Talk about productivity in insurance is often framed around helping people do more: process more claims, sell more policies. Agency leaders, however, know productivity isn't just about doing more—it's about working smarter.

Insurance technology providers are reshaping the tools at the heart of the industry to make that happen. Producers can anticipate what their clients need, servicers can respond to clients faster and spend less time clicking from one screen to another, and agency leaders can make faster, more data-informed business decisions.

A 2024 Vertafore technology survey found that agency staff still say they want efficiency from their tech stack more than anything else and that they would benefit most from reducing manual data entry.

Over the past two years, I've traveled across the U.S. as part of Vertafore's Project Impact to visit agencies and observe how servicers work. The insights gleaned from those visits are driving real technology improvements.

Smart insurtech providers are investing to adapt to the way agency professionals work.

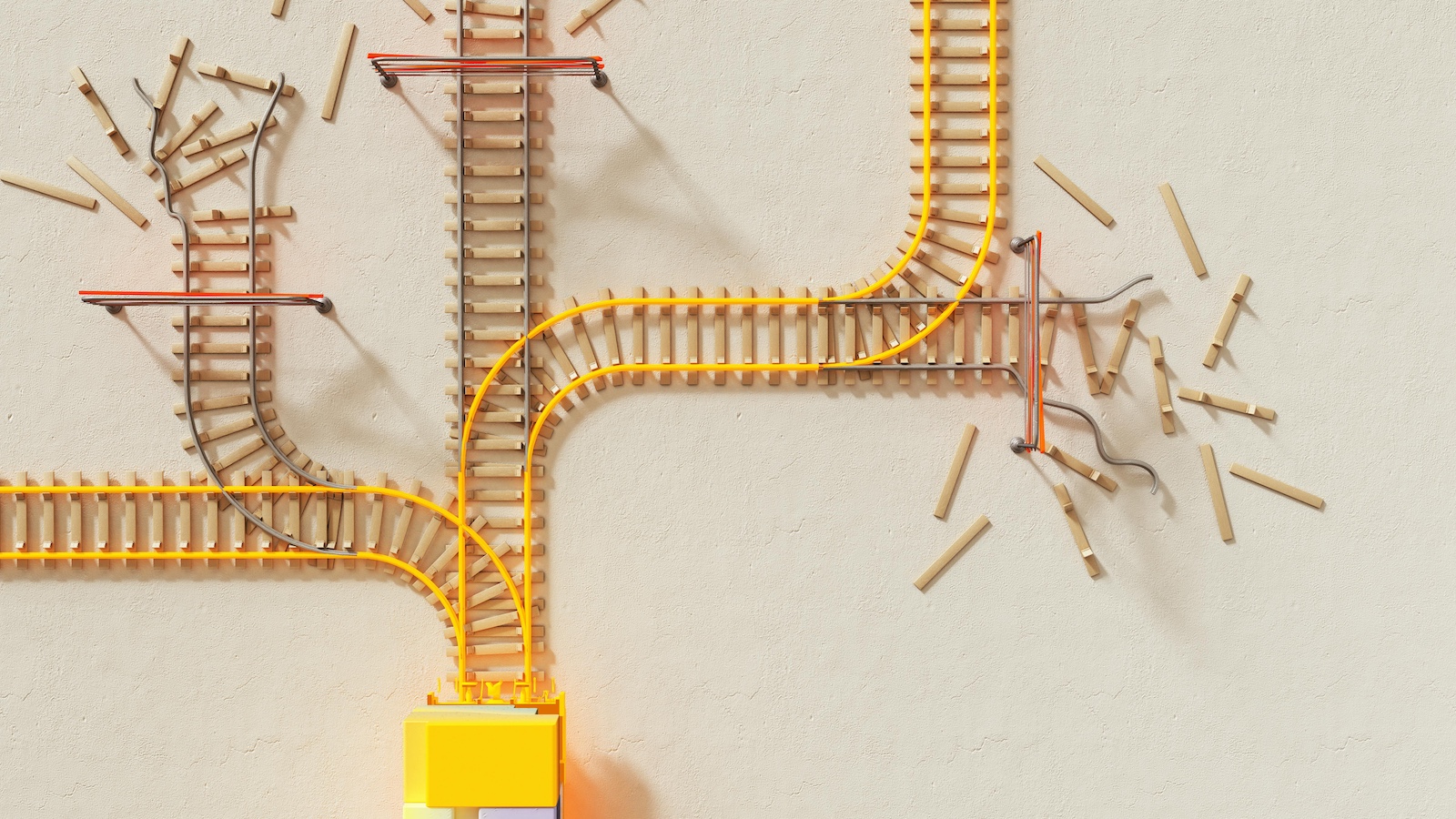

They are designing platforms that connect and work seamlessly, reducing friction and giving users more time back. We're moving from siloed, single-purpose systems to integrated, intelligent ecosystems.

The gap between the promise of productivity and the reality of user experience is closing because of intentional design and investment in three core areas.

Automation built-in

Providers are embedding AI and automation into workflows, not leaving it up to agencies to figure it out.

Agency servicers spend a significant amount of time reentering information from client emails into forms. In some cases, I watched servicers write down policy information by hand while on the phone with a client so they can reenter it later when they aren't doing two things at once.

By building tools around automation, providers are cutting down the number of steps in processes and saving agencies time. Tools built with automation in mind can read the information from an email, predict what it's about and place it into the appropriate workflow.

Automation is improving accuracy, client satisfaction, and agency productivity. Automated processes create the foundation for agencies to pursue new opportunities without adding more tasks to staff workloads.

APIs and interoperability

No single provider can excel at everything—and they don't need to. Today's innovators focus on their strengths while building open ecosystems and partnerships, giving agencies the freedom to choose the best tools for their needs.

For example, many agencies want to leverage best-in-class e-signature solutions to improve their clients' experience and to make it easier to do business. APIs allow the e-signature tool to plug into the agency's core systems and automatically access forms from the AMS. Clients and users both benefit from this integration.

APIs also work to reduce duplicate data entry, facilitate instant document sharing, and make it easy to grow a tech stack by adding solutions without downtime that disrupts workflows or client service. That means less rekeying, fewer delays, and faster client response times.

Providers that build open-platform systems that take advantage of APIs help agencies customize their tech stack. The result is flexibility and scale without operational drag: APIs give agencies the flexibility to grow without breaking workflows.

Turning data into decisions

All the data pouring into an agency can easily become overwhelming or messy as it changes hands from one staff member to another. But providers are making data not just available but actionable.

Data dashboards provide a unified view of an agency and help make sense of the data in real time. Analytics helps uncover opportunities for agencies to grow and for producers to produce.

For agency leaders, a productivity dashboard can provide insights into time spent on tasks and overall performance. This information can then help refine workflows by highlighting individual producers or addressing bottlenecks. For producers, intelligent data analytics tools take into account past quoting, client behavior, and market trends to help find growth and retention opportunities.

Across the board, data analytics are helping agencies move from data overload to strategic insight.

What agencies should look for in their partners

The evolution of the insurance industry means agencies should expect more from their technology. Insurtech tools that listen to users are offering experiences that empower agencies to work smarter. Consider these three questions when choosing a tech partner:

- Are they making continuous investments in their core systems?

- Do they help with integration and interoperability across the tech stack?

- Do they provide automation and insights delivered in ways that reflect my real-world workflows?

The next wave of productivity isn't about agencies adapting to technology—it's about providers delivering smarter, simpler, connected solutions that fit within the systems agencies use so they can work better. Agencies that align with partners that embrace this philosophy will be best positioned for growth.

If your technology partner isn't working this way, it might be time to ask why.