In recent years, the mid/large commercial lines segment has worked extensively to evolve the distribution ecosystem through new partnerships and expansion strategies. Additionally, carriers in the segment have been deploying new technologies for distribution to not only enhance internal operations and processes but to further support the success of distributors, whether retail agencies, brokers, wholesalers or MGAs. However, according to new SMA research, not all solutions meet the expectations of carrier executives today.

SMA's recently published report, "Distribution Technologies for Mid/Large Commercial Lines: Carrier Plans in 2023 and Beyond," covers the current state of digital capabilities that carriers offer distribution partners, an assessment of the barriers to deploying new capabilities, and carriers' plans to provide new solutions. The insights are based on a survey of executives at carriers focused on the mid/large commercial market.

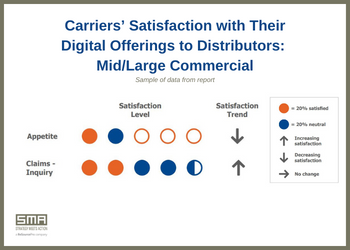

Across the sales value chain, insurer executives generally have low satisfaction with digital capabilities, particularly in early stages of the sales process. There is significant dissatisfaction regarding digital appetite solutions, which is not entirely surprising given how little automation exists in the area. The reality is that distributors often misunderstand a carrier's appetite – a challenge that has existed for years. Market conditions can result in the ebb and flow of a carrier's appetite, and at times they may pull back in writing certain risks. Other times, they may have increased appetite in a specific class. Although improved communication can help alleviate pain points, tech solutions that support appetite matching between carriers and distributors will be essential for the continued success of carrier/distributor relationships.

In contrast, insurers' satisfaction levels with their digital offerings for servicing are notably higher than sales, with claims inquiry capabilities rating the highest among executives. Insurers continue to pour investments into claims operations, as it is one of the highest touchpoint areas for policyholders. However, a recent SMA survey of agents reveals a need for carrier partners to enhance claims capabilities, with about half of agents and brokers in mid/large commercial lines desiring carriers to prioritize projects in claims download and filing capabilities.

See also: Designing a Digital Insurance Ecosystem

These insights from the report highlight the imperative for carriers to continue to evolve how they interact with and serve distribution partners. Insurers that focus on strategies that enable distributors to place coverage efficiently and competitively with minimal friction and excellent customer experience will be the ones to contend with in the future.

"Distribution Technologies for Mid/Large Commercial Lines: Carrier Plans in 2023 and Beyond" is part of SMA's research series based on surveys and interviews of insurers, agencies, brokers, MGAs and others in the distribution channel, including insights from ReSource Pro's extensive footprint of distribution clients.