.

So is insurance really broken and in need of fixing?

Let's not forget what insurance is all about. In essence, insurance is about the pooling and sharing of risk. Swapping an uncertain, and potentially large, outgo for a small(er) more certain outgo (the premium). This is unlikely to change, and insurance companies obviously already do this.

But, I do believe, there is a need to modernize, especially in relation to the customer experience. I don't see insurtech companies causing a complete revolution. But they are likely to play a big part in the evolution of insurance.

What do you think? Does insurance need to evolve? Is insurtech the answer to the customer experience issues? Are these insurtechs all marketing talk and lacking substance? Will the asset-rich insurance incumbents ultimately lead the way in the unfolding tech world evolution?

This post first appeared on the ProActuary blog here.